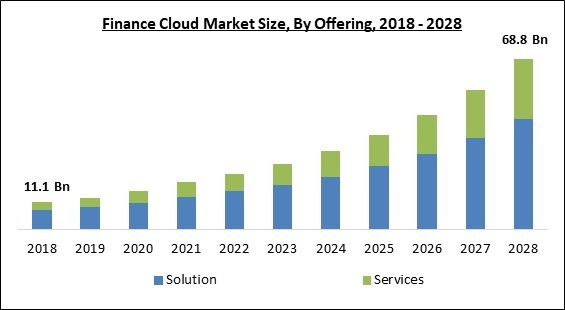

The Global Finance Cloud Market size is expected to reach $68.8 billion by 2028, rising at a market growth of 20.5% CAGR during the forecast period.

Any expanding business's modern finance staff is equipped with a range of potent software alternatives to handle the business's finances. They use a range of financial management tools to develop budgets, produce invoices, monitor all expenditures, approve purchase requests, and manage payments. Often, they are all separate on-premises systems that don't talk to one another.

A disjointed system results in severe team miscommunication, catastrophic time and resource waste, and a cumbersome procedure with lots of room for human mistakes. The management of an organization's financial planning via the cloud is known as cloud financial management. It provides organizations and finance teams with an ecosystem of interconnected solutions for account management, financial report creation, payment processing, payroll administration, and budget management.

The data can be viewed from anywhere at any time because it is available online. Comparatively speaking, on-premise ERP systems are more expensive than cloud financial management software. There are no setup fees, ongoing costs, or support costs. Users can anticipate costs because of the subscription-based pricing model, which makes it easier for the user to manage their cash flow.

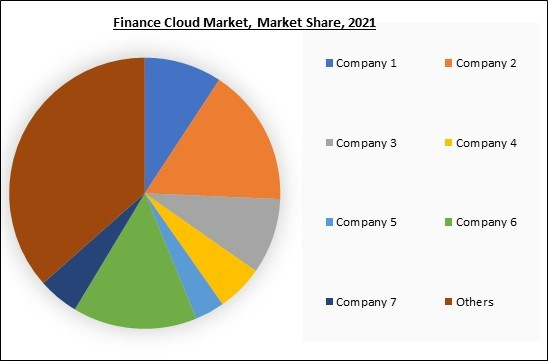

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The below illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Partnerships & Collaborations.

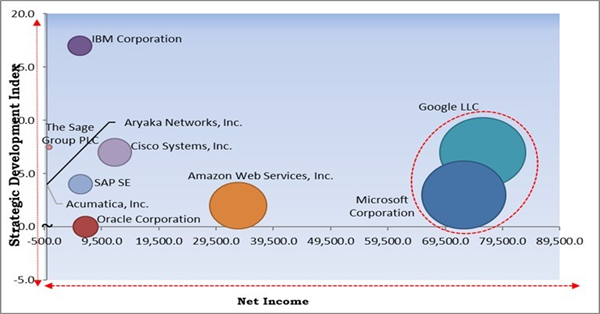

The major strategies followed by the market participants are Partnerships. Based on the Analysis presented in the Cardinal matrix; Microsoft Corporation and Google LLC are the forerunners in the Finance Cloud Market. Companies such Amazon Web Services, IBM Corporation, SAP SE are some of the key innovators in Finance Cloud Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include IBM Corporation, Google LLC, Microsoft Corporation, Oracle Corporation, SAP SE, Amazon Web Services, Inc., Cisco Systems, Inc., The Sage Group PLC, Acumatica, Inc., and Aryaka Networks, Inc.

Any expanding business's modern finance staff is equipped with a range of potent software alternatives to handle the business's finances. They use a range of financial management tools to develop budgets, produce invoices, monitor all expenditures, approve purchase requests, and manage payments. Often, they are all separate on-premises systems that don't talk to one another.

A disjointed system results in severe team miscommunication, catastrophic time and resource waste, and a cumbersome procedure with lots of room for human mistakes. The management of an organization's financial planning via the cloud is known as cloud financial management. It provides organizations and finance teams with an ecosystem of interconnected solutions for account management, financial report creation, payment processing, payroll administration, and budget management.

The data can be viewed from anywhere at any time because it is available online. Comparatively speaking, on-premise ERP systems are more expensive than cloud financial management software. There are no setup fees, ongoing costs, or support costs. Users can anticipate costs because of the subscription-based pricing model, which makes it easier for the user to manage their cash flow.

COVID-19 Impact Analysis

The COVID-19 pandemic had a favorable effect on the cloud-finance sector. The financial industry has fundamentally altered its current business strategy, upgrading the current product lines and adjusting company performance with a more economical and efficient approach. Banks and other financial institutions have adopted the cloud much more widely to maintain efficient internal operations in the event of a pandemic. As a result, amid the health crisis, there has been a considerable surge in demand for finance cloud.The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The below illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Partnerships & Collaborations.

Market Growth Factors

The Growing Demand For Operational Efficiency And Transparency

The majority of organizations traditionally devote time and energy to making decisions and delivering company information. Successful organizations are always looking for new systems to better serve their customers and boost their profit margins. Cloud solutions are currently key platforms that provide financial companies with a strong foundation and informational backbone. Many financial institutions handle back-office tasks and essential business activities like payments and credit risk monitoring utilizing a mixed blend of public and private clouds.An Increase In Developing-Region Cloud Adoption

The market for cloud computing services has great potential to grow in emerging economies like India, China, Brazil, and Africa. For instance, the monitoring and analytics software provider ITRS Group Ltd. Since these nations are developing and have limited financial resources, they require cost-effective solutions, which increase demand for cloud technology and lower IT costs. After all, businesses can be sure that files, programs, and other data are protected if they are not housed securely onsite.Market Restraining Factors

Increased Maintenance & Investment Costs

The cost of acquiring and implementing a cloud system is high at first. International software providers including IBM Corp., SAP, Oracle, and Microsoft demand exorbitant prices for their products. Additionally, the maintenance and support services provided by these software companies are very expensive. The overall annual cost of upkeep and updating the cloud system consists of internal expenses (user training, IT wages, and project management), external expenses (IT vendors and contractors), and annual maintenance and support fees paid to cloud suppliers.Offering Outlook

By offering, the Finance Cloud Market is bifurcated into Solution and Services. The solution segment acquired the highest revenue share in the finance cloud market in 2021. It is because the user can build a single client database and begin automating billing, revenue management, and other essential financial procedures using a cloud financing system. It is the most effective technique to carry out profitable and predictable operations and wins loyal customers.Deployment Outlook

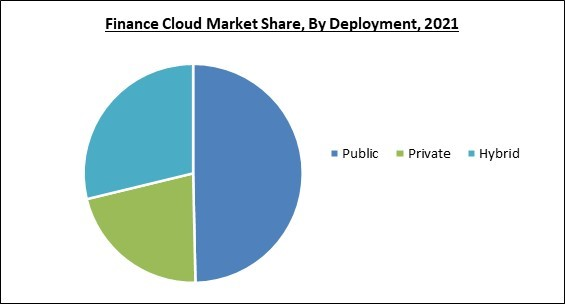

By Functionality, the Finance Cloud Market is classified into Public, Private, and Hybrid. The private cloud segment registered a significant revenue share in the finance cloud market in 2021. The private cloud offers users low-cost management tools and services for cloud applications, including data storage, security, and monitoring. Organizations can take advantage of numerous cloud computing advantages while maintaining control, security, and customization by utilizing the private cloud.Organization Size Outlook

Based on the Organization Size, the Finance Cloud Market is bifurcated into Large Enterprises and Small & Medium Enterprises (SMEs). The small & medium enterprise (SMEs) segment witnessed a substantial revenue share in the finance cloud market in 2021. Due to factors like strict regulatory compliance, lower IT infrastructure costs, and fraud detection and prevention tools, this market is expected to increase. Infrastructure as a service, platform as a service, and software as a service are examples of noisy computing services.Application Outlook

On the basis of Application, the Finance Cloud Market is divided into Revenue Management, Wealth Management, Account Management, Customer Relationship Management, Asset Management, and Others. The wealth management segment procured the highest revenue share in the finance cloud market in 2021. Regulation requirements, shifting generational wealth, and rising demand for cloud technologies from wealth and investment companies are all contributing to the market expansion of this sector.End-Use Outlook

By End-use, the Finance Cloud Market is classified into Banking & Financial Services, and Insurance. The banking & financial services segment garnered the largest revenue share in the finance cloud market in 2021. Reduced client acquisition costs, growing security concerns, and the necessity for disaster recovery are a few reasons for this market segment's rise. For the adoption of the cloud, banks and other financial institutions are working with finance cloud providers.Regional Outlook

Region-wise, the Finance Cloud Market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The north America segment acquired the highest revenue share in the finance cloud market in 2021. Due to the region's strong economy and increased internet penetration rates, isolated infrastructure has been migrated to the cloud in North America. The growth of the North American finance cloud market is also largely attributed to increased security and agility, decreased capital expenditure (CapEx), and simplified IT administration.Cardinal Matrix-Finance Cloud Market Competition Analysis

The major strategies followed by the market participants are Partnerships. Based on the Analysis presented in the Cardinal matrix; Microsoft Corporation and Google LLC are the forerunners in the Finance Cloud Market. Companies such Amazon Web Services, IBM Corporation, SAP SE are some of the key innovators in Finance Cloud Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include IBM Corporation, Google LLC, Microsoft Corporation, Oracle Corporation, SAP SE, Amazon Web Services, Inc., Cisco Systems, Inc., The Sage Group PLC, Acumatica, Inc., and Aryaka Networks, Inc.

Strategies deployed in Finance Cloud Market

Partnerships, Collaborations and Agreements:

- Aug-2022: IBM formed a partnership with VMware, an American cloud computing. Together the companies aimed to support global partners and customers to update mission-crucial workloads and expedite time to appreciate in hybrid cloud environments. Additionally, jointly companies are intending to help customers in regulated enterprises such as healthcare, financial services, and public sector oration the cost, intricacy, and hazard of modernizing and migrating mission-critical workloads in the cloud.

- Jul-2022: Sage came into a partnership with Microsoft, an American multinational technology enterprise. This partnership aimed to combine Microsoft Business Products, such as Microsoft Teams and Microsoft 365, as ingrained services in Sage developments and the Sage Digital Network. Additionally, the partnership would streamline life for millions of SMBs, drawing friction and allowing them to complete real productivity gains.

- Jul-2022: Acumatica came into a partnership with Shopify, a Canadian multinational e-commerce business. Through this partnership, Shopify would permit Acumatica to deliver customers with creative business management solutions that allow them to scale their online and in-store retail procedures. Moreover, Merchants can utilize Shopify’s solution to address B2B and direct-to-consumer (DTC) stores in a single medium.

- May-2022: Acumatica formed a partnership with Aarialife Technologies, a supreme cloud solution provider. Through this partnership, Acumatica functions with Aarialife in India due to long-time experience in effectively executing Cloud ERP-Solutions. Additionally, Acumatica is operating 100% through local members globally because regional knowledge of the finance, markets, and tax regulations and talking the local language is important for consumers.

- Apr-2022: SAP partnered with Kyndryl, the world’s largest IT infrastructure services supplier. This partnership would utilize SAP’s Business Technology Platform (SAP BTP) and Kyndryl’s in-depth expertise in data, artificial intelligence (AI), and cyber resiliency services to boost and allow a cost-effective path to the cloud for consumers. Additionally, new solutions would help consumers decipher their most difficult digital business transformation challenges.

- Nov-2021: Google Cloud formed a partnership with CME Group, an American global markets company. Under this acquisition, companies aimed to bring together CME Group's best-in-class financial talent within Google Cloud's deep engineering expertise which would help boost technological invention in capital markets technology. Additionally, CME Group transfers to the cloud and changes how international derivatives markets work with technology.

- Nov-2021: Amazon Web Services partnered with Nasdaq, an American stock exchange. Through this partnership, the companies aimed to develop the next era of cloud-enabled infrastructure for the global capital markets. Moreover, integrating Nasdaq’s 50 years of experience in advanced technology for the capital industry with the reliability, proven security, and stability of the leading cloud would help joint consumers and Nasdaq resume expanding their companies and seamlessly transact billions of dollars in trades daily.

- Apr-2021: SAP SE came into a partnership with Dediq, a private equity firm. Together, the companies aimed to administer the quickly transforming banking and insurance industry, the two companies would together develop SAP’s financial services offering with a substantial investment in new solutions. Additionally, these solutions would be based on SAP software and be combined into SAP’s comprehensive offering and product strategy.

- Dec-2020: Google Cloud partnered with Deutsche Bank, a German multinational investment bank. Together, the entities aimed to drive the bank’s evolution to the cloud and co-innovate new services and products. Additionally, Deutsche Bank is a pioneer in the market, and Google couldn’t be more delighted to partner with such a crucial market leader.

Product Launches and Product Expansions:

- Jun-2022: Cisco introduced AppDynamics Cloud, which maximizes company outcomes and consumer experiences by optimizing cloud-native applications. The AppDynamics propel detection and explanation of performance problems with intelligent operations, allowing investment protection through constant data integrations with OpenTelemetry standards and technology collaborations with cloud providers and solutions.

- Nov-2021: Microsoft introduced Financial Services. The new cloud service will deliver Microsoft productivity tools combined with financial services-specific features and regulatory clearance.

- May-2021: Google Cloud introduced Datashare for financial services. The new data share is a solution developed to assign the entire capital markets environment market data publishers such as exchanges and other providers, and data consumers, like asset managers, investment banks, and hedge funds to share market data more safely and easily. Additionally, data share is created on Google Cloud analytics services like BigQuery and would utilize Analytics Hub.

- Mar-2021: IBM introduced IBM Cloud Satellite. The new cloud would permit its business customers to launch constant cloud services anywhere and in any circumstances within any cloud, on-premises, or at the edge. Additionally, this would provide customers across industries, such as financial services, telecommunications, government, healthcare, retail, and more, permit to a constant and secured set of cloud services wherever their workload resides.

Acquisition & Mergers:

- Apr-2022: Sage took over Mateo cloud savings and loan software from MAS Integrated Solutions. This acquisition would strengthen Sage’s devotion to supporting non-profit and faith-based associations to manage programs that concern a revolving loan fund. Additionally, the acquisition of Mateo is a natural fit for the vertical approach and would allow Sage to provide added worth to associations in the non-profit sector.

- Feb-2022: IBM took over Neudesic, a leading U.S. cloud services consultancy. With this acquisition, Neudesic would extend IBM's offering of hybrid multi-cloud benefits and further refinement the company's AI strategy and hybrid cloud.

- Jul-2021: IBM acquired Bluetab Solutions Group, an enterprise software, and technical services business. With this acquisition, Bluetab would evolve a strategic part of IBM's data services consulting practice to enhance and advance its AI strategy and hybrid cloud.

- May-2021: Aryaka completed the acquisition of Secucloud, a proven SASE platform provider. With this acquisition, the combined technologies would allow Aryaka to deliver a truly connected network and network security-as-a-service portfolio. Additionally, the acquisition would complement Aryaka's existing offering and especially improves its ability to compete and succeed in bigger deals while providing the industry’s most flexible, managed SASE solution experience.

- Jan-2021: IBM completed the acquisition of Taos, a supreme cloud professional, and managed services provider. Through this acquisition, Taos would add the in-depth expertise, public cloud alliances, and creative solutions required to propel the adoption and growth of IBM's hybrid cloud platform throughout the Americas and IBM is committed to assisting customers to guide their open hybrid cloud expeditions with those providers.

- Jan-2021: Cisco completed the acquisition of the Banzai Cloud, a privately held corporation headquartered in Budapest. With this acquisition, the Banzai Cloud team would develop Cisco’s abilities and expertise via its established experience with whole end-to-end cloud-native application runtime, deployment, development, and safety workflows.

Geographical Expansions:

- Mar-2022: Sage expanded its geographical footprint by establishing Sage Intacct Manufacturing in France. This expansion is part of the new lineage of Sage Intacct products that are multi-tenant cloud-native and combined closely with other solutions in the Sage Business Cloud.

Scope of the Study

Market Segments Covered in the Report:

By Offering

- Solution

- Security

- Financial Reporting & Analysis

- Financial Forecasting

- Governance, Risk & Compliances

- Others

- Services

By Deployment

- Public

- Private

- Hybrid

By End-use

- Banking & Financial Services

- Insurance

By Organization Size

- Large Enterprises

- Small & Medium Enterprises (SMEs)

By Application

- Wealth Management

- Account Management

- Revenue Management

- Customer Relationship Management

- Asset Management

- Others

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- IBM Corporation

- Google LLC

- Microsoft Corporation

- Oracle Corporation

- SAP SE

- Amazon Web Services, Inc.

- Cisco Systems, Inc.

- The Sage Group PLC

- Acumatica, Inc.

- Aryaka Networks, Inc.

Unique Offerings from the Publisher

- Exhaustive coverage

- The highest number of Market tables and figures

- Subscription-based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Chapter 1. Market Scope & Methodology

Chapter 2. Market Overview

Chapter 3. Competition Analysis - Global

Chapter 4. Global Finance Cloud Market by Offering

Chapter 5. Global Finance Cloud Market by Deployment

Chapter 6. Global Finance Cloud Market by End-use

Chapter 7. Global Finance Cloud Market by Organization Size

Chapter 8. Global Finance Cloud Market by Application

Chapter 9. Global Finance Cloud Market by Region

Chapter 10. Company Profiles

Companies Mentioned

- IBM Corporation

- Google LLC

- Microsoft Corporation

- Oracle Corporation

- SAP SE

- Amazon Web Services, Inc.

- Cisco Systems, Inc.

- The Sage Group PLC

- Acumatica, Inc.

- Aryaka Networks, Inc.

Methodology

LOADING...