Key Highlights

- The Internet access market includes all Internet service revenues collected to provide narrowband and broadband Internet access through consumer and business channels. All revenues calculated are retail revenues that are exclusive of taxes. Only fixed communication is included, and mobile phone connections are not considered.

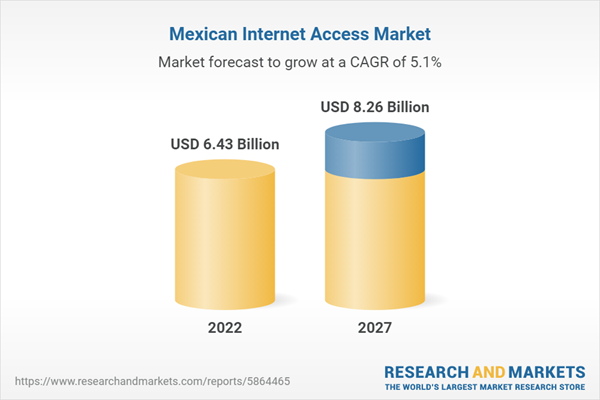

- The Mexican internet access market had total revenues of $6.4 billion in 2022, representing a compound annual growth rate (CAGR) of 7.9% between 2017 and 2022.

- Market consumption volume increased with a CAGR of 7.1% between 2017 and 2022, to reach a total of 0.08 billion Internet Users in 2022.

- The increased daily usage of internet via mobile phones and increase in mobile broadband subscriptions is driving the market growth of the internet access market in the country. According to in-house research, the number of mobile internet subscribers in Mexico increased from 108,835,922 in 2021 to 115,897,960 in 2022.

Scope

- Save time carrying out entry-level research by identifying the size, growth, major segments, and leading players in the internet access market in Mexico

- Use the Five Forces analysis to determine the competitive intensity and therefore attractiveness of the internet access market in Mexico

- Leading company profiles reveal details of key internet access market players’ global operations and financial performance

- Add weight to presentations and pitches by understanding the future growth prospects of the Mexico internet access market with five year forecasts

Reasons to Buy

- What was the size of the Mexico internet access market by value in 2022?

- What will be the size of the Mexico internet access market in 2027?

- What factors are affecting the strength of competition in the Mexico internet access market?

- How has the market performed over the last five years?

- What are the main segments that make up Mexico's internet access market?

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- America Movil, SA DE C.V.

- Telefonica, S.A.

- AT&T Inc

- Verizon Communications Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 53 |

| Published | July 2023 |

| Forecast Period | 2022 - 2027 |

| Estimated Market Value ( USD | $ 6.43 Billion |

| Forecasted Market Value ( USD | $ 8.26 Billion |

| Compound Annual Growth Rate | 5.1% |

| Regions Covered | Mexico |