Ammonia is a compound of hydrogen and nitrogen. It is a colorless gas that has a distinct odor. Ammonia is considered one of the key components used to manufacture several things. It can be easily dissolved in water and form an ammonium hydroxide solution. Ammonia can be easily compressed and converted into a colorless liquid under pressure. Due to its less combustible nature, it can be used across several industries in numerous applications.

Ammonia Market Drivers

Rising demand from various end-use sectors

The booming demand for ammonia across theagriculture industryas fertilizer, as it is a major source of nitrogen, is one of the key factors playing a significant role in shaping the market growth during the forecast period. The wide usage of ammonia across the pharmaceutical industry as an ingredient is also anticipated to positively impact the market in the projected period. Additionally, the market is expected to experience significant growth due to the increasing use of ammonia as a refrigerant. This trend is largely attributed to ammonia's many advantages, including its environmental safety and that ammonia-based refrigeration systems use less electricity.Other capabilities, such as better heat transfer properties compared with other refrigerants, make it suitable for smaller areas, thus allowing the plant construction costs to be considerably lower. Therefore, the rising usage of ammonia in refrigeration systems is projected to augment the business growth opportunities for manufacturers in the coming years.

Ammonia is widely used in numerous applications across the food and beverage sector, wastewater treatment plants, industrial and household cleaning products, metallurgical processes, and others. Moreover, regional players are investing heavily in capacity expansions to meet the growing domestic and international demand for ammonia, showing the potential for market growth.

The Asia-Pacific region is expected to show good growth in the coming years.

Geographically, the Asia-Pacific region is expected to hold a significant market share throughout the forecast period. The presence of the two largest economies, such as India and China, is one of the major factors bolstering the share of the APAC region in the global ammonia market. These countries are some of the crop-producing countries in the region, which is a notable factor supplementing the demand for fertilizers.

Furthermore, the presence of well-established industries in countries like India, China, and South Korea further bolsters the ammonia market growth in the Asia-Pacific region during the next five years. The regional development of industries utilizing ammonia will positively impact market expansion. The presence of established fertilizer manufacturing companies in the region, along with the expanding pharmaceutical industry, supports market growth in the coming years.

Reasons for buying this report:

- Insightful Analysis: Gain detailed market insights covering major as well as emerging geographical regions, focusing on customer segments, government policies and socio-economic factors, consumer preferences, industry verticals, other sub-segments.

- Competitive Landscape: Understand the strategic maneuvers employed by key players globally to understand possible market penetration with the correct strategy.

- Market Drivers & Future Trends: Explore the dynamic factors and pivotal market trends and how they will shape up future market developments.

- Actionable Recommendations: Utilize the insights to exercise strategic decision to uncover new business streams and revenues in a dynamic environment.

- Caters to a Wide Audience: Beneficial and cost-effective for startups, research institutions, consultants, SMEs, and large enterprises.

What do businesses use our reports for?

Industry and Market Insights, Opportunity Assessment, Product Demand Forecasting, Market Entry Strategy, Geographical Expansion, Capital Investment Decisions, Regulatory Framework & Implications, New Product Development, Competitive IntelligenceReport Coverage:

- Historical data & forecasts from 2022 to 2030

- Growth Opportunities, Challenges, Supply Chain Outlook, Regulatory Framework, Customer Behaviour, and Trend Analysis

- Competitive Positioning, Strategies, and Market Share Analysis

- Revenue Growth and Forecast Assessment of segments and regions including countries

- Company Profiling (Strategies, Products, Financial Information, and Key Developments among others)

The Ammonia market is segmented and analyzed as follows:

By Form

- Dry

- Liquid

- Gas

By Application

- Agriculture

- Mining

- Refrigeration

- Pharmaceuticals

- Others

By Geography

- North America

- South America

- Europe

- Middle East and Africa

- Asia-Pacific

Table of Contents

Companies Mentioned

- BASF SE

- Yara

- CF Industries Holdings, Inc.

- CSBP Limited

- EuroChem Group

- Nutrien Ltd.

- GROUP DF

- IFFCO

- Huaqiang Chemical Group Stock Co., Ltd

- Koch Industries, Inc.

- OCI N.V.

- SABIC

- QAFCO

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 130 |

| Published | December 2024 |

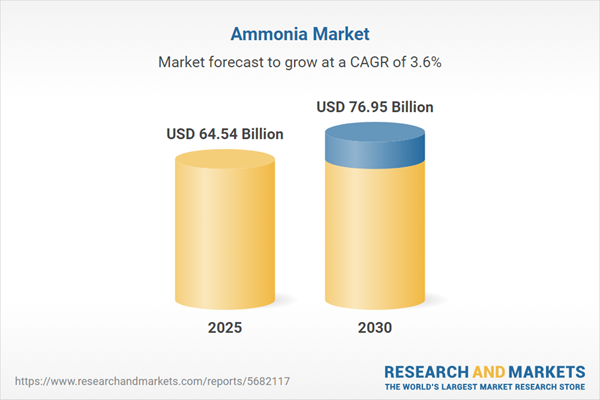

| Forecast Period | 2025 - 2030 |

| Estimated Market Value ( USD | $ 64.54 Billion |

| Forecasted Market Value ( USD | $ 76.95 Billion |

| Compound Annual Growth Rate | 3.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 13 |