Speak directly to the analyst to clarify any post sales queries you may have.

The growing chronic disease prevalence, growth in the biologics market, and technological advancements are anticipated to propel the market. However, fluctuations in raw material prices, emerging markets such as newly developed drugs, and lack of compliance with regulatory standards hamper the market's growth.

Driving Factors In The Global Pharmaceutical Packaging Market

- Rising pharmaceutical industry across the globe

- A surge in demand for flexible packaging

- Rising demand for biological products and emerging treatments such as cell and gene therapies

- Aging Demographics of Industrialized Countries

Active Mergers And Acquisitions Playing A Key Role In Smooth Functioning For The Growth of The Global Pharmaceutical Packaging Market

a) In February 2018, Berry Global acquired Clopay Plastic Products Company for a purchase price of USD 475 million.b) Berry Global completed the acquisition of RPC Group in July 2019. RPC Group is one of the global leaders in plastics conversion for packaging and non-packaging markets.

c) On June 11, 2019, Amcor acquired Bemis Company, a global manufacturer of flexible packaging products. Its flexible segment develops and supplies flexible packaging globally. In FY2021, the Flexible segment accounted for approximately 78% of Amcor’s net sales.

d) In November 2021, Gerresheimer acquired the IP of a new generation cartridge-based autoinjector suitable for small and large molecules, enhancing its broad portfolio, medical devices, and primary packaging from Midas Pharma. Midas Pharma is a Germany-based pharmaceutical company.

e) In 2018, Gerresheimer acquired Sensile Medical, a drug delivery technology company, and thus the company extended its business model in the OEM for drug delivery platforms for pharmaceutical and biopharmaceutical customers.

Increasing Virtual Consultations Is Anticipating The Growth Of Aluminium-Based Drug Packaging

High-income countries from North America and Europe are witnessing an increased adoption of virtual visits and e-prescriptions, leading to a large dependency on the home delivery of medicines. The home delivery of goods is one of the significant challenges for pharmaceutical packaging companies as the customers are not aware of the proper disposal of packaged products and materials, leading to a substantial environmental impact. Due to this concern, aluminum packaging is one of the improved solutions to overcome this issue.INDUSTRY’S ONGOING TRENDS

Eco-Friendly Packaging

Around 85% of the waste produced by healthcare operations, including pharmaceutical and medical equipment packaging, is non-hazardous and, therefore, exhibits the potential to be replaced by other eco-friendly and reusable alternatives, enabling significant cost savings. Many pharma companies are shifting to sustainable packaging that uses recyclable materials and biodegradable plastics. Sustainable pharmaceutical packaging is expected to grow during the forecast period. PET (polyethylene terephthalate) is a recyclable plastic material. It is a very versatile material for the manufacturing of pharmaceutical products packaging. It has a good carbon dioxide (CO2), oxygen, and moisture barrier, allowing it to store liquids and solids as fresh as possible. Europe is expected to lead the growth in the biodegradable pharmaceutical packaging market. In Europe, the key players in the global biodegradable pharmaceutical packaging market include Gerresheimer, Berry Global, International Paper, and Amcor.Introduction Of Anti-Counterfeiting Features

A counterfeit pharmaceutical product is deliberately and fraudulently mislabelled concerning identity. Counterfeit pharmaceutical products may include products with correct ingredients, wrong ingredients, without active ingredients, wrong ingredients with the inaccurate quantity of an active ingredient, or with fake packaging. The global pharmaceutical packaging market has witnessed a major challenge with the growing incidences of counterfeit products. As a result, many manufacturers in recent years have introduced several anti-counterfeiting features to fight the distribution of counterfeit pharmaceutical products. These anti-counterfeiting features include using thermochromic inks for labeling, holograms, QR code, RFID labels, and many more. Some innovations include child-resistant, senior-friendly & high barrier, unit-dose, multi-dose, and specialty film packaging.IMPACT OF COVID-19

- COVID-19 has shown adverse effects on the global healthcare industry and has thus contributed to hindering the growth of the pharmaceutical packaging market. The COVID-19 impact on the pharmaceutical sector included changes in demand, regulation adjustments, R&D process changes, and supply chain restructuring. In addition, trends such as industry slow-down, delays in approvals, modifying clinical trial methods, self-sufficiency in the pharmaceutical product supply chain, and variations in consumption of health & nutritional products are expected to be some of the long-term impacts of the COVID-19 pandemic on the pharmaceutical industry globally.

- During the pandemic, pharma packaging companies witnessed stable revenue growth in 2020. Major pharmaceutical packaging companies increased their production capacity to support the increased demand for pre-filled syringes, blister packs, ampoules/vials, bags, cartridges, containers, and bottles. This was mainly due to a surge in demand for COVID-19-related medications and vaccines. Moreover, pharmaceutical packaging for biologics, sterile packaging, smart packaging, patient focus packaging, cleanroom expansion, and others are anticipated to drive the global pharmaceutical packaging market in the long term.

SEGMENTATION ANALYSIS

INSIGHTS BY TYPE SEGMENTATION

- Primary pharmaceutical packaging segmentation accounted for the largest market share of 70.20% in 2021, owing to the growing demand for blister packs, bottles, vials, ampoules, pouches, sachets, and bags. The blister packs account for a significant revenue share of 35.23% in 2021 in the global pharmaceutical packaging market due to the high demand for prescription and non-prescription medications/drugs, among which the demand for generic drugs is the highest among LMIC. Although the pharmaceutical sector accounts for the major share of the global market, a consistent surge in blister packaging demand contributes to its cost-effectiveness. The evolution from simple bulk packaging materials toward ready-to-sterilize (RTS) primary packaging components and systems is the dominant trend in the primary packaging segment of the market

- Innovations in secondary pharmaceutical packaging include developing child-resistant (CR) cartons, tamper-evident (TE) cartons, and cold-chain packaging. The secondary packaging segment accounted for 20.30% of the global pharmaceutical packaging market share.

- Tertiary packaging is used for the safe handling and smooth transportation of products. Examples of tertiary packaging include plastic bags, shrink wraps, and cardboard boxes. The increasing trend of e-pharmacy will likely further the adoption of tertiary packaging in the pharmaceutical packaging market. It is expected to grow with a CAGR of 3.96% during the forecast period.

Segmentation by Type

- Primary

- Blister Packs

- Bottles

- Vials

- Ampoules

- Others

- Secondary

- Tertiary

INSIGHTS FROM MATERIAL SEGMENTATION

- Paper materials accounted for the highest revenue share of 39.36% in 2021 in the global pharmaceutical packaging market due to their increasing demand in secondary and tertiary packaging, low cost, and increasing focus on recyclable and eco-friendly materials. Demand for paper-based packaging, both corrugated and folding cartons, has been rising across Europe during the last few years owing to its largest pharmaceutical market and the largest exporter of pharmaceuticals. WestRock Company is one of the leading manufacturers of paper-based packaging.

- Plastics held the third largest share in 2021 in the pharmaceutical packaging market by material segmentation. It is expected to grow at the highest CAGR of 4.94% from 2022-2027, powered due its growing demand in all three packaging types. In addition, plastics are widely used in packaging because of their versatility, flexibility, and cost-effectiveness. However, due to its non-decomposable properties and its ban for use because of its environmental issues as it produces a high quantity of greenhouse gases has banned its use in several countries. As a result, recyclable plastics are in high demand. The most widely used-recyclable plastics in pharmaceutical packaging include PET, HDPE, and PP, among which PET is the most commonly recycled plastic worldwide, followed by HDPE. Several governments and companies are developing initiatives to use recycled plastics as packaging material for pharmaceutical medicines and supplies.

Segmentation by Material

- Paper

- Glass

- Plastic

- Others

INSIGHTS FROM END-USER SEGMENTATION

Pharmaceutical companies account for the highest market share of 48.18% in the global pharmaceutical packaging market by end-user segment. It is expected to grow at the highest CAGR of 5.10% during the forecast period. The highest revenue share of pharma companies is because pharmaceutical companies are the primary source for the pharmaceutical packaging market. As the demand for pharmaceuticals continues to grow, the need for packaging has also increased significantly.Segmentation by End-User

- Pharmaceutical Companies

- CMO/ CDMO

- Plastic

GEOGRAPHICAL ANALYSIS

North America accounts for 36% of the global pharmaceutical packaging market share. The growing pharmaceutical sales in North America are the major driving factor for the pharmaceutical packaging market in the region. North America, in particular the US, will continue to be the largest pharma packaging market long term due to the advanced drug-producing sector. The US market is expected to maintain moderate growth due to the increasing aging population, robust innovations, and increasing consumer demand for sophisticated packaging.Emerging markets such as Brazil, China, and India are anticipated to grow at the fastest rate, which can be attributed to their large population and demographic factors such as a growing young population and longer life expectancy. APAC is estimated to show the highest growth of 5.01% during the forecast period. The pharmaceutical industry is booming, especially in developing countries such as China, India, and Brazil, as well as in developed countries such as the US, UK, and Germany. According to the India Brand Equity Foundation (IBEF), India is the largest provider of generic drugs globally. At the same time, the Indian pharmaceutical sector supplies around 50% of the global demand for several vaccines, 40% demand for generic drugs in the US, and 25% of all tablets in the UK.

Segmentation by Geography

- North America

- US

- Canada

- Europe

- Germany

- Italy

- Spain

- France

- UK

- APAC

- Japan

- China

- South Korea

- India

- Australia

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East & Africa

- Turkey

- Saudi Arabia

- South Africa

VENDORS LANDSCAPE

The global pharmaceutical packaging market is highly dynamic and competitive, with several international, regional, and local vendors offering a diverse and comprehensive range of pharmaceutical packaging products with wide applications. The key players in the industry are Berry Global, Amcor, Gerresheimer, WestRock, and AptarGroup.The industry also has the presence of prominent players, some of which include ACG, Airnov, Borosil, CCL Industries, and Drug Plastics Group.Key Vendors

- Amcor

- Aptar Group

- Berry Global

- Gerresheimer

- WestRock

Other Prominent Vendors

- ACG

- Airnov

- AVI Global Plast

- BD

- Bilcare

- Borosil

- CCL Industries

- Coesia

- Drug Plastics Group

- DWK Life Sciences

- LOG

- Meghmani Group

- Neelam Global

- Nolato

- Nemera

- PolyCine

- RENOLIT

- Schur Flexibles Holding

- Specialty Polyfilms

- SGD Pharma

- SCHOTT

- Sippex IV bags

- SUPER OLEFINS

- West Pharmaceutical Services

- Wihuri Group

Vendors' Activities In The Pharmaceutical Packaging Market Include:

- Expansion activities are helping the vendors to improve their global distribution networks, allowing the players to explore untapped opportunities.

- Large-scale investments and funding in the pharmaceutical packaging market are seen through varied conglomerates and investment firms.

A Diverse Range of Pharmaceutical Packaging Products Offered In The Industry

- A surge in technological innovations in pharmaceutical packaging and several new product launches can be witnessed in the pharmaceutical packaging market. For instance, on October 27, 2021, Amcor launched its dual-chamber pouch for drug-device combination product packaging in Europe.

- Global players are projected to increase their footprint in the pharmaceutical packaging market, especially in terms of features and price.

- Companies with a strong footprint in the developed nations are strategically expanding their business in low- and middle-income countries (LMIC), which can be attributed to the growing aging population and chronic diseases in those countries.

KEY QUESTIONS ANSWERED

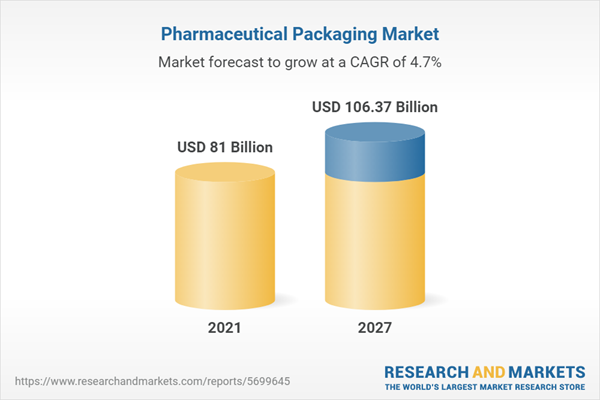

1. How big is the pharmaceutical packaging market?2. What is the growth rate of the global pharmaceutical packaging market?

3. Who are the key players in the global pharmaceutical packaging market?

4. Which region will dominate the global pharmaceutical packaging market?

5. What are the factors driving the pharmaceutical packaging market?

Table of Contents

Companies Mentioned

- Amcor

- Aptar Group

- Berry Global

- Gerresheimer

- WestRock

- ACG

- Airnov

- AVI Global Plast

- BD

- Bilcare

- Borosil

- CCL Industries

- Coesia

- Drug Plastics Group

- DWK Life Sciences

- LOG

- Meghmani Group

- Neelam Global

- Nolato

- Nemera

- PolyCine

- RENOLIT

- Schur Flexibles Holding

- Specialty Polyfilms

- SGD Pharma

- SCHOTT

- Sippex IV bags

- SUPER OLEFINS

- West Pharmaceutical Services

- Wihuri Group

Methodology

Our research comprises a mix of primary and secondary research. The secondary research sources that are typically referred to include, but are not limited to, company websites, annual reports, financial reports, company pipeline charts, broker reports, investor presentations and SEC filings, journals and conferences, internal proprietary databases, news articles, press releases, and webcasts specific to the companies operating in any given market.

Primary research involves email interactions with the industry participants across major geographies. The participants who typically take part in such a process include, but are not limited to, CEOs, VPs, business development managers, market intelligence managers, and national sales managers. We primarily rely on internal research work and internal databases that we have populated over the years. We cross-verify our secondary research findings with the primary respondents participating in the study.

LOADING...

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 335 |

| Published | December 2022 |

| Forecast Period | 2021 - 2027 |

| Estimated Market Value ( USD | $ 81 Billion |

| Forecasted Market Value ( USD | $ 106.37 Billion |

| Compound Annual Growth Rate | 4.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 30 |