Automobile technology has improved rapidly over the years, and automobile safety technology has gradually been integrated into all aspects of automobiles. Government across the region is imposing regulations pertaining to vehicle and driver’s safety and to prevent accidents. The estimated death toll is the largest annual increase in the history of the US Mortality Analysis and Reporting System. This has forced the government agencies to strongly emphasize on improving safety policies and standards and invest heavily in automotive passive safety systems such as airbags and seatbelts to reduce traffic accidents. For instance, The National Highway Traffic Safety Administration, US, enforced new vehicle performance standards and partnerships with state and local governments, to help reduce deaths, injuries and economic losses from motor vehicle crashes in the region. In May 2022, NHTSA approved US$ 740 million in funding for the 402 State and Community Grants Program, the Section 1906 Racial Profiling Data Collection Grant, and the Section 405 National Priority Safety Program. These factors are therefore driving the automotive passive safety system market.

Market Overview

North America is segmented into the US, Canada, and Mexico. Across the region, technological advancements have led to a highly competitive market. The region attracts several technological developments, which consist of economically robust countries. These companies are continuously enhancing the overall business processes to meet customers' demand for high-quality products and services in the best possible way. North America has leverage in the developed automotive market and is, therefore, considered one of the most significant economies in passenger and commercial vehicle production and sales throughout the world. According to the Organisation Internationale des Constructeurs d'Automobiles (OICA) 2021 report, the US produced 7,604,154 commercial vehicles in 2021; 6,895,604 in 2020; and 8,367,239 in 2019 and Canada produced 826,767 commercial vehicles in 2021; 1,048,942 in 2020; and 1,455,215 in 2019. Mexico produced 2,437,411 commercial vehicles in 2021; 2,209,121 in 2020; and 2,604,080 in 2019, as stated by the report. As per OICA statistics, the US, Canada, and Mexico are leading in the commercial vehicle production segment worldwide. Thus, with the continuous production of commercial vehicles across the region, the need for automotive passive safety systems will increase significantly, supporting the growth of the automotive passive safety system market in North America. Governments of North American countries are taking initiatives to produce or develop the electric vehicle industry. According to an article published on Skadden in September 2021, the United States Department of Energy (DoE) continuously financed the US electric vehicle (EV) and energy infrastructure. Several DOE-financed projects for EV infrastructure and innovative energy-related technologies include Advanced Technology Vehicles Manufacturing (ATVM) Loan Program (US$ 17.7 billion in direct loan authority), Title 17 Innovative Energy (Section 1703) Loan Guarantee Program (~US$ 24 billion in loan guarantee authority), and US$ 2 billion under the Tribal Energy (Partial) Loan. Thus, the continuous focus on the production or development of the electric vehicle industry creates opportunities for Automotive Passive Safety System manufacturers because of the growing measures in electric vehicles for maintaining better safety.North America Automotive Passive Safety System Market Segmentation

The North America automotive passive safety system market is segmented into type, vehicle type and country.- Based on type, the North America automotive passive safety system market can be categorized into airbags, seatbelts, occupant sensing system, child safety system, and others. The airbags segment registered the largest market share in 2022.

- Based on vehicle type, the North America automotive passive safety system market is bifurcated into passenger car and commercial vehicles. The passenger car segment held a larger market share in 2022.

- Based on country, the market is segmented into the US, Canada, and Mexico. The US dominated the market share in 2022.

Table of Contents

Companies Mentioned

- Autoliv Inc

- Continental AG

- FAURECIA

- Hyundai Mobis

- Joyson Safety Systems

- Knauf Industries

- Robert Bosch GmbH

- Tokairika Co., Ltd.

- Toyoda Gosei Co., Ltd

- ZF Friedrichshafen AG

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 119 |

| Published | October 2022 |

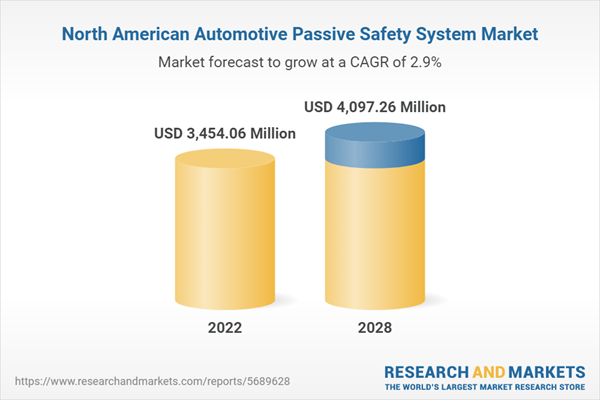

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 3454.06 Million |

| Forecasted Market Value ( USD | $ 4097.26 Million |

| Compound Annual Growth Rate | 2.9% |

| Regions Covered | North America |

| No. of Companies Mentioned | 10 |