Speak directly to the analyst to clarify any post sales queries you may have.

An authoritative introduction outlining converging technical, regulatory, and procurement drivers that are redefining insulation product selection and market behavior

The insulation products landscape is at an inflection point where material science advances, evolving building codes, and shifting procurement priorities converge to reshape decision frameworks for manufacturers, specifiers, and installers. Stakeholders increasingly evaluate insulation not only for thermal performance but also for acoustic control and fire resistance, requiring a more integrated view of product attributes across a broader set of applications. At the same time, capital deployment and supply chain management must adapt to accelerating regulatory updates and to the operational pressures of new construction pipelines and replacement cycles.

Against this backdrop, buyers and suppliers must balance short-term execution with medium-term strategic planning. New construction projects demand specification certainty and consistent material availability, while replacement work emphasizes retrofit compatibility and minimal disruption. These contrasting installation method requirements influence product design, logistical planning, and after-sales support expectations. Consequently, organizations that align product portfolios with both installation and application-specific needs will be better positioned to capture specification-driven opportunities and to support long-term asset resilience and occupant comfort.

How tightening regulatory mandates, materials innovation, and evolving building owner priorities are catalyzing rapid shifts in insulation product development and procurement

Recent transformative shifts in the insulation sector reflect a combination of regulatory tightening, technological progress, and shifting end-use priorities that together are accelerating product evolution. Regulatory frameworks have increasingly prioritized life-safety outcomes and energy efficiency, prompting manufacturers to reformulate materials and to provide more granular performance data. Concurrently, innovations in foam chemistry, engineered fibers, and spray technologies have broadened the trade-offs stakeholders can consider between thermal conductivity, acoustic damping, and fire performance.

Market participants also face changing construction workflows and heightened sustainability expectations. Commercial and residential building owners place greater emphasis on total installed cost and long-term operational efficiency, which favors solutions that deliver predictable performance over decades rather than solely low up-front cost. In industrial sectors, process safety and insulation durability under extreme conditions are becoming decisive selection criteria, thereby shaping investment in premium material types and specialized form factors. As a result, successful suppliers are those that can adapt product portfolios rapidly while maintaining traceable documentation that satisfies evolving compliance and specification regimes.

The aggregate effects of tariff-driven trade shifts in 2025 are prompting supply chain realignment, material substitution strategies, and heightened emphasis on sourcing resilience

The cumulative policy and trade adjustments introduced in 2025 are altering raw material access, cost structures, and sourcing strategies across the supply chain. Tariff implementations have increased the focus on domestic sourcing alternatives and on supply continuity planning, prompting manufacturers to reassess supplier concentration and to accelerate qualification of secondary suppliers. For downstream buyers, these changes have placed a premium on contractual resilience and on transparent origin tracing for the materials used in thermal, acoustic, and fire-resistant applications.

In response, many market actors are pursuing a combination of nearshoring, strategic inventory positioning, and material substitution where feasible. These shifts have operational implications: procurement cycles lengthen as suppliers are vetted for trade compliance and logistical reliability, and engineering teams revisit specification frameworks to preserve performance while accommodating new material economics. The net effect is a heightened need for cross-functional coordination between sourcing, engineering, and commercial teams so that project schedules, safety requirements, and lifecycle goals remain aligned despite an unsettled trade environment.

Comprehensive segmentation intelligence revealing how installation methods, application priorities, industry end-use profiles, form factors, and material choices interact to shape demand patterns

A nuanced segmentation perspective reveals where value and risk concentrate across installation practices, applications, end-use industries, form factors, and material types. Installation method dynamics show that new construction projects emphasize early-stage specification and integration with building envelopes, while replacement activity demands retrofit compatibility, minimized downtime, and robust long-term adhesion and fit. Application distinctions underscore that acoustic solutions differ materially from thermal and fire resistance approaches; acoustic requirements frequently drive selection of blankets, foams, and panels optimized for vibration damping and reverberation control, whereas thermal strategies often favor specialized assemblies for floor, roof, and wall applications that balance conductivity and thickness constraints.

End-use industry variations further refine opportunity sets: commercial buildings, including hospitality, offices, and retail spaces, prioritize occupant comfort, acoustic privacy, and aesthetics in addition to energy efficiency, while industrial environments require materials that resist chemical exposure, high temperatures, and abrasion. Residential demand traditionally splits between new buildings and renovation activity, the latter creating greater sensitivity to ease of installation and compatibility with existing substrates. Form factor considerations affect logistics, installation speed, and on-site performance: boards, including flexible boards, rigid boards, and semi rigid boards, offer predictable dimensions and compressive strengths; loose fill and rolls provide adaptability for irregular cavities; and sprays, whether blow in or spray foam, enable air-sealing and seamless coverage but require specialized application controls. Finally, material type choices-ranging from expanded polystyrene and extruded polystyrene to glass wool, polyurethane foam, and rock wool-are evaluated across a matrix of thermal performance, acoustic attenuation, fire behavior, moisture resilience, and recycling potential. Synthesizing these segmentation layers yields a clearer picture of where incremental product development and targeted commercial efforts will deliver the highest returns.

Regional strategic differentiation and localized demand drivers across the Americas, Europe, Middle East & Africa, and Asia-Pacific that influence production, specification, and go-to-market choices

Regional dynamics are increasingly determinant for strategic positioning, supply chain architecture, and product specification preferences. In the Americas, investment in energy efficiency retrofits and regulatory updates in several states are driving demand for high-performing thermal and acoustic solutions, and the region is also responding to nearshoring trends that favor localized manufacturing and shorter logistical lead times. Transitioning north-south trade flows and infrastructure renewal programs further define pockets of accelerated demand that favor modular and easy-to-install form factors.

In Europe, Middle East & Africa, variations in climate, construction norms, and fire-safety codes create differentiated specification demands; northern markets prioritize thermal continuity and airtightness, Mediterranean and Middle Eastern climates emphasize thermal performance under high solar loads, and select African markets are focused on affordable, locally sourced insulation options. These geographic distinctions influence material selection, with some markets shifting toward mineral wool and glass fiber for fire safety and thermal stability, while others adopt foams where installation speed and thickness constraints dominate.

Across Asia-Pacific, rapid urbanization and large-scale infrastructure projects are the dominant drivers, yielding strong appetite for both new construction systems and high-volume replacement solutions. Supply chain capacity, material cost-competitiveness, and modular construction techniques are critical in this region, and success depends on aligning product design with broad contractor preferences for efficient installation, durability in humid and tropical climates, and compliance with emergent national building standards.

How differentiated R&D investments, strategic partnerships, and sustainability transparency are reshaping competitive positioning and commercial advantage in the insulation sector

Competitive dynamics in the insulation arena are shaped by firms that combine technical R&D, scale manufacturing, and robust channel relationships. Leading players are investing selectively in product platforms that integrate multiple performance attributes-thermal, acoustic, and fire resistance-so they can offer bundled solutions that simplify specification for building owners and design teams. In parallel, some manufacturers are prioritizing investments in flexible form factors and in application-specific formulations to capture retrofit and niche industrial segments where premium pricing can be sustained by demonstrated lifecycle benefits.

Partnerships and strategic alliances are also differentiators: collaborations between material producers and applicators improve installation consistency and reduce performance variability in the field, while technology partnerships that enhance testing, certification, and digital documentation help speed approval cycles. Additionally, companies that prioritize traceability, recyclability, and transparent material disclosures are gaining competitive advantage in procurement environments that increasingly apply sustainability criteria. Ultimately, firms that align product development with compliance pathways, contractor workflows, and end-user value propositions will be best positioned to convert technical superiority into commercial traction.

Actionable strategic priorities for manufacturers and suppliers to enhance resilience, accelerate adoption of high-value products, and secure specification-led growth across regional markets

Industry leaders should pursue a multi-pronged strategy that balances near-term operational resilience with medium-term portfolio transformation. Begin by strengthening supplier diversification to mitigate tariff and logistic risks while instituting tighter inventory and contract monitoring to preserve project timelines. Simultaneously, invest in product lines that offer multi-attribute performance-thermally efficient materials that also provide acoustic damping and improved fire resistance-to meet more specification criteria with fewer SKUs and to reduce complexity for specifiers.

Additionally, prioritize application-centric training and certification programs for applicators to improve on-site performance and to reduce warranty exposure. This approach not only improves end-user satisfaction but also accelerates adoption of higher-value form factors such as spray systems and specialized boards. From a commercial perspective, develop modular commercial offers that bundle technical documentation, on-site support, and sustainability disclosures to address procurement requirements in the commercial, industrial, and residential channels. Finally, pursue targeted regional investments aligned with specific demand drivers-such as retrofit programs in the Americas, fire-safety-driven product lines in Europe, Middle East & Africa, and volume-oriented manufacturing scale in Asia-Pacific-to optimize return on investment and to fortify local market share.

A rigorous, triangulated research approach combining primary interviews, standards review, and expert workshops to validate technical performance and commercial implications

This research synthesizes primary interviews, secondary literature review, and structured expert workshops to ensure a robust and triangulated evidence base. Primary inputs include consultations with technical leads across manufacturing, specification experts within commercial and residential construction, and procurement leads involved in major infrastructure and retrofit programs. These engagements provided qualitative insight into product performance trade-offs, installation challenges, and end-user priorities.

Secondary analysis incorporated regulatory documentation, publicly available technical standards, and product datasheets to validate performance claims and to map compliance trajectories. Expert workshops brought together cross-functional practitioners to stress-test assumptions, evaluate scenario impacts of tariff adjustments, and refine segmentation logic across installation method, application, end-use industry, form factor, and material type. Finally, synthesis focused on actionable implications for product development, sourcing, and commercial strategies, ensuring recommendations are grounded in operational realities and current regulatory environments.

A forward-looking synthesis highlighting the imperative to align product innovation, supply chain resilience, and application-focused commercial models to secure long-term competitiveness

In conclusion, the insulation products sector is undergoing a phase of pragmatic transformation driven by regulatory tightening, material innovation, and changing end-user expectations across thermal, acoustic, and fire-resistant applications. Organizations that proactively align their product portfolios with installation realities and that invest in supplier resilience will navigate tariff-induced disruptions more effectively. Meanwhile, commercial success will increasingly hinge on the ability to deliver demonstrable lifecycle benefits, transparent material documentation, and installation competence that reduces on-site variability.

Looking forward, the firms that couple technical excellence with adaptive supply chain strategies and targeted regional investments will capture the most resilient revenue streams. By focusing on multi-attribute product development, contracting for reliability, and building strong applicator ecosystems, stakeholders can turn current challenges into opportunities for differentiation and long-term market relevance.

Additional Product Information:

- Purchase of this report includes 1 year online access with quarterly updates.

- This report can be updated on request. Please contact our Customer Experience team using the Ask a Question widget on our website.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

17. China Insulation Products Market

Companies Mentioned

The key companies profiled in this Insulation Products market report include:- Armacell International S.A.

- Aspen Aerogels, Inc.

- Atlas Roofing Corporation

- BASF SE

- Cabot Corporation

- CertainTeed Corporation

- Covestro AG

- DuPont de Nemours, Inc.

- GAF Materials LLC

- Holcim Ltd.

- Huntsman International LLC

- Johns Manville

- Kingspan Group plc

- Knauf Group

- Owens Corning

- Rockwool A/S

- Saint-Gobain S.A.

- The Dow Chemical Company

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 184 |

| Published | January 2026 |

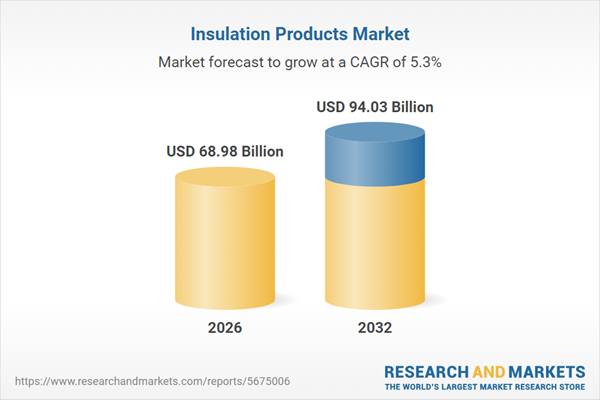

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 68.98 Billion |

| Forecasted Market Value ( USD | $ 94.03 Billion |

| Compound Annual Growth Rate | 5.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 19 |