Intelligent transport systems (ITS) refer to a sophisticated and integrated framework that leverages advanced technologies to optimize transportation networks and enhance overall mobility. ITS incorporates a range of cutting-edge technologies such as sensors, communication systems, data analytics, and artificial intelligence to collect, process, and disseminate information in real-time. By doing so, ITS aims to improve the safety, efficiency, and sustainability of transportation systems. One of the key features of ITS is its ability to enable seamless connectivity among different modes of transport, including road, rail, air, and maritime, facilitating better coordination and smoother intermodal travel. Through the integration of traffic management, vehicle control systems, and traveler information services, ITS can efficiently manage traffic flow, reduce congestion, and mitigate accidents. Moreover, ITS promotes the adoption of smart vehicles that can communicate with each other and the infrastructure, further enhancing safety and reducing fuel consumption. The implementation of ITS has far-reaching impacts on various sectors, including urban planning, logistics, and environmental sustainability. It plays a vital role in creating smart cities and contributes to achieving sustainable transportation goals by optimizing energy consumption and emissions. Additionally, ITS fosters innovation in the automotive industry, driving the development of autonomous vehicles and cutting-edge mobility solutions.

Rapid urbanization and expanding population has led to increased traffic congestion and transportation challenges. ITS offers effective solutions to manage and optimize urban mobility, thus gaining significant traction in densely populated areas. Additionally, the continuous evolution of technology, including advancements in sensors, connectivity, and data analytics, has paved the way for the integration of sophisticated ITS solutions. The availability of cost-effective and reliable technologies encourages the widespread adoption of ITS across various transportation sectors. Other than this, safety concerns are a significant driver for ITS adoption. Intelligent transportation systems offer features like collision avoidance systems, real-time traffic updates, and emergency response management, enhancing overall road safety and minimizing accidents. Besides this, with the exponential growth in vehicles on the road, there is a pressing need for efficient traffic management systems. ITS helps in optimizing traffic flow, reducing congestion, and improving overall transportation efficiency. Besides this, as environmental concerns rise, the focus on eco-friendly transportation solutions grows. ITS plays a pivotal role in promoting eco-friendly practices by enabling better route planning, reducing fuel consumption, and encouraging the use of public transportation. In line with this, the development and integration of autonomous vehicles go hand in hand with ITS advancements. The prospect of self-driving cars and their potential benefits in terms of safety and efficiency fuels interest in ITS technologies. moreover, the trend towards a connected world where devices and systems communicate with each other fosters the demand for ITS. Seamless connectivity between vehicles, infrastructure, and control centers enables real-time data exchange and enhances the effectiveness of transportation systems.

Intelligent Transport Systems Market Trends/Drivers:

Advancements in Technology

ITS heavily relies on cutting-edge innovations to function effectively. Advancements in sensors, communication protocols, and data analytics have paved the way for the development of sophisticated ITS solutions. For example, the emergence of high-precision GPS systems enables accurate vehicle tracking and navigation, while advancements in LiDAR and camera technology enhance object detection and enable autonomous driving capabilities. Moreover, the rise of 5G networks and V2X (vehicle-to-everything) communication empowers real-time data exchange between vehicles and infrastructure, enabling faster decision-making and more efficient traffic management. As technology continues to evolve, it opens new possibilities for further enhancing the capabilities and applications of ITS, which in turn, fuels market growth.Rising Demand for Safer Transport

ITS provides an array of safety-oriented features such as collision avoidance systems, adaptive cruise control, and lane departure warning systems. These technologies help reduce accidents and fatalities by enhancing driver awareness and improving vehicle control. Moreover, ITS enables real-time monitoring of road conditions and weather, allowing for timely warnings and adjustments to ensure safer travel. With road accidents being a significant global public health issue, governments and transportation authorities are increasingly investing in ITS solutions to mitigate risks and improve overall road safety standards, thereby driving the growth of the market.Increasing Need for Efficient Traffic Management

