Speak directly to the analyst to clarify any post sales queries you may have.

KEY DRIVERS OF THE 2025 MARKET SURGE

- The western region of the U.S. experienced strong economic growth, leading to increased construction activity and a corresponding rise in demand for power tools and accessories. The region's demand for new homes and home remodeling stimulated growth in the power tool accessories market.

- California High-Speed Rail (CHSR) Overview: An ambitious USD 135 billion project aiming to connect major cities like Los Angeles and San Francisco with trains traveling up to 220 mph. The scale and complexity of this project have led to increased demand for power tools and accessories, particularly in the initial operating segments under construction.

- WB1200 (Seattle, Washington): Scheduled for completion in 2025, WB1200 is a twin skyscraper complex in Seattle's Denny Triangle neighborhood. The project includes 1,014 apartments and retail space, reflecting the city's ongoing urban development and the associated rise in construction activities.

- Spring District (Bellevue, Washington): The Spring District is a USD 2.3 billion mixed-use development in Bellevue, Washington. Set to be completed by 2028, the project encompasses residential, office, and retail spaces, significantly contributing to the region's construction landscape.

- The Foothill Gold Line project is extending the A-Line light rail through Los Angeles County. With Phase 2B1 expected to open in 2025, the project is enhancing regional connectivity and stimulating construction-related activities.

MARKET TRENDS & DRIVERS

Surging Prominence of United States Manufacturing

Through decades of technological leadership, access to critical resources, and early industrial maturity, the U.S. built a substantial advantage in precision manufacturing and industrial tooling. However, changing global economic dynamics, competitive manufacturing environments in Asia, and evolving domestic market demands have begun reshaping the U.S. power tool accessories market landscape. In response to tariff volatility on imports from China and Southeast Asia, especially during the U.S.-China trade war; several U.S.-based power tool accessory manufacturers have begun relocating production back to the United States or nearby countries in North America.Midwest and Southern U.S. states have emerged as preferred destinations due to available industrial infrastructure, government incentives, and proximity to core construction and automotive markets. Production relocation to Mexico and Canada is also gaining traction to mitigate tariff exposure and logistics bottlenecks while preserving North American supply chain integrity. Moreover, US firms are increasingly investing in Industry 4.0 technologies, including IoT-enabled machine tools, additive manufacturing, and AI-driven predictive maintenance systems, to enhance operational efficiency and precision in accessory manufacturing.

The South (Texas, Florida), Midwest (Ohio, Illinois), and West (California) continue to lead the demand for power tool accessories due to large-scale residential and commercial construction activity fueled by population growth, real estate development, and federal infrastructure investments. The Infrastructure Investment and Jobs Act (IIJA) has provided a significant boost to accessory demand, especially for industrial and commercial-grade power tool accessories needed in public works and energy projects.

Rise in Initiatives in Manufacturer-led Programs

Leading manufacturers like Bosch, Makita, and DeWalt are expanding professional training and certification programs in key states such as California, Texas, and Florida, where demand for skilled tradespeople and DIYers is strong. Programs like Bosch’s Power Tools Academy focus on educating users about proper accessory use, safety, and efficiency, boosting user skills, brand loyalty, and accessory sales.States including Illinois, Ohio, and New York are seeing increased adoption of digital platforms by manufacturers like Stanley Black & Decker and Bosch. Heavy investment in e-commerce portals and online marketing improves accessibility to power tool accessories, with smart tools, tutorials, and promotions driving consumer engagement and sales, especially in densely populated areas. Moreover, in southern states like Georgia, North Carolina, and Alabama, manufacturers are introducing financial initiatives such as leasing, zero-percent financing, and trade-in programs to help contractors and dealers access premium accessories with less upfront cost. Companies like Husqvarna and Hilti support dealers with equipment loans, enabling contractors to upgrade regularly and boosting sales through ongoing accessory purchases.

Urban centers in states like California, New York, and Illinois have embraced manufacturer-led referral and loyalty programs to expand their customer base for power tool accessories. Brands such as Husqvarna have launched loyalty clubs that reward customers for referring friends and making repeat purchases, building a strong community of trusted users. These programs leverage word-of-mouth marketing and social proof to attract new customers while retaining existing ones. Coupled with heavy discount offers and promotional events, these incentives play a crucial role in urban areas where competition is high, and customer engagement through personalized rewards fosters brand loyalty and increases accessory sales.

US POWER TOOL ACCESSORIES MARKET SEGMENTATION INSIGHTS

INSIGHTS BY OPERATION TYPE

Cutting accessories represent the dominant operation type segment within the U.S. power tool accessories market, driven by their essential role across construction, woodworking, metal fabrication, and demolition applications. This leadership stems from several key dynamics: cutting accessories undergo frequent wear and tear due to intensive use, ensuring steady aftermarket demand and repeat sales opportunities for manufacturers. Continuous advancements in blade materials, precision engineering, and cordless tool compatibility have further elevated this segment’s value, enabling better durability, cleaner cuts, and compatibility with modern, battery-powered tools.The versatility of cutting accessories also supports a wide range of applications, from high-performance circular saw blades for wood, metal, and composite cutting, to durable reciprocating saw blades suited for demolition and renovation tasks and precision jigsaw blades for intricate, curved, and craft cuts. Leading brands have capitalized on these trends by offering specialized, high-efficiency products tailored for both professional and DIY markets. Rising infrastructure projects, custom carpentry demand, and the ongoing shift toward cordless tools continue to expand the market for cutting accessories, making it one of the most resilient and commercially attractive segments within the U.S. power tool accessories market. Additionally, the surge in U.S. infrastructure investments, including the Infrastructure Investment and Jobs Act (IIJA), which provides USD 550 billion in new infrastructure spending over five years, continues to expand the market for cutting accessories, making it one of the most resilient and commercially attractive segments within the U.S. power tool accessories market.

INSIGHTS BY ACCESSORY TYPE

In 2024, drill bits dominate the U.S. power tool accessories market by accessory type segment, driven by their indispensable role in construction, manufacturing, infrastructure projects, and residential DIY activities. Their versatility across wood, metal, masonry, plastics, and multi-material drilling ensures sustained, recurring demand across sectors. The segment’s growth is propelled by ongoing construction activity, industrial maintenance requirements, and a rising DIY culture across the U.S. continuous product innovation in drill bit materials, coatings, and designs, coupled with enhanced compatibility with cordless and high-speed impact drills that fuels the market expansion.An important factor supporting this growth is the federal Infrastructure Investment and Jobs Act (IIJA), which has funneled billions into public works and commercial construction. This legislation is driving heightened demand for robust, high-performance drill bits used in infrastructure projects, notably in states like Texas, California, and Ohio, where construction activity is intense. Additionally, the surge in remote work and home improvement has accelerated consumer interest in premium drill bit sets for DIY projects. Furthermore, key operational trends include:

- Impact-rated, multi-material drill bit sets for cordless drills such as the DeWalt FlexTorq Impact Ready Sets designed for high-torque cordless drills and Milwaukee Shockwave™ Impact Duty Bits cater to contractors working on mixed-material job sites.

- High-performance masonry and concrete drill bits Bosch Bulldog Xtreme Bits are widely used in infrastructure and commercial construction projects and Diablo Rebar Demon Bits deliver durability in rebar-laden concrete applications.

- The ongoing boom in U.S. residential renovations, custom furniture projects, and large-scale infrastructure developments (bridges, highways, commercial real estate) will amplify demand for versatile, durable, and application-specific drill bits.

INSIGHTS BY END USERS

The industrial sector is a dominant end-user segment within the U.S. power tool accessories market, encompassing diverse activities such as manufacturing, mining, shipbuilding, oil and gas, and material processing. These industries demand durable, high-performance accessories for critical tasks including drilling, cutting, grinding, and fastening. The need for operational efficiency, precision, and safety in harsh working environments consistently drives a strong demand for specialized power tool accessories. Key ongoing and upcoming industrial projects (2024-2025) driving demand include:- US Steel Big River 2 Mill (Osceola, AR): This multi-billion-dollar advanced steel production facility requires heavy-duty cutting wheels, drill bits, and grinding accessories essential for steel fabrication, plant construction, and ongoing maintenance work.

- Form Energy Iron-Air Battery Factory (Weirton, WV): A pioneering grid-scale battery production plant fueling demand for robust drilling, fastening, and material-cutting accessories tailored for energy infrastructure-grade materials.

- Chevron Renewable Diesel Plant Conversion (El Segundo, CA): Industrial site conversion projects necessitate metal cutting wheels, demolition blades, and anti-vibration grinding tools to safely dismantle and retrofit existing oil infrastructure.

- Intel D1X Module 3 Expansion (Hillsboro, OR): Although focused on semiconductors, the industrial construction phase of this expansion generates high-volume demand for durable drilling, fastening, and grinding tools designed for structural steel, piping, and process equipment installations.

INSIGHTS BY INDUSTRIAL END USERS

The energy sector stands as a crucial industrial end-user segment within the U.S. power tool accessories market, driven by robust growth in renewable energy projects, infrastructure modernization, nuclear plant expansions, and mining equipment manufacturing. Renewables, particularly wind and solar, are fueling strong demand for cordless fastening and drilling accessories that enhance technician mobility, safety, and efficiency in challenging field environments. The ongoing shift from corded to cordless power tools supports increased operational flexibility and reduces reliance on fixed power sources, a critical advantage for technicians working at heights and remote locations.The wind energy segment demands specialized cordless fastening solutions designed to withstand harsh outdoor conditions and provide reliable joint consistency during turbine assembly and maintenance. Meanwhile, solar energy projects heavily rely on precision drilling accessories and fastening tools essential for rapid, efficient solar panel installation and structural assembly. Leading manufacturers like Stanley Black & Decker continue to innovate with renewable energy-optimized cordless toolkits, emphasizing longer battery life, durability, and lower cycle times.

Additionally, traditional energy sectors, including nuclear and mining, contribute to steady demand for durable, heavy-duty accessories tailored for infrastructure upgrades and equipment manufacturing. Manufacturers investing in advanced battery technology, rugged accessory materials, and cordless compatibility are best positioned to capitalize on this evolving landscape, underscoring the energy sector’s pivotal role in powering growth within the U.S. power tool accessories market.

INSIGHTS BY DISTRIBUTION CHANNEL

Offline distribution remains a dominant channel within the U.S. power tool accessories market, driven by the strong presence of established retail networks, specialty tool stores, and professional dealer outlets. Traditional brick-and-mortar stores such as Home Depot, Lowe’s, and Ace Hardware continue to capture a significant share of accessory sales, benefiting from customer preferences for hands-on product evaluation, expert advice, and immediate availability. In addition, professional contractors and industrial buyers rely heavily on authorized distributors and local dealers to access high-quality, brand-certified accessories with tailored service and technical support. The offline channel also benefits from manufacturer-led training programs and promotional events conducted in-store, which enhance customer engagement and drive accessory upgrades. Despite growing e-commerce adoption, offline distribution’s direct customer interaction and trusted service experience ensure its continued prominence in the U.S. power tool accessories market.GEOGRAPHICAL ANALYSIS

The Southern region holds a dominant position in the U.S. power tool accessories market, driven by rapid infrastructure development, expanding industrial hubs, and a thriving construction sector. States like Texas, Florida, and Georgia lead in large-scale commercial and residential projects, increasing demand for a wide range of power tool accessories, especially heavy-duty cutting and drilling tools. The South also benefits from strong dealer networks and manufacturer-led financial initiatives such as leasing and trade-in programs that make premium accessories more accessible to contractors.The Southern region is driven by significant infrastructure and industrial projects that sustain high demand for a wide range of power tool accessories. Key ongoing projects such as the Los Filos Expansion (scheduled for completion between Q2 2021 and Q1 2026) underscore the region’s role as a hub for large-scale mining and construction activities requiring durable, high-performance accessories. Other critical projects influencing demand include the Abujar Gold Project (Q3 2021 - Q4 2024), the KoBold Metals Project (Q2 2022 - Q4 2024), and the Khoemacau Copper Project (Q2 2021 - Q3 2024). These developments fuel consistent needs for cutting, drilling, and fastening accessories tailored for heavy-duty industrial use; thereby supporting the Southern power tool accessories market.

The West region, anchored by California and other tech-forward states, drives innovation with high adoption of cordless and smart power tools, while the Midwest maintains steady demand through its manufacturing and agricultural base. The Northeast’s dense urban markets focus on digital sales platforms and loyalty programs to engage professional users. Overall, the South’s robust growth and infrastructure investments make it the dominant geography in the U.S. power tool accessories market.

U.S. POWER TOOL ACCESSORIES MARKET COMPETITIVE LANDSCAPE

The U.S. power tool accessories market exhibits a moderately consolidated structure, with intensifying competition among global tool manufacturers, specialized accessory producers, and value-focused private-label brands. Market growth is being driven by expanding DIY culture, increasing residential remodeling activities, and heightened demand for high-performance, precision accessories across both professional contractors and consumer segments. Furthermore, leading brands including Stanley Black & Decker, Robert Bosch, Milwaukee Tool, and Makita U.S.A. continue to strengthen their positions in the U.S. power tool accessories market through product line expansions, battery platform integrations, and smart-enabled accessory innovations. These companies are actively leveraging multi-brand strategies, exclusive retail partnerships, and omnichannel distribution networks to widen their consumer reach.However, the relatively low product differentiation in certain accessory categories - such as drill bits, saw blades, and sanding pads - has intensified pricing pressures and led to commoditization risks. Additionally, the growing influx of imported, lower-cost accessories from Asian manufacturers is contributing to price erosion and quality perception challenges in the mid-tier segment. Also, the commoditization risk is particularly pronounced in accessory types with minimal differentiation or brand loyalty, which has forced premium players such as Milwaukee, Bosch, and DeWalt to consistently innovate with features like impact-rated accessories, carbide-tipped blades, and precision-ground bits to justify premium pricing and preserve their professional customer base.

Leading brands in the U.S. power tool accessories market are increasingly integrating their accessory products within broader battery platforms and smart-enabled tool systems. For instance, DeWalt’s ToughSystem 2.0 and Milwaukee’s PACKOUT modular storage systems now feature custom insert trays and accessory bundles, enhancing convenience and cross-selling opportunities at both retail outlets and online stores. Furthermore, retail dynamics in the U.S. power tool accessories market are heavily influenced by exclusive retail partnerships and omnichannel sales strategies. Milwaukee Tool’s exclusivity with Home Depot, Diablo’s exclusivity with Home Depot, and Kobalt’s exclusivity with Lowe’s enable these brands to secure dedicated shelf space, promotional support, and consistent consumer exposure in targeted retail environments.

Key Company Profiles

- Stanley Black & Decker

- Robert Bosch

- Milwaukee Tool

- Makita U.S.A., Inc

- AIMCO

- Oregon Tool, Inc.

- Emerson Electric Co

- Ridgid

- SKIL

- Craftsman

- Snap-on Incorporated

Other Prominent Company Profiles

- Diablo Tools

- Ryobi

- Dewalt

- Dremel

- Chicago Pneumatic

- Matco Tools

- Cornwell Quality Tools

- Senco Brands, Inc

- Paslode

- Chervon Holdings Limited

- FEIN Power Tools, Inc

- FERM

- Festool GmbH

- Dynabrade Inc

- Husqvarna Group

- Atlas Copco

- Ingersoll Rand

- Metabo

- Proxxon

- Worx

Segmentation by Operations Type

- Cutting

- Drilling

- Fastening

- Routing and Planning

- Others

Segmentation by Accessory Type

- Drill Bits

- Circular Saw Blades

- Batteries

- Screwdriver Bits

- Reciprocating Saw Blades

- Jigsaw Blades

- Band Saw Blades

- Abrasive Wheels

- Router Bits

- Others

Segmentation by End Users

- Industrial

- Commercial

- Residential

Segmentation by Industrial End Users

- Energy

- Construction

- Aerospace

- Automotive

- Electronics

- Shipbuilding

- Others

Segmentation by Distribution Channel

- Offline

- Online

Segmentation by Geography

- Southern U.S

- Western U.S

- Midwestern U.S

- Northeastern U.S

KEY QUESTIONS ANSWERED

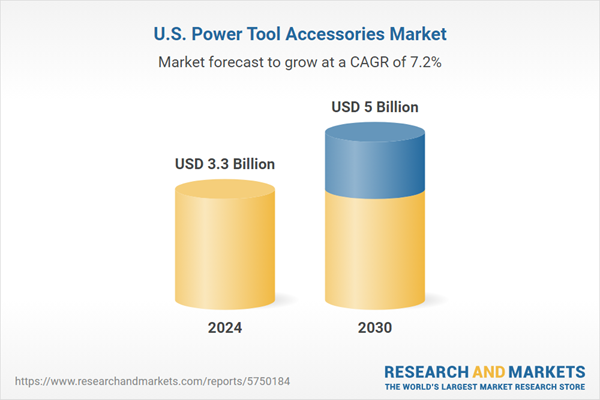

1. How big is the U.S. power tool accessories market?2. What is the growth rate of the U.S. power tool accessories market?

3. Which region dominates the U.S. power tool accessories market share?

4. What are the significant trends in the U.S. power tool accessories industry?

5. Who are the key players in the U.S. power tool accessories market?

Table of Contents

Companies Mentioned

- Stanley Black & Decker

- Robert Bosch

- Milwaukee Tool

- Makita U.S.A., Inc

- AIMCO

- Oregon Tool, Inc.

- Emerson Electric Co

- Ridgid

- SKIL

- Craftsman

- Snap-on Incorporated

- Diablo Tools

- Ryobi

- Dewalt

- Dremel

- Chicago Pneumatic

- Matco Tools

- Cornwell Quality Tools

- Senco Brands, Inc

- Paslode

- Chervon Holdings Limited

- FEIN Power Tools, Inc

- FERM

- Festool GmbH

- Dynabrade Inc

- Husqvarna Group

- Atlas Copco

- Ingersoll Rand

- Metabo

- Proxxon

- Worx

Methodology

Our research comprises a mix of primary and secondary research. The secondary research sources that are typically referred to include, but are not limited to, company websites, annual reports, financial reports, company pipeline charts, broker reports, investor presentations and SEC filings, journals and conferences, internal proprietary databases, news articles, press releases, and webcasts specific to the companies operating in any given market.

Primary research involves email interactions with the industry participants across major geographies. The participants who typically take part in such a process include, but are not limited to, CEOs, VPs, business development managers, market intelligence managers, and national sales managers. We primarily rely on internal research work and internal databases that we have populated over the years. We cross-verify our secondary research findings with the primary respondents participating in the study.

LOADING...

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 139 |

| Published | June 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 3.3 Billion |

| Forecasted Market Value ( USD | $ 5 Billion |

| Compound Annual Growth Rate | 7.1% |

| Regions Covered | United States |

| No. of Companies Mentioned | 31 |