The aerogel market is driven by several key factors, including its lightweight, insulating properties, which make it ideal for use in aerospace, construction, and energy industries. The growing demand for energy-efficient materials and advancements in thermal insulation are major contributors to its adoption. Aerogels also offer superior performance in extreme environments, such as space exploration and military applications, boosting their market potential. Additionally, the increasing focus on sustainable solutions fuels interest in aerogels as they are often made from eco-friendly materials. For instance, in April 2024, SA-Dynamics introduced bio-based and recyclable insulation textiles using 100% bio-based aerogel fibers. With up to 90% of the air trapped in nanopores, these approved fabrics provide insulation on par with materials derived from fossil fuels. SA-Dynamics intends to transform the building industry by substituting bio-based materials for fossil-based ones. Moreover, research into new manufacturing techniques that lower production costs and enhance material properties is expected to expand the market, as industries seek innovative and high-performance solutions.

In the United States, the aerogel market outlook is driven by factors such as the growing demand for energy-efficient building materials and advanced thermal insulation solutions. The aerospace and defense sectors are significant contributors, with aerogels offering lightweight, high-performance insulation for aircraft and spacecraft. Increased investment in renewable energy, particularly solar power, also boosts the demand for aerogels in solar thermal systems. Government initiatives supporting research and development, along with the push for sustainable, eco-friendly materials, further accelerate market growth. Additionally, the emergence of new manufacturing technologies that lower costs and improve the properties of aerogels is enhancing their adoption in industries such as construction, oil and gas, and automotive, driving overall market expansion in the U.S. For instance, in August 2024, MIT spin-out AeroShield Materials, which is creating innovative technology for energy efficiency applications in the built environment, opened a new manufacturing facility for aerogel insulation in Waltham, Massachusetts, and raised an additional $5 million with the help of new investor MassMutual Ventures and existing investors MassVentures and Massachusetts Clean Energy Center.

Aerogel Market Trends:

Increasing Product Demand from the Oil and Gas Sector

The global oil consumption is expected to rise by more robust than expected 1.7 mb/d in 1Q24 due to strengthening US economic forecasts and rising bunkering. This expansion will support the adoption of aerogel. The growing use of aerogel materials in the oil and gas industry also contributes to the promising future of the aerogel market forecast. The oil and gas sector uses these types of material coatings as insulators. The oil and gas industry uses pipes to move large amounts of raw oil. These coatings' chemical inertness and ability to stop leaks make them excellent for pipe insulation and security. These blankets made of these materials are also used as insulation for walls and roofs in the construction sector. The creation of new structures as well as the renovation of ageing historic structures and infrastructure are driving market growth. Their application levels have increased due to their significant weight reduction compared to other traditional insulation materials. The aerogel market size thus shows significant growth due to this factor.Lighter and Thinner Compared to Conventional Insulations

Aerogel is extremely light in weight because over 99 percent of its composition is air or gas. For instance, spray foam, one of the lightest conventional insulators, has a density of 8 kg/m3, whereas aerogel has a density as low as 0.001 gm/cm3. Moreover, aerogels are mostly used as heat-resistant coatings because of their higher heat resistance (R value). Furthermore, a thinner aerogel layer can have an insulating effect comparable to plastic foam and glass. For instance, plastic foam varieties such as XPS, EPS, and PU have heat sensitivity values of roughly 5 per inch, 4 per inch, and 6 per inch, respectively, but the aerogel has a value of about 10 per inch. Therefore, when compared to traditional insulating coatings like fiberglass and plastic foam, aerogel offers 25% cost savings for target values of R 4 and 18-23% cost savings for target values of R 12. According to the report, this factor is significantly contributing to the rising aerogel market demands..Increasing Production of Electric Vehicles

Energy-saving insulation for electric vehicle (EV) batteries and the fast advancement of battery technologies are expected to propel a significant share of the aerosol market overview. Many original equipment manufacturers (OEMs) and battery pack manufacturers are always working to enhance the performance of electric car batteries because of heightened competition and consumer demand for fuel-efficient vehicles. Aerogels can self-extinguish and are resistant to fire. They prevent the heat and fire from spreading to neighboring cells in the event of a thermal runaway in battery cells. Moreover, sturdy aerogel insulation is used in car door frames, roofs, and hoods and takes up only 50% of the space required by conventional foam materials. Aerogel uses less energy and provides better passive in-cabin climate management.Aerogel Industry Segmentation:

The publisher provides an analysis of the key trends in each segment of the global aerogel market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on based on type, form, processing, and application.Analysis by Type:

