Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

However, the market faces significant hurdles due to the high costs and technical complexities involved in tracking small-scale orbital debris. As the object density in Low Earth Orbit rises, existing sensor technologies struggle to reliably monitor minute, non-functional fragments that retain enough kinetic energy to destroy operational spacecraft. This capability gap, combined with the lack of a unified global regulatory framework for space traffic management, leads to data interoperability challenges among international operators, potentially hindering the seamless development of the comprehensive situational awareness networks necessary for future space sustainability.

Market Drivers

The rapid expansion of Low Earth Orbit (LEO) satellite mega-constellations serves as a major catalyst for the Global Space Situational Awareness Market. As commercial entities deploy thousands of satellites to provide global connectivity, the orbital environment is becoming increasingly congested, requiring precise tracking and automated collision avoidance systems to prevent catastrophic accidents. This high density compels operators to execute frequent orbital adjustments to safeguard their assets; for example, SpaceX reported to the Federal Communications Commission in July 2024 that its Starlink satellites performed roughly 50,000 collision-avoidance maneuvers in the six months ending May 31, 2024. Such high-frequency maneuvering demonstrates a critical reliance on real-time situational awareness data to manage complex traffic patterns and maintain commercial operations.Simultaneously, rising government defense spending on Space Domain Awareness (SDA) is reshaping the market, as nations increasingly view space as a contested warfighting domain. Defense agencies are investing heavily in ground-based radar and space-based optical sensors to monitor adversary activities and protect sovereign assets. According to the Department of the Air Force in March 2024, the Fiscal Year 2025 budget request for the U.S. Space Force reached $29.4 billion, indicating a strategic shift toward resilient architectures and advanced monitoring capabilities. This influx of public funding accelerates the development of next-generation tracking technologies, which are essential as the scope of the challenge grows; the European Space Agency noted in July 2024 that global surveillance networks were tracking approximately 35,000 artificial objects, underscoring the escalating debris threat.

Market Challenges

The technical complexity and substantial expense associated with tracking small-scale orbital debris constitute a major barrier to the Global Space Situational Awareness Market's growth. While current infrastructure can effectively monitor large assets, the financial and technological burden of detecting minute fragments results in a critical capability gap. This limitation prevents service providers from delivering a comprehensive safety picture, which is vital for the commercial viability of increasingly crowded orbits.According to the European Space Agency in 2024, statistical models estimate there are over one million space debris objects larger than 1 cm in orbit, yet surveillance networks currently track only about 35,000 total objects. This discrepancy impedes market expansion by increasing operational risks and insurance costs for satellite operators. The uncertainty regarding these untrackable threats compels stakeholders to divert capital toward risk mitigation rather than investing in advanced situational awareness services. Consequently, the prohibitive cost of developing high-sensitivity sensors to bridge this data gap slows the adoption of holistic monitoring solutions, directly hampering the sector's financial progress.

Market Trends

A significant trend is the Shift Toward Commercialization of SSA Data and Services, which is fundamentally changing the procurement landscape as government agencies move from proprietary, government-owned infrastructures to purchasing data-as-a-service from private entities. This strategic pivot enables defense and civil organizations to bypass the capital-intensive process of building and maintaining sensor networks, gaining immediate access to agile, high-fidelity tracking capabilities from the commercial sector. By integrating commercial data streams, operators can close coverage gaps and improve revisit rates for critical orbital regimes without bearing the full financial weight of constellation management; as noted by LeoLabs in January 2025, the company secured over $50 million in contracts in 2024, reflecting the surging public sector demand for scalable, commercial space domain awareness solutions.Concurrently, the Deployment of Dedicated Space-Based Surveillance Sensors is emerging as a critical evolution to address the inherent limitations of terrestrial monitoring networks. Unlike ground-based radars and optical telescopes, which are restricted by geography, day-night cycles, and atmospheric conditions, orbital sensors offer continuous, unobstructed observation of the space environment. This capability is particularly vital for maintaining custody of maneuvering assets and detecting threats in the increasingly congested geosynchronous and cislunar belts where ground coverage is often intermittent. According to Defense News in May 2025, the contract ceiling for the U.S. Space Force's Proliferated Low Earth Orbit program expanded to $13 billion to incorporate advanced space-based sensing architectures, meeting escalating military requirements for resilient monitoring.

Key Players Profiled in the Space Situational Awareness Market

- Lockheed Martin Corporation

- L3Harris Technologies, Inc.

- Kratos Defense & Security Solutions, Inc.

- Parsons Corporation

- ExoAnalytic Solutions, Inc.

- NorthStar Earth and Space Inc.

- LeoLabs, Inc.

- Slingshot Aerospace, Inc.

- Vision Engineering Solutions, LLC

- GlobVision Inc.

- Peraton Corp.

Report Scope

In this report, the Global Space Situational Awareness Market has been segmented into the following categories:Space Situational Awareness Market, by Offering:

- Service

- Software

Space Situational Awareness Market, by Object:

- Mission Related Debris

- Rocket Bodies

- Fragmentation Debris

- Non-Functional Spacecraft

- Functional Spacecraft

Space Situational Awareness Market, by End Use:

- Commercial

- Government & Military

Space Situational Awareness Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Space Situational Awareness Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Space Situational Awareness market report include:- Lockheed Martin Corporation

- L3Harris Technologies, Inc.

- Kratos Defense & Security Solutions, Inc.

- Parsons Corporation

- ExoAnalytic Solutions, Inc.

- NorthStar Earth and Space Inc.

- LeoLabs, Inc.

- Slingshot Aerospace, Inc.

- Vision Engineering Solutions, LLC

- GlobVision Inc.

- Peraton Corp.

Table Information

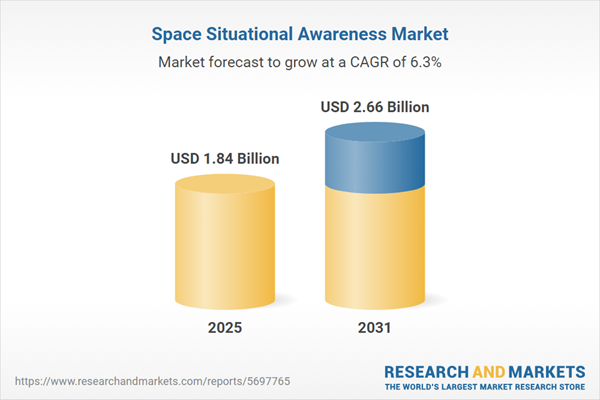

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | January 2026 |

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 1.84 Billion |

| Forecasted Market Value ( USD | $ 2.66 Billion |

| Compound Annual Growth Rate | 6.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 12 |