The surgical blade market is anticipated to experience growth during the forecast period, driven by an increasing number of surgical procedures globally, a rise in cosmetic surgeries, and escalating healthcare expenditures. The establishment of more Centers of Excellence (CoE) for disease management worldwide is also contributing to market expansion. As the global population ages, there is a heightened demand for focused healthcare services to address chronic diseases, further boosting the market for specific surgical treatments. Additionally, the prevalence of cardiovascular diseases is expected to positively influence market growth. The rising rates of organ donation and transplantation activities around the world are further strengthening the growth prospects for surgical blades. Moreover, the growing adoption of minimally invasive surgical techniques will support market development in the coming years, although stringent government regulations may moderately hinder expansion.

Drivers of the Global Surgical Blade Market:

- Increasing Number of Surgical Procedures: The global rise in surgical interventions is a significant factor driving market growth. In the United Kingdom, for instance, surgeries are considered critical treatments provided by the National Health Service (NHS) in secondary care. This trend is bolstered by an increasing number of surgeons, particularly female surgeons, contributing to market demand.

Geographical Outlook of the Surgical Blades Market:

- Global Market Segmentation: The global surgical blade market is segmented into five regions: North America, South America, Europe, the Middle East and Africa, and Asia Pacific. In North America and Asia Pacific, various key factors drive market growth that reflects advancements in healthcare technology and changing medical demands.

Reasons for buying this report:

- Insightful Analysis: Gain detailed market insights covering major as well as emerging geographical regions, focusing on customer segments, government policies and socio-economic factors, consumer preferences, industry verticals, other sub-segments.

- Competitive Landscape: Understand the strategic maneuvers employed by key players globally to understand possible market penetration with the correct strategy.

- Market Drivers & Future Trends: Explore the dynamic factors and pivotal market trends and how they will shape up future market developments.

- Actionable Recommendations: Utilize the insights to exercise strategic decision to uncover new business streams and revenues in a dynamic environment.

- Caters to a Wide Audience: Beneficial and cost-effective for startups, research institutions, consultants, SMEs, and large enterprises.

What do businesses use our reports for?

Industry and Market Insights, Opportunity Assessment, Product Demand Forecasting, Market Entry Strategy, Geographical Expansion, Capital Investment Decisions, Regulatory Framework & Implications, New Product Development, Competitive Intelligence.Report Coverage:

- Historical data & forecasts from 2022 to 2030

- Growth Opportunities, Challenges, Supply Chain Outlook, Regulatory Framework, Customer Behaviour, and Trend Analysis

- Competitive Positioning, Strategies, and Market Share Analysis

- Revenue Growth and Forecast Assessment of segments and regions including countries

- Company Profiling (Strategies, Products, Financial Information, and Key Developments among others)

The global surgical blades market has been segmented as following:

- By Type

- Sterile

- Non-Sterile

- By Material Type

- Hardened & Tempered Steel

- Stainless Steel

- Carbon Steel

- By End-User

- Hospitals

- Clinics

- Ambulatory Surgery Centers

- Life Sciences & Biomedical Research Organization

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Rest of South America

- Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

- Rest of Europe

- Middle East and Africa

- Saudi Arabia

- UAE

- Rest of the Middle East and Africa

- Asia Pacific

- China

- India

- Japan

- South Korea

- Taiwan

- Thailand

- Indonesia

- Rest of Asia-Pacific

- North America

Table of Contents

Companies Mentioned

- GPC Medical Ltd

- B. Braun Melsungen AG

- Stryker

- Smith-Nephew

- CONMED

- Zimmer Biomet

- Swann-Morton Limited

- Hindustan Syringes & Medical Devices Ltd.

- Narang Medical

- Kehr Surgical Private Limited

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 138 |

| Published | January 2025 |

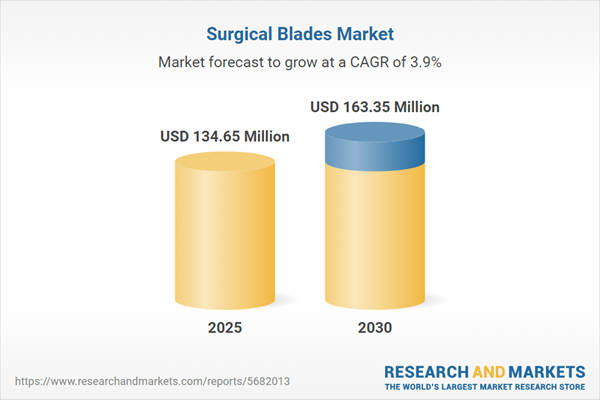

| Forecast Period | 2025 - 2030 |

| Estimated Market Value ( USD | $ 134.65 Million |

| Forecasted Market Value ( USD | $ 163.35 Million |

| Compound Annual Growth Rate | 3.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |