At present, the refurbished medical equipment market is growing steadily due to its affordability, practicality, and increasing acceptance in the healthcare industry. As hospitals and clinics are facing budget constraints, especially in developing regions, they are turning to refurbished devices to access essential diagnostic and treatment tools at lower costs. These machines offer reliable performance when restored to original standards, making them a smart alternative to expensive new equipment. Small and mid-sized healthcare facilities benefit greatly, enabling them to expand services without heavy financial investment. Refurbished equipment is also employed for training, research, and backup purposes. The growing awareness about sustainable practices is further driving the demand, as refurbishing reduces electronic waste and promotes reuse.

The United States has emerged as a major region in the refurbished medical equipment market owing to many factors. Rising healthcare costs, increased demand for affordable solutions, and expanding access to quality care are offering a favorable refurbished medical equipment market outlook. Hospitals, clinics, and diagnostic centers are seeking economical alternatives to new devices without compromising performance and reliability. Refurbished equipment provides a practical solution, especially for facilities with limited budgets or those in rural areas. The growing number of outpatient centers and private practices is also driving the demand for used but certified medical devices. In March 2025, Kaiser Permanente upgraded its Sunnyside Medical Center in Clackamas, US, by building a new, cutting-edge private hospital tower. The new facility, covering 615,000 square feet, would incorporate state-of-the-art technology, increased service capabilities, and contemporary patient features, such as fully private patient rooms. Apart from this, technological advancements in refurbishment processes are improving the safety, functionality, and lifespan of refurbished products, boosting confidence among healthcare providers.

Refurbished Medical Equipment Market Trends:

Growing incidence of critical ailments

Rising incidence of critical ailments is creating the need for timely diagnosis, monitoring, and treatment across healthcare settings. The World Health Organization (WHO) reported that around 20 Million new cancer cases were documented in 2022, leading to 9.7 Million fatalities. Cardiovascular diseases ranked as the top cause of death globally, accounting for roughly 17.9 Million fatalities annually. Diseases, such as cancer, cardiovascular disorders, and neurological conditions, require advanced medical devices like imaging systems, ventilators, infusion pumps, and surgical equipment. As more patients require frequent and specialized care, healthcare providers must expand their infrastructure and capabilities. Refurbished equipment offers an affordable and efficient way to meet this growing demand, especially for hospitals and clinics facing financial constraints. These devices help maintain care quality while reducing capital expenses. In both urban and rural areas, refurbished tools allow medical facilities to handle higher patient volumes and improve service delivery.Rising privatization of healthcare sector

Increasing privatization of the healthcare sector is among the major refurbished medical equipment market trends. The private healthcare market in India reached USD 116.4 Billion in 2024 and is set to grow at a CAGR of 5.4% during 2025-2033, according to a report published by the publisher. As more private hospitals, diagnostic centers, and specialty clinics are entering the healthcare space, they are seeking affordable, reliable equipment to set up and expand operations quickly. Refurbished medical devices offer a practical choice, enabling new entrants to manage capital expenditures while ensuring access to advanced technology. Private players are also facing competitive pressure to provide high-quality care without excessive costs, making refurbished systems an attractive alternative to expensive new equipment. These facilities often operate in underserved regions, where affordability and quick availability are critical. Refurbished equipment allows them to meet patient requirements, maintain service quality, and allocate resources more efficiently.Increasing geriatric population

Rising geriatric population is fueling the refurbished medical equipment market growth. According to the WHO, by 2050, the population of individuals aged 60 years and above is set to hit 2.1 Billion. The count of people aged 80 and above is expected to increase threefold from 2020 to 2050, totaling 426 Million. Older adults are more prone to chronic ailments, such as arthritis and respiratory issues, which require frequent medical evaluations and long-term care. Healthcare facilities need to expand their equipment inventory to meet the growing needs of aging patients, often while working within budget constraints. Refurbished medical devices offer a practical and affordable solution, allowing providers to maintain high service levels without heavy financial investment. Equipment like imaging systems, patient monitors, and mobility aids are in constant demand among elderly patients, making refurbished options especially valuable.Refurbished Medical Equipment Industry Segmentation:

The publisher provides an analysis of the key trends in each segment of the global refurbished medical equipment market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product type, application, and end-user.Analysis by Product Type:

- Medical Imaging