'Medical supplies' is a collective term used for various medical equipment such as catheters, oxygen and diagnostic supplies, gloves, surgical masks, syringes, injection supplies, durable medical supplies such as wheelchairs, hospital beds, therapeutic supplies, and many more. Healthcare professionals use these products and equipment to effectively diagnose, treat, and manage medical conditions.

The market is projected to fuel growth in the forecast period owing to the increasing number of chronic diseases at the global level. The growing geriatric population further puts pressure on increasing advanced healthcare facilities dedicated to older people. This will further enhance favorable growth prospects for the market to increase in the forecast period. Government investment in several healthcare projects and the development of novel and improved healthcare facilities are further augmenting the market during the forecast period.

The medical supplies market consists of a wide range of products and equipment that are used in healthcare for augmenting medical services. The products include diagnostic supplies, consumables, and disposable items such as gloves and syringes. Additionally, there are durable medical supplies like patient vital sign monitors and surgical instruments. These products serve hospitals, clinics, laboratories, ambulatory diagnostic markets, and other healthcare facilities.

Medical Supplies Market Drivers

The growing global prevalence of chronic diseases is set to drive a significant surge in demand, fueling the expansion of the medical supplies market during the forecast period

There has been an increase in chronic diseases worldwide. These include the prevalence of cardiovascular diseases, diabetes, hypertension, and many other non-communicable diseases. National Health Council reported that in 2020, around 157 million Americans were suffering from chronic diseases. As per the reports by the World Health Organization, Cardiovascular diseases account for most non-communicable deaths, which was 17.9 million in 2023, followed by 9.3 million deaths by cancer, 4.1 million deaths by chronic respiratory diseases, and 2 million deaths by diabetes, and when combined with other NCDs disease death, it accounts for 74% of all deaths globally. In America, 75% of all healthcare costs include chronic conditions.Thus, the growing prevalence of chronic diseases will drive the market growth of medical supplies that help in delivering healthcare services.

Medical Supplies Market Geographical Outlook:

North America will continue to dominate the medical supplies market during the forecast period

North America is expected to account for a sizable portion of the global medical supplies market. It will continue to dominate the market for medical supplies. This growth is owing to various reasons, such as the advanced healthcare infrastructure in the North American region, such as the USA and Canada. Along with the advanced healthcare infrastructure, there is also a high prevalence of chronic diseases. According to the Centers for Disease Control & Prevention's statistics, over 1.6 million people in the United States are diagnosed with cancer each year.It is further estimated that around 600,000 die from cancer, making it the second leading cause of death in the country.The government is increasingly spending on healthcare services, leading to an overall rise in demand for medical supplies. The U.S. Department of Health & Human Services made a $75 million investment in rural America in 2024. Thus, the North American region is anticipated to hold a dominant share of the medical supplies market in the forecast period.Reasons for buying this report:

- Insightful Analysis: Gain detailed market insights covering major as well as emerging geographical regions, focusing on customer segments, government policies and socio-economic factors, consumer preferences, industry verticals, other sub-segments.

- Competitive Landscape: Understand the strategic maneuvers employed by key players globally to understand possible market penetration with the correct strategy.

- Market Drivers & Future Trends: Explore the dynamic factors and pivotal market trends and how they will shape up future market developments.

- Actionable Recommendations: Utilize the insights to exercise strategic decision to uncover new business streams and revenues in a dynamic environment.

- Caters to a Wide Audience: Beneficial and cost-effective for startups, research institutions, consultants, SMEs, and large enterprises.

What do businesses use our reports for?

Industry and Market Insights, Opportunity Assessment, Product Demand Forecasting, Market Entry Strategy, Geographical Expansion, Capital Investment Decisions, Regulatory Framework & Implications, New Product Development, Competitive IntelligenceReport Coverage:

- Historical data & forecasts from 2022 to 2030

- Growth Opportunities, Challenges, Supply Chain Outlook, Regulatory Framework, Customer Behaviour, and Trend Analysis

- Competitive Positioning, Strategies, and Market Share Analysis

- Revenue Growth and Forecast Assessment of segments and regions including countries

- Company Profiling (Strategies, Products, Financial Information, and Key Developments among others)

The Medical Supplies market is segmented and analyzed as follows:

By Type

- Diagnostic Medical Supplies

- Wound Care

- Disinfectants

- Personal Protective Equipment

- Others

By End-User

- Hospitals

- Clinics

- Ambulatory Surgery Centers

- Diagnostic Centers

- Biomedical Research Organization

By Distribution Channel

- Online

- Offline

By Geography

- North America

- South America

- Europe

- Middle East and Africa

- Asia-Pacific

Table of Contents

Companies Mentioned

- APS Biogroup

- Medtronic

- Cardinal Health

- Becton, Dickinson and Company

- Johnson & Johnson Services, Inc.

- B. Braun Melsungen AG

- 3M

- Boston Scientific Corporation

- Abbott

- Terome Corporation

- Teleflex Incorporated

Table Information

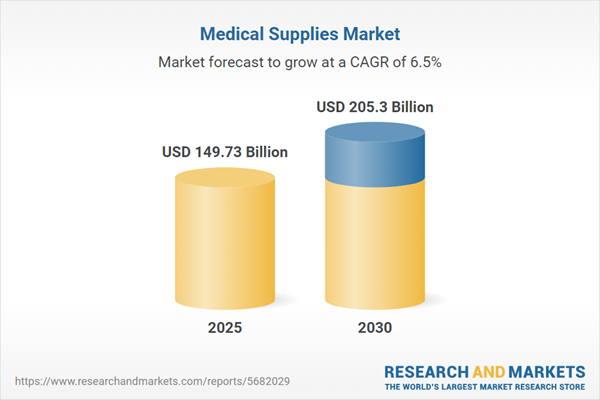

| Report Attribute | Details |

|---|---|

| No. of Pages | 136 |

| Published | December 2024 |

| Forecast Period | 2025 - 2030 |

| Estimated Market Value ( USD | $ 149.73 Billion |

| Forecasted Market Value ( USD | $ 205.3 Billion |

| Compound Annual Growth Rate | 6.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |