Speak directly to the analyst to clarify any post sales queries you may have.

In 2021, the government planned to invest USD 900 billion in infrastructure development projects across the UK for the next ten years. The government is also investing in affordable housing schemes and the healthcare sector. An investment of USD 4.3 billion & USD 4.9 billion is allocated for building hospitals & affordable housing schemes in 2022, respectively. Investments were also directed for the upgradation of public infrastructure such as roadways, railways, & airports. USD 171 billion will be allocated to repair and redevelop roadways, bridges, and traffic signals across the UK in 2022. Such development projects are projected to boost the UK used construction equipment market growth.

KEY HIGHLIGHTS

1. The material handling segment has the largest share in the UK used construction equipment market. Forklifts & telehandlers held the largest share in the material handling segment in 2021.2. Forklifts are compact equipment used for material handling in confined spaces such as small warehouses & distribution centers. In 2021, the growth in the e-commerce & logistics industry in the UK prompted the demand for warehouses. Government investment doubled to USD 7.9 billion in 2021 for expanding warehouses in Northwest, East Midlands, & West Midlands. Growth in the logistics & e-commerce industry is expected to positively impact the demand for used forklifts & telescopic handlers in the UK used construction equipment market. According to CEA (Construction Equipment Association) report, telehandlers witnessed sharp growth of more than 100% in 2021.

3. Used mini excavators are also gaining market share in the UK used construction equipment market. Small & medium contractors prefer to buy used mini excavators used for digging, stone plying and handling medium size loads at construction sites. The UK is facing the challenge of rising labor costs, so contractors prefer to buy these machines to reduce dependency on construction laborers.

4. UK government also increased its focus on upgrading public infrastructure, which includes the development of airports & railway stations. An investment of USD 3.9 million is planned for developing airports across the UK in 2022. In addition, the USD 491.6 million funds are allocated for building eco-friendly stations by installing solar panels & smart LED lighting.

5. The demand for young used equipment is growing in the UK market due to the government’s strict environmental norms. UK government introduced the Stage V emission Standard, which is expected to prompt the demand for young used equipment around 2-4 years old. Used construction equipment demand is expected to remain steady in the UK market due to the rise in public infrastructure projects in 2022.

6. The rise in construction material and labor costs are the major challenges in the UK. New government emission regulation is expected to hamper the demand for diesel-based large used construction equipment, such as large excavators, cranes, & loaders, which have long working hours.

MARKET SEGMENTATIONS

Segmentation by Type

- Earthmoving Equipment:

- Excavator

- Backhoe Loaders

- Motor Graders

- Other Earthmoving Equipment (Other loaders, Bulldozers, Trenchers)

- Material Handling Equipment

- Crane

- Forklift & Telescopic Handlers

- Aerial Platforms (Articulated Boom Lifts, Telescopic Boom lifts, Scissor lifts)

- Road Construction Equipment

- Road Rollers

- Asphalt Pavers

- End Users

- Construction

- Manufacturing

- Mining

- Others

MARKET TRENDS & DRIVERS

Government Investment for Housing Development Projects to Overcome Housing Crisis

- The UK is facing a housing crisis due to low investment in the country’s housing sector in 2022. The mismatch of demand & supply of housing units across the country resulted in a surge in the prices of houses. In 2022, the housing price increased by 11% compared to 2021. Cities with the most significant housing shortages primarily concentrate in the Greater Southeast of England, such as London and Brighton. To overcome the housing crisis, the government plans to build 300,000 new homes yearly to match demand and keep housing costs affordable from 2020. However, the government missed the yearly housing target, and 216,000 housing units were constructed between 2020-2021.

- In 2021, the government introduced the affordable Housing Delivery Plan 2022-2025 in Bristol city. The project aims to build 1,000 new affordable housing units in a year by 2024. This project is an updated version of the Housing Delivery Plan 2017-2020. The UK used construction equipment market will likely play a vital role in housing development projects.

Rise In Government Investment For Development Of Transit Facilities Across UK

- In 2022, the government plans to boost the investment in transport infrastructure in the country's Cornwall, Greater Manchester, Newcastle & Southampton regions to enhance the economic recovery post-pandemic. The government planned to invest USD 170 million in four significant road development & maintenance projects across the country, which is expected to reduce traffic congestion and improve connectivity.

- Four major road projects announced by the UK government in 2022 are a 6.2-kilometer road linking St Austell to A30 road in Cornwall (USD 83.4 million), maintenance of Tyne Bridge & central motorways (USD 37.5 million), enhancing walking & cycling accessibility across A34 between Greater Manchester & Stockport (USD 35.7 million), & maintenance of A35 Red bridge Causeway connecting New Forest, & Southampton (USD 14.2 million).

Growing Investment in the National Health Sector

- The pandemic exerted pressure on the Nation's health sector with the surge in demand for upgraded treatment facilities across the UK. Responding to this demand, the government developed the national healthcare plan to construct new hospitals and upgrade the existing ones.

- The UK government is expected to invest USD 4.3 billion in constructing 40 hospitals by 2030. The government is implementing new guidelines that will help to standardize the design for new hospitals and use modular construction methods to accelerate the building program. The government also announced USD 1 billion for upgrading its facilities in the existing 20 hospitals. Such healthcare projects will propel the growth of the UK used construction equipment market.

Newer Used Construction Equipment Witness Growth in Demand in UK Market

- Stage V emission norms introduced in 2020 focus on reducing carbon emissions. The government introduced strict emission norms for heavy construction equipment in 2020. There is a surge in demand for newer used construction equipment that are 2-4 years old in the UK market in 2021. The rental companies & contractors focused on buying newer used equipment to fulfill the emission standard set by the government.

- The government makes it mandatory to use construction equipment maintaining Stage V emission standards for one of the largest transport infrastructure projects (HS2) & other highway development projects in England.

Growth in Renewable Projects

- In 2022, the government's increased investment in renewable projects resulted in a 6.5% increase in renewable energy generation capacity in 2022 as compared to 2021. The country aims to produce 100% electricity from renewable energy resources by 2035. In 2022, the government invested $427.6 million to develop offshore wind generation projects. USD 34.1 million is allocated to increase biomass production, and further USD 5.3 million is directed to support innovative technologies that will generate hydrogen from biomass & waste. Investment is also planned for setting up solar panels & heat pumps to reduce carbon emissions from buildings. The solar projects are under process in the South-West, South-East, Yorkshire and Humberside, and East region of the country in 2022.

MARKET RESTRAINTS

Rising Building Material Costs & Labour Shortage Restrict the Demand for Used Construction Equipment

- In 2022, the UK construction industry is facing severe issues of labor shortage & rising building material prices such as iron, steel, timber & glass. Labor shortages in the UK construction industry were major issues post-Brexit in 2020. Changes in immigration laws post Brexit in 2020 restrict the labor migration in the UK from other European countries. Other factors, such as supply chain disruption of raw materials & rising inflation, and low labor availability due to the aging population hampering the construction industry’s growth in the UK. There is a sharp rise in building material prices such as steel (52.7%), timber (30%), cement (24.4%) & concrete (37%) in 2022 as compared to 2021 in the market. Hindrance in infrastructure projects due to the low availability of labor & rising building material prices is expected to restrict the demand for used construction equipment in the UK market.

Used Construction Equipment Demand Is Expected to Be Impacted Due to Rising Prices

- There is a sharp rise in used construction equipment in the UK market in 2022. According to Euro Auction data, used construction equipment is almost as high as new ones in 2022. The recent used construction equipment auction event organized by Euro Auction in Feb 2022 in Leeds witnessed high demand for good-condition used machinery. A sharp rise in prices is seen for telehandlers & mini excavators in Leeds Auction in 2022; these equipment prices were close to new ones. The demand for mini excavators & telehandlers is growing due to the rise in infrastructure development projects across the UK. This equipment can operate in confined places and is majorly used for repair & redevelopment projects.

VENDOR LANDSCAPE

- JCB has the most robust share in the UK used construction equipment market. JCB, Kubota, Caterpillar & Volvo are the market leaders in the UK industry and has a strong distribution network & provide a wide variety of products. Kubota is the market leader in mini excavators in the region.

- Hitachi Construction Machinery, Komatsu & Manitou are emerging strong in the UK used construction equipment market. These companies are introducing innovative products to capture construction equipment market share. For instance, in 2022, Hitachi launched Z-axis excavators equipped with Stage V emission technology for the UK industry. Manitou group also launched ultra-compact rough terrain telehandlers in the European market to capture customers from the construction & agriculture industries.

Key Vendors

- JCB

- Caterpillar

- Komatsu

- Volvo Construction Equipment

- Manitou

- Hitachi Construction Machinery

- Kubota

- Kobelco

Other Prominent Vendors

- Liebherr Group

- Hyundai Construction Equipment

- Yanmar

- LiuGong

Auctioneers Profile

- Ritchie Bros.

- Equippo

- Sandhills Global

- Surplex

- Apex auction

- Angermann machinery & equipment GmbH & co.

- Euro Auctions

Distributor Profiles

- SJH-All Plant Group Ltd

- Molson Group

- Cautrac

KEY QUESTIONS ANSWERED

1. What is the expected size of the UK used construction equipment market by 2028?2. What is the expected number of units sold in the UK used construction equipment market by 2028?

3. What is the growth rate of the UK used construction equipment market?

4. What are the latest trends impacting the growth of the UK used construction equipment market?

5. Who are the key players in the UK used construction equipment market?

Table of Contents

Companies Mentioned

- JCB

- Caterpillar

- Komatsu

- Volvo Construction Equipment

- Manitou

- Hitachi Construction Machinery

- Kubota

- Kobelco

- Liebherr Group

- Hyundai Construction Equipment

- Yanmar

- LiuGong

- Ritchie Bros.

- Equippo

- Sandhills Global

- Surplex

- Apex auction

- Angermann machinery & equipment GmbH & co.

- Euro Auctions

- SJH-All Plant Group Ltd

- Molson Group

- Cautrac

Methodology

Our research comprises a mix of primary and secondary research. The secondary research sources that are typically referred to include, but are not limited to, company websites, annual reports, financial reports, company pipeline charts, broker reports, investor presentations and SEC filings, journals and conferences, internal proprietary databases, news articles, press releases, and webcasts specific to the companies operating in any given market.

Primary research involves email interactions with the industry participants across major geographies. The participants who typically take part in such a process include, but are not limited to, CEOs, VPs, business development managers, market intelligence managers, and national sales managers. We primarily rely on internal research work and internal databases that we have populated over the years. We cross-verify our secondary research findings with the primary respondents participating in the study.

LOADING...

Table Information

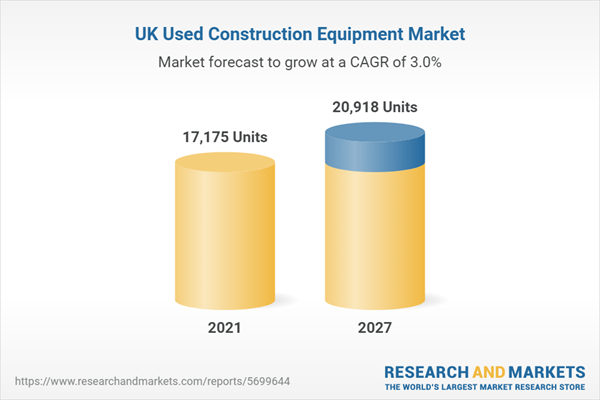

| Report Attribute | Details |

|---|---|

| No. of Pages | 120 |

| Published | December 2022 |

| Forecast Period | 2021 - 2027 |

| Estimated Market Value in 2021 | 17175 Units |

| Forecasted Market Value by 2027 | 20918 Units |

| Compound Annual Growth Rate | 2.9% |

| Regions Covered | United Kingdom |

| No. of Companies Mentioned | 22 |