A safety switch is a device that instantly turns off the power supply if an electrical fault is detected. This reduces the risk of electricity-related fires, electric shock, injury and death by cutting off the electrical supply automatically. As a result, these switches are extensively utilized across various industry verticals including pharmaceutical, oil and gas, and aerospace. Moreover, numerous organizations are using safety switches in their workplace in order to prevent work-related hazards, safeguard workforce and meet the required corporate safety standards.

A safety switch is a crucial device, chiefly designed to offer instant protection against electrical accidents or mishaps. Characterized by its function to automatically shut down the electrical power supply when imbalance or leakage in the current is detected, it mitigates the risk of electrical shocks, fires, and other hazardous conditions. This highly sensitive device operates based on the fundamental principle of detecting the difference between the current flowing into the circuit and the current flowing out. If this difference exceeds a safe limit, the safety switch rapidly disconnects the electrical power, providing an added layer of security in electrical systems.

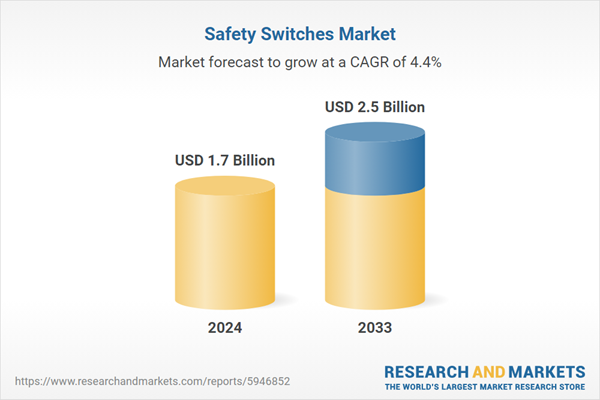

The global market is primarily driven by the escalating focus on safety measures in industrial and residential premises. In addition to this, the stringent regulatory mandates related to electrical safety across various regions are propelling the market. Moreover, increased construction activities worldwide and the subsequent rise in electrical installations are fueling the product demand. In line with this, the increasing digitalization and the mounting reliance on electrical appliances among the masses are significant contributors to the market expansion. Besides this, the proliferation of smart homes and buildings necessitating advanced safety measures is contributing to the growth of the market. The market is further driven by the growing environmental concerns resulting in higher acceptance of energy-efficient product variants. Furthermore, continual technological advancements leading to the development of switches with enhanced durability and minimized maintenance needs are creating lucrative opportunities in the market.

Safety Switches Market Trends/Drivers

Enhancement in industrial safety standards

Increasing workplace safety standards is influencing the expansion of the market. Industries globally are progressively recognizing the need for safety protocols to prevent accidents and improve the overall safety quotient in work environments. It is acknowledged that a large proportion of industrial accidents are caused by electrical failures, which can lead to catastrophic outcomes. As a result, organizations are investing more in advanced safety measures, among which safety switches play an integral part. These devices not only safeguard equipment from damage but also protect employees from potential hazards, enhancing productivity and overall operational efficiency. Consequently, these high safety standards adopted in the industrial sector have become a prominent force in propelling the safety switches market. Companies' increasing commitment to maintaining a safer workplace environment, along with the growing awareness of the substantial benefits of electrical safety measures, are likely to sustain this trend.Rapid expansion of infrastructure development

Another significant market driver is the rapid expansion of infrastructure development worldwide. As nations focus on modernizing their infrastructure, the integration of high-quality electrical installations, including safety switches, has become indispensable. This is especially true for emerging economies that are experiencing robust growth in sectors such as residential, commercial, and industrial construction. The extensive utilization of electrical systems in these sectors demands advanced safety measures to mitigate electrical hazards. As safety switches are essential components ensuring electrical safety in these facilities, the escalating infrastructure development is subsequently boosting their demand. Furthermore, the stringent electrical codes and regulations, which necessitate the use of safety switches in these establishments, further reinforce the market growth, making the expansive infrastructure development a significant market driver.Growing number of power distribution networks

The considerable growth in the number of power distribution networks across the globe is another key factor influencing the market. With burgeoning urbanization and industrialization, there is an escalating demand for reliable and safe power distribution. The safety switch, with its ability to disconnect the power supply during an electrical fault, plays a pivotal role in these networks, protecting the system from potential damage and reducing downtime. The expansion of power distribution networks necessitates a greater number of these protective devices, consequently fostering market growth. In addition, as various nations aim to strengthen their power infrastructure to meet the increasing power demands, the need for efficient safety measures within these networks also amplifies, providing further impetus to the market on a global level.Safety Switches Industry Segmentation

This report provides an analysis of the key trends in each segment of the global safety switches market report, along with forecasts at the global and regional levels from 2025-2033. The report has categorized the market based on product type, safety system, switch type and end-user.Breakup by Product Type

- Contact Safety Switch

- Hinge Switches

- Locking Switches

- Others

- Non-Contact Safety Switch

- Inductive Switches

- Magnetic Switches

- RFID Transponder Switches

The report has provided a detailed breakup and analysis of the market based on the product type. This includes contact safety switch (hinge, locking and others), and non-contact safety switch (inductive, magnetic and RFID transponder switches). According to the report, non-contact safety switch represented the largest segment.

The need for safety mechanisms that can operate effectively in harsh conditions, such as extreme temperatures or the presence of dust or liquids, bolsters the market for non-contact switches. The advantage of minimal wear and tear due to the absence of physical contact extends the lifespan of these switches, making them a preferred choice for many industries. The ability of non-contact switches to offer precise, reliable, and interference-free operation enhances their appeal in critical applications.

On the other hand, the proliferation of industrial automation requires precise control and regulation mechanisms, such as contact safety switches, driving their adoption in many sectors. Enhanced workplace safety regulations globally have increased the demand for reliable and robust safety systems, contributing to the expansion of this market. The necessity for machinery and equipment to halt operations immediately in case of emergencies reinforces the need for contact switches, encouraging their increased usage.

Breakup by Safety System

- Burner Management Systems (BMS)

- Emergency Shutdown (ESD) Systems

- Fire and Gas Monitoring Systems

- High Integrity Pressure Protection Systems (HIPPS)

- Turbomachinery Control (TMC) Systems

The report has provided a detailed breakup and analysis of the market based on the safety system. This includes burner management systems (BMS), emergency shutdown (ESD) systems, fire and gas monitoring systems, high integrity pressure protection (HIPPS) systems and turbomachinery control (TMC) systems. According to the report, burner management systems (BMS) represented the largest segment.

The regulatory compliance requirement for safety in industrial combustion processes stimulates the demand for burner management systems. The focus on minimizing the risks of explosion in burner management operations and reducing plant downtime due to burner shutdown drives the market for BMS. Also, continual advancements in technology, enabling seamless integration of BMS with existing infrastructure, paves the way for their adoption.

On the other hand, the need to comply with stringent safety regulations imposed by government and international safety agencies are fueling the growth of emergency shutdown (ESD) systems, fire and gas monitoring systems, high integrity pressure protection (HIPPS) systems and turbomachinery control (TMC) systems segments. These regulations mandate the installation of safety systems to prevent industrial accidents and protect workers. There is also an increased awareness about the importance of safety in the workplace, which is driving the demand for safety systems as industries are more committed to ensuring a safe working environment.

Breakup by Switch Type

- Switchboard Safety Switches

- Power Point Switches

- Portable Safety Switches

Rapid urbanization and the corresponding demand for efficient electricity management systems necessitate the use of switchboard safety switches. The need for reliable and quick power shut-off capabilities in residential, commercial, and industrial settings influences the market for these switches. The growing trend of modernizing and upgrading aging electrical systems fuels the demand for these switches.

On the other hand, the increasing demand for electricity safety in households and workplaces underpins the need for power point Switches. Also, the trend towards the adoption of sophisticated electrical and electronic appliances necessitates enhanced protection mechanisms, thereby driving the market for these switches.

Moreover, the growing use of portable devices and appliances in both domestic and commercial sectors propels the demand for portable safety switches. The need for flexible and transient safety measures in temporary setups, such as events or construction sites, fosters the use of these switches.

Breakup by End-User

- Energy and Power

- Oil and Gas

- Chemical

- Food and Beverage

- Metal and Mining

- Pharmaceutical

- Others

The report has provided a detailed breakup and analysis of the market based on the end-user. This includes oil and gas, energy and power, chemical, food and beverage, metal and mining, pharmaceutical and others. According to the report, oil and gas represented the largest segment.

The critical need for safety in the volatile oil and gas industry necessitates the use of reliable safety systems, including various types of safety switches. The increasing exploration and production activities in the sector create a demand for robust safety measures, hence, driving the market. The adherence to stringent safety norms and regulations in the oil and gas industry boosts the usage of safety switches.

On the other hand, rapid industrial expansion in these sectors is leading to increased usage of heavy machinery and complex systems. The need for safety switches becomes paramount to ensure the smooth operation of these machines and systems. Also, the potential risk of equipment failure, worker injury, or production downtime in the energy and power, chemical, food and beverage, metal and mining, pharmaceutical industries necessitates the use of safety switches.

Breakup by Region

- North America

- Europe

- Asia Pacific

- Middle East and Africa

- Latin America

The report has also provided a comprehensive analysis of all the major regional markets, which include North America, Asia Pacific, Europe, Middle East and Africa, and Latin America. According to the report, Asia Pacific represented the largest market.

The impressive economic growth and industrialization in the Asia Pacific region have led to a heightened need for efficient and reliable safety systems. In addition, the trend of factory automation in the Asia Pacific region is accelerating, influenced by the drive for improved productivity and efficiency, as well as the need to meet the demands of the growing population.

Also, the extensive construction activities and infrastructural developments in the region contribute to the demand for various safety switches. Furthermore, the increasing regulatory focus on safety standards and compliance in the region propels the market.

Moreover, there is a concerted effort by authorities to enforce strict adherence to safety protocols, in order to prevent accidents and uphold workers' safety. This increasing regulatory scrutiny is driving industries to incorporate reliable safety systems, thereby propelling the market growth.

Competitive Landscape

Top players are expanding their distribution networks both domestically and internationally to reach a wider consumer base. They are partnering with local distributors and suppliers by forming strategic collaborations and setting up new sales and service centers to improve their market reach. The leading manufacturers also are investing heavily in research and development to introduce innovative safety switches with advanced features, improved durability, and higher reliability. Furthermore, they are focusing on providing excellent customer service, including after-sales services, is a key strategy to retain existing customers and attract new ones. Given the increasing focus on environmental sustainability and stringent safety standards, companies are developing safety switches that meet international safety standards and are environmentally friendly.The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- ABB

- General Electric

- Rockwell

- Schneider Electric

- Siemens

- Eaton

- Honeywell

- Omron

- Pilz

- SICK

Key Questions Answered in This Report

1. How big is the safety switches market?2. What is the future outlook of the safety switches market?

3. What are the key factors driving the safety switches market?

4. Which region accounts for the largest safety switches market share?

5. Which are the leading companies in the global safety switches market?

Table of Contents

Companies Mentioned

- ABB

- General Electric

- Rockwell

- Schneider Electric

- Siemens

- Eaton

- Honeywell

- Omron

- Pilz

- SICK

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 145 |

| Published | February 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 1.7 Billion |

| Forecasted Market Value ( USD | $ 2.5 Billion |

| Compound Annual Growth Rate | 4.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |