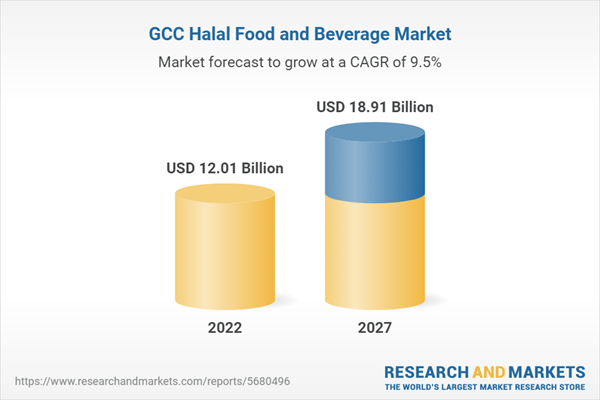

GCC Halal Food and Beverage Market are expected to reach US$ 18.90 Billion in 2027. Halal food is a term used to describe a group of foods and beverages produced primarily under Islamic dietary laws. Alcohol, pig by-products, and animals that are dead before slaughtering or not slain in Allah's name are all deemed haram or unfit for eating, according to the law. Furthermore, these food items are packaged and stored in utensils that must be cleaned according to Islamic standards.GCC Halal Food and Beverage Market was US$ 10.96 Billion in 2021. Industry Trends, Growth, Insight, Outlook, Impact of Inflation, Company Analysis, Forecast 2023-2027

Gulf Cooperation Council (GCC) Halal Food and Beverage Industry is expanding with a CAGR of 9.50% during 2022-2027:

The demand for halal food by-products in the GCC region is mainly driven by many Muslims who follow Islamic Sariah regulations as part of their religious beliefs. Furthermore, the demand is being driven by the growing number of stringent regulatory frameworks that include required halal labeling and certification standards for food and drinks.Furthermore, increased knowledge of food safety, hygiene, and trustworthiness afforded by halal food items, particularly among non-Muslims, is boosting the industry across the Gulf Cooperation Council. In addition, a significant increase in the food retail sector and the increasing availability of halal food and beverages across various distribution channels are also driving market expansion.

COVID 19 Impact on GCC Countries Halal Food and Beverage Industry:

The disturbance of the halal food and beverage industry's outlook caused by COVID-19's rapid spread harmed market growth in 2020. Surprisingly, the market directly impacted production and demand, disrupting supply chains and needs and affecting businesses and financial markets financially. Consumer preference for healthy, nutritious, and safer products, on the other hand, is growing. The favorable evolution of consumers' preferences towards safe and high-quality halal products is predicted to strengthen this market in the upcoming years. As a result, the halal food business is expected to explode through 2021. According to the publisher, Gulf Cooperation Council Halal Food and Beverage Market Size was US$ 10.96 Billion in 2021.Meat, Poultry, and Seafood Segment have one of the Highest Market Share:

In the GCC Halal Food and Beverage Industry, meat, poultry, and seafood items have the highest market share because of their vast reach and appeal. Besides, due to rising affluence and healthy eating trends among consumers, emerging economies such as the UAE, Kuwait, Saudi Arabia, Oman, Qatar, and Bahrain are likely to make significant contributions to the halal meat and poultry business growth.Furthermore, the increased demand for packaged processed beef products, regarded as hygienic and high-quality, is likely to propel segmental expansion in the coming years. In addition, with increased consumer awareness of food quality and safety, halal certification is becoming more popular for additional items such as dairy, cereals, grain-based products, non-dairy beverages, fruits, vegetables, and nuts.

E-Commerce is one of the Fastest Growing Industry:

Our analysis has studied the markets for supermarkets and hypermarkets, e-commerce, convenience stores, and other retail formats. E-Commerce has the fastest-growing market share, due to the rapid expansion of online channels, which has fuelled segmental growth significantly in recent years. E-commerce channels are rapidly evolving to invest in innovative technologies and provide consumers with various products. Furthermore, these online retailers are investing in meeting all regulatory criteria to increase the safety and quality of their products. The evolution of online retail channels would be aided by expanding global digitalization.Saudi Arabia Holds the Dominant Share in the Market:

Saudi Arabia is expected to be the fastest-growing country in the region's halal food and beverage market throughout the forecast period, with the most significant market share. It is also the primary producer of food and beverages in the Gulf region. However, the country's fast-growing population has outpaced its food supply, forcing it to rely on imports, fueling demand for Halal food products.In addition, Saudi Arabia's government has been enacting new rules to encourage the production of more halal cuisine. These laws are expected to make the country's food and beverage self-sufficient and provide domestic farmers with more chances to diversify their animals, such as poultry, camels, sheep, and dairy production.

Competitive Landscape among the Key Players:

The existence of multiple regional and global players fighting for market share in the halal food and beverage industry in the GCC is fragmented and highly competitive. Cargill Inc., Nestle, Unilever Group, and BRF S.A. are among the market's leading companies. Furthermore, businesses are concentrating on improving their production processes and product developments while maintaining ethical standards.Moreover, corporations are employing advanced technology for various purposes, including the detection of haram substances in cheese manufacturing, such as rennet. Additionally, enterprises can now use fungal rennet as a halal-certified product replacement with appreciation to technological improvements.

The publisher's latest report “Gulf Cooperation Council (GCC) Halal Food and Beverage Market, & Forecast By (Meat, Poultry and Sea food, Dairy Products, Cereals and Grain Based Products, Non-Dairy Beverages and Fruits, Vegetables and Nuts), Distribution Channel (Supermarkets and Hypermarkets, E-Commerce, Convenience Store and Other Retail Formats), Region (UAE, Kuwait, Saudi Arabia, Oman, Qatar and Bahrain), Companies (Cargill Inc., Nestle, Unilever Group, and BRF S.A.)” provides a detailed analysis of GCC Halal Food and Beverage Industry.

Product - The market is covered from 5 viewpoints:

1. Meat, Poultry and Sea food2. Dairy Products

3. Cereals and Grain Based Products

4. Non-Dairy Beverages

5. Fruits, Vegetables and Nuts

Distribution Channel - The market is covered from 4 viewpoints:

1. Supermarkets and Hypermarkets2. E-Commerce

3. Convenience Store

4. Other Retail Formats

Region - The market is covered from 6 viewpoints:

1. United Arab Emirates (UAE)2. Kuwait

3. Saudi Arabia

4. Oman

5. Qatar

6. Bahrain

Company Insights:

- Business overview

- Recent Development

- Sales Analysis

Key Players Analysis:

1. Cargill inc.2. Nestle

3. Unilever Group

4. BRF S.A.

Table of Contents

Companies Mentioned

- Cargill inc.

- Nestle

- Unilever Group

- BRF S.A.

Methodology

In this report, for analyzing the future trends for the studied market during the forecast period, the publisher has incorporated rigorous statistical and econometric methods, further scrutinized by secondary, primary sources and by in-house experts, supported through their extensive data intelligence repository. The market is studied holistically from both demand and supply-side perspectives. This is carried out to analyze both end-user and producer behavior patterns, in the review period, which affects price, demand and consumption trends. As the study demands to analyze the long-term nature of the market, the identification of factors influencing the market is based on the fundamentality of the study market.

Through secondary and primary researches, which largely include interviews with industry participants, reliable statistics, and regional intelligence, are identified and are transformed to quantitative data through data extraction, and further applied for inferential purposes. The publisher's in-house industry experts play an instrumental role in designing analytic tools and models, tailored to the requirements of a particular industry segment. These analytical tools and models sanitize the data & statistics and enhance the accuracy of their recommendations and advice.

Primary Research

The primary purpose of this phase is to extract qualitative information regarding the market from the key industry leaders. The primary research efforts include reaching out to participants through mail, tele-conversations, referrals, professional networks, and face-to-face interactions. The publisher also established professional corporate relations with various companies that allow us greater flexibility for reaching out to industry participants and commentators for interviews and discussions, fulfilling the following functions:

- Validates and improves the data quality and strengthens research proceeds

- Further develop the analyst team’s market understanding and expertise

- Supplies authentic information about market size, share, growth, and forecast

The researcher's primary research interview and discussion panels are typically composed of the most experienced industry members. These participants include, however, are not limited to:

- Chief executives and VPs of leading corporations specific to the industry

- Product and sales managers or country heads; channel partners and top level distributors; banking, investment, and valuation experts

- Key opinion leaders (KOLs)

Secondary Research

The publisher refers to a broad array of industry sources for their secondary research, which typically includes, however, is not limited to:

- Company SEC filings, annual reports, company websites, broker & financial reports, and investor presentations for competitive scenario and shape of the industry

- Patent and regulatory databases for understanding of technical & legal developments

- Scientific and technical writings for product information and related preemptions

- Regional government and statistical databases for macro analysis

- Authentic new articles, webcasts, and other related releases for market evaluation

- Internal and external proprietary databases, key market indicators, and relevant press releases for market estimates and forecasts

LOADING...

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 110 |

| Published | October 2022 |

| Forecast Period | 2022 - 2027 |

| Estimated Market Value ( USD | $ 12.01 Billion |

| Forecasted Market Value ( USD | $ 18.91 Billion |

| Compound Annual Growth Rate | 9.5% |

| Regions Covered | Middle East |

| No. of Companies Mentioned | 4 |