Renewable methanol is a sustainable and environmentally friendly alternative to traditional methanol, which is primarily derived from fossil fuels. It is produced through a process that utilizes renewable resources, such as biomass, carbon dioxide (CO2) captured from industrial emissions or the atmosphere, and renewable electricity. This innovative production method typically involves the conversion of these feedstocks into syngas and then further synthesis to yield methanol.

Renewable methanol can serve as a versatile energy carrier and chemical feedstock, finding applications in transportation fuels, energy storage, and the production of various chemicals and materials. Its development represents a significant step towards a more sustainable and circular economy, mitigating greenhouse gas emissions while offering a viable alternative in the transition to cleaner energy and chemical production.

The increasing awareness of environmental issues among the masses is driving the global market. Renewable methanol plays a pivotal role in mitigating the levels of particulate matter and various greenhouse gases, such as carbon dioxide, nitrous oxide, and sulfur dioxide, thus contributing to a reduction in emissions. Also, the rising adoption of renewable methanol as both an additive and a substitute for gasoline, due to its favorable attributes such as a high octane rating, resistance to knocking, and oxygen content. The urgent need to combat climate change and reduce greenhouse gas emissions is augmenting the global market.

Methanol produced from renewable sources offers a way to significantly lower the carbon footprint compared to traditional fossil-based methanol, as it can be produced using renewable energy and even incorporate captured carbon dioxide emissions, making it a potential carbon-neutral or carbon-negative fuel and feedstock. Moreover, governments and regulatory bodies around the world are imposing increasingly stringent emissions reduction targets and regulations. As a result, industries are seeking cleaner alternatives to reduce their environmental impact. Renewable methanol aligns with these goals, making it an attractive choice for companies striving to meet regulatory requirements and sustainability commitments.

Renewable Methanol Market Trends/Drivers:

Environmental Sustainability and Carbon Emissions Reduction

The global emphasis on environmental sustainability and the urgent need to reduce carbon emissions is a significant driver. As countries strive to meet their climate goals outlined in international agreements, such as the Paris Agreement, renewable methanol emerges as a valuable tool. Its production process, which utilizes renewable resources and can even capture carbon dioxide emissions, makes it a low-carbon or carbon-neutral fuel and feedstock option.In sectors, including transportation, where decarbonization is challenging, renewable methanol can be blended with traditional fuels or used as a neat fuel in methanol fuel cells, drastically reducing greenhouse gas emissions. Industries seeking to reduce their carbon footprint also turn to renewable methanol as a cleaner alternative in chemical synthesis and industrial processes, further augmenting its demand.

Increasing Demand for Sustainable Transportation Fuels

The transportation sector is a significant contributor to global emissions, and governments, as well as consumers, are increasingly seeking cleaner alternatives to traditional fossil fuels. Renewable methanol can be a game-changer in this regard. It can be used as a drop-in replacement or blended with gasoline or diesel, reducing emissions from road vehicles and maritime shipping.Methanol fuel cells, powered by renewable methanol, offer longer ranges and shorter refueling times compared to electric batteries, making them an attractive option for various applications, including passenger cars, buses, and trucks. As regulatory pressures and consumer preferences shift towards low-emission and zero-emission vehicles, the demand for renewable methanol in the transportation sector is poised to grow significantly.

Advancements in Renewable Energy Integration

Renewable methanol production relies heavily on renewable electricity sources, such as wind and solar power, for the electrolysis of water and the generation of hydrogen required in its synthesis. As these renewable energy technologies become more cost-effective and accessible, the cost of producing renewable methanol decreases, making it a more economically viable option.Additionally, innovations in energy storage solutions, such as grid-scale batteries, enable the efficient utilization of intermittent renewable energy sources, ensuring a stable supply for renewable methanol production facilities. This synergy between renewable energy and renewable methanol production not only reduces the carbon footprint of methanol but also ensures a consistent supply, making it an attractive option for industries seeking to decarbonize their operations and meet sustainability targets.

Renewable Methanol Industry Segmentation:

This report provides an analysis of the key trends in each segment of the global renewable methanol market report, along with forecasts at the global, regional and country levels from 2025-2033. Our report has categorized the market based on feedstock, application and end use industry.Breakup by Feedstock:

- Agricultural Waste

- Forestry Residues

- Municipal Solid Waste

- Co2 Emissions

- Others

Municipal solid waste dominates the market

The report has provided a detailed breakup and analysis of the market based on the feedstock. This includes agricultural waste, forestry residues, municipal solid waste, Co2 emissions and others. According to the report, municipal solid waste represented the largest segment.In urban areas worldwide, the generation of municipal solid waste is a continuous process, and as populations grow, so does the availability of this resource. Converting MSW into renewable methanol not only reduces the burden on landfills but also provides an economically viable and sustainable solution for waste disposal. Furthermore, the use of municipal solid waste as a feedstock aligns with the principles of a circular economy. It promotes the recycling and repurposing of waste materials into valuable products, such as methanol, thus minimizing environmental impacts.

Additionally, MSW often contains organic matter, which can be converted into syngas through processes, including gasification or pyrolysis. This syngas can then be transformed into methanol, effectively closing the loop on waste utilization. Moreover, from an environmental perspective, the conversion of MSW into renewable methanol is seen as a carbon-neutral or even carbon-negative approach.

Breakup by Application:

- Formaldehyde

- Dimethyl Ether (DME) and Methyl tert-Butyl Ether (MTBE)

- Gasoline

- Solvents

- Others

Formaldehyde dominates the market

The report has provided a detailed breakup and analysis of the market based on the application. This includes formaldehyde, dimethyl ether (DME) and methyl tert-butyl ether (MTBE), gasoline, solvents, and others. According to the report, formaldehyde represented the largest segment.Formaldehyde is widely used in the manufacturing of composite wood products, including particleboard, plywood, and medium-density fibreboard (MDF). The ability of formaldehyde resins to provide adhesion and structural stability makes them indispensable in the construction and furniture industries. These resins are known for their cost-effectiveness and durability, which contribute to their prevalence in the market. Formaldehyde also plays a pivotal role in the production of textiles and paper. In textile finishing, formaldehyde-based resins are used to impart wrinkle resistance and durability to fabrics.

In the paper industry, formaldehyde is utilized as a crosslinking agent in the production of specialty papers, including photographic and filter papers, where dimensional stability and strength are critical. Furthermore, it is a key component in the manufacture of various chemical intermediates and additives. It is used in the production of chemicals, including melamine, pentaerythritol, and methylene diphenyl diisocyanate (MDI), which have applications in adhesives, coatings, plastics, and foams.

Breakup by End Use Industry:

- Chemicals

- Transportation

- Power Generation

- Others

Transportation dominates the market

The report has provided a detailed breakup and analysis of the market based on the end use industry. This includes chemicals, transportation, power generation and others. According to the report, transportation represented the largest segment.From personal vehicles and public transit to the shipping of goods across the globe, transportation is a fundamental aspect of daily life and the global economy. It directly influences and supports various other industries, including manufacturing, retail, agriculture, and tourism. The demand for transportation services continues to grow as populations increase and global trade expands, further solidifying its status as a major end-use industry. The transportation sector is also undergoing significant transformations to address environmental concerns and meet sustainability goals.

Electric vehicles (EVs) and hybrid vehicles are gaining traction as cleaner and more energy-efficient alternatives to traditional internal combustion engine vehicles. Additionally, sustainable fuels such as renewable methanol, hydrogen, and biofuels are being explored to reduce the carbon footprint of transportation. These advancements align with global efforts to mitigate the impact of transportation on climate change and air quality, making the sector even more critical in the context of sustainability.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia Pacific exhibits a clear dominance, accounting for the largest renewable methanol market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific accounted for the largest market share.Asia Pacific boasts a rapidly growing population and expanding urbanization. This demographic trend has led to increased energy consumption, urban development, and infrastructure investments. Consequently, there is a growing need for sustainable energy solutions, making the region a prime market for renewable methanol. With governments and businesses in Asia Pacific increasingly focused on reducing carbon emissions and achieving sustainability goals, the demand for clean energy sources, such as renewable methanol has surged. Furthermore, Asia Pacific is home to some of the world's largest economies.

These nations have shown a strong commitment to renewable energy adoption and sustainable practices. Also, the availability of abundant renewable resources in Asia Pacific, such as solar and wind energy, contributes to the region's dominance in the renewable methanol market. These resources provide a reliable and renewable source of energy for the production of methanol through processes, such as electrolysis and biomass conversion.

Competitive Landscape:

Several companies are investing in research and development to improve the efficiency and cost-effectiveness of renewable methanol production processes. They are exploring various feedstock options, such as biomass, carbon capture, and renewable hydrogen, to create a more sustainable supply chain. Additionally, advancements in electrolysis and gasification technologies are being pursued to enhance the conversion of renewable resources into methanol. Companies are scaling up their production capacity for renewable methanol to meet growing demand. This involves constructing new production facilities and retrofitting existing ones to accommodate the increased production of renewable methanol.Expanding capacity is crucial for making renewable methanol more widely available and competitive in various markets. In line with this, leading players are forming partnerships with other industry players, research institutions, and governments to accelerate the development and adoption of renewable methanol technologies. Collaborations help share knowledge, reduce risks, and facilitate access to funding and resources.

The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided.

Some of the key players in the market include:

- Advanced Chemical Technologies

- Advent Technologies A/S

- BASF SE

- Blue Fuel Energy Corporation

- Carbon Recycling International

- Enerkem

- Methanex Corporation

- Methanol Holdings (Trinidad) Limited (Proman AG)

- Nordic Green Aps

- OCI N.V.

- Södra Skogsägarna

Key Questions Answered in This Report:

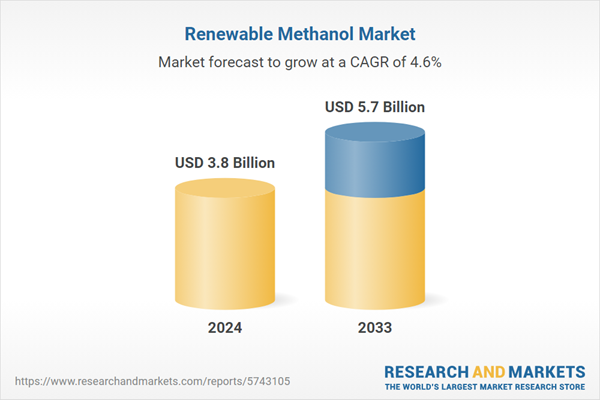

- What was the size of the global renewable methanol market in 2024?

- What is the expected growth rate of the global renewable methanol market during 2025-2033?

- What are the key factors driving the global renewable methanol market?

- What has been the impact of COVID-19 on the global renewable methanol market?

- What is the breakup of the global renewable methanol market based on the feedstock?

- What is the breakup of the global renewable methanol market based on the application?

- What is the breakup of the global renewable methanol market based on the end use industry?

- What are the key regions in the global renewable methanol market?

- Who are the key players/companies in the global renewable methanol market?

Table of Contents

Companies Mentioned

- Advanced Chemical Technologies

- Advent Technologies A/S

- BASF SE

- Blue Fuel Energy Corporation

- Carbon Recycling International

- Enerkem

- Methanex Corporation

- Methanol Holdings (Trinidad) Limited (Proman AG)

- Nordic Green Aps

- OCI N.V.

- Södra Skogsägarna

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 148 |

| Published | April 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 3.8 Billion |

| Forecasted Market Value ( USD | $ 5.7 Billion |

| Compound Annual Growth Rate | 4.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |