Growth in Government Regulatory Policies for Energy Saving and Conservation Fuel the North America HVAC System Market

Governments across the world are using a variety of strategies to encourage energy saving and conservation. They are including sizable line items for energy costs in their yearly operational budgets. In addition, they are saving a lot of money on energy costs incurred in public buildings and are exhibiting energy and environmental leadership by investing in energy efficiency.Other than the increase in the efficiency of both new and existing facilities, many governments are including energy efficiency standards in their decisions of product purchases. The main energy consumers in municipal level operations are often the water and wastewater treatment facilities. High-quality HVAC systems can be employed at water and wastewater facilities to decrease energy costs and greenhouse gas emissions. Through energy data management and evaluation, energy efficiency standards for public buildings, uptake of retrofit programs for already-existing public buildings, acquisition of energy-efficient appliances and equipment, and establishment of energy-efficient operations and maintenance procedures, state and local governments are promoting energy efficiency programs and policies for public facilities, equipment, and government operations.

North America HVAC System Market Overview

North America comprises of technologically advanced economies, such as the US and Canada. Developments in technology across North America have contributed to a highly competitive market for all industries. In the North American region, HVAC systems are experiencing widespread adoption given the features provided in these systems. Moreover, the complexity of emerging requirements for a more clean and efficient use of energy is another aspect contributing to innovation in the industry. According to Air Conditioning Contractors of America ACCA, the HVAC services in North America are set to increase in value from US$ 25.6 billion in 2019 to US$ 35.8 billion in 2030. The market is witnessing potential growth given the adoption of advanced technologies and the increasing need for green construction solutions. Industries choose to link their HVAC systems to building management automation systems that streamline the system’s operation and maintenance. HVAC system demand is directly proportional to the rise in manufacturing facilities, the pharmaceutical industry, IT, and ITES companies with rapid industrialization and service sector expansion. As such, the utilization of advanced HVAC systems that have a strong emphasis on energy efficiency, and air quality improvement, is driving the development of the industrial sector.North America HVAC System Market Revenue and Forecast to 2030 (US$ Million)

North America HVAC System Market Segmentation

The North America HVAC system market is segmented based on component, type, implementation, application, and country. Based on component, the North America HVAC system market is segmented into thermostat, air handling units, central ACs, furnace, heat pump, compressor, and others. The central ACs segment held the largest market share in 2022.Based on type, the North America HVAC system market is segmented into split system, ductless system, and packaged system. The split system segment held the largest market share in 2022.

Based on application, the North America HVAC System Market is segmented into residential, commercial, and industrial. The residential segment held the largest market share in 2022.

Based on implementation, the North America HVAC system market is segmented into new installation and retrofit. The new installation segment held a larger market share in 2022.

Based on country, the North America HVAC system market is segmented into US, Canada, and Mexico of North America. The US dominated the North America HVAC system market in 2022.

Blue Star Ltd, Mitsubishi Electric Corp, Hitachi Ltd, Daikin Industries Ltd, Emerson Electric Co, Honeywell International Inc, LG Electric Inc, Carrier Global Corp, and Johnson Controls Inc are some of the leading companies operating in the North America HVAC system market.

Table of Contents

Executive Summary

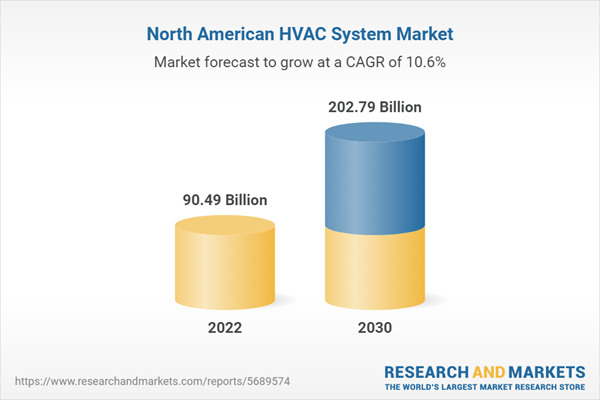

At 10.6% CAGR, the North America HVAC System Market is speculated to be worth US$ 2,02,793.85 million by 2030..According to this research, the North America HVAC system market was valued at US$ 90,492.1 million in 2022 and is expected to reach US$ 2,02,793.85 million by 2030, registering a CAGR of 10.6% from 2022 to 2030. Rise in demand for energy-efficient solutions is the critical factor attributed to the North America HVAC system market expansion.

Greenhouse gases are the primary sources of global warming and climate change. These gases absorb the infrared energy and re-emit it back into the space, half of which returns to the Earth as heat, consequently adding to the warmth emanating from the Earth’s surface. Small businesses and large industries emit various carbon compounds, such as carbon dioxide, because of using fossil fuels, which are known as “carbon footprint.” Since energy-efficient solutions emit fewer harmful greenhouse gas emissions into the environment, they can contribute to lowering the carbon footprint and controlling the adverse effects of global warming. To improve the quality-of-life usage of energy-efficient appliances has been growing in recent times. The reason behind the increase in energy-efficient solutions is not only because they save energy but also because they need less maintenance and have lesser replacement costs. These solutions contribute to a positive impact on the environment. Energy efficiency can offer long-term benefits by reducing overall electricity demand by lessening the need to invest in new infrastructure for electricity generation and transmission. It also contributes to the diversification of utility resource portfolios and can act as a buffer against the risk of volatile energy procurement costs. So, to achieve energy efficiency, many manufacturing industries and commercial manufacturing players are investing in high-efficiency HVAC systems. A highly efficient HVAC system uses less energy and performs more effectively than ordinary systems, lowering the carbon footprint on the environment. The seasonal energy efficiency ratio assesses how effectively air conditioning and heat pumps cool in an HVAC system. Thus, the high demand for energy-efficient solutions is driving the market for HVAC systems.

On the contrary, lack of skilled technical workforce hurdles the growth North America HVAC system market.

Based on component, the North America HVAC system market is segmented into thermostat, air handling units, central ACs, furnace, heat pump, compressor, and others. The central ACs segment held 28.0% market share in 2022, amassing US$ 25,325.61 million. It is projected to garner US$ 60,770.18 million by 2030 to expand at 11.6% CAGR during 2022-2030.

Based on type, the North America HVAC system market is categorized into split system, ductless system, and packaged system. The split system segment held 46.2% share of the North America HVAC system market in 2022, amassing US$ 41,799.8 million. It is projected to garner US$ 94,778.0 million by 2030 to expand at 10.8% CAGR during 2022-2030.

Based on implementation, the North America HVAC system market is bifurcated into new installation and retrofit. The new installation segment held 67.6% share of North America HVAC system market in 2022, amassing US$ 61,206.40 million. It is projected to garner US$ 1,25,114.01 million by 2030 to expand at 9.3% CAGR during 2022-2030.

Based on application, the North America HVAC system market is segmented into residential, commercial, and industrial. The residential segment held 46.2% share of North America HVAC system market in 2022, amassing US$ 41,819.04 million. It is projected to garner US$ 90,399.53 million by 2030 to expand at 10.1% CAGR during 2022-2030.

Based on country, the North America HVAC system market is segmented into US, Canada, and Mexico. The US segment held 74.4% share of North America HVAC system market in 2022, amassing US$ 67,318.77 million. It is projected to garner US$ 1,53,591.88 million by 2030 to expand at 10.9% CAGR during 2022-2030.

Key players operating in the North America HVAC system market are Blue Star Ltd, Mitsubishi Electric Corp, Hitachi Ltd, Daikin Industries Ltd, Emerson Electric Co, Honeywell International Inc, LG Electric Inc, Carrier Global Corp, and Johnson Controls Inc, among others.

In May 2023, Blackstone (NYSE: BX) and Emerson (NYSE: EMR) announced that private equity funds managed by Blackstone (“Blackstone”) have completed the previously announced acquisition of a majority stake in Emerson’s Climate Technologies business in a transaction valuing the business at $14.0 billion. This closing marks a significant milestone in the HVAC and refrigeration (HVACR) industry leader’s journey to advance the next generation of climate technologies. In Nov 2021, Emerson announced the launch of its HVACR Educator Resource platform. The platform is designed to offer industry educators access to tools, training and educational materials. In Feb 2023, Johnson Controls-Hitachi Air Conditioning introduced the new addition to the VRF lineup offered, the air365 Max. It’s designed to offer seamless comfort, energy efficiency, and easily operated features. The air365 Max is an end-to-end solution for HVAC professionals, architects, and building owners.

Companies Mentioned

- Mitsubishi Electric Corp

- Blue Star Ltd

- Hitachi Ltd

- Daikin Industries Ltd

- Emerson Electric Co

- Honeywell International Inc

- LG Electric Inc

- Carrier Global Corp

- Johnson Controls Inc

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 153 |

| Published | November 2023 |

| Forecast Period | 2022 - 2030 |

| Estimated Market Value in 2022 | 90.49 Billion |

| Forecasted Market Value by 2030 | 202.79 Billion |

| Compound Annual Growth Rate | 10.6% |

| Regions Covered | North America |

| No. of Companies Mentioned | 9 |