Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

Growing Consumer Awareness About Pesticide Residues on Food

The growing consumer awareness about pesticide residues on food is significantly driving up the demand for pesticide residue testing services in France. With increasing concerns about food safety and the potential health risks associated with pesticide exposure, consumers are actively seeking assurances about the quality of the food they consume. This heightened awareness has created a demand for rigorous testing procedures to assess and monitor pesticide residues in agricultural products. Pesticide residue testing ensures that food items comply with stringent safety standards and regulatory requirements, providing consumers with the confidence that the products they purchase meet established health and safety benchmarks.The demand for pesticide residue testing is not only driven by individual consumers but also by retailers, food manufacturers, and regulatory bodies seeking to uphold and demonstrate adherence to safety protocols. This trend is particularly evident in the context of organic and locally sourced produce, where consumers are increasingly inclined to choose products with lower pesticide residues or, ideally, none at all. In response to this demand, testing laboratories and service providers in France are expanding their capacities and capabilities to meet the evolving requirements of the food industry. The emphasis on pesticide residue testing underscores a broader shift towards transparency and accountability in the food supply chain, with consumers playing an active role in shaping industry practices and standards related to food safety in the French market.

Increasing Demand for Organic Produce

The escalating demand for organic produce in France is concurrently intensifying the need for pesticide residue testing. As consumers increasingly prioritize health-conscious choices and sustainable agricultural practices, the organic food market has witnessed remarkable growth. To meet the stringent organic certification standards and assure consumers of the purity of their products, both organic farmers and conventional growers transitioning to organic practices are seeking robust pesticide residue testing. Consumers opting for organic produce are particularly concerned about the absence of synthetic pesticides, making thorough testing imperative to ensure compliance with organic farming regulations.Pesticide residue testing serves as a critical quality assurance step for organic producers, verifying that their products are free from unwanted chemical residues. The transparency offered by rigorous testing aligns with the principles of organic farming and provides consumers with the confidence that they are making choices aligned with their health and environmental values. This surge in demand for pesticide residue testing is not only attributed to individual consumers but also to retailers, distributors, and certification bodies working to uphold the integrity of the organic label. In response to this trend, testing laboratories and service providers specializing in pesticide residue analysis are expanding their capacities and refining their methodologies. The intersection of the rising demand for organic produce and the need for comprehensive pesticide residue testing underscores the pivotal role of testing services in supporting the growth and credibility of the organic food market in France.

Advancements in Pesticide Residue Testing Technology

Advances in pesticide residue testing technology are driving a notable surge in demand for these services in France. Ongoing enhancements in testing methodologies, incorporating cutting-edge instrumentation such as advanced chromatography and mass spectrometry, have significantly boosted the precision and sensitivity of pesticide residue analysis. These technological strides enable more precise detection and quantification of trace pesticide levels in agricultural products. With consumers becoming more discerning and regulatory standards evolving, there is an increased focus on comprehensive and efficient testing to ensure food product safety and compliance.The demand for pesticide residue testing in France is further fueled by the agri-food industry's dedication to meeting stringent quality and safety standards. Food producers, processors, and retailers recognize the importance of adopting state-of-the-art testing technologies to enhance product integrity and comply with regulations. Moreover, the traceability and transparency provided by advanced testing methods align with consumer expectations for informed choices regarding food safety. As the landscape of pesticide residue testing continues to evolve, testing laboratories and service providers are experiencing heightened demand for their expertise. Investments in technological innovations and ongoing improvements in testing protocols position these entities to meet the growing demands of the French Market, fostering consumer trust and supporting broader safety and quality assurance efforts in the agri-food sector.

Increase in the Number of Certified Laboratories

The proliferation of certified laboratories is playing a pivotal role in escalating the demand for pesticide residue testing services in France. With an increasing emphasis on food safety and compliance with stringent regulatory standards, the certification of testing laboratories ensures the reliability and accuracy of pesticide residue analyses. As the number of certified laboratories grows, there is a subsequent rise in the availability of trustworthy testing services, attracting both agricultural producers and food manufacturers seeking to uphold the integrity of their products.Certified laboratories offer a stamp of approval that resonates with consumers and regulatory bodies alike, instilling confidence in the results generated. The assurance of adherence to recognized standards bolsters the credibility of pesticide residue testing, making it an essential component in the quality assurance processes of the agri-food industry. The heightened demand for testing services is particularly pronounced in industries producing fruits, vegetables, and other crops where pesticide use is prevalent. The increase in certified laboratories not only expands testing capacity but also fosters healthy competition, encouraging ongoing advancements in testing methodologies and technologies. This dynamic landscape positions France as a leader in upholding rigorous standards for pesticide residue testing, aligning with global best practices. As the number of certified laboratories continues to grow, the demand for pesticide residue testing is set to rise, contributing to enhanced food safety practices and reinforcing the commitment to consumer protection and regulatory compliance in the French agri-food sector.

Key Market Challenges

High Costs Associated with Pesticide Residue Testing

The high costs associated with pesticide residue testing are proving to be a deterrent, decreasing the demand for such testing services in France. Pesticide residue testing involves complex analytical processes, sophisticated equipment, and skilled labor, contributing to elevated operational expenses for testing laboratories. These costs are often transferred to farmers, food processors, and other stakeholders in the agri-food supply chain, prompting some to reconsider the frequency and extent of pesticide residue testing. In an environment where maintaining cost-efficiency is crucial for businesses, the financial burden associated with comprehensive testing can impact the willingness of stakeholders to invest in rigorous pesticide residue analyses.This decrease in demand for pesticide residue testing may be particularly noticeable among smaller-scale producers and growers who face tighter profit margins. The economic considerations involved in pesticide residue testing are further accentuated by the challenges of balancing stringent regulatory requirements with the imperative to keep testing costs within sustainable limits. To address this issue and reignite demand, there is a need for innovative solutions within the testing industry to reduce testing costs without compromising accuracy and reliability. Additionally, industry stakeholders, including government bodies, may explore incentive programs or subsidies to alleviate the financial burden on agricultural businesses, encouraging broader compliance with pesticide residue testing standards. Balancing the economic considerations with the imperative for comprehensive testing is essential to ensure the continued integrity of food safety practices in the French agri-food sector.

Complex Constantly Evolving Regulatory Framework

The complex and constantly evolving regulatory framework surrounding pesticide residue testing is contributing to a decrease in demand for such services in France. The intricate nature of regulations, which includes frequent updates and adjustments, poses challenges for stakeholders across the agri-food supply chain in navigating compliance requirements. The dynamic regulatory landscape demands a continual adaptation of testing protocols and methodologies to align with evolving standards. This complexity can result in a hesitancy among farmers, food processors, and retailers to engage in comprehensive and frequent pesticide residue testing, as the continuous changes in regulations may lead to uncertainties and increased compliance costs.The demanding nature of compliance, coupled with the need for staying abreast of regulatory updates, places a burden on businesses in terms of time, resources, and expertise. Smaller-scale producers, in particular, may find it challenging to keep up with the regulatory intricacies, leading to a potential decrease in demand for pesticide residue testing services. Additionally, the evolving regulatory framework may influence some stakeholders to adopt a wait-and-see approach, leading to a temporary slowdown in testing activities until there is greater stability and clarity in the regulatory environment.

Key Market Trends

Advent of On-Site Testing Kits

The advent of on-site testing kits is driving a surge in demand for pesticide residue testing in France. These portable and user-friendly testing kits provide a rapid and convenient solution for farmers, food processors, and retailers to assess pesticide residues directly at the production site. This transformative technology offers real-time results, enabling quick decision-making and immediate actions to mitigate potential risks. The convenience and efficiency of on-site testing contribute to an increased awareness and urgency regarding pesticide residue monitoring, as stakeholders across the agri-food supply chain seek to ensure the safety and compliance of their products.The demand for on-site testing kits is propelled by the need for swift and accessible solutions, aligning with the evolving landscape of food safety and consumer expectations. Farmers, in particular, benefit from the ability to conduct preliminary tests on their crops before harvesting, allowing for timely adjustments to pesticide application practices. Food processors and retailers leverage these kits for routine checks during the production process, contributing to a proactive approach in maintaining the quality and safety of their offerings. The rise in demand for on-site testing kits not only signifies a shift towards decentralized testing but also encourages innovation in the pesticide residue testing sector. As these kits become integral tools for quality control and compliance, their adoption contributes to a heightened focus on food safety and reinforces France's commitment to ensuring the highest standards in the agri-food industry.

Growing Popularity of Biopesticides

The growing popularity of biopesticides is significantly elevating the demand for pesticide residue testing in France. With an increasing emphasis on sustainable and environmentally friendly agricultural practices, biopesticides, derived from natural substances, have gained traction as alternatives to conventional chemical pesticides. As these biopesticides become more prevalent in French agriculture, there is a parallel need to rigorously test and monitor for their residues on crops. Pesticide residue testing plays a crucial role in ensuring compliance with regulatory standards and guaranteeing that biopesticides, while being eco-friendly, do not leave unwanted residues that could impact food safety.The demand for pesticide residue testing is particularly pronounced in sectors where biopesticides are extensively used, such as organic farming and integrated pest management systems. Consumers, more than ever, are seeking assurance that the produce they consume is not only grown sustainably but also free from harmful residues. This has led to an increased reliance on testing services to verify the effectiveness of biopesticides in pest control and to confirm the absence of residues that may compromise the safety of the final food products. As the agricultural landscape continues to shift towards more sustainable practices, the demand for pesticide residue testing is expected to grow in tandem with the adoption of biopesticides. This trend underscores the commitment of French agriculture to environmental stewardship and consumer well-being while creating opportunities for testing laboratories to expand their services in response to evolving industry needs.

Segmental Insights

Type Insights

Based on the Type, in the France Pesticide Residue Testing Market, the Insecticides segment holds a dominant position due to the widespread and intensive use of insecticides in various agricultural practices across the country. The agricultural industry heavily relies on insecticides to combat the high prevalence of insect pests, such as aphids, caterpillars, and beetles, which pose significant threats to crop yields and food production. These pests can cause extensive damage to crops, leading to substantial financial losses for farmers.Consequently, the need for frequent and thorough testing of agricultural products for insecticide residues has become paramount. Accurate and efficient residue testing methods are crucial to ensure the safety and quality of agricultural products in the market. The growing demand for residue testing of insecticides reflects the industry's commitment to adhering to stringent regulations and consumer demands for pesticide-free and safe food products. With an increasing emphasis on sustainability and environmental stewardship, the France Pesticide Residue Testing Market plays a crucial role in ensuring the responsible use of insecticides and minimizing their impact on the environment. By employing advanced testing techniques and technologies, the market strives to provide reliable and comprehensive analysis of pesticide residues, enabling farmers and consumers to make informed decisions about the safety and quality of agricultural products.

Technology Insights

Based on the Technology, in the France Pesticide Residue Testing Market, High-Performance Liquid Chromatography (HPLC) is currently dominating. This highly acclaimed analytical method has gained popularity due to its exceptional versatility, efficiency, and precise results in detecting a wide range of pesticides in various samples. HPLC utilizes a mobile phase and a stationary phase to meticulously separate and identify pesticide residues with utmost accuracy, ensuring reliable quantitative and qualitative data. Its capability to handle complex matrices and provide robust analysis has established it as the go-to method for pesticide analysis in France.With its remarkable ability to analyze diverse samples, ranging from agricultural produce to environmental matrices, HPLC significantly contributes to ensuring food safety and environmental protection. By enabling robust pesticide residue testing, this powerful technique plays a pivotal role in safeguarding the well-being of consumers and the preservation of our environment. The continuous advancements and refinements in HPLC technology have further enhanced its precision and efficiency, making it an indispensable tool in the field of pesticide analysis. As the demand for reliable and accurate pesticide residue testing continues to grow, HPLC remains at the forefront, setting the standard for excellence in the France Pesticide Residue Testing Market.

Regional Insights

The Northern region of France is currently dominating the France Pesticide Residue Testing Market. This dominance is largely attributed to the extensive agricultural activities in this region, which include the cultivation of various crops, such as wheat, barley, and rapeseed, as well as the rearing of livestock. These agricultural practices necessitate the frequent testing of pesticide residues to ensure the safety and quality of the produce that is being harvested and distributed. Moreover, the Northern region's proactive approach towards maintaining environmental standards and ensuring public health has played a significant role in its leading position in the market. The region has implemented strict regulations and guidelines for pesticide usage, promoting sustainable farming practices and minimizing the potential risks associated with pesticide residues.Additionally, the Northern region has established strong collaborations between farmers, agricultural organizations, and research institutions to further enhance testing methodologies and develop innovative solutions for pesticide residue management. This collaborative effort has not only boosted the region's expertise in pesticide residue testing but has also contributed to its reputation as a hub for agricultural innovation and sustainable farming practices. Overall, the Northern region's dominance in the France Pesticide Residue Testing Market can be attributed to its thriving agricultural sector, stringent environmental standards, and continuous efforts towards ensuring the safety and quality of agricultural products.

Report Scope:

In this report, the France Pesticide Residue Testing Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:France Pesticide Residue Testing Market, By Type:

- Insecticides

- Herbicides

- Insecticides

- Others

France Pesticide Residue Testing Market, By Technology:

- LC-MS/ GC-MS

- HPLC

- Gas Chromatography

- Others

France Pesticide Residue Testing Market, By Food Tested:

- Fruits Vegetables

- Cereal Pulses

- Processed Foods

- Dairy Products

- Meat Poultry

- Others

France Pesticide Residue Testing Market, By Class:

- Organochlorines

- Organophosphates

- Organonitrogens Carbamates

- Others

France Pesticide Residue Testing Market, By Region:

- Northern France

- Western France

- Eastern France

- Southern France

- Central France

- Southwestern France

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the France Pesticide Residue Testing Market.Available Customizations:

France Pesticide Residue Testing market report with the given market data, the publisher offers customizations according to a company's specific needs.This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- SGS France SA

- Intertek International France SASU

- Eurofins Analytics France - SAS

- bioMérieux France

- Bureau Veritas Group

- TÜV SÜD France SAS

- PerkinElmer SAS

- Primoris France S.A.R.L.

Table Information

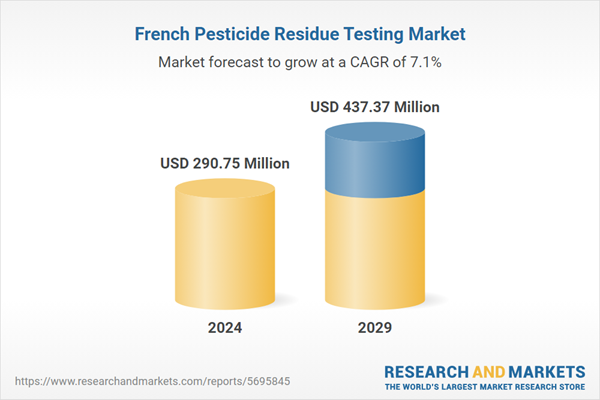

| Report Attribute | Details |

|---|---|

| No. of Pages | 80 |

| Published | April 2024 |

| Forecast Period | 2024 - 2029 |

| Estimated Market Value ( USD | $ 290.75 Million |

| Forecasted Market Value ( USD | $ 437.37 Million |

| Compound Annual Growth Rate | 7.1% |

| Regions Covered | France |

| No. of Companies Mentioned | 8 |