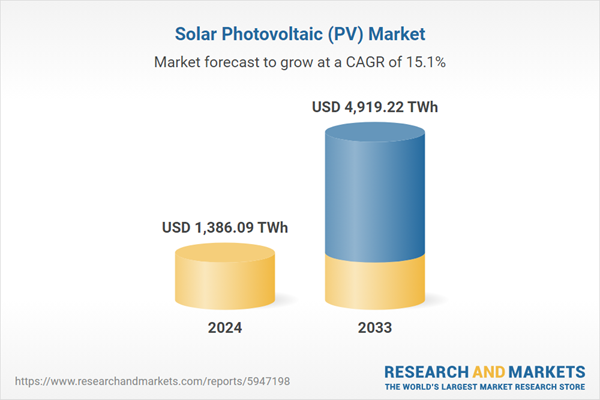

Solar Photovoltaic (PV) Market Analysis:

Market Growth and Size: The global market is experiencing significant growth, attributed to the increasing global demand for renewable energy sources and environmental sustainability. This market is expanding rapidly, with Asia Pacific leading in terms of market size, driven by countries, such as China and India with their substantial investments and favorable government policies.Major Market Drivers: Key drivers include governmental support through incentives and policies, technological advancements improving efficiency and reducing costs, and growing environmental awareness. The economic viability and energy security provided by solar PV systems also contribute to the market's growth.

Technological Advancements: Continuous innovations in solar panel efficiency, manufacturing processes, and energy storage solutions are vital for the market. The integration of solar PV with smart technologies and artificial intelligence is enhancing functionality and appeal, making solar energy more practical and efficient.

Industry Applications: Solar PV finds applications across residential, commercial, and utility sectors, with utility-scale installations being the largest segment. The versatility of solar PV systems allows for their use in various settings, from rooftop installations in urban areas to large ground-mounted arrays in rural regions.

Key Market Trends: A significant trend is the shift towards decentralized energy production, with an increasing number of residential and commercial users adopting rooftop solar systems. The market is also seeing a rise in corporate investments in solar energy as part of sustainability initiatives.

Geographical Trends: While the Asia Pacific region dominates the market, significant growth is also observed in North America and Europe, driven by supportive government policies and environmental awareness. Emerging markets in Latin America and the Middle East and Africa are showing potential due to their abundant solar resources and growing energy needs.

Competitive Landscape: The market is characterized by the presence of key players engaging in strategic partnerships, research and development, and expansion into new markets. These companies are focusing on innovative solutions to enhance efficiency and reduce costs, while also maintaining strong commitments to sustainability.

Challenges and Opportunities: Challenges include the intermittency of solar energy, the need for improved energy storage solutions, and competition with traditional energy sources. However, these challenges present opportunities for innovation in energy storage, grid integration, and the development of new materials and technologies to improve solar PV systems' efficiency and cost-effectiveness.

Solar Photovoltaic (PV) Market Trends:

Government policies and incentives

Governmental support plays a pivotal role in driving the market. This support often comes in the form of financial incentives, such as tax credits, rebates, feed-in tariffs, and subsidies that significantly reduce the initial investment costs for solar installations. Policies such as net metering, which allows residential and commercial solar system owners to sell excess electricity back to the grid, also enhance the attractiveness of investing in solar PV systems. Furthermore, governments around the world are setting ambitious renewable energy targets and implementing regulations to reduce carbon emissions, which directly favor the adoption of solar PV technologies. These policies encourage residential and commercial users and attract large-scale investments from corporations and utility providers.Continual technological advancements

The solar PV market is significantly influenced by continuous technological advancements. These advancements include improvements in the efficiency of solar panels, which allow for more electricity to be generated from the same amount of sunlight. Higher efficiency panels are particularly attractive in areas with limited space, as they maximize energy production per square foot.Innovations in manufacturing processes have also reduced the cost of producing solar panels, making them more affordable for a broader range of consumers. Additionally, advancements in energy storage technologies, such as lithium-ion batteries, have made solar energy more practical and reliable, as they enable the storage of excess energy for use when sunlight is not available.

Environmental awareness and climate change concerns

As individuals and organizations become more conscious of their carbon footprint and the impact of fossil fuels on the environment, there is an increasing shift towards renewable energy sources. Solar PV systems offer a clean and sustainable alternative, generating electricity without emitting greenhouse gases. This environmental benefit is a strong motivating factor for both residential and commercial consumers looking to reduce their environmental impact.Additionally, the visible effects of climate change are prompting governments and international organizations to invest in and promote sustainable energy solutions, including solar PV. The desire to mitigate the effects of climate change and transition to a more sustainable energy future is thus a significant factor fueling the growth of the solar PV market.

Solar Photovoltaic (PV) Industry Segmentation:

This report provides an analysis of the key trends in each segment of the global solar photovoltaic (PV) market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, grid type, deployment, and end user.Breakup by Type:

- Thin Film

- Multi-Si

- Mono-Si

Thin-film solar PV panels segment includes various technologies, such as amorphous silicon, cadmium telluride (CdTe), and copper indium gallium selenide (CIGS). Thin-film panels are less efficient compared to crystalline silicon panels but are cheaper to produce and offer better performance in low-light conditions. They are ideal for large-scale utility projects and in applications where weight and space constraints are critical, such as on industrial rooftops and in integrated building photovoltaics. The thin-film segment is favored for its aesthetic appeal in architectural applications and its potential for integration into a variety of materials for building-integrated photovoltaics (BIPV).

On the other hand, multi-crystalline silicon (multi-Si) solar PV panels are manufactured from multiple silicon crystals melted together. These panels are widely recognized for their blue, speckled appearance and are more cost-effective than their mono-Si counterparts. While they have lower efficiency rates compared to mono-Si panels, the manufacturing process of multi-Si is simpler and less energy-intensive, making them a more economically viable option for large-scale solar installations and residential applications.

Furthermore, mono-crystalline silicon (mono-Si) solar panels, made from a single, continuous crystal structure, are known for their high efficiency and sleek black appearance. These panels have the highest efficiency rates among all types of solar panels due to their purity of silicon, making them ideal for applications where space is limited, such as residential solar installations.

Breakup by Grid Type:

- On-Grid

- Off-Grid

On-grid holds the largest share in the industry

A detailed breakup and analysis of the market based on the grid type have also been provided in the report. This includes on-grid and off-grid. According to the report, on-grid accounted for the largest market share.On-grid, or grid-tied, solar PV systems are popular due to their simplicity, cost-effectiveness, and the ability to use the grid as a virtual battery, eliminating the need for energy storage in batteries. When these systems produce more electricity than needed, the surplus is fed back into the grid, often earning the producer energy credits or compensation through net metering policies. On-grid systems are ideal for residential, commercial, and industrial applications in regions with a stable grid infrastructure. They are favored for their economic benefits, ease of installation, and the reliability of having a continuous power supply, supplemented by the grid when solar production is insufficient.

On the other hand, the off-grid solar PV segment caters primarily to remote areas where grid connectivity is either unavailable or impractical. These systems are often coupled with energy storage solutions, such as batteries to ensure a continuous power supply, especially during the night or on cloudy days. Off-grid systems are crucial for rural electrification, providing a sustainable and independent source of energy to areas lacking traditional grid infrastructure.

Breakup by Deployment:

- Ground-mounted

- Rooftop Solar

Ground-mounted represents the leading market segment

The report has provided a detailed breakup and analysis of the market based on the deployment. This includes ground-mounted and rooftop solar. According to the report, ground-mounted represented the largest segment.Ground-mounted solar PV systems represent the largest segment in the market as these systems are installed on open land and can be scaled to a much larger size compared to rooftop systems, making them suitable for industrial and commercial electricity generation. Ground-mounted solar arrays have the advantage of optimal positioning and angling toward the sun, which maximizes energy production.

They are often used in rural or remote areas where land availability is not a constraint. This segment benefits from economies of scale, leading to lower costs per watt of electricity generated. The ground-mounted segment is instrumental in driving large-scale solar adoption, contributing significantly to the overall growth of renewable energy capacity worldwide.

On the other hand, rooftop solar PV systems are installations on the roofs of residential, commercial, or industrial buildings. This segment is particularly popular in urban areas where ground space is limited. Rooftop solar allows property owners to utilize unused roof space to generate electricity, leading to reduced energy bills and increased energy independence. These systems are tailored to meet the energy needs of the building they are installed on and can also provide additional benefits, including thermal insulation and reduced heat island effect in urban areas.

Breakup by End User:

- Residential

- Commercial

- Utility

Utility accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the end user. This includes residential, commercial, and utility. According to the report, utility represented the largest segment.The utility segment is the largest in the solar PV market, predominantly driven by large-scale solar farms and mass electricity generation projects. Utilities invest in vast solar installations to supplement and diversify their energy mix, reduce reliance on fossil fuels, and meet regulatory requirements for renewable energy production. These large-scale projects contribute significantly to national grids, providing renewable energy to a broad customer base. The utility segment benefits from economies of scale, resulting in lower costs per watt and making solar energy more competitive with conventional energy sources.

On the other hand, the commercial segment includes solar PV installations on commercial buildings, businesses, and industrial facilities. Companies adopt solar energy to reduce operational costs, secure energy independence, and enhance their green credentials, aligning with corporate sustainability goals. This segment often utilizes both rooftop and ground-mounted systems, depending on space availability and energy requirements.

