Food Emulsifiers Market Analysis:

- Market Growth and Size: The market is witnessing significant growth, fueled by the rising demand for processed foods, where emulsifiers play a vital role in texture and shelf-life enhancement, with promising future expansion.

- Industry Applications: The market experiences high demand from diverse industries, including bakery, confectionery, dairy, and packaged foods, where emulsifiers improve product quality, texture, and stability.

- Geographical Trends: Europe leads the food emulsifiers market, driven by its established food processing industry and stringent quality standards, fostering innovation and growth.

- Competitive Landscape: The market is characterized by intense competition among key players focusing on research and development (R&D), product innovation, and clean label solutions to meet evolving consumer preferences.

- Challenges and Opportunities: While the market faces challenges such as regulatory scrutiny and clean label demands, it also offers opportunities in the expanding functional food sector and natural emulsifier alternatives.

- Future Outlook: The future of the food emulsifiers market looks promising, with potential growth in the clean label and natural emulsifier segments, as consumers continue to seek healthier and transparent food choices.

Food Emulsifiers Market Trends:

Escalating demand for processed foods

In today's fast-paced lifestyle, consumers increasingly seek convenience in their food choices, contributing to the popularity of processed foods such as baked goods, confectionery items, and ready-to-eat meals. Food emulsifiers play a pivotal role in enhancing the quality of these products by addressing key attributes such as texture, stability, and shelf-life. Emulsifiers enable the creation of appealing textures in baked goods, ensuring softness in bread, fluffiness in cakes, and creaminess in fillings. In confectionery, they aid in achieving the desired consistency and mouthfeel of chocolates, candies, and creamy centers. Additionally, in ready-to-eat (RTE) meals, emulsifiers help maintain product stability during storage and reheating, ensuring a consistent and pleasant eating experience. As consumer preferences continue to evolve, the leading food manufacturers are relying on emulsifiers to meet these demands, making them an integral part of the processed food industry. The enhanced convenience and extended shelf-life provided by food emulsifiers contribute to their enduring appeal, making them essential for a wider audience of consumers seeking both taste and convenience in their food choices.Rising health consciousness

As consumers become more health-conscious and discerning about their dietary choices, there is a growing preference for low-fat and reduced-calorie food products. Food emulsifiers play a crucial role in the development of such healthier options while preserving the taste and texture that consumers enjoy. Emulsifiers are invaluable in low-fat and reduced-calorie food formulations, where they aid in creating products that are better for overall health as well as satisfy sensory expectations. These additives help distribute fat substitutes evenly, resulting in a smoother texture and improved mouthfeel. In salad dressings, spreads, and other reduced-fat products, emulsifiers ensure that the oil and water components remain stably mixed, preventing separation and maintaining product quality. The alignment of emulsifiers with the augmenting demand for better nutrition and healthier choices reinforces their significance in the food industry. As health-conscious consumers continue to seek foods that offer both taste and nutritional benefits, the role of emulsifiers in enabling such products becomes increasingly vital, accelerating their adoption and application across a wide range of low-fat and reduced-calorie food items.Emerging clean label trends

The rising clean label trend is a pivotal driver in the food emulsifiers market as consumers increasingly prioritize natural and transparent ingredients in their food choices. In response to this demand, food manufacturers are shifting their focus toward providing clean label products, and food emulsifiers play a crucial role in this transformation. Emulsifiers derived from natural sources, such as lecithin sourced from soy or sunflower, are gaining immense popularity owing to their clean label appeal. These naturally derived emulsifiers align with consumers' desires for more transparent ingredient lists and products that are free from synthetic additives. To cater to this growing trend, manufacturers are actively developing and promoting natural emulsifier options, expanding their product portfolios to include clean label alternatives. The availability of these natural emulsifiers is supporting market growth as more food producers embrace clean label practices to meet consumer expectations for healthier, more authentic, and less processed food products. This alignment with clean label trends underscores the importance of natural emulsifiers in shaping the future of the food industry.Food Emulsifiers Industry Segmentation:

The publisher provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on type, application, and source.Breakup by Type:

- Mono and di-glycerides and their Derivatives

- Lecithin

- Sorbitan Ester

- Polyglycerol Ester

- Others

Mono and di-glycerides and their derivatives account for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the type. This includes mono and di-glycerides and their derivatives, lecithin, sorbitan ester, polyglycerol ester, and others. According to the report, mono and di-glycerides and their derivatives represented the largest segment.Mono and di-glycerides and their derivatives dominate the food emulsifiers market owing to their versatility and wide-ranging applications. Their ability to improve texture, stability, and shelf-life in various food products, including baked goods, margarine, and ice cream, fuels their demand. Additionally, they align with the emerging clean label trend as they can be sourced from natural fats, addressing consumers' preference for more transparent and natural ingredients.

Lecithin is a significant segment in the food emulsifiers market, fueled by its natural origin and multifunctional properties. It serves as an emulsifier, stabilizer, and texture enhancer in products like chocolates, dressings, and baked goods. Lecithin's clean label appeal, allergen-free status, and ability to improve product texture contribute to its growth.

Sorbitan esters are valued in the food emulsifiers market for their excellent emulsifying properties. They are commonly used in the production of beverages, salad dressings, and sauces. The demand for sorbitan esters is catalyzed by their capacity to create stable emulsions and their suitability for various food applications.

Polyglycerol esters are gaining immense traction in the food emulsifiers market owing to their ability to enhance the texture and stability of products like bakery items, margarine, and dairy alternatives. The demand is propelled by the need for emulsifiers that can improve the overall quality and mouthfeel of these products while meeting clean label criteria. Polyglycerol esters offer an alternative to synthetic emulsifiers, aligning with the shifting trend toward more natural and sustainable ingredients.

Breakup by Application:

- Confectionary Products

- Bakery Products

- Dairy and Frozen Desserts

- Meat Products

- Others

Dairy and frozen desserts represent the leading market segment

The report has provided a detailed breakup and analysis of the market based on the application. This includes confectionary products, bakery products, dairy and frozen desserts, meat products, and others. According to the report, dairy and frozen desserts represented the largest segment.Dairy and frozen desserts, like ice cream and yogurt, dominate the food emulsifiers market due to their widespread consumption. Emulsifiers play a crucial role in achieving a smooth and creamy texture, preventing ice crystal formation, and stabilizing these products during storage and distribution. The growing demand for indulgent and innovative dairy and frozen dessert options accelerates the use of emulsifiers to maintain product quality.

Confectionery products, including chocolates and candies, benefit from food emulsifiers by improving texture, mouthfeel, and shelf-life. The demand is driven by consumers' preferences for smooth and creamy confections, which emulsifiers help achieve. Emulsifiers also enable the incorporation of various flavors and fillings, enhancing product innovation.

Bakery products, such as bread, pastries, and cakes, rely on food emulsifiers for improved dough handling, texture enhancement, and extended freshness. The growth in the bakery segment is fueled by the need for consistent product quality and increased shelf-life, aligning with consumer expectations for convenient and high-quality baked goods.

Emulsifiers find extensive applications in meat products, such as sausages and processed meats, to improve binding, texture, and moisture retention. The demand in the meat segment is spurred by the need for consistent product quality, enhanced juiciness, and cost-effective processing methods, which emulsifiers facilitate. Emulsifiers also contribute to reducing fat content in meat products while maintaining taste and mouthfeel, aligning with health-conscious consumer preferences.

Breakup by Source:

- Plant Source

- Animal Source

Plant source holds the largest share in the industry

A detailed breakup and analysis of the market based on the source have also been provided in the report. This includes plant source and animal source. According to the report, plant source represented the largest segment.Plant-based food emulsifiers dominate the food emulsifiers market as they are derived from natural sources like soybeans and sunflower seeds. These emulsifiers align with consumer demands for clean label ingredients and plant-based products. They cater to the growing number of vegans and vegetarians seeking alternatives in their diets. Additionally, plant-based emulsifiers are known for their sustainability, as they reduce the environmental impact associated with animal agriculture. Their versatility allows them to be used in a wide range of food products while maintaining transparency and naturalness. The rise in clean label trends and eco-conscious consumer choices has contributed to the dominance of plant-based emulsifiers in the market, fostering healthier and more sustainable food options.

Animal-based food emulsifiers, traditionally sourced from ingredients like egg yolks and animal fats, have been used in certain food applications for many years. However, their usage has declined in recent times due to numerous factors. These emulsifiers often raise concerns about allergens, making them less suitable for consumers with dietary restrictions. Additionally, the rising sustainability concerns related to animal agriculture have led to a shift away from animal-based ingredients in food products. While they still find applications in specific traditional products like mayonnaise, the dominance of plant-based emulsifiers has grown significantly in the market. The plant-based alternatives cater to clean label and dietary preference trends as well as contribute to more environmentally friendly food choices.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Europe leads the market, accounting for the largest food emulsifiers market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Europe accounted for the largest market share.Europe dominates the food emulsifier market, driven by its established food processing industry, strict quality standards, and commitment to clean label and natural ingredients. The region's clean label trend and demand for sustainable food production support the use of plant-based emulsifiers. Europe's emphasis on product quality, texture, and shelf-life in various food applications solidifies its leadership in the market. Furthermore, Europe's robust research and development initiatives in the food industry continuously foster innovation in emulsifier technology, ensuring the region remains at the forefront of delivering high-quality and sustainable food solutions to meet evolving consumer preferences.

North America also maintains a significant position in the food emulsifier market by emphasizing clean label trends and the demand for healthier, processed foods. Consumers seek products with transparent and natural ingredients, driving the use of emulsifiers derived from plant sources. The region also fosters innovation in the bakery and confectionery sectors, which rely heavily on food emulsifiers for product stability and texture.

The Asia Pacific region plays a vital role in the food emulsifier market owing to its expanding population and evolving dietary preferences. The rising demand for convenience foods, dairy products, and baked goods is on the rise, fostering the use of emulsifiers for improved product quality. Additionally, Asia Pacific's expanding food processing industry and focus on innovation contribute to market growth.

Latin America represents a growing food emulsifier market, with increasing urbanization and consumer preferences for processed and convenient foods. The region's dairy and confectionery sectors, in particular, rely on emulsifiers to maintain product quality and meet consumer expectations for taste and texture. Latin America's food industry is becoming more sophisticated, resulting in greater utilization of emulsifiers to improve product stability and consistency.

In the Middle East and Africa region, the food emulsifier market is propelled by the region's growing food and beverage industry, urbanization, and changing consumer preferences. Emulsifiers find applications in bakery and dairy products, catering to the increasing demand for processed foods. The region's interest in cleaner labels and healthier alternatives further promotes the use of emulsifiers to meet consumer expectations for quality and consistency. While Europe dominates the market, the Middle East and Africa offer significant growth potential in the coming years.

Leading Key Players in the Food Emulsifiers Industry:

Ley players in the market are actively engaging in several strategic initiatives. They are also investing in research and development (R&D) to innovate and introduce new emulsifiers that cater to changing consumer preferences, such as natural and clean label options. These companies are expanding their production capacities to meet the growing demand for food emulsifiers in various food segments, including bakery, confectionery, and dairy. Additionally, they are focusing on strategic acquisitions and partnerships to strengthen their market presence and global reach. Furthermore, these industry leaders are actively participating in sustainability efforts by adopting environmentally friendly production processes and sourcing raw materials responsibly. Overall, their efforts are geared toward maintaining a competitive edge in a dynamic and evolving market while meeting consumer demands for safe, high-quality, and sustainable food products.The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major companies have also been provided.

Some of the key players in the market include:

- Adani Wilmar Ltd.

- Archer Daniels Midland Company

- BASF SE

- Cargill Incorporated

- Corbion

- Dupont Nutrition And Biosciences

- Ingredion Incorporated

- Kerry Group Plc.

- Lasenor Emul SL

- Palsgaard A/S

- Riken Vitamin Co. Ltd.

Key Questions Answered in This Report

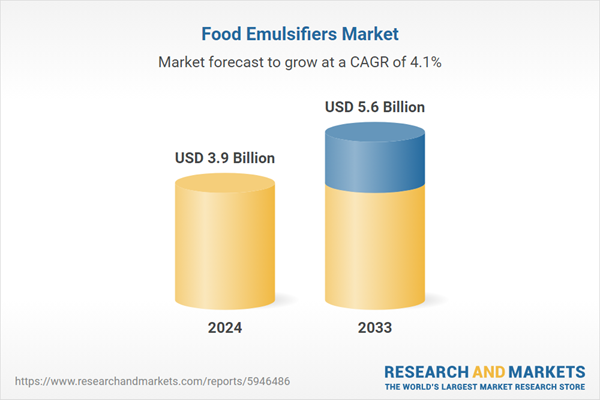

1. What was the size of the global food emulsifiers market in 2024?2. What is the expected growth rate of the global food emulsifiers market during 2025-2033?

3. What are the key factors driving the global food emulsifiers market?

4. What has been the impact of COVID-19 on the global food emulsifiers market?

5. What is the breakup of the global food emulsifiers market based on the type?

6. What is the breakup of the global food emulsifiers market based on the application?

7. What is the breakup of the global food emulsifiers market based on the source?

8. What are the key regions in the global food emulsifiers market?

9. Who are the key players/companies in the global food emulsifiers market?

Table of Contents

Companies Mentioned

- Adani Wilmar Ltd.

- Archer Daniels Midland Company

- BASF SE

- Cargill Incorporated

- Corbion

- Dupont Nutrition and Biosciences

- Ingredion Incorporated

- Kerry Group Plc.

- Lasenor Emul SL

- Palsgaard A/S

- Riken Vitamin Co. Ltd.q

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 128 |

| Published | January 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 3.9 Billion |

| Forecasted Market Value ( USD | $ 5.6 Billion |

| Compound Annual Growth Rate | 4.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |