The days of monitoring coastline and submarine solely with human eyes, hoping to detect repeat offenders and known criminals using sometimes-out-of-date paper, are long gone (although still a vital part of the effort). Satellites and sensor-equipped unmanned aerial vehicles (UAVs), ships, boats, and naval ports constantly monitor the country's borders and coastlines. The rapidly growing need for interdiction, the wide range of sensors and platforms currently in use or planned, and the dozens of local, state, and federal agencies involved have all increased the need for shared intelligence at all levels via real-time networks, advanced communications systems, and artificial intelligence (AI). Further, refugee ships are currently one of the most pressing issues on the high seas, so the naval surveillance operations are critical for ensuring that all activities on the seas or oceans are conducted securely and that national and international security is not harmed. Additionally, the Europe naval system surveillance radar market is driven by increasing marine safety and national safety awareness and an increase in trade and freight transport activities by the sea. Furthermore, increasing security concerns, rapid development in international marine trade, and regulatory compliance for maritime trade contribute to naval system surveillance radar market growth. Thus, implementing various rules and regulations for the better integration and regulation of maritime advanced security and surveillance system boosts the Europe naval system surveillance radar market growth.

Market Overview

Germany, France, Italy, the UK, Russia, and the Rest of Europe are the key contributors to the naval system surveillance radar market in the Europe. Well-established military & defense sectors are driving the demand for naval system surveillance radar across Europe. According to the report published by SIPRI in 2021, the military spending in Europe was US$ 418 billion, and the funding was implemented for various projects to improve surveillance and radar systems across North Atlantic Treaty Organization (NATO) allies and all the (European Union) EU member states. Thus, high military expenses across European countries drive the growth of the Europe naval system surveillance radar market across Europe. Europe is witnessing a rising penetration of advanced naval technologies, leading to the growing adoption of naval system surveillance radar. Further, in January 2020, Indra opened Spain's largest radar factory, which is one of the largest in Europe. Indra has centralized the production of all of its radar systems in a 7000-square-meter facility. The majority of next-generation radars will be sold to governments worldwide. The company’s initiatives to develop radar systems in the Europe region by opening the factory are boosting the Europe naval system surveillance radar market growth in the region. Further, in September 2021, Thales was awarded a contract to supply the Albatros Maritime Surveillance and Intervention Aircraft (AVSIMAR) program with its SEARCHMASTER surveillance radar and mission navigation system. This new initiative across regions drives the growth of the Europe naval system surveillance radar market across Europe.Europe Naval System Surveillance Radar Market Segmentation

The Europe naval system surveillance radar market is segmented into type, application, and country. Based on type, the market is segmented into x-band and ku-band, l-band and s-band, and others. The x-band and ku-band segment registered the largest market share in 2022.- Based on application, the market is bifurcated into weapon guidance system and surveillance. The surveillance segment held a larger market share in 2022.

- Based on country, the market is segmented into Germany, France, Italy, UK, Russia, and Rest of Europe. Russia dominated the market share in 2022.

Table of Contents

Companies Mentioned

- BAE Systems.

- HENSOLDT.

- Israel Aerospace Industries Ltd.

- Leonardo S.p.a.

- Lockheed Martin Corporation.

- Northrop Grumman Corporation.

- Raytheon Technologies Corporation.

- Saab AB.

- Thales Group.

- Ultra.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 132 |

| Published | October 2022 |

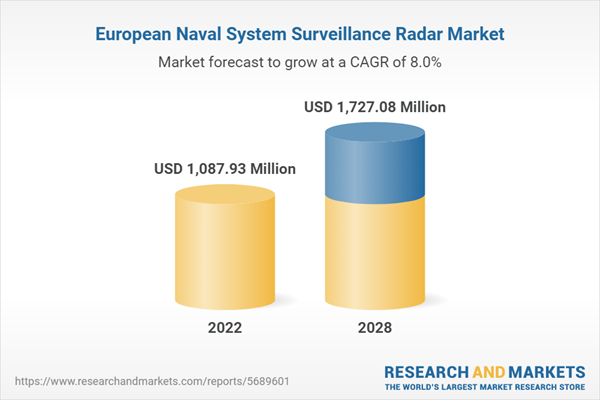

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 1087.93 Million |

| Forecasted Market Value ( USD | $ 1727.08 Million |

| Compound Annual Growth Rate | 8.0% |

| Regions Covered | Europe |

| No. of Companies Mentioned | 10 |