Speak directly to the analyst to clarify any post sales queries you may have.

MARKET OUTLOOK

New Zealand has over 5.1 million food consumers and is one of Oceania's second largest food markets. The country is implementing the concept of precision agriculture to increase productivity. The focus on agricultural mechanization in developing countries will increase the demand for tractors and the growing sense of accuracy in farming for technologically advanced tractors in the New Zealand tractors market.As the global challenge regarding the shortage of food crops mirrors that of New Zealand, stakeholders in food production, including public and private bodies and farmers, are shifting focus toward closing the yield gap and substantial increments in the amount of food produced. The New Zealand tractor market will again play a pivotal role in operating all the new-age, technologically advanced equipment to fulfill the need for increased farm output. Governments must adopt effective and sustainable farming practices to ensure food security and safety. The country has witnessed a massive increase in farm mechanization, both in terms of agricultural and industrial productivity, over the past four decades, driven by the technological renaissance.

KEY HIGHLIGHTS

1. Regarding agricultural acreage, New Zealand is one of the second largest countries in Oceania. Arable land covers 491 thousand hectares of the total land of New Zealand.2. The New Zealand tractor market increased by 22% in 2021 compared to 2020. The increase in crop production and tractor sales was due to favorable monsoon rains in 2020 and 2021, which helped to recover post-COVID-19 pandemic.

3. New Zealand's farmers are wealthy and have sufficient money to invest in agriculture machinery such as tractors. In addition, the country's farmers also benefit from easy credit loans for purchasing agricultural machinery.

4. In 2020, New Zealand imported USD 187 million worth of tractors, of which Germany accounted for a 28.1% share of the imports, followed by Australia (14.8%) and France (11.6%).

5. The New Zealand agricultural industry exports about one-third of its products. Cereals are grown on about one-third of New Zealand’s agricultural land. Barley is the leading crop grown on around 55,500 hectares of land, followed by wheat and maize; such factors promote the New Zealand tractor market.

6. In 2020, New Zealand exported USD 10 million worth of tractors, of which Australia accounted for an 82.5% share of the overall exports of tractors from New Zealand, followed by Germany (4.1%) and the Cook Islands (2.8%).

MARKET TRENDS & OPPORTUNITIES

Increasing Usage of Energy Efficient Tractors

The AgriStarters project aims to improve the living conditions of those who are a part of the agricultural supply chain and to provide essential equipment sustainably. This aim joins an already announced objective to reduce total greenhouse gas (GHC) emissions by 40% by 2030 and zero emissions by 2040. Adopting energy-efficient tractors in the New Zealand tractor market will fulfill these objectives.Use of Non-conventional Fuels in Tractors

The New Zealand tractor market is witnessing a massive demand for tractors running on different fuels. The sale of tractors is affected due to fluctuating prices of conventional fuels such as diesel. Thus, manufacturers are focusing on developing alternative fuel-based tractors; nowadays, tractors running on liquefied natural gas (LNG), compressed natural gas (CNG), propane, diesel, and kerosene are also available. To support net zero emissions use of diesel in a tractor in the Auckland region are in a high position.SEGMENTATION ANALYSIS

INSIGHTS BY HP TYPE

In 2021, the Above 260 HP segment recorded high growth in the New Zealand tractor market. The primary factor for developing the high-power range of tractors is the presence of extensive farmlands and heavy operational capabilities. The sales of 161-260 HP tractors in the country are expected to remain steady during the forecast period, as farm sales will likely remain the same in the coming years.The 260 HP segment generated the highest sales in most of the regions of New Zealand. This segment mainly includes semi-professional tractors with a customer base in medium-scale agriculture and hobby farmers. Due to its medium and larger farms and concentrated farming, New Zealand has been a significant market for medium and high HP tractors. Regarding regions, Auckland and Canterbury's regions reportedly show a higher demand for agriculture tractors than the country's other regions.

Segmentation by Horsepower

- Less Than 80 HP

- 80-160 HP

- 161-260 HP

- Above 260 HP

INSIGHTS BY WHEEL DRIVE

The New Zealand tractor market is categorized into two segments based on the wheel drive type of tractors: 2-Wheel Drive (2WD) and 4-Wheel Drive (4WD). The agriculture tractor market in New Zealand is dominated by mid-range HP 2WD tractors. Among the several tractor models available in the country, 2WD tractors are the most favored by farmers as these tractors provide a low relative cost of ownership, the sufficiency of features and haulage power, and conventional thinking.The 2-wheel drive is expected to grow with a CAGR of 3.24% during the forecast period. The segment dominates the industry with a 91.7% market share. Ease of driving and flexibility during light loads and plain fields are significant factors boosting the demand for two-wheel-drive tractors. The majority share of the 2-wheel drive tractors segment is dominated by the top brand John Deere, New Holland, Massey Ferguson, and Case IH in the New Zealand tractor market.

Segmentation by Drive Type

- 2-Wheel Drive

- 4-Wheel Drive

REGIONAL ANALYSIS

- Auckland region holds more than 39% of the New Zealand tractor market share. The region is leading in adopting and penetrating farm mechanization practices. Some of the significant agricultural cities in this region are Mangere, Manukau City, Muriwai Beach, Murrays Bay, North Shore, and more

- The New Zealand tractor market is currently in the growth stage, and manufacturers are seeking capacity augmentation. Taranaki and Hawke’s Bay region of the country still has negligible farm mechanization, and vendors can explore these regions with a portfolio of medium-sized tractors

- The major crops of the Nelson region are apples, pears, and kiwifruit. These crops constitute 31%, 28%, and 25% of total crop production. The region is leading with a high penetration of compact tractors. The hilly and plateau terrain of the region has driven the adoption of low HP tractors

Segmentation by Regions

- New Zealand

- Auckland

- Nelson

- Taranaki

- Wellington

- Otago

- Canterbury

- Hawke’s Bay

COMPETITIVE LANDSCAPE

- John Deere and New Holland dominate the New Zealand tractor market with a collective market share of over 40%. The threat of rivalry is high in the New Zealand agriculture tractor market since more than 50% of the share belongs to the top three key players

- John Deere offers new Electric Variable Transmission for select 8 Series Tractors new JD14X engine for 9 Series; EVT enables electric power generation, a way the industry will leverage power produced by the tractor for its implements in the future

- In February 2022, Massey Ferguson launched the MF 6S series tractors. This machine provides up to 180 HP with advanced technology

- In March 2021, CNH Industrial partnered with Monarch Tractors, a US-based Agri-technology company, to improve long-term sustainability and raise awareness among farmers of the importance of zero-emission agriculture

- Massey Ferguson launched the MF 8S series tractors. This series of tractors is distinguished by a guard-u install engine and a neo-retro design. These tractors are designed to advance smart farming technologies

Key Vendors

- John Deere

- AGCO

- CNH Industrial

- Kubota

Other Prominent Vendors

- Deutz-Fahr

- Yanmar

- CLAAS Group

- JCB

- Iseki

- Kioti

KEY QUESTIONS ANSWERED

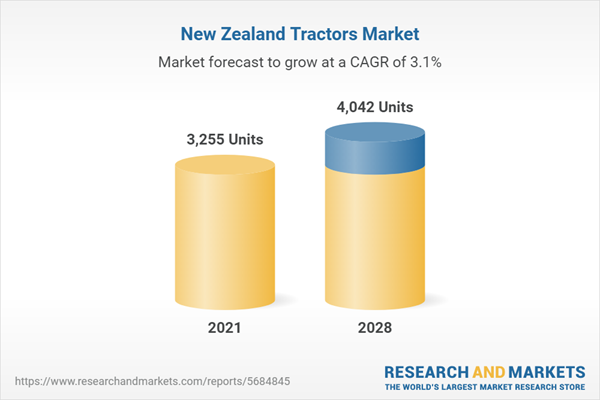

1. How many tractors are sold in New Zealand each year?2. What are the expected units to be sold in the New Zealand tractor market by 2028?

3. What is the growth rate of the New Zealand tractor market?

4. Tractors with which horsepower type will constitute the largest share by 2028 in New Zealand?

5. Which wheel drive holds the highest market shares in the New Zealand tractor market?

6. Which companies dominate the New Zealand tractor market share?

Table of Contents

Companies Mentioned

- John Deere

- AGCO

- CNH Industrial

- Kubota

- Deutz-Fahr

- Yanmar

- CLAAS Group

- JCB

- Iseki

- Kioti

Methodology

Our research comprises a mix of primary and secondary research. The secondary research sources that are typically referred to include, but are not limited to, company websites, annual reports, financial reports, company pipeline charts, broker reports, investor presentations and SEC filings, journals and conferences, internal proprietary databases, news articles, press releases, and webcasts specific to the companies operating in any given market.

Primary research involves email interactions with the industry participants across major geographies. The participants who typically take part in such a process include, but are not limited to, CEOs, VPs, business development managers, market intelligence managers, and national sales managers. We primarily rely on internal research work and internal databases that we have populated over the years. We cross-verify our secondary research findings with the primary respondents participating in the study.

LOADING...

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 175 |

| Published | November 2022 |

| Forecast Period | 2021 - 2028 |

| Estimated Market Value in 2021 | 3255 Units |

| Forecasted Market Value by 2028 | 4042 Units |

| Compound Annual Growth Rate | 3.1% |

| Regions Covered | New Zealand |

| No. of Companies Mentioned | 10 |