Furthermore, the residential segment comprises solar PV systems installed on individual homes and housing complexes. This segment is driven by homeowners seeking to reduce electricity bills, gain energy independence, and contribute to environmental sustainability. Residential solar installations typically involve rooftop systems but can also include small-scale ground-mounted arrays in properties with sufficient land.

Breakup by Region:

Solar Photovoltaic (PV) Market

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia Pacific leads the market, accounting for the largest solar photovoltaic (PV) market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific accounted for the largest market share.The Asia Pacific region represents the largest segment in the market, driven by significant investments and rapid expansion in various countries. This region's growth is fueled by abundant sunlight, government incentives, and a strong push towards renewable energy to meet the increasing power demands of its large and growing population. China, a global leader in solar PV manufacturing, plays a pivotal role in the region's dominance, along with India's ambitious solar targets. The availability of cost-effective labor and materials, coupled with substantial government support in terms of subsidies and favorable policies, makes Asia Pacific a key player in the global solar PV market.

On the contrary, in North America, the solar PV market is primarily driven by the United States, with Canada also contributing significantly. The region's growth is supported by government policies, tax incentives, and a growing awareness of renewable energy benefits. The United States, with its state-specific renewable energy targets and incentives, is a major market for both residential and utility-scale solar installations.

Additionally, Europe's solar PV market is characterized by strong government support, ambitious renewable energy targets, and a high level of environmental awareness among the populace. Countries, including Germany, Spain, and Italy have been at the forefront of solar adoption, driven by favorable feed-in tariffs and subsidies. The European Union’s commitment to reducing carbon emissions and transitioning to a sustainable energy future continues to drive the growth of solar PV in this region.

On the other hand, the Latin America solar PV market is emerging, with countries, such as Brazil, Mexico, and Chile leading the way. The region benefits from high solar irradiance and a growing need for sustainable energy solutions. Latin America's market growth is encouraged by government policies, international investments, and a gradual shift from traditional energy sources to renewable energies.

Furthermore, the Middle East and Africa region is experiencing gradual growth in the solar PV market, primarily driven by the need to diversify energy sources away from oil and gas. Countries, such as the United Arab Emirates, Saudi Arabia, and South Africa are investing in large-scale solar projects to capitalize on the abundant solar resources available in the region. Government initiatives, combined with the decreasing costs of solar technology, are key factors propelling the market in this region. Moreover, solar PV offers a viable solution for electrification in remote and rural areas in Africa, where grid connectivity is often a challenge.

Leading Key Players in the Solar Photovoltaic (PV) Industry:

Key players in the solar PV market are actively engaging in various strategies to strengthen their market position and capitalize on the growing demand for renewable energy. These strategies include investing in research and development to enhance efficiency and reduce the costs of solar panels, expanding manufacturing capacities, and exploring new materials and technologies. Many are forming strategic partnerships and collaborations to enter new markets and leverage each other’s strengths. Additionally, these companies are focusing on sustainability and corporate social responsibility to improve their brand image and appeal to environmentally conscious consumers.The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major companies have also been provided.

Some of the key players in the market include:

- Acciona S.A.

- Canadian Solar Inc.

- First Solar Inc.

- JA Solar Technology Co

- JinkoSolar Holding Co. Ltd.

- LONGi Green Energy Technology Co. Ltd.

- Sharp Corporation

- Solar Frontier K.K

- SunPower Corporation

- Suntech Power Co. Ltd. (Shunfeng Int'l)

- Tata Power Solar Systems Limited (Tata Power Company Limited)

- Trina Solar Co. Ltd.

Key Questions Answered in This Report:

- How big is the solar photovoltaic (PV) market?

- What is the future outlook of solar photovoltaic (PV) market?

- What are the key factors driving the solar photovoltaic (PV) market?

- Which region accounts for the largest solar photovoltaic (PV) market share?

- Which are the leading companies in the global solar photovoltaic (PV) market?

Table of Contents

Companies Mentioned

- Acciona S.A.

- Canadian Solar Inc.

- First Solar Inc.

- JA Solar Technology Co

- JinkoSolar Holding Co. Ltd.

- LONGi Green Energy Technology Co. Ltd.

- Sharp Corporation

- Solar Frontier K.K

- SunPower Corporation

- Suntech Power Co. Ltd. (Shunfeng Int'l)

- Tata Power Solar Systems Limited (Tata Power Company Limited)

- Trina Solar Co. Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 147 |

| Published | April 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 1386.09 TWh |

| Forecasted Market Value ( USD | $ 4919.22 TWh |

| Compound Annual Growth Rate | 15.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 12 |