PVC Additives Market

The polyvinyl chloride (PVC) additives market serves as the critical ingredients ecosystem that enables PVC resin to meet performance demands across construction, packaging, wire & cable, automotive, and industrial applications. Additives such as stabilizers (lead‑free, Ca/Zn, barium/zinc), plasticizers, impact‑modifiers, lubricants, fillers, pigments, and processing aids allow PVC to deliver durability, weatherability, flexibility, fire resistance and cost efficiency. Among top end‑uses are pipes & fittings, window and door profiles, rigid sheets and panels, wire/cable insulation, flooring and membranes, and film packaging. Recent trends include the shift toward sustainable, low‑migration, non‑phthalate plasticizers, bio‑based and recycled‑friendly additives, and regulatory‑driven reformulation (e.g., REACH, phthalate bans). Meanwhile, demand from emerging economies for affordable infrastructure and lightweight materials fuels growth in rigid PVC markets - thereby increasing additive requirements. Driving factors include rapid construction and infrastructure build‑out globally, increased lightweighting in automotive and electrical segments, growth in packaging and medical applications, and migration from traditional materials (steel, concrete) to PVC. The competitive landscape features large chemical and performance‑additives players (BASF, Clariant, Arkema, Evonik, Lanxess, Songwon, Adeka) offering innovation, global supply chains and regulatory‑compliance portfolios. Differentiation increasingly covers performance attributes (UV/thermal stability, low odour, high clarity), sustainability credentials (bio‑based feedstock, certifications) and system‑cost optimisation (lower dosage, multi‑function additives). Challenges include raw material price volatility (oils, metals, PVC resin), shifts in regulation (phthalates, heavy metals), and growing criticism of PVC’s sustainability credentials. Nonetheless, the PVC additives market remains robust, pivoting from commodity additives toward advanced functional systems that enable modern PVC applications in building, infrastructure, electrical and mobility domains.PVC Additives Market Key Insights

- Construction infrastructure growth underpins rigid PVC demand. As global urbanisation and redevelopment accelerate, rigid PVC pipes, profiles and sheet volumes rise, directly lifting stabiliser, filler and lubricant demand. Exceptional durability and low maintenance make PVC-additive-enabled systems a preferred choice in many markets.

- Regulatory reformulation accelerates additive innovation. Stringent regulations on phthalates, lead stabilisers, heavy metal salts and high migration plasticisers force additive manufacturers to transition portfolios to Ca/Zn, organotins replacement systems, non phthalate plasticisers and advanced stabiliser synergists, creating both cost and opportunity.

- Sustainability and circular economy demands reshape portfolios. Additive firms invest in bio based plasticisers, recycled PVC friendly stabilisers, low dosage multi function systems and documentation for recycling compatibility, enabling brands to claim eco credentials and meet vinyl industry initiatives.

- Demand for lightweighting and cost efficiency in automotive/EV drives PVC usage. As the mobility sector shifts to EVs and lightweight structures, PVC and corresponding additives capture share in wiring, battery enclosures, insulation and interior trims - where cost/performance beats higher cost polymers.

- Packaging & medical growth expands flexible PVC additives. Flexible PVC films and tubing benefit from phthalate free plasticisers, antimicrobial additives and clarity enhancers. The need for hygiene, sterility and low migration additives opens high margin niches.

- Quality and performance expectations raise additive value. High clarity profiles, longer life windows/doors, UV stable outdoor membranes and cable jacketing all demand additives with tight specifications (ASTM/ISO), driving premium pricing and differentiation.

- Emerging markets focus drives geographic shift in demand. Asia Pacific, Latin America and MEA regions show stronger additive demand growth, owing to infrastructure investment, relaxed specification corridors and raw material arbitrage, compared to slower growth in mature Europe.

- Raw material price volatility and feedstock risk persist. The dependence on oil, metal salts, and commodity PVC feedstock leaves additive manufacturers exposed to cost swings; strategies such as vertical integration, cost pass through and alternative chemistries are increasingly critical.

- Digital supply chains and localisation matter. Additive producers deploy modular compounding units near PVC processors, offer just in time delivery, and provide technical support to optimise dosage, reduce scrap and align with global brands - service becomes an important differentiator.

- Recycling compatibility and legacy PVC stock present opportunity. Additives for recycled PVC and stabilisers compatible with mixed feedstocks open new revenue angles as the vinyl industry places greater emphasis on circularity, enabling OEMs to incorporate rPVC without performance loss.

PVC Additives Market Reginal Analysis

North America

In North America, PVC additive demand is sustained by a mature construction base, replacement cycles in residential/renovation, and growth in packaging and medical tubing. Regulatory reformulation - especially phthalate bans and state‑level chemical restrictions - drives premium additive replacement. Additive manufacturers emphasise innovation (non‑phthalate, bio‑based) and strong supply networks across US and Canada. Food‑contact clear films and EV wiring also contribute niche growth.Europe

Europe remains a stringent regulatory environment with REACH, vinyl‑industry sustainability initiatives, and high demand for traceable, low‑impact additives. Building and construction (pipes, profiles), packaging, and automotive sectors demand high‑performing, recyclable formulations. Growth is slower than emerging regions but margins are higher and premium solutions (fine stabilisers, low‑migration plasticisers) are prevalent. Sustainability claims and recycled content documentation are valued.Asia‑Pacific

Asia‑Pacific leads in volume growth of PVC additives, driven by large infrastructure build‑out in China, India, Southeast Asia and higher usage in agriculture, construction, pipes, profiles and flexible film. Cost‑sensitive producers favour local additive supply while global brands co‑locate compounding plants. The region is increasingly targeted for new additive innovations adapted for high‑humidity, high‑temperature environments and has a growing need for high‑quality stabilisers and low‑dose systems.Middle East & Africa

The Middle East & Africa region reflects diverse demand: large‑scale infrastructure and industrial projects in the GCC drive rigid PVC additives demand, while many African markets are emerging and cost constrained. Additive producers emphasise durable stabilisers suited to harsh climate, import scale, and justification for modular local service. Rising interest in recycling and sustainable vinyl supports future additive segments.South & Central America

In South & Central America, PVC additive growth aligns with construction, pipe/rural irrigation, wiring and agricultural film applications. Cost‑effectiveness is a key driver, and local/regional additives producers compete on price and service. Currency volatility and supply‑chain disruptions are risks, but improved demand for cleaner additive systems (non‑phthalate, Ca/Zn stabilisers) helps transition. Growth is aided by expanding middle‑class housing and infrastructure investment.PVC Additives Market Segmentation

By Type

- Stabilizers

- Impact Modifiers

- Processing Aids

- Plasticizers

- Lubricants

- Others

By Fabrication Process

- Extrusion

- Injection Molding

- Others

By Application

- Pipes & Fittings

- Profiles & Tubing

- Rigid Sheet & Panel

- Wires & Cables

- Bottles

- Others

Key Market players

AkzoNobel, Clariant AG, SABIC, Solvay S.A., LyondellBasell, Formosa Plastics Corporation, INEOS Group, BASF SE, Lanxess AG, DuPont de Nemours, LG Chem Ltd., Mitsubishi Chemical Corporation, Chevron Phillips Chemical Company, The Dow Chemical Company, Evonik Industries AG.PVC Additives Market Analytics

The report employs rigorous tools, including Porter’s Five Forces, value chain mapping, and scenario-based modelling, to assess supply-demand dynamics. Cross-sector influences from parent, derived, and substitute markets are evaluated to identify risks and opportunities. Trade and pricing analytics provide an up-to-date view of international flows, including leading exporters, importers, and regional price trends.Macroeconomic indicators, policy frameworks such as carbon pricing and energy security strategies, and evolving consumer behaviour are considered in forecasting scenarios. Recent deal flows, partnerships, and technology innovations are incorporated to assess their impact on future market performance.

PVC Additives Market Competitive Intelligence

The competitive landscape is mapped through proprietary frameworks, profiling leading companies with details on business models, product portfolios, financial performance, and strategic initiatives. Key developments such as mergers & acquisitions, technology collaborations, investment inflows, and regional expansions are analyzed for their competitive impact. The report also identifies emerging players and innovative startups contributing to market disruption.Regional insights highlight the most promising investment destinations, regulatory landscapes, and evolving partnerships across energy and industrial corridors.

Countries Covered

- North America - PVC Additives market data and outlook to 2034

- United States

- Canada

- Mexico

- Europe - PVC Additives market data and outlook to 2034

- Germany

- United Kingdom

- France

- Italy

- Spain

- BeNeLux

- Russia

- Sweden

- Asia-Pacific - PVC Additives market data and outlook to 2034

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Malaysia

- Vietnam

- Middle East and Africa - PVC Additives market data and outlook to 2034

- Saudi Arabia

- South Africa

- Iran

- UAE

- Egypt

- South and Central America - PVC Additives market data and outlook to 2034

- Brazil

- Argentina

- Chile

- Peru

Research Methodology

This study combines primary inputs from industry experts across the PVC Additives value chain with secondary data from associations, government publications, trade databases, and company disclosures. Proprietary modeling techniques, including data triangulation, statistical correlation, and scenario planning, are applied to deliver reliable market sizing and forecasting.Key Questions Addressed

- What is the current and forecast market size of the PVC Additives industry at global, regional, and country levels?

- Which types, applications, and technologies present the highest growth potential?

- How are supply chains adapting to geopolitical and economic shocks?

- What role do policy frameworks, trade flows, and sustainability targets play in shaping demand?

- Who are the leading players, and how are their strategies evolving in the face of global uncertainty?

- Which regional “hotspots” and customer segments will outpace the market, and what go-to-market and partnership models best support entry and expansion?

- Where are the most investable opportunities - across technology roadmaps, sustainability-linked innovation, and M&A - and what is the best segment to invest over the next 3-5 years?

Your Key Takeaways from the PVC Additives Market Report

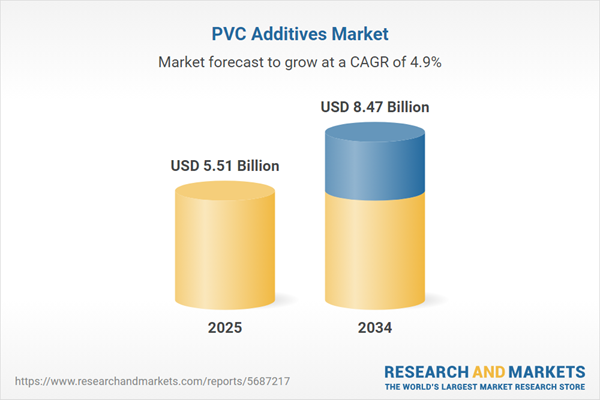

- Global PVC Additives market size and growth projections (CAGR), 2024-2034

- Impact of Russia-Ukraine, Israel-Palestine, and Hamas conflicts on PVC Additives trade, costs, and supply chains

- PVC Additives market size, share, and outlook across 5 regions and 27 countries, 2023-2034

- PVC Additives market size, CAGR, and market share of key products, applications, and end-user verticals, 2023-2034

- Short- and long-term PVC Additives market trends, drivers, restraints, and opportunities

- Porter’s Five Forces analysis, technological developments, and PVC Additives supply chain analysis

- PVC Additives trade analysis, PVC Additives market price analysis, and PVC Additives supply/demand dynamics

- Profiles of 5 leading companies - overview, key strategies, financials, and products

- Latest PVC Additives market news and developments

Additional Support

With the purchase of this report, you will receive:- An updated PDF report and an MS Excel data workbook containing all market tables and figures for easy analysis.

- 7-day post-sale analyst support for clarifications and in-scope supplementary data, ensuring the deliverable aligns precisely with your requirements.

- Complimentary report update to incorporate the latest available data and the impact of recent market developments.

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- AkzoNobel

- Clariant AG

- SABIC

- Solvay S.A.

- LyondellBasell

- Formosa Plastics Corporation

- INEOS Group

- BASF SE

- Lanxess AG

- DuPont de Nemours

- LG Chem Ltd.

- Mitsubishi Chemical Corporation

- Chevron Phillips Chemical Company

- The Dow Chemical Company

- Evonik Industries AG.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 160 |

| Published | November 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 5.51 Billion |

| Forecasted Market Value ( USD | $ 8.47 Billion |

| Compound Annual Growth Rate | 4.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |