Camel dairy refers to a specialized farm where camels are raised primarily for their milk production. These unique dairies are gaining popularity due to the nutritional benefits of camel milk, which is rich in vitamins, minerals, and proteins, while being lower in fat and lactose compared to cow's milk. It helps in digestion and improve the immune system. In addition to being employed for direct consumption, camel milk can also be processed into various dairy products such as cheese, yogurt, and ice cream. Additionally, the sustainable and eco-friendly aspects of camel dairies make them an attractive alternative to conventional dairy farming.

The market is primarily driven by the increasing consumption for centuries for its nutritional benefits. In addition, camel milk is rich in vitamins, minerals, and proteins, making it a popular choice among health-conscious consumers seeking natural and wholesome alternatives, which is influencing the market growth. Moreover, the growing awareness about the health benefits of camel milk such as aiding in digestion and providing relief to individuals with certain food allergies represents another major growth-inducing factor. Besides this, the government is supporting the camel dairy industry by investing in research and development (R&D), infrastructure, and modern dairy farming practices, thus accelerating market growth. This support has contributed to the improvement in camel milk production and processing, ensuring higher-quality products for consumers. Furthermore, the export potential of camel milk and its derivatives led to the growth of the industry and the growing awareness about the nutritional value of camel dairy products are creating a positive market outlook.

Saudi Arabia Camel Dairy Market Trends/Drivers

Growing awareness regarding health benefits

The increasing demand for camel dairy is due to the increasing awareness among consumers regarding the health benefits of the product. Additionally, camel milk is known to be a rich source of essential vitamins, minerals, proteins, and healthy fats and contains higher levels of certain nutrients, such as vitamin C, iron, and unsaturated fatty acids thus influencing the market growth. These nutritional properties are associated with various health benefits, including improved immune function, better digestion, and potential relief for individuals with certain food allergies. Moreover, research studies are indicating that camel dairy may have anti-inflammatory and antioxidant properties, making it potentially beneficial for individuals with inflammatory conditions or oxidative stress-related ailments thus representing another major growth-inducing factor. Besides this, medical professionals, nutritionists, and health experts continue to highlight the nutritional value and potential health benefits of camel milk, thus accelerating market growth.Implementation of several initiatives by the government

The government is actively involved in promoting and supporting the camel dairy industry through various initiatives. Additionally, the extensive investment in research and development (R&D) to enhance camel milk production and processing techniques, including conducting scientific studies to improve camel breeding practices, nutrition, and health management, is influencing the market growth. Moreover, the government is allocating funds for the establishment of modern dairy farming facilities, equipped with advanced equipment and technologies that improve the hygiene and quality of milk production and ensure the welfare and well-being of the camels, thus representing another major growth-inducing factor. Besides this, the government is offering financial incentives and subsidies to encourage the growth of the camel dairy sector. This support extends to both large-scale commercial farms and small-scale farmers, promoting inclusivity and sustainable growth in the industry. Furthermore, the government is also facilitating the certification and standardization of camel dairy products, ensuring compliance with international food safety and quality standards thus propelling the market growth.Saudi Arabia Camel Dairy Industry Segmentation

This report provides an analysis of the key trends in each segment of the Saudi Arabia camel dairy market report, along with forecasts at the country and regional levels from 2025-2033. The report has categorized the market based on product type, distribution channel and packaging.Breakup by Product Type

- Raw Camel Milk

- Pasteurized Camel Milk

- Flavoured Camel Milk

- Camel Milk Cheese

- Camel Milk Yoghurt

- Camel Milk Ice Cream

- Camel Milk Laban

- Camel Milk Ghee

- Camel Milk Infant Formula

- Camel Milk Powder

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes raw camel milk, pasteurized camel milk, flavoured camel milk, camel milk cheese, camel milk yoghurt, camel milk ice cream, camel milk laban, camel milk ghee, camel milk infant formula, camel milk powder, and others. According to the report, pasteurized camel milk, accounted for the largest market share.

Pasteurization is a critical process that involves heating the milk to destroy harmful pathogens, ensuring it is safe for consumption while retaining its nutritional value. In addition, the rising demand for pasteurized camel milk due to the increasing awareness of food safety and hygiene among consumers is propelling market growth. Moreover, pasteurized camel milk offers several advantages over raw camel milk, and eliminates the risk of harmful bacteria, making it a safer choice, particularly for vulnerable populations such as children, pregnant women, and the geriatric population, which represents another major growth-inducing factor. Also, pasteurization extends the shelf life of camel milk, enabling better distribution and availability across the region. Besides this, pasteurized camel milk retains the nutritional benefits associated with camel milk, including vitamins, minerals, and proteins. Consumers value these nutrients for their potential health benefits and see pasteurized camel milk as a convenient and safe source of natural goodness. Furthermore, the widespread availability of pasteurized camel milk in retail stores, supermarkets, and online platforms is further contributing to the market growth.

Breakup by Distribution Channel

- Supermarkets and Hypermarkets

- Convenience Stores

- Specialty Stores

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel has also been provided in the report. This includes supermarkets and hypermarkets, convenience stores, specialty stores, online stores, and others. According to the report, supermarkets and hypermarkets accounted for the largest market share.

Supermarkets and hypermarkets retail outlets offer numerous types of products under one roof, including camel milk, camel milk yoghurt, and camel milk ice cream, making them a convenient and accessible choice for consumers which is contributing to the market growth. They are present in major cities, towns, and even remote areas, ensuring the widespread availability of camel milk products. This accessibility is significantly contributing to the increasing popularity and demand for camel milk among consumers from various demographics, thus propelling market growth. Moreover, supermarkets and hypermarkets often stock a diverse range of camel milk products, including fresh camel milk, camel milk-based beverages, and camel milk-based dairy products. This diverse selection allows consumers to explore different options and brands, further stimulating market growth. Besides this, these retail giants have well-established supply chains and efficient logistics systems, allowing them to maintain consistent stock levels and ensure product freshness. This reliability in the supply chain instills consumer confidence in purchasing camel milk products from these outlets, thus accelerating the market growth. Furthermore, supermarkets and hypermarkets often offer promotional deals and discounts on camel milk products, attracting more consumers and fostering brand loyalty, which is creating a positive market outlook.

Breakup by Packaging

- Cartons

- Bottles

- Cans

- Jars

- Others

A detailed breakup and analysis of the market based on the packaging has also been provided in the report. This includes cartons, bottles, cans, jars, and others. According to the report, bottles accounted for the largest market share.

The increasing demand for bottles in the camel dairy industry to provides an efficient and convenient way to store and transport camel milk, ensuring its freshness and quality are preserved, is influencing the market growth. Moreover, the transparency of bottles allows consumers to inspect the product before purchase, instilling confidence in the product's purity and hygiene which represents another major growth-inducing factor. Additionally, bottles with secure caps minimize the risk of contamination and tampering, ensuring the safety of the camel milk. Moreover, bottles are available in various sizes, catering to different consumer needs, whether for individual servings or family consumption. This versatility has made them a preferred choice among retailers and consumers. Besides this, the increasing popularity of bottles due to their eco-friendliness, reusable and recyclable properties, aligning with the growing environmental consciousness among consumers is accelerating the market growth. Furthermore, the aesthetics of bottles play a role in enhancing the appeal of camel milk products on store shelves, contributing to their market visibility and consumer attraction.

Breakup by Region

- Eastern Region

- Central Region

- Western Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include the eastern region, central region, western region, and southern region. According to the report, the western region accounted for the largest market share.

The Western Region is driven by the rich heritage of camel farming and the strong cultural significance of camel milk consumption. In addition, camel dairy has been an integral part of the local lifestyle and traditions for generations, and this deep-rooted cultural connection to camel milk is contributing to consistent demand and consumption of camel dairy products in the region. Moreover, the Western Region's favorable climatic conditions and vast desert landscapes provide an ideal environment for camel farming resulting in a high concentration of camel herds, making the region a key hub for camel milk production representing another major growth-inducing factor. Besides this, this western region’s proximity to major urban centers and its well-established transportation infrastructure facilitates the distribution of camel milk products to other parts of the country, enhancing market accessibility and availability. Furthermore, the widespread adoption of modern dairy farming practices and technology are led to improved milk yields and product quality, further creating a positive market outlook.

Competitive Landscape

Nowadays, key players in the market are employing various strategies to strengthen their positions and maintain a competitive edge. They are focusing on ensuring the highest quality standards for their products and investing in quality control measures and adhering to international food safety and hygiene standards, obtaining certifications and endorsements from reputable organizations enhancing their credibility, and instilling confidence in consumers. They are also expanding their product portfolios by introducing several camel dairy products including flavored camel milk, camel milk-based desserts, and camel milk powder. They are building strong customer relationships and engaging with consumers through social media, customer support channels, and interactive events. Moreover, they are also conducting educational campaigns to raise awareness about the nutritional benefits and cultural significance of camel milk.The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided.

Key Questions Answered in This Report

1. What was the size of the Saudi Arabia camel dairy market in 2024?2. What is the expected growth rate of the Saudi Arabia camel dairy market during 2025-2033?

3. What are the key factors driving the Saudi Arabia camel dairy market?

4. What has been the impact of COVID-19 on the Saudi Arabia camel dairy market?

5. What is the breakup of the Saudi Arabia camel dairy market based on the product type?

6. What is the breakup of the Saudi Arabia camel dairy market based on the distribution channel?

7. What is the breakup of the Saudi Arabia camel dairy market based on the packaging?

8. What are the key regions in the Saudi Arabia camel dairy market?

Table of Contents

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 139 |

| Published | February 2025 |

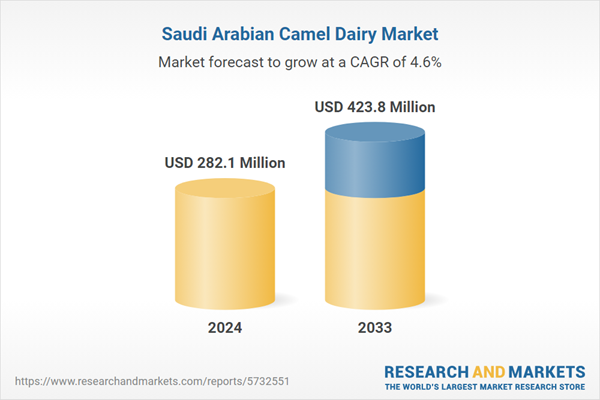

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 282.1 Million |

| Forecasted Market Value ( USD | $ 423.8 Million |

| Compound Annual Growth Rate | 4.6% |

| Regions Covered | Saudi Arabia |