Speak directly to the analyst to clarify any post sales queries you may have.

Furthermore, the expansion of green acreage by the government through the construction of public parks, playgrounds, and laws is boosting the demand for zero-turn lawn mowers. Backyards and lawn areas are highly popular among European households to increase the property's aesthetic appearance. Also, with the rising interest in gardening and lawn care activities, the demand for landscaping services is growing significantly, pushing the demand for equipment in the industry.

Sustainable purchasing is increasingly gaining momentum among the consumer, resulting in the consumer preference for equipment that reduces harmful emissions, thereby offering substantial growth opportunities to battery-powered zero turn mowers in the Europe zero turn mowers market. Long battery life and lower price are the key factors to increasing the market growth of battery-powered zero-turn lawn mowers.

KEY HIGHLIGHTS

1. The U.K. accounts for more than 2,200 golf courses and has one of the most significant numbers of golf courses in Europe. Many golf courses support the demand for garden power tools in the market, leading to a surge in demand in the Europe zero turn mowers market.2. Initiatives such as greening the city of Paris between 2014 and 2020 - including creating 74 acres of gardens, 200 re-vegetation projects, educational farms, and park and garden renovations - are boosting demand for zero turn mowers across the nation.

3. Homeownership in Europe has been increasing continuously since 2017, with an exception in Q4 2022 due to the reduced spending induced by the COVID-19 pandemic.

4. In 2020, the number of households across Italy witnessed a steady increase, reaching around 26.1 million, boosting the country’s housing sector. Hence, such expansions in the household units are expected to grow the green acreage across the residential sector, thereby increasing the Europe zero turn mowers market growth.

5. Belgium's zero turn mowers market was valued at USD 56.52 Million in 2021 and is expected to reach USD 74.92 Million by 2027.

INDUSTRY OPPORTUNITIES & TRENDS

Rising Demand For Electric Zero-Turn Lawn Mowers

The industry for electric mowers is witnessing exponential growth in the Europe zero turn mowers market due to the increasing demand for convenience, effectiveness, and efficiency across various end-users. The factors such as eliminating harmful emissions and lowering noise levels with better comfort and smart features are boosting the industry's demand for electric-powered lawn mowers. Manufacturing electric lawn mowers have become necessary to bridge the variety gap and meet the requirement for productivity and efficiency. Many end customers of electric zero-turn mowers have migrated from tractor mowers. These are typically used when there is significant ground to cover as they have a precision turn and work faster than other mowers.Growing Adoption Of Green Spaces & Green roofs

Green roofs improve the environment, insulate infrastructures and buildings, reduce air pollution, and increase biodiversity. Green roofs can help reduce air pollution by checking the status of CO2 in the air. Therefore, adopting green roofs would certainly combat the growing air pollution problem in the country. Thus, these green roof initiatives would drive the Europe zero turn mowers market during the forecast period.The Increasing Number of Golf Courses

In 2020, there were more than 8940 golf courses spread over 151 countries, with most of the courses concentrated in the top golfing countries, including Argentina, the U.K., Germany, Austria, France, Italy, and others. England, Germany, and France are the primary markets for the number of golf courses. Hence, these countries are expected to generate the highest demand in the Europe zero turn mowers market.SEGMENTATION ANALYSIS

- The gasoline-powered mowers lead the Europe zero turn mowers market and are expected to grow at a CAGR of 6.35%. The highest share of gasoline-based zero turn mowers is attributed to their high power compared to cordless zero-turn lawn mowers. Furthermore, gasoline-powered zero-turn mowers are suitable for tall, thick, and dense grass to get the mowing job done in a shorter period than other mowers.

- Based on horsepower type, Europe zero turn mowers market is categorized as 18-24 HP, >24 HP, and < 18 HP. The 18-24 HP are the leading segment owing to their better suitability for the lawns and backyards with medium to larger areas with higher industry penetration.

- The golf courses & other sports arenas segment is expected to add a revenue of USD 240.81 million during the forecast period. The growing popularity of various sports and government initiatives to encourage individual participation in sports are boosting the demand for sports arenas in multiple countries. As a result, the need to maintain sports grounds is growing significantly. Hence, the above factors will likely support the Europe zero turn mowers market.

Segmentation by Fuel Type

- Gasoline-Powered

- Electric-Cordless

- Propane-Powered

Segmentation by Horsepower Type

- < 18HP

- 18-24HP

- >24HP

Segmentation by End-User

- Professional Landscaping Services

- Golf Courses & Other Sports Arenas

- Residential

- Government & Others

Segmentation by Blade Type

- Standard Blades

- Mulching Blades

- Lifting Blades

Segmentation by Start Type

- Push Start

- Key Start

Segmentation by Distribution Channel

- Offline

- Online

REGIONAL ANALYSIS

The U.K. is expected to observe the fastest growth rate in the Europe zero turn mowers market during the forecast period. The country is growing at the highest CAGR of 6.69% in Europe. The growth is ascribed to the significant penetration of regional green areas. Moreover, the rising governmental efforts to cut down harmful effects of gasoline-based lawn mowers, such as toxic emissions and noise pollution is, encouraging the adoption of lawn mowers, which is expected to support the industry growth. Also, initiatives such as greener Britain, Greening of the city of Paris, and several others are expected to support the market growth.In 2021 Germany accounted for a share of 13.39% and was the second leading industry in the Europe zero turn mowers market. The presence of many sports stadiums or arenas, including tennis, football, golf, and others, supports the demand for zero turn mowers in the country. The country hosts various sports events annually that call for the continuous upgradation of stadiums.

Segmentation by Geography

- Europe

- U.K.

- Germany

- France

- Italy

- Spain

- Sweden

- Netherlands

- Belgium

- Poland

- Switzerland

- Finland

- Austria

COMPETITIVE LANDSCAPE

The Europe zero turn mowers market is moderately fragmented, with many local and international players. As consumers expect constant advancements and upgrades in garden equipment, the increasingly changing economic environment may have a negative impact on vendors. The current condition urges suppliers to adjust and improve their value proposition to attain a strong business existence.Deere & Co., Husqvarna, Kubota, MTD Goods, STIGA, & The Toro Group are among the major vendors in the Europe zero turn mowers market. The competition among these leading players on the global stage is high. Several players offer various gardening equipment to achieve economies of scale. Other players in the industry are Ariens Company, Bobcat, and Briggs & Stratton. The acquisition strategy was followed by most of the players on the path to becoming industry leaders. The concentration of markets in developed countries such as the U.K., Germany, and other Western European countries is high. The competition between vendors is mainly based on offerings and pricing.

Key Vendors

- Deere & Company

- Honda

- Husqvarna Group

- Kubota Corporation

- MTD Products

- STIGA Group

- The Toro Company

Other Prominent Vendors

- Ariens Company

- Bobcat Company

- Briggs & Stratton

- Chervon Group

- Greenworks Tools

- IHI Shibaura Machinery Corporation

- Masport

- Metalcraft of Mayville

- The Grasshopper Company

- Textron

- Techtronic Industries

- WALKER MANUFACTURING

- Wright Manufacturing

- Yangzhou Weibang Garden

KEY QUESTIONS ANSWERED

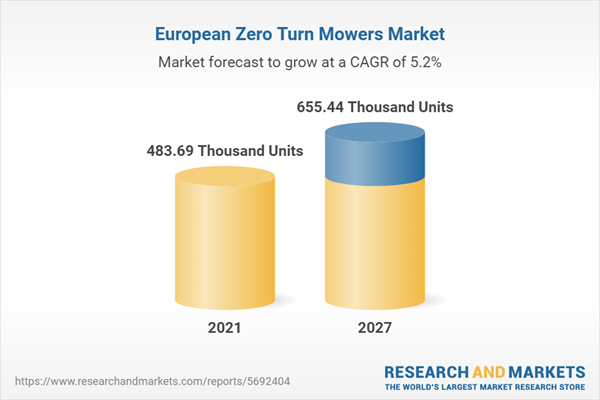

1. What is the market size of the Europe zero turn mowers market?2. What is the growth rate of the Europe zero turn mowers market?

3. What will Europe zero turn mowers market size in terms of volume in 2027?

4. Who are the key players in the Europe zero turn mowers market?

5. What are the major factors driving the growth of the Europe zero turn mowers market?

Table of Contents

Companies Mentioned

- Deere & Company

- Honda

- Husqvarna Group

- Kubota Corporation

- MTD Products

- STIGA Group

- The Toro Company

- Ariens Company

- Bobcat Company

- Briggs & Stratton

- Chervon Group

- Greenworks Tools

- IHI Shibaura Machinery Corporation

- Masport

- Metalcraft of Mayville

- The Grasshopper Company

- Textron

- Techtronic Industries

- WALKER MANUFACTURING

- Wright Manufacturing

- Yangzhou Weibang Garden

Methodology

Our research comprises a mix of primary and secondary research. The secondary research sources that are typically referred to include, but are not limited to, company websites, annual reports, financial reports, company pipeline charts, broker reports, investor presentations and SEC filings, journals and conferences, internal proprietary databases, news articles, press releases, and webcasts specific to the companies operating in any given market.

Primary research involves email interactions with the industry participants across major geographies. The participants who typically take part in such a process include, but are not limited to, CEOs, VPs, business development managers, market intelligence managers, and national sales managers. We primarily rely on internal research work and internal databases that we have populated over the years. We cross-verify our secondary research findings with the primary respondents participating in the study.

LOADING...

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 253 |

| Published | November 2022 |

| Forecast Period | 2021 - 2027 |

| Estimated Market Value in 2021 | 483.69 Thousand Units |

| Forecasted Market Value by 2027 | 655.44 Thousand Units |

| Compound Annual Growth Rate | 5.1% |

| Regions Covered | Europe |

| No. of Companies Mentioned | 21 |