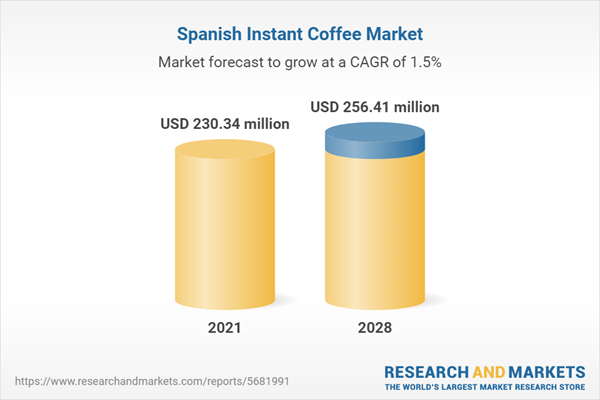

Spain instant coffee market is estimated to grow at a CAGR of 1.54% to reach US$256.406 million in 2028 from US$230.339 million in 2021.

Instant coffee, also known as soluble coffee, coffee crystals, and coffee powder, is a beverage made from boiled coffee beans that allow consumers to rapidly produce hot coffee by swirling hot water or milk into the powder or crystals.The increase in consumer demand for coffee due to growing disposable income is driving the expansion of the instant coffee industry. The primary driver of market growth is instant coffee's availability, affordability, ease of use, and deliciousness. The market will expand as more people become aware of the health advantages of coffee. Further, a boost to the market is expected to come from introducing new coffee flavors in various potencies tailored to the regional or national palate.

According to the Ministry of Foreign Affairs report, there has been a significant increase in coffee imports from 2018-2019 due to rising consumption in the country; however, in 2021, the imports declined since Spain is focusing on producing coffee on their own. As such, instant coffee production in Spain is also anticipated to increase steadily.

One of the key drivers of the nation's GDP is the hospitality sector. The industry is partly responsible for the region's considerable influx of foreign visitors. The country's expanding hotel industry is further expected to aid the market's growth throughout the projected period. Further, investments by key players are expected to fuel the market. For instance, in September 2022, Nestle announced investing EUR100m (US$97m) in one of its largest coffee factories in Spain.

Various manufacturers in Spain are innovating compostable coffee capsules, which is further surging the market. For instance, in November 2022, Nestlé Spain invested in green energy at its production facilities to ensure that its coffee is made ethically and responsibly. The soluble and capsuled coffee production plant in Girona has decreased the amount of water generated and the amount of CO2 emitted for every tonne of output by 35% and 40%, respectively.

The trend of café at home is one of the major drivers accelerating the market expansion.

The growing number of coffee shops is expected to boost the market. According to World Coffee Portal, in November 2022, East Crema Coffee, a network of specialty coffee shops in Spain, inaugurated its fifth location. By 2024, it plans to have 50 sites. The business has just opened its first facility outside of Madrid, where it also intends to add a sixth branch before the year ends. Manufacturers in the country are focusing on the innovation of new sustainable products. For instance, in March 2023, Recycap, a start-up firm in Valencia, obtained €400,000 in investment to streamline coffee capsule recycling and expand the business. Additionally, coffee consumption has increased because it increases energy levels, aids in fat burning by reactivating the body's metabolism, and improves productivity and cognitive function.Market Developments:

- To provide consumers with the taste of artisan coffee they would expect from a coffee, Nescafe expanded its inventory in April 2021 by introducing a Roastery Collection line. Two Arabica-bean-based instant coffee mixes, Light Roast, and Dark Roast, are part of the Nescafe Gold Blend Roastery line.

- In Jun 2020, Nestlé - in collaboration with Starbucks, introduced a new line of goods for consumption at home called Starbucks Premium Instant Coffee.

The offline segment is expected to dominate sales throughout the forecast period.

The offline segment in Spain's instant coffee market is segmented into retail and food service. The offline segment still holds a significant portion of the instant coffee market in Spain, although it has faced increasing competition from online sales in recent years. Several factors are affecting the growth of the offline segment in Spain's instant coffee market. One of the primary factors is the country's economic conditions. With the rising disposable income in Spain, the market is expected to grow in the forecast period. Another factor affecting the growth of the offline segment is the level of convenience offered by these physical stores. The prevalence of coffee consumption out-of-home, in office areas, is further boosting the growth prospects during the forecast period.Market Segmentation:

By Type

- Freeze-Dried Instant Coffee

- Spray-Dried Instant Coffee

- Others

By Distribution Channel

- Offline

- Retail

- Food Services

- Online

By Province

- Madrid

- Barcelona

- Valencia

- Others

Table of Contents

Companies Mentioned

- Nestle

- SEDA (an Olam Group Company)

- PROSOL

- Vendin

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 82 |

| Published | June 2023 |

| Forecast Period | 2021 - 2028 |

| Estimated Market Value ( USD | $ 230.34 million |

| Forecasted Market Value ( USD | $ 256.41 million |

| Compound Annual Growth Rate | 1.5% |

| Regions Covered | Spain |

| No. of Companies Mentioned | 4 |