ITS provides intelligent solutions to optimize traffic flow and reduce congestion through real-time traffic monitoring, dynamic signal control, and adaptive traffic light systems. By analyzing data from various sources such as traffic cameras, sensors, and mobile devices, ITS can identify traffic bottlenecks and implement strategies to improve traffic flow. Efficient traffic management not only reduces travel time for commuters but also has economic and environmental benefits, such as lower fuel consumption and greenhouse gas emissions. As a result, governments and transportation authorities worldwide are turning to ITS to address the challenges of growing urban traffic, driving the expansion of the ITS market.Intelligent Transport Systems Industry Segmentation:

The publisher provides an analysis of the key trends in each segment of the global intelligent transport systems market report, along with forecasts at the global and regional levels from 2025-2033. Our report has categorized the market based on mode of transport, product, protocol, offering and application.Breakup by Mode of Transport:

- Roadways

- Railways

- Airways

Roadways dominate the market

The report has provided a detailed breakup and analysis of the market based on the mode of transport. This includes roadways, railways, and airways. According to the report, roadways represented the largest segment.Road transportation is one of the most widely used and accessible modes of transport globally. It serves as a primary means of commuting for both passengers and freight, catering to diverse transportation needs ranging from daily commutes to the movement of goods and services. The extensive road network in most countries facilitates connectivity to even remote areas, making it a preferred choice for transportation. Additionally, roadways offer a high level of flexibility and door-to-door service, allowing for efficient last-mile delivery and accessibility to various destinations. Unlike other modes of transport that may be limited to specific routes or locations, road transportation provides direct connectivity to a wide range of destinations. Other than this, the relatively lower infrastructure cost and quicker deployment of road transport systems contribute to its dominance in the market. Building roads and highways is generally less capital-intensive compared to constructing railways or developing water transport infrastructure. Furthermore, the growth of e-commerce and the increasing demand for fast and reliable logistics services have further bolstered the significance of roadways in the transportation sector. The ability to transport goods swiftly and efficiently by road has become essential for meeting consumer expectations and market demands. As a result, the roadways segment continues to hold a dominant position in the market, reflecting its versatility, accessibility, and adaptability to various transportation needs.

Breakup by Product:

- Network Management Systems

- Advanced Traffic Management Systems (ATMS)

- Road User Charging, Congestion Charging, etc.

- Freight and Commercial Systems

- Public Transport Systems

- Security and Crime Reduction Systems

- Automotive and Infotainment Systems

- Road Safety Systems

- Communications Systems

Network management systems represent the most popular product

A detailed breakup and analysis of the market based on the product has also been provided in the report. This includes network management systems (advanced traffic management systems, road user charging, congestion charging, etc.), freight and commercial systems, public transport systems, security and crime reduction systems, automotive and infotainment systems, road safety systems, and communications systems. According to the report, network management systems accounted for the largest market share.With the rapid growth of technology and the increasing complexity of modern networks, there is a heightened demand for advanced management solutions that can efficiently handle diverse and interconnected systems. New network management systems offer cutting-edge features and capabilities that cater to the evolving needs of businesses and organizations. Additionally, the rise of digital transformation initiatives across industries has resulted in a surge of network infrastructures that require effective management. The new network management systems are designed to accommodate these modern, digital-first networks, providing enhanced visibility, automation, and scalability. Other than this, the growing complexity of cybersecurity threats necessitates robust network management tools that can monitor, detect, and respond to security incidents effectively. New network management systems often incorporate sophisticated security features to safeguard against cyberattacks and unauthorized access. Besides this, the shift towards cloud-based and virtualized environments demands adaptive management systems that can seamlessly handle virtualized networks and cloud resources. These new management systems are specifically tailored to address the challenges of virtualized infrastructures, making them indispensable for organizations adopting cloud technologies.

Breakup by Protocol:

- Short Range

- Wave (IEEE 802.11)

- Wpan (IEEE 802.15)

- Long Range

- Wimax (IEEE 802.11)

- Ofdm

- IEEE 1512

- Traffic Management Data Dictionary (TMDD)

- Others

The short-range communication protocol segment holds a significant position in the market breakup due to its widespread adoption in various applications that require proximity-based data exchange. Short-range protocols, such as Bluetooth and NFC (Near Field Communication), are commonly used for connecting smartphones, tablets, wearables, and IoT devices. They facilitate seamless data transfer, enabling devices to communicate effortlessly over short distances without the need for complex setup procedures. The popularity of short-range protocols is also driven by their low-power consumption, making them ideal for battery-operated devices and IoT applications. With the increasing trend of smart homes, wearables, and IoT ecosystems, short-range protocols continue to gain traction, leading to their prominence in the market.

The large range or long-range communication protocol segment is a significant player in the market due to its ability to provide communication over extended distances, often measured in kilometers or miles. Long-range protocols, such as LoRaWAN (Long Range Wide Area Network) and NB-IoT (Narrowband Internet of Things), are well-suited for applications that require long-distance connectivity, such as smart city infrastructure, agricultural monitoring, and industrial IoT deployments. These protocols offer robust signal penetration and minimal power consumption, allowing devices to transmit data reliably over vast areas with minimal infrastructure requirements. As IoT applications continue to expand across industries, long-range protocols play a vital role in enabling large-scale, wide-area deployments, making them a substantial and essential segment in the market breakup by protocol.

Breakup by Offering:

- Hardware

- Interface Board

- Sensor

- Surveillance Camera

- Telecommunication Network

- Monitoring and Detection System

- Others

- Software

- Visualization Software

- Video Detection Management Software

- Transit Management System

- Others

- Services

- Business and Cloud Services

- Support and Maintenance Services

Hardware holds the largest share in the market

A detailed breakup and analysis of the market based on the offering has also been provided in the report. This includes hardware (interface board, sensor, surveillance camera, telecommunication network, monitoring and detection system, and others), software (visualization software, video detection management software, transit management system, and others), and services (business and cloud services and support and maintenance services). According to the report, hardware accounted for the largest market share.Hardware forms the foundation of any technological solution, including those in the market research industry. Market research firms require a wide range of hardware components, such as computers, servers, storage devices, networking equipment, and data collection tools, to support their data processing, analysis, and storage needs. Additionally, the growing demand for advanced technologies, such as artificial intelligence and machine learning, in market research necessitates powerful hardware infrastructure to handle the complex computational requirements. High-performance hardware enables quicker data processing, facilitating faster insights and analysis for clients. Other than this, as the volume and complexity of data continue to expand, market research firms must invest in robust hardware systems to efficiently handle and store vast amounts of data securely. This is particularly crucial in big data analytics, where large datasets need to be processed and stored for in-depth analysis. Moreover, the hardware segment includes various specialized tools and devices for data collection, such as survey equipment, sensors, and wearable devices, which are vital for obtaining accurate and real-time data from various sources.

Breakup by Application:

- Fleet Management and Asset Monitoring

- Intelligent Traffic Control

- Collision Avoidance

- Parking Management

- Passenger Information Management

- Ticketing Management

- Emergency Vehicle Notification

- Automotive Telematics

Intelligent traffic control is the largest application segment

The report has provided a detailed breakup and analysis of the market based on application. This includes fleet management and asset monitoring, intelligent traffic control, collision avoidance, parking management, passenger information management, ticketing management, emergency vehicle notification, and automotive telematics. According to the report, intelligent traffic control represented the largest segment.Intelligent traffic control holds the largest segment in the market breakup by application due to its crucial role in addressing the pressing challenges of modern transportation systems. As urbanization and population growth lead to increased traffic congestion and road safety concerns, there is a growing demand for efficient and adaptive traffic management solutions. Intelligent traffic control systems leverage advanced technologies such as sensors, data analytics, and real-time communication to monitor and optimize traffic flow. These systems can dynamically adjust traffic signals based on real-time traffic conditions, reducing congestion and minimizing delays for commuters. By efficiently managing traffic flow, intelligent traffic control contributes to improved fuel efficiency and reduced emissions, aligning with sustainability goals. Moreover, the integration of intelligent traffic control systems with other components of Intelligent Transport Systems (ITS) enables seamless connectivity between vehicles and infrastructure. This connectivity facilitates the implementation of smart traffic management strategies, including vehicle-to-infrastructure (V2I) communication, which enhances safety by providing drivers with real-time information and warnings.

Breakup by Region:

- North America

- Asia Pacific

- Europe

- Middle East and Africa

- Latin America

North America exhibits a clear dominance in the market

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America was the largest market for ITS.North America has some of the world's most technologically advanced countries, including the United States and Canada. These nations have a strong focus on innovation and infrastructure development, leading to substantial investments in modern transportation solutions. The region's robust technological ecosystem provides a conducive environment for the deployment of ITS and the development of cutting-edge technologies that drive the market. Additionally, the population density and urbanization in North American cities have resulted in significant transportation challenges, such as traffic congestion, safety concerns, and the need for efficient public transit. ITS offers viable solutions to tackle these issues, making it an attractive option for governments and transportation authorities in the region. Other than this, favorable government initiatives and policies promoting smart cities and sustainable transportation have further boosted the ITS market in North America. Governments have been proactive in implementing ITS projects, including smart traffic management systems, real-time traveler information, and intelligent public transportation systems. Besides this, the strong presence of key players and technology providers in the ITS industry, such as IBM, Siemens, and Cisco, has significantly contributed to the market's growth in North America. These companies actively collaborate with governments and local authorities to implement advanced ITS solutions.

Competitive Landscape:

Key players are heavily investing in research and development to innovate and develop cutting-edge ITS technologies. They focus on improving sensors, communication protocols, data analytics, and artificial intelligence capabilities to enhance the efficiency and effectiveness of transportation systems. These advancements lead to the creation of smarter and more reliable ITS solutions. Additionally, they form strategic partnerships and collaborations with governments, local authorities, and other stakeholders to deploy large-scale ITS projects. These partnerships enable the seamless integration of ITS solutions into existing transportation infrastructure, promoting their widespread adoption. Other than this, companies often conduct pilot projects and demonstrations to showcase the capabilities and benefits of their ITS solutions. These initiatives help potential clients and governments understand the practical applications and advantages of implementing ITS in real-world scenarios. Besides this, key players actively engage in acquiring or merging with other companies to expand their ITS offerings and market reach. Such moves help them access new technologies, talent, and customer bases, strengthening their position in the ITS market. In line with this, ensuring standardization and interoperability of ITS solutions is crucial for their widespread adoption. Key players work on establishing industry standards and protocols to enable seamless communication and integration among different ITS components.The market research report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Siemens AG

- Thales Group

- Garmin Ltd.

- Cubic Corporation

- FLIR Systems

- Lanner Electronics

- DENSO Corporation

- International Business Machines (IBM) Corporation

- ADDCO Acquisition LLC

- TomTom N.V.

- Kapsch TrafficCom AG

- Iteris Inc.

- Q-Free ASA

- Efkon GmbH

- GeoToll, Inc.

- ElectricFeel AG

- Doublemap, LLC

- BestMile Sarl

- Aptiv PLC (nuTonomy)

Key Questions Answered in This Report

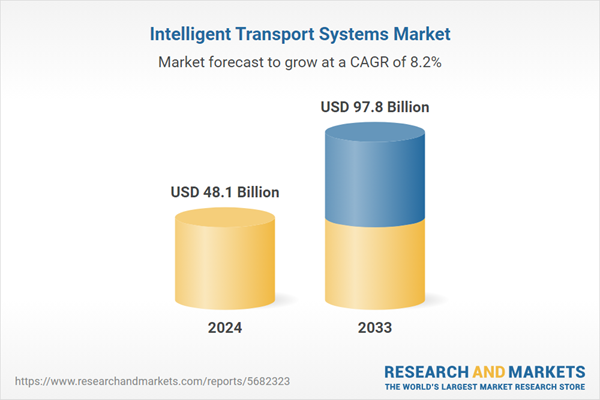

1. What was the size of the global intelligent transport systems market in 2024?2. What is the expected growth rate of the global intelligent transport systems market during 2025-2033?

3. What has been the impact of COVID-19 on the global intelligent transport systems market?

4. What are the key factors driving the global intelligent transport systems market?

5. What is the breakup of the global intelligent transport systems market based on the mode of transport?

6. What is the breakup of the global intelligent transport systems market based on the product?

7. What is the breakup of the global intelligent transport systems market based on the offering?

8. What is the breakup of the global intelligent transport systems market based on the application?

9. What are the key regions in the global intelligent transport systems market?

10. Who are the key players/companies in the global intelligent transport systems market?

Table of Contents

1 Preface2 Scope and Methodology

2.1 Objectives of the Study

2.2 Stakeholders

2.3 Data Sources

2.3.1 Primary Sources

2.3.2 Secondary Sources

2.4 Market Estimation

2.4.1 Bottom-Up Approach

2.4.2 Top-Down Approach

2.5 Forecasting Methodology

3 Executive Summary

4 Introduction

4.1 Overview

4.2 Key Industry Trends

5 Global Intelligent Transport Systems Market

5.1 Market Overview

5.2 Market Performance

5.3 Impact of COVID-19

5.4 Market Breakup by Mode of Transport

5.5 Market Breakup by Product

5.6 Market Breakup by Protocol

5.7 Market Breakup by Offering

5.8 Market Breakup by Application

5.9 Market Breakup by Region

5.10 Market Forecast

6 Market Breakup by Mode of Transport

6.1 Roadways

6.1.1 Market Trends

6.1.2 Market Forecast

6.2 Railways

6.2.1 Market Trends

6.2.2 Market Forecast

6.3 Airways

6.3.1 Market Trends

6.3.2 Market Forecast

7 Market Breakup by Product

7.1 Network Management Systems

7.1.1 Market Trends

7.1.2 Market Breakup by Type

7.1.2.1 Advanced Traffic Management Systems (ATMS)

7.1.2.2 Road User Charging, Congestion Charging, etc.

7.1.3 Market Forecast

7.2 Freight and Commercial Systems

7.2.1 Market Trends

7.2.2 Market Forecast

7.3 Public Transport Systems

7.3.1 Market Trends

7.3.2 Market Forecast

7.4 Security and Crime Reduction Systems

7.4.1 Market Trends

7.4.2 Market Forecast

7.5 Automotive and Infotainment Systems

7.5.1 Market Trends

7.5.2 Market Forecast

7.6 Road Safety Systems

7.6.1 Market Trends

7.6.2 Market Forecast

7.7 Communications Systems

7.7.1 Market Trends

7.7.2 Market Forecast

8 Market Breakup by Protocol

8.1 Short Range

8.1.1 Market Trends

8.1.2 Market Breakup by Type

8.1.2.1 Wave (IEEE 802.11)

8.1.2.2 Wpan (IEEE 802.15)

8.1.3 Market Forecast

8.2 Long Range

8.2.1 Market Trends

8.2.2 Market Breakup by Type

8.2.2.1 Wimax (IEEE 802.11)

8.2.2.2 Ofdm

8.2.3 Market Forecast

8.3 IEEE 1512

8.3.1 Market Trends

8.3.2 Market Forecast

8.4 Traffic Management Data Dictionary (TMDD)

8.4.1 Market Trends

8.4.2 Market Forecast

8.5 Others

8.5.1 Market Trends

8.5.2 Market Forecast

9 Market Breakup by Offering

9.1 Hardware

9.1.1 Market Trends

9.1.2 Market Breakup by Type

9.1.2.1 Interface Board

9.1.2.2 Sensor

9.1.2.3 Surveillance Camera

9.1.2.4 Telecommunication Network

9.1.2.5 Monitoring and Detection System

9.1.2.6 Others

9.1.3 Market Forecast

9.2 Software

9.2.1 Market Trends

9.2.2 Market Breakup by Type

9.2.2.1 Visualization Software

9.2.2.2 Video Detection Management Software

9.2.2.3 Transit Management System

9.2.2.4 Others

9.2.3 Market Forecast

9.3 Services

9.3.1 Market Trends

9.3.2 Market Breakup by Type

9.3.2.1 Business and Cloud Services

9.3.2.2 Support and Maintenance Services

9.3.3 Market Forecast

10 Market Breakup by Application

10.1 Fleet Management and Asset Monitoring

10.1.1 Market Trends

10.1.2 Market Forecast

10.2 Intelligent Traffic Control

10.2.1 Market Trends

10.2.2 Market Forecast

10.3 Collision Avoidance

10.3.1 Market Trends

10.3.2 Market Forecast

10.4 Parking Management

10.4.1 Market Trends

10.4.2 Market Forecast

10.5 Passenger Information Management

10.5.1 Market Trends

10.5.2 Market Forecast

10.6 Ticketing Management

10.6.1 Market Trends

10.6.2 Market Forecast

10.7 Emergency Vehicle Notification

10.7.1 Market Trends

10.7.2 Market Forecast

10.8 Automotive Telematics

10.8.1 Market Trends

10.8.2 Market Forecast

11 Market Breakup by Region

11.1 North America

11.1.1 Market Trends

11.1.2 Market Forecast

11.2 Asia Pacific

11.2.1 Market Trends

11.2.2 Market Forecast

11.3 Europe

11.3.1 Market Trends

11.3.2 Market Forecast

11.4 Middle East and Africa

11.4.1 Market Trends

11.4.2 Market Forecast

11.5 Latin America

11.5.1 Market Trends

11.5.2 Market Forecast

12 SWOT Analysis

12.1 Overview

12.2 Strengths

12.3 Weaknesses

12.4 Opportunities

12.5 Threats

13 Value Chain Analysis

14 Porters Five Forces Analysis

14.1 Overview

14.2 Bargaining Power of Buyers

14.3 Bargaining Power of Suppliers

14.4 Degree of Competition

14.5 Threat of New Entrants

14.6 Threat of Substitutes

15 Price Analysis

16 Competitive Landscape

16.1 Market Structure

16.2 Key Players

16.3 Profiles of Key Players

16.3.1 Siemens AG

16.3.2 Thales Group

16.3.3 Garmin Ltd.

16.3.4 Cubic Corporation

16.3.5 FLIR Systems

16.3.6 Lanner Electronics

16.3.7 DENSO Corporation

16.3.8 International Business Machines (IBM) Corporation

16.3.9 ADDCO Acquisition, LLC

16.3.10 TomTom N.V.

16.3.11 Kapsch TrafficCom AG

16.3.12 Iteris, Inc.

16.3.13 Q-Free ASA

16.3.14 Efkon GmbH

16.3.15 GeoToll, Inc.

16.3.16 ElectricFeel AG

16.3.17 Doublemap, LLC

16.3.18 BestMile Sarl

16.3.19 Aptiv PLC (nuTonomy)

List of Figures

Figure 1: Global: Intelligent Transport Systems Market: Major Drivers and Challenges

Figure 2: Global: Intelligent Transport Systems Market: Sales Value (in Billion USD), 2019-2024

Figure 3: Global: Intelligent Transport Systems Market: Breakup by Mode of Transport (in %), 2024

Figure 4: Global: Intelligent Transport Systems Market: Breakup by Product (in %), 2024

Figure 5: Global: Intelligent Transport Systems Market: Breakup by Protocol (in %), 2024

Figure 6: Global: Intelligent Transport Systems Market: Breakup by Offering (in %), 2024

Figure 7: Global: Intelligent Transport Systems Market: Breakup by Application (in %), 2024

Figure 8: Global: Intelligent Transport Systems Market: Breakup by Region (in %), 2024

Figure 9: Global: Intelligent Transport Systems Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 10: Global: Intelligent Transport Systems Industry: SWOT Analysis

Figure 11: Global: Intelligent Transport Systems Industry: Value Chain Analysis

Figure 12: Global: Intelligent Transport Systems Industry: Porter’s Five Forces Analysis

Figure 13: Global: Intelligent Transport Systems (Roadways) Market: Sales Value (in Billion USD), 2019 & 2024

Figure 14: Global: Intelligent Transport Systems (Roadways) Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 15: Global: Intelligent Transport Systems (Railways) Market: Sales Value (in Billion USD), 2019 & 2024

Figure 16: Global: Intelligent Transport Systems (Railways) Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 17: Global: Intelligent Transport Systems (Airways) Market: Sales Value (in Billion USD), 2019 & 2024

Figure 18: Global: Intelligent Transport Systems (Airways) Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 19: Global: Intelligent Transport Systems (Network Management) Market: Sales Value (in Billion USD), 2019 & 2024

Figure 20: Global: Intelligent Transport Systems (Network Management) Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 21: Global: Intelligent Transport Systems (Freight and Commercial) Market: Sales Value (in Billion USD), 2019 & 2024

Figure 22: Global: Intelligent Transport Systems (Freight and Commercial) Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 23: Global: Intelligent Transport Systems (Public Transport) Market: Sales Value (in Billion USD), 2019 & 2024

Figure 24: Global: Intelligent Transport Systems (Public Transport) Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 25: Global: Intelligent Transport Systems (Security and Crime Reduction) Market: Sales Value (in Billion USD), 2019 & 2024

Figure 26: Global: Intelligent Transport Systems (Security and Crime Reduction) Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 27: Global: Intelligent Transport Systems (Automotive and Infotainment) Market: Sales Value (in Billion USD), 2019 & 2024

Figure 28: Global: Intelligent Transport Systems (Automotive and Infotainment) Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 29: Global: Intelligent Transport Systems (Road Safety) Market: Sales Value (in Billion USD), 2019 & 2024

Figure 30: Global: Intelligent Transport Systems (Road Safety) Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 31: Global: Intelligent Transport Systems (Communications) Market: Sales Value (in Billion USD), 2019 & 2024

Figure 32: Global: Intelligent Transport Systems (Communications) Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 33: Global: Intelligent Transport Systems (Short Range) Market: Sales Value (in Billion USD), 2019 & 2024

Figure 34: Global: Intelligent Transport Systems (Short Range) Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 35: Global: Intelligent Transport Systems (Long Range) Market: Sales Value (in Billion USD), 2019 & 2024

Figure 36: Global: Intelligent Transport Systems (Long Range) Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 37: Global: Intelligent Transport Systems (IEEE 1512) Market: Sales Value (in Billion USD), 2019 & 2024

Figure 38: Global: Intelligent Transport Systems (IEEE 1512) Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 39: Global: Intelligent Transport Systems (Traffic Management Data Dictionary) Market: Sales Value (in Billion USD), 2019 & 2024

Figure 40: Global: Intelligent Transport Systems (Traffic Management Data Dictionary) Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 41: Global: Intelligent Transport Systems (Other Protocols) Market: Sales Value (in Billion USD), 2019 & 2024

Figure 42: Global: Intelligent Transport Systems (Other Protocols) Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 43: Global: Intelligent Transport Systems (Hardware) Market: Sales Value (in Billion USD), 2019 & 2024

Figure 44: Global: Intelligent Transport Systems (Hardware) Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 45: Global: Intelligent Transport Systems (Software) Market: Sales Value (in Billion USD), 2019 & 2024

Figure 46: Global: Intelligent Transport Systems (Software) Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 47: Global: Intelligent Transport Systems (Services) Market: Sales Value (in Billion USD), 2019 & 2024

Figure 48: Global: Intelligent Transport Systems (Services) Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 49: Global: Intelligent Transport Systems (Fleet Management and Asset Monitoring) Market: Sales Value (in Billion USD), 2019 & 2024

Figure 50: Global: Intelligent Transport Systems (Fleet Management and Asset Monitoring) Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 51: Global: Intelligent Transport Systems (Intelligent Traffic Control) Market: Sales Value (in Billion USD), 2019 & 2024

Figure 52: Global: Intelligent Transport Systems (Intelligent Traffic Control) Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 53: Global: Intelligent Transport Systems (Collision Avoidance) Market: Sales Value (in Billion USD), 2019 & 2024

Figure 54: Global: Intelligent Transport Systems (Collision Avoidance) Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 55: Global: Intelligent Transport Systems (Parking Management) Market: Sales Value (in Billion USD), 2019 & 2024

Figure 56: Global: Intelligent Transport Systems (Parking Management) Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 57: Global: Intelligent Transport Systems (Passenger Information Management) Market: Sales Value (in Billion USD), 2019 & 2024

Figure 58: Global: Intelligent Transport Systems (Passenger Information Management) Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 59: Global: Intelligent Transport Systems (Ticketing Management) Market: Sales Value (in Billion USD), 2019 & 2024

Figure 60: Global: Intelligent Transport Systems (Ticketing Management) Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 61: Global: Intelligent Transport Systems (Emergency Vehicle Notification) Market: Sales Value (in Billion USD), 2019 & 2024

Figure 62: Global: Intelligent Transport Systems (Emergency Vehicle Notification) Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 63: Global: Intelligent Transport Systems (Automotive Telematics) Market: Sales Value (in Billion USD), 2019 & 2024

Figure 64: Global: Intelligent Transport Systems (Automotive Telematics) Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 65: North America: Intelligent Transport Systems Market: Sales Value (in Billion USD), 2019 & 2024

Figure 66: North America: Intelligent Transport Systems Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 67: Asia Pacific: Intelligent Transport Systems Market: Sales Value (in Billion USD), 2019 & 2024

Figure 68: Asia Pacific: Intelligent Transport Systems Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 69: Europe: Intelligent Transport Systems Market: Sales Value (in Billion USD), 2019 & 2024

Figure 70: Europe: Intelligent Transport Systems Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 71: Middle East and Africa: Intelligent Transport Systems Market: Sales Value (in Billion USD), 2019 & 2024

Figure 72: Middle East and Africa: Intelligent Transport Systems Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 73: Latin America: Intelligent Transport Systems Market: Sales Value (in Billion USD), 2019 & 2024

Figure 74: Latin America: Intelligent Transport Systems Market Forecast: Sales Value (in Billion USD), 2025-2033

List of Tables

Table 1: Global: Intelligent Transport Systems Market: Key Industry Highlights, 2024 and 2033

Table 2: Global: Intelligent Transport Systems Market Forecast: Breakup by Mode of Transport (in Billion USD), 2025-2033

Table 3: Global: Intelligent Transport Systems Market Forecast: Breakup by Product (in Billion USD), 2025-2033

Table 4: Global: Intelligent Transport Systems Market Forecast: Breakup by Protocol (in Billion USD), 2025-2033

Table 5: Global: Intelligent Transport Systems Market Forecast: Breakup by Offering (in Billion USD), 2025-2033

Table 6: Global: Intelligent Transport Systems Market Forecast: Breakup by Application (in Billion USD), 2025-2033

Table 7: Global: Intelligent Transport Systems Market Forecast: Breakup by Region (in Billion USD), 2025-2033

Table 8: Global: Intelligent Transport Systems Market Structure

Table 9: Global: Intelligent Transport Systems Market: Key Players

Companies Mentioned

- Siemens AG

- Thales Group

- Garmin Ltd.

- Cubic Corporation

- FLIR Systems

- Lanner Electronics

- DENSO Corporation

- International Business Machines (IBM) Corporation

- ADDCO Acquisition LLC

- TomTom N.V.

- Kapsch TrafficCom AG

- Iteris Inc.

- Q-Free ASA

- Efkon GmbH

- GeoToll Inc.

- ElectricFeel AG

- Doublemap LLC

- BestMile Sarl

- Aptiv PLC (nuTonomy)

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 138 |

| Published | August 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 48.1 Billion |

| Forecasted Market Value ( USD | $ 97.8 Billion |

| Compound Annual Growth Rate | 8.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 19 |