- Silica

- Polymer

- Carbon

- Others

Analysis by Form:

- Blanket

- Particle

- Panel

- Monolith

Analysis by Processing:

- Virgin

- Composites

- Additives

Analysis by Application:

- Oil and Gas

- Construction

- Transportation

- Electronics

- Others

Regional Analysis:

- North America

- Europe

- Asia Pacific

- Middle East and Africa

- Latin America

Key Regional Takeaways:

United States Aerogel Market Analysis

In 2024, the United States accounted for the market share of over 85.00%. In terms of growth, the United States market is experiencing considerable growth due to recent improvements in material science and demand from various industries for energy efficiency solutions. Aerogel, recognized by its superior properties, which include low density, high thermal resistance, and great insulation, has become a significant material in various applications, and it is being fast-tracked in industries like aerospace, construction, and automobile, where high-performance insulation is the requirement.The increasing importance of energy efficiency, especially in building materials and insulation systems, drives demand for aerogel. Since aerogel provides unmatched thermal performance compared to conventional insulation materials, it is finding a more preferred solution to cut energy consumption and increase sustainability.

Furthermore, the strong expansion of the U.S. oil and gas sector has helped spur growth in the market. According to an industrial report, the United States increased crude oil production by 12.9 million b/d by the year 2023; 8.5% compared to the year 2022's output at 11.9 million b/d. With that in mind, production rise within the Permian and gulf region means refineries and transportation systems should keep looking towards using improved versions of insulators like aerogel for high operations in those industries. The combined demand from energy, industrial, and sustainability-focused applications positions the U.S. aerogel market in a continued growth trajectory.

Europe Aerogel Market Analysis

The Europe aerogel market is witnessing significant growth driven by stringent energy efficiency regulations, sustainability goals, and advancements in material science. The adoption of the recast Energy Performance of Buildings Directive (EPBD) in May 2024 mandates all new residential and non-residential buildings to be zero-emission by 2028 for public buildings and 2030 for others, creating a strong demand for high-performance insulation materials like aerogel. Additionally, the European Union's focus on reducing carbon emissions and achieving sustainability targets has bolstered the adoption of aerogel for its lightweight, energy-efficient, and environmentally friendly properties. The region’s growing construction sector, particularly in green building projects, and increasing R&D investments in aerogel production technologies further support market expansion. Furthermore, aerogel's versatility in industrial applications, such as oil and gas pipeline insulation and aerospace, is driving its adoption across diverse sectors, solidifying its role in Europe's sustainability initiatives.The increasing emphasis on retrofitting older buildings to meet modern energy standards also fuels the demand for aerogel-based insulation solutions. Moreover, collaborations between aerogel manufacturers and construction companies to develop innovative, cost-effective products are expected to enhance market penetration in the coming years.

Asia Pacific Aerogel Market Analysis

Asia Pacific factors are significantly contributing to the growth of the aerogel market in the region. The Asia-Pacific (APAC) region is a major player in the global oil and gas industry, supplying 10%-15% of global needs while also being the largest consumer of oil and gas. This dynamic creates strong opportunities for alternative energy solutions, including the adoption of aerogel for high-performance insulation applications in the oil and gas sector. Additionally, China’s 14th Five-Year Plan, which emphasizes investment in infrastructure projects, energy efficiency, and green building development, is driving demand for sustainable materials like aerogel. With an estimated USD 4.2 Trillion allocated for new infrastructure projects between 2021 and 2025, including retrofitting over 350 million square meters of buildings and constructing net-zero-energy buildings, the market for energy-efficient insulation materials is poised for growth. The need for lightweight, high-performance insulating materials like aerogel in both the construction and energy sectors further supports the expanding demand in the Asia Pacific aerogel market.Latin America Aerogel Market Analysis

As per industry reports, Brazil leads Latin America and the Caribbean in key infrastructure and construction projects, with numerous developments in the pipeline as of February 2023. This surge in construction activity is a significant growth driver for the Latin American aerogel market. Aerogel's superior thermal insulating properties make it an ideal material for use in energy-efficient buildings, helping to meet the region's increasing demand for sustainable and energy-efficient construction solutions. In addition, countries like Chile, Mexico, Colombia, and Peru, which also have over USD 100 Billion in infrastructure projects under development, further contribute to the growing demand for advanced materials like aerogel in the construction sector. As the region increasingly focuses on sustainable building practices and energy-efficient infrastructure, the adoption of aerogel products is expected to rise across various sectors, including residential, commercial, and industrial construction. This trend is further reinforced by government incentives and regulations promoting green building standards and energy efficiency.Middle East and Africa Aerogel Market Analysis

Countries in the Middle East, such as the UAE and Saudi Arabia, are making significant investments in large-scale infrastructure projects, including smart cities and sustainable buildings, which are driving the growth of the aerogel market in the region. A prime example is Saudi Arabia’s Neom City, a mega-project that emphasizes energy efficiency and the use of advanced materials. This focus on sustainable development and the incorporation of energy-efficient technologies is leading to an increased adoption of aerogel insulation, known for its superior thermal performance. Additionally, the UAE and Oman have set ambitious targets to achieve net-zero emissions by 2050, while Saudi Arabia, Bahrain, and Kuwait have committed to this goal by 2060. In line with these initiatives, the UAE has pledged to reduce emissions by 19% by 2030. As the region prioritizes eco-friendly construction practices and strives to meet its environmental targets, the demand for aerogel products, offering enhanced insulation and energy savings, continues to rise, further driving market growth across the Middle East and Africa.Competitive Landscape:

Key market players are investing in research operations to improve aerogel materials and develop new applications, which include enhancing the performance characteristics, reducing production costs, and expanding the range of aerogel products available. Additionally, they are investigating various aerogel applications, propelling the market's expansion. For instance, in October 2024, The US Department of Energy granted loan of USD 670.6 million to Aspen Aerogels for facilitating the construction of a new production plant that will be manufacturing aerogel thermal barriers for vehicles. Furthermore, leading organizations are concentrating on employing renewable ingredients, using green production techniques, and making aerogel products more ecologically friendly to satisfy clients who care about the environment. Key companies are actively promoting and informing prospective clients about the advantages of aerogels. To assist clients in incorporating aerogels into their goods and procedures, they are also holding workshops, and seminars, and offering technical assistance.The report provides a comprehensive analysis of the competitive landscape in the aerogel market with detailed profiles of all major companies, including:

- Aspen Aerogels, Inc.

- BASF SE

- Cabot Corporation

- The Dow Chemical Company

- JIOS Aerogel Corporation

- Svenska Aerogel Holding AB

- Enersens SAS

- Active Aerogels

- Nano Tech Co., Ltd.

- Guangdong Alison Hi-Tech Co., Ltd.

- Intelligent Insulation Ltd.

- Surnano Aerogel Co. Ltd.

- Taasi Corporation

- Protective Polymers Ltd

- Green Earth Aerogel Technology SL

Key Questions Answered in This Report

1. What is aerogel?2. How big is the aerogel market?

3. What is the CAGR of the aerogel Market?

4. What are the key factors driving the global aerogel market?

5. What is the leading segment of the global aerogel market based on the type?

6. What is the leading segment of the global aerogel market based on form?

7. What is the leading segment of the global aerogel market based on processing?

8. What is the leading segment of the global aerogel market based on application?

9. What are the key regions in the global aerogel market?

10. Who are the key players/companies in the global aerogel market?

Table of Contents

1 Preface2 Scope and Methodology

2.1 Objectives of the Study

2.2 Stakeholders

2.3 Data Sources

2.3.1 Primary Sources

2.3.2 Secondary Sources

2.4 Market Estimation

2.4.1 Bottom-Up Approach

2.4.2 Top-Down Approach

2.5 Forecasting Methodology

3 Executive Summary

4 Introduction

4.1 Overview

4.2 Key Industry Trends

5 Global Aerogel Market

5.1 Market Overview

5.2 Market Performance

5.3 Impact of COVID-19

5.4 Market Breakup by Type

5.5 Market Breakup by Form

5.6 Market Breakup by Processing

5.7 Market Breakup by Application

5.8 Market Breakup by Region

5.9 Market Forecast

6 SWOT Analysis

6.1 Overview

6.2 Strengths

6.3 Weaknesses

6.4 Opportunities

6.5 Threats

7 Value Chain Analysis

8 Porter’s Five Forces Analysis

8.1 Overview

8.2 Bargaining Power of Buyers

8.3 Bargaining Power of Suppliers

8.4 Degree of Competition

8.5 Threat of New Entrants

8.6 Threat of Substitutes

9 Market Breakup by Type

9.1 Silica

9.1.1 Market Trends

9.1.2 Market Forecast

9.2 Polymer

9.2.1 Market Trends

9.2.2 Market Forecast

9.3 Carbon

9.3.1 Market Trends

9.3.2 Market Forecast

9.4 Others

9.4.1 Market Trends

9.4.2 Market Forecast

10 Market Breakup by Form

10.1 Blanket

10.1.1 Market Trends

10.1.2 Market Forecast

10.2 Particle

10.2.1 Market Trends

10.2.2 Market Forecast

10.3 Panel

10.3.1 Market Trends

10.3.2 Market Forecast

10.4 Monolith

10.4.1 Market Trends

10.4.2 Market Forecast

11 Market Breakup by Processing

11.1 Virgin

11.1.1 Market Trends

11.1.2 Market Forecast

11.2 Composites

11.2.1 Market Trends

11.2.2 Market Forecast

11.3 Additives

11.3.1 Market Trends

11.3.2 Market Forecast

12 Market Breakup by Application

12.1 Oil and Gas

12.1.1 Market Trends

12.1.2 Market Forecast

12.2 Construction

12.2.1 Market Trends

12.2.2 Market Forecast

12.3 Transportation

12.3.1 Market Trends

12.3.2 Market Forecast

12.4 Electronics

12.4.1 Market Trends

12.4.2 Market Forecast

12.5 Others

12.5.1 Market Trends

12.5.2 Market Forecast

13 Market Breakup by Region

13.1 North America

13.1.1 Market Trends

13.1.2 Market Forecast

13.2 Europe

13.2.1 Market Trends

13.2.2 Market Forecast

13.3 Asia Pacific

13.3.1 Market Trends

13.3.2 Market Forecast

13.4 Middle East and Africa

13.4.1 Market Trends

13.4.2 Market Forecast

13.5 Latin America

13.5.1 Market Trends

13.5.2 Market Forecast

14 Competitive Landscape

14.1 Market Structure

14.2 Key Players

14.3 Profiles of Key Players

14.3.1 Aspen Aerogels, Inc.

14.3.2 BASF SE

14.3.3 Cabot Corporation

14.3.4 The Dow Chemical Company

14.3.5 JIOS Aerogel Corporation

14.3.6 Svenska Aerogel Holding AB

14.3.7 Enersens SAS

14.3.8 Active Aerogels

14.3.9 Nano Tech Co., Ltd.

14.3.10 Guangdong Alison Hi-Tech Co., Ltd.

14.3.11 Intelligent Insulation Ltd.

14.3.12 Surnano Aerogel Co. Ltd.

14.3.13 Taasi Corporation

14.3.14 Protective Polymers Ltd

14.3.15 Green Earth Aerogel Technology SL

List of Figures

Figure 1: Global: Aerogel Market: Major Drivers and Challenges

Figure 2: Global: Aerogel Market: Sales Value (in Million USD), 2019-2024

Figure 3: Global: Aerogel Market: Breakup by Type (in %), 2024

Figure 4: Global: Aerogel Market: Breakup by Form (in %), 2024

Figure 5: Global: Aerogel Market: Breakup by Processing (in %), 2024

Figure 6: Global: Aerogel Market: Breakup by Application (in %), 2024

Figure 7: Global: Aerogel Market: Breakup by Region (in %), 2024

Figure 8: Global: Aerogel Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 9: Global: Aerogel Industry: SWOT Analysis

Figure 10: Global: Aerogel Industry: Value Chain Analysis

Figure 11: Global: Aerogel Industry: Porter’s Five Forces Analysis

Figure 12: Global: Aerogel (Silica) Market: Sales Value (in Million USD), 2019 & 2024

Figure 13: Global: Aerogel (Silica) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 14: Global: Aerogel (Polymer) Market: Sales Value (in Million USD), 2019 & 2024

Figure 15: Global: Aerogel (Polymer) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 16: Global: Aerogel (Carbon) Market: Sales Value (in Million USD), 2019 & 2024

Figure 17: Global: Aerogel (Carbon) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 18: Global: Aerogel (Other Types) Market: Sales Value (in Million USD), 2019 & 2024

Figure 19: Global: Aerogel (Other Types) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 20: Global: Aerogel (Blanket) Market: Sales Value (in Million USD), 2019 & 2024

Figure 21: Global: Aerogel (Blanket) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 22: Global: Aerogel (Particle) Market: Sales Value (in Million USD), 2019 & 2024

Figure 23: Global: Aerogel (Particle) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 24: Global: Aerogel (Panel) Market: Sales Value (in Million USD), 2019 & 2024

Figure 25: Global: Aerogel (Panel) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 26: Global: Aerogel (Monolith) Market: Sales Value (in Million USD), 2019 & 2024

Figure 27: Global: Aerogel (Monolith) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 28: Global: Aerogel (Virgin) Market: Sales Value (in Million USD), 2019 & 2024

Figure 29: Global: Aerogel (Virgin) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 30: Global: Aerogel (Composites) Market: Sales Value (in Million USD), 2019 & 2024

Figure 31: Global: Aerogel (Composites) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 32: Global: Aerogel (Additives) Market: Sales Value (in Million USD), 2019 & 2024

Figure 33: Global: Aerogel (Additives) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 34: Global: Aerogel (Oil and Gas) Market: Sales Value (in Million USD), 2019 & 2024

Figure 35: Global: Aerogel (Oil and Gas) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 36: Global: Aerogel (Construction) Market: Sales Value (in Million USD), 2019 & 2024

Figure 37: Global: Aerogel (Construction) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 38: Global: Aerogel (Transportation) Market: Sales Value (in Million USD), 2019 & 2024

Figure 39: Global: Aerogel (Transportation) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 40: Global: Aerogel (Electronics) Market: Sales Value (in Million USD), 2019 & 2024

Figure 41: Global: Aerogel (Electronics) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 42: Global: Aerogel (Other Applications) Market: Sales Value (in Million USD), 2019 & 2024

Figure 43: Global: Aerogel (Other Applications) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 44: North America: Aerogel Market: Sales Value (in Million USD), 2019 & 2024

Figure 45: North America: Aerogel Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 46: Europe: Aerogel Market: Sales Value (in Million USD), 2019 & 2024

Figure 47: Europe: Aerogel Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 48: Asia Pacific: Aerogel Market: Sales Value (in Million USD), 2019 & 2024

Figure 49: Asia Pacific: Aerogel Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 50: Middle East and Africa: Aerogel Market: Sales Value (in Million USD), 2019 & 2024

Figure 51: Middle East and Africa: Aerogel Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 52: Latin America: Aerogel Market: Sales Value (in Million USD), 2019 & 2024

Figure 53: Latin America: Aerogel Market Forecast: Sales Value (in Million USD), 2025-2033

List of Tables

Table 1: Global: Aerogel Market: Key Industry Highlights, 2024 and 2033

Table 2: Global: Aerogel Market Forecast: Breakup by Type (in Million USD), 2025-2033

Table 3: Global: Aerogel Market Forecast: Breakup by Form (in Million USD), 2025-2033

Table 4: Global: Aerogel Market Forecast: Breakup by Processing (in Million USD), 2025-2033

Table 5: Global: Aerogel Market Forecast: Breakup by Application (in Million USD), 2025-2033

Table 6: Global: Aerogel Market Forecast: Breakup by Region (in Million USD), 2025-2033

Table 7: Global: Aerogel Market: Competitive Structure

Table 8: Global: Aerogel Market: Key Players

Companies Mentioned

- Aspen Aerogels Inc.

- BASF SE

- Cabot Corporation

- The Dow Chemical Company

- JIOS Aerogel Corporation

- Svenska Aerogel Holding AB

- Enersens SAS

- Active Aerogels

- Nano Tech Co. Ltd.

- Guangdong Alison Hi-Tech Co. Ltd.

- Intelligent Insulation Ltd.

- Surnano Aerogel Co. Ltd.

- TAASI Corporation

- Protective Polymers Ltd.

- Green Earth Aerogel Technology SL

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 145 |

| Published | August 2025 |

| Forecast Period | 2024 - 2033 |

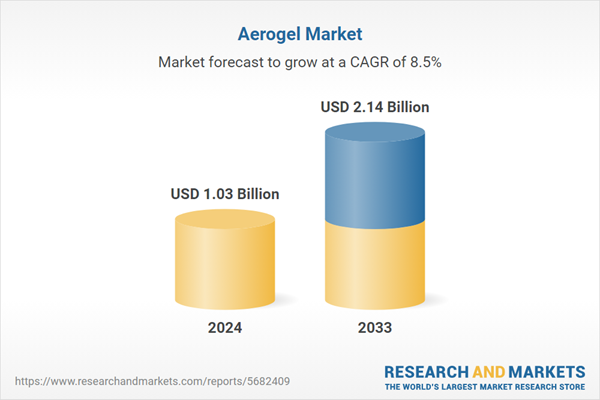

| Estimated Market Value ( USD | $ 1.03 Billion |

| Forecasted Market Value ( USD | $ 2.14 Billion |

| Compound Annual Growth Rate | 8.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |