An electric kettle is an electronic pot, tea kettle, or hot pot primarily used for boiling water. The primary factor driving the market growth of electric kettles includes the rising demand for convenience products across the developed economies of the world, such as India and China, among others. Furthermore, the rising concerns regarding the consumption of hot water are also projected to be a critical factor that is amplifying the demand for electric kettles, thus bolstering market growth in the coming years. Also, the inclination of consumers toward the use of electric appliances is due to growing concerns for the conservation of other sources, such as oil and gasoline, among others. Besides, the high costs of gasoline are also leading to shifting consumer preferences toward the use of electric appliances in their kitchens, such as induction cooktops, electric kettles, and others. In addition, the rapid urbanization coupled with the changing lifestyle and the growing population is driving the demand for convenience products. This, in turn, is positively influencing the market growth throughout the forecast period.

Furthermore, the rising participation by key market players in the development and launch of new products, coupled with the rising penetration of new players in the market, further shows the potential for the market to grow soon. For example, in July 2019, Krutan, a leading home appliances manufacturer in India, announced the re-launch of an electric kettle model in India. The company also collaborated with Amazon to expand its reach to customers through expanding distribution channels.

Stainless steel is projected to hold a decent share

Based on the type of material, the electric kettle market is segmented into stainless steel, plastic, glass, and others. The stainless-steel segment is projected to hold a decent market share throughout the forecast period. The prime factor supplementing the growth of this segment is on account of its higher durability. Furthermore, various launched of stainless-steel electric kettles is also vital factor supplementing the growth of this segment during the next five years. The glass segment is projected to witness healthy growth in the coming years as these kettles are made from glass and have stylish designs, which is further augmenting its adoption, especially across the high-income groups. The plastic segment holds a notable share but is projected to grow at a slow CAGR in the coming years, mainly because of the raising concerns regarding the health hazards of plastic.Based on end-use, the electric kettle market has been segmented into residential and commercial. The residential segment holds a major market share and is estimated to maintain its dominance throughout the forecast period. The rising working-class population, along with the increased consumer spending on convenience products, are some of the prime factors supplementing the growth of this segment during the next five years.

The commercial segment is anticipated to witness healthy growth throughout the forecast period because of the booming hospitality and travel & tourism industry around the globe. The growth of the tourism sector has led to a decent increase in the number of facilities across the hospitality industry, including hotels, restaurants, resorts, and others. This, in turn, further provides an impetus for the market to grow during the next five years.

By the distribution channel, the market has been classified into online and offline. The offline segment is projected to hold a decent share of the market. The primary factors driving the growth of this segment include the presence of a considerably large population base that is reluctant towards online shopping.

Online sales are projected to witness considerable growth on account of the rising internet and smartphone penetration in the major developing economies around the globe.

North America to hold a noteworthy share in 2020.

Geographically, the electric kettle market has been classified into North America, South America, Europe, the Middle East and Africa, and the Asia Pacific. The North American region is expected to hold a substantial share throughout the forecast period because of the early adoption of technology. Moreover, the inclination towards energy-saving technology coupled with the presence of key market players in the region is some of the factors bolstering the growth in the North American region during the next five years. The market in the APAC region will show healthy growth on account of rising disposable income coupled with the growing working population.

Competitive Insights

Prominent key market players in the electric kettle market include Morphy Richards, Conair Corporation, Spectrum Brands Inc., and Philips, among others. These companies hold a noteworthy share in the market on account of their good brand image and product offerings.Major players in the electric kettle market have been covered along with their relative competitive position and strategies. The report also mentions recent deals and investments of different market players over the last two years.

Recent Developments and expansions

- In January 2020, Instant Brands Inc., a leading Canadian company that sells kitchen appliances, launched their latest product, the Instant Pot Kettle, with the ability for allowing users to designate the desired temperature.

- In May 2020, Xiaomi Corporation announced the launch of its new smart electric kettle in China.

- Everybody is always in awe of ZunVolt's wide range of unique products that are offered to customers. After successfully releasing several winter products, ZunVolt expanded its already extensive product line by releasing the much-awaited electrical kettle in January 2022 for just Rs. 1499.

COVID-19 Impact

The recent pandemic of COVID-19 across the globe is projected to boost the demand for electric kettles, especially in the short run. Drinking hot water is considered beneficial for boosting the immunity system of human beings. Thus, the high convenience offered by electric kettles, coupled with a rapid increase in the consumption of hot water during this pandemic, is also a major factor supplementing the demand for electric kettles across both developed and developing economies of the world. This, in turn, is projected to drive market growth during the next few months.Segmentation

By Type of Material

- Stainless Steel

- Glass

- Plastic

By End-Use

- Residential

- Commercial

By Distribution Channel

- Online

- Offline

By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Europe

- Germany

- France

- United Kingdom

- Spain

- Middle East and Africa

- Saudi Arabia

- Israel

- Asia Pacific

- China

- Japan

- South Korea

- India

Table of Contents

Companies Mentioned

- Morphy Richards

- Aroma Housewares Company

- Conair Corporation (Cuisinart)

- Koninklijke Philips N.V.

- Spectrum Brands Holdings, Inc.

- Chef's Choice by EdgeCraft

- Hamilton Beach Brands Holding Company

- Breville Group Limited

- Crompton Greaves Consumer Electricals Limited.

- Bajaj Electricals Ltd

- Stovekraft

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 145 |

| Published | September 2022 |

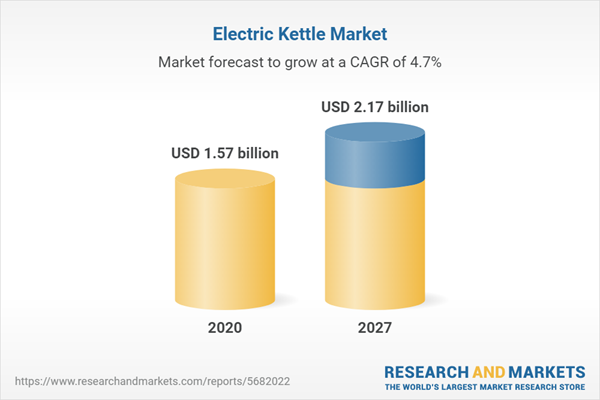

| Forecast Period | 2020 - 2027 |

| Estimated Market Value ( USD | $ 1.57 billion |

| Forecasted Market Value ( USD | $ 2.17 billion |

| Compound Annual Growth Rate | 4.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |