Companies are increasingly preferring app-based workforce management platforms to create smart workplaces. Reluctance toward embracing the benefits of mobility may cost them a fortune, especially in the longer run, by triggering inefficiencies and employee dissatisfaction. A mobile application creates a central hub to provide consistency in employee experience. With location monitoring, businesses can deliver hyper-local content and send real-time alerts and notifications to their employees. When location monitoring is integrated into the application, location monitoring further helps deliver relevant and timely experiences while increasing efficiency, productivity, and engagement of the employees. Mobile applications make it simple to enter workers’ official day count and other related information in data systems. Apps serve as a single hub combining all digital touchpoints associated with the management into a seamless, user-friendly platform. Making all work-related materials available on a single app allows enterprises to ensure the seamless functioning of employees, both, on campus and at home. Management teams can communicate and collaborate with coworkers and the firm via official mobile apps. Moreover, these apps can automatically capture the arrival time of employees at their perspective workstations. Such benefits of mobile app-based solutions for workforce management are creating growth opportunities for the back-office workforce management market players.

Market Overview

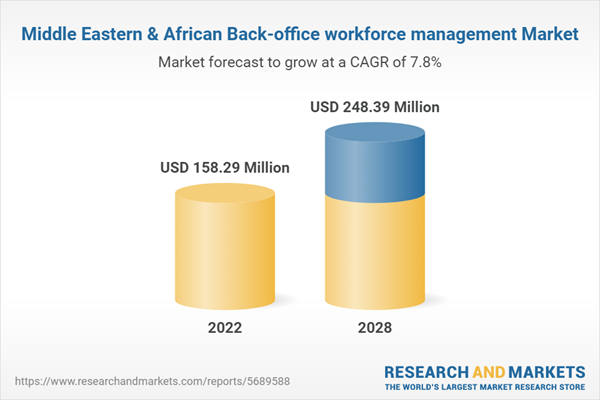

Businesses in the Middle East are laying out ambitious transformation roadmaps to ensure their relevance in the digital world. The adoption of third-party platform technologies, including cloud, mobility, and social media, is growing in the region. Large companies are willing to optimize their workforces and operate efficiently. In November 2020, Johnson Controls, the global leader in smart and sustainable buildings, announced the launch of a new suite of flexible services for its customers in the Middle East & Africa. To provide these services, Johnson Controls will leverage its Open Blue digital technology, combined with its 130 years of experience in the green building business, to deliver remote and contactless services. Industrial Revolution 4.0, 5G infrastructure, and digital transformation are growing significantly in the Middle East & Africa. Further, the advent of large-scale, advanced cloud service providers is expected to trigger the adoption of secure cloud-based services in the region. South Africa is at the forefront of adopting cloud-based services, with Microsoft takes advantage of Microsoft Azure's general availability to open its first data center in Africa. Additionally, AWS opened its AWS Africa in 2020, suggesting a greater need for workforce management solutions in the Middle East & Africa. The highest market growth in the region is estimated to be in Saudi Arabia.Middle East & Africa Back-office workforce management Market Segmentation

The Middle East & Africa back-office workforce management market is segmented into solution, end user, and country. Based on solution, the market is segmented into robotic automation process, performance management, back-office optimization, process analytics, and others. The robotic automation process segment held the largest market share in 2022.- Based on end user, the market is segmented into IT and telecom, BFSI, transportation, retail and E-commerce, government, and others. The IT and telecom segment held the largest market share in 2022.

- Based on country, the market is segmented into Saudi Arabia, UAE, South Africa, and Rest of Middle East & Africa. Saudi Arabia dominated the market share in 2022.

Table of Contents

Companies Mentioned

- NICE Ltd.

- Open Text Corporation

- Verint Systems, Inc.

- ActiveOps PLC

- Alvaria, Inc.

- Calabrio Inc.

- Oracle Corporation

- Genesys

- Intradiem

- Team Software

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 124 |

| Published | October 2022 |

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 158.29 Million |

| Forecasted Market Value ( USD | $ 248.39 Million |

| Compound Annual Growth Rate | 7.8% |

| Regions Covered | Africa, Middle East |

| No. of Companies Mentioned | 10 |