Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Market Drivers:

Rising Disposable Incomes and Lifestyle Aspirations

India's growing middle-class population and increasing disposable incomes have played a pivotal role in driving the demand for SUVs. As economic stability rises, consumers are shifting their preferences toward vehicles that offer superior comfort, spacious interiors, and advanced features. SUVs are seen as a status symbol, blending practicality with style, making them a popular choice among urban and semi-urban buyers. This shift is further supported by an increase in dual-income households, where purchasing power allows for investments in premium vehicle categories like SUVs, which are often equipped with cutting-edge technology and luxury features.Expanding Road Infrastructure and Urbanization

The rapid expansion of road networks, highways, and expressways in India has made SUVs a practical choice for consumers. Improved infrastructure allows SUVs to showcase their versatility, catering to both city commuting and off-road adventures. Additionally, the rise in urbanization has contributed to the popularity of compact and mid-sized SUVs, which offer the commanding driving position and road presence that urban dwellers seek, while remaining maneuverable in congested traffic. Rural markets are also contributing to SUV sales as improved connectivity to urban centers increases the demand for vehicles capable of handling varied terrains.Government Initiatives and Changing Taxation Policies

Government policies favoring the automotive sector, such as the implementation of the Goods and Services Tax (GST), have streamlined the tax structure, making SUVs more affordable for buyers. Additionally, incentives for hybrid and electric SUVs under the Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) scheme have encouraged manufacturers to diversify their offerings with environmentally friendly models. Furthermore, relaxed regulatory norms on emission standards and vehicle dimensions have allowed automakers to innovate and deliver SUVs tailored to Indian conditions, contributing significantly to the segment's growth.Evolution of Consumer Preferences and Automotive Technology

Indian consumers are increasingly valuing features like advanced safety systems, infotainment, and fuel efficiency in their vehicles, all of which are prominently featured in modern SUVs. The integration of advanced driver assistance systems (ADAS), panoramic sunroofs, and premium interiors has made SUVs an attractive option. Simultaneously, advancements in automotive engineering have enabled manufacturers to produce fuel-efficient SUVs that mitigate traditional concerns about higher operational costs. These innovations, coupled with flexible financing options, have widened the accessibility of SUVs across different income groups, making them a dominant segment in India’s automotive market.Urbanization

Rapid urbanization is leading to increased vehicle ownership, particularly in metropolitan areas. As more people seek spacious and comfortable vehicles for city driving and family use, the demand for SUVs is set to grow. For instance, In February 2024, Klaus Zellmer CEO of Skoda Auto quoted that India is the most promising growth market for Skoda Auto and Skoda Auto India is looking to increase its share in the Indian market to 5% by 2030.Key Market Challenges

High Cost and Affordability Issues

One of the primary challenges for the Indian SUV market is the high cost of these vehicles, which limits their accessibility to a large section of the population. While SUVs offer features like higher ground clearance, robust performance, and a more premium feel, they come with a higher price tag than smaller vehicles. The cost of manufacturing, especially with the inclusion of advanced technology, safety features, and premium materials, drives up the price of the vehicle. Additionally, the rising cost of raw materials, labor, and energy, as well as the increasing demand for better technology and safety features, further exacerbates this issue. In a price-sensitive market like India, this makes SUVs out of reach for many consumers, especially in smaller towns and rural areas, and despite the availability of financing options, the overall cost of ownership remains a significant barrier.Fuel Efficiency and Environmental Concerns

India’s rising fuel prices make fuel efficiency a critical concern for SUV buyers. SUVs, particularly larger ones, generally offer lower fuel efficiency compared to smaller vehicles like hatchbacks and sedans. With the increasing cost of petrol and diesel, this becomes a major point of consideration for consumers looking to reduce running costs. Moreover, there is growing pressure to curb carbon emissions and reduce the environmental impact of vehicles. The Indian government has introduced more stringent emission standards, pushing for greener alternatives like electric and hybrid vehicles. However, despite emerging electric SUV options, adoption remains slow due to factors like high initial costs, insufficient charging infrastructure, and concerns about battery longevity. This creates a gap between the demand for eco-friendly vehicles and the practicalities of their implementation in the market.Intense Competition

The Indian SUV market is becoming increasingly competitive, with both domestic and international brands vying for consumer attention. Indian automakers such as Tata Motors, Mahindra & Mahindra, and Maruti Suzuki are long-standing players in the market, but they now face stiff competition from global brands like Hyundai, Toyota, Kia, and Volkswagen. The surge in SUV demand has led to a wider range of models, catering to diverse consumer needs across price points. While this offers consumers more choices, it also leads to a fragmented market, making it difficult for manufacturers to stand out. Intense price competition among automakers leads to discounts and deals, often resulting in reduced profit margins and potentially compromising vehicle quality or features. The challenge for manufacturers lies in maintaining a competitive edge through continuous innovation while balancing price and quality.Infrastructure and Road Conditions

The infrastructure and road conditions in India present significant challenges for the SUV market. While SUVs are built for off-roading and rough terrain, urban environments in India often lack the necessary infrastructure to support these larger vehicles. Roads in many urban areas are narrow, poorly maintained, and prone to heavy traffic, which can make driving an SUV less practical.Parking space is also a growing concern, as SUVs require more room than smaller cars, making them unsuitable for the limited parking options available in cities. Additionally, in rural and semi-urban areas, while SUVs are preferred for their ability to handle rough roads, the absence of well-maintained roads and limited service centers can hinder the ownership experience. Growing environmental regulations in cities that restrict high-emission vehicles further complicate the appeal of SUVs, creating a mismatch between the capabilities of these vehicles and the conditions they are expected to operate in.

Key Market Trends

Growing Preference for Compact and Subcompact SUVs

Compact and subcompact SUVs have emerged as a dominant segment in the Indian automotive market. These vehicles, combining the rugged appeal of traditional SUVs with the practicality of smaller cars, cater perfectly to urban consumers. Their compact size ensures maneuverability in traffic-congested cities, while features such as higher ground clearance and sporty designs add to their appeal. Models like the Tata Nexon, Hyundai Venue, and Maruti Suzuki Brezza have gained significant popularity, driven by their affordability and feature-rich offerings. This trend reflects the evolving consumer preference for vehicles that strike a balance between style, functionality, and cost-effectiveness.Shift Toward Electrification and Sustainable Mobility

The SUV market in India is experiencing a gradual shift toward electrification as environmental awareness grows and government incentives encourage the adoption of green technologies. Manufacturers are increasingly investing in hybrid and fully electric SUVs, catering to eco-conscious consumers. Models like the Tata Nexon EV and MG ZS EV demonstrate the potential of electric SUVs to combine environmental benefits with robust performance. As more manufacturers introduce electric models, this segment is expected to expand significantly. For instance, In February 2024, Hyundai Motors announced it will invest over USD 3.85 billion from to 2033 in expanding its EV range and enhancing its current car and SUV platforms.However, the adoption rate is still dependent on improving charging infrastructure and reducing the cost of electric vehicles. As battery technology evolves and policies like the FAME scheme continue to incentivize adoption, the trend toward sustainable mobility is expected to accelerate.

Integration of Advanced Technology and Connected Features

Indian consumers are increasingly drawn to SUVs equipped with advanced technologies and connected features. Modern SUVs now come with sophisticated infotainment systems, voice-activated controls, and smartphone integration via Apple CarPlay and Android Auto. Additionally, safety features such as Advanced Driver Assistance Systems (ADAS), adaptive cruise control, and 360-degree cameras are becoming common even in mid-range models. This trend signifies a shift in consumer expectations, with buyers seeking vehicles that offer more than just mobility. Automakers are leveraging these technologies to enhance customer experiences and gain a competitive edge in the market.Rising Popularity of Customization and Personalization

The growing demand for personalized vehicles is shaping the SUV market in India. Consumers today are looking for unique features and styling options that reflect their individuality. Automakers have responded by offering extensive customization options, from body kits and color schemes to interior trims and accessories. Additionally, special editions and limited-run models are becoming increasingly popular, as they allow brands to cater to niche markets while maintaining exclusivity. This trend aligns with the aspirations of a younger, style-conscious demographic that values individuality and seeks vehicles tailored to their preferences.Segmental Insights

Type Insights

The compact segment is the dominant segment in the Indian SUV market. Compact SUVs are highly popular due to their affordability, practicality, and versatility, making them appealing to a broad spectrum of consumers, particularly in urban and semi-urban areas. These vehicles strike a balance between the ruggedness of traditional SUVs and the maneuverability and fuel efficiency of smaller cars.Models like the Maruti Suzuki Brezza, Tata Nexon, and Hyundai Venue have consistently led sales charts in this segment. Compact SUVs are preferred for their lower cost of ownership, advanced features, and suitability for Indian road conditions. Their dominance is further supported by the growing trend of first-time car buyers and upgraders moving from hatchbacks or sedans to entry-level SUVs. Meanwhile, mid-size SUVs hold a significant market share but trail behind compact SUVs, and large SUVs remain a niche category catering primarily to premium buyers.

Regional Insights

North India was the dominated region in the Indian SUV market, driven by rapid urbanization, growing disposable incomes, and a strong preference for SUVs. States like Delhi, Haryana, Punjab, Uttar Pradesh, and Rajasthan contribute significantly to the demand, with a high concentration of middle and upper-middle-class consumers. The region's expanding infrastructure, including improved highways and better connectivity, has made larger vehicles like SUVs more practical for both urban and rural areas. Additionally, the preference for robust vehicles suited to varying terrains further boosts SUV sales, making North India a key market for automakers in the country.Key Market Players

- Tata Motors Limited

- Mahindra & Mahindra Limited

- Maruti Suzuki India Limited

- Hyundai Motor India Limited

- Kia India Private Limited

- Toyota Kirloskar Motor Private Limited

- ŠKODA AUTO Volkswagen India Private Limited

- MG Motor India Private Limited

- Mercedes-Benz India Private Limited

- BMW India Private Limited

Report Scope:

In this report, the India SUV Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:India SUV Market, By Type:

- Compact

- Mid-size

- Large

India SUV Market, By Seating Capacity:

- 5-seater

- 7-seater

India SUV Market, By Propulsion Type:

- Petrol

- Diesel

- Electric

India SUV Market, By Region:

- North India

- West India

- South India

- East India

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the India SUV Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Tata Motors Limited

- Mahindra & Mahindra Limited

- Maruti Suzuki India Limited

- Hyundai Motor India Limited

- Kia India Private Limited

- Toyota Kirloskar Motor Private Limited

- ŠKODA AUTO Volkswagen India Private Limited

- MG Motor India Private Limited

- Mercedes-Benz India Private Limited

- BMW India Private Limited

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 70 |

| Published | December 2024 |

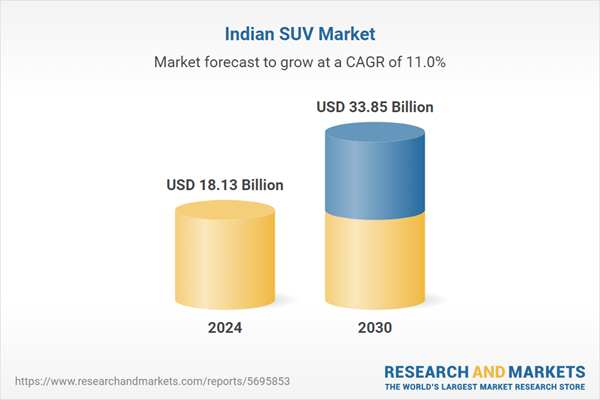

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 18.13 Billion |

| Forecasted Market Value ( USD | $ 33.85 Billion |

| Compound Annual Growth Rate | 10.9% |

| Regions Covered | India |

| No. of Companies Mentioned | 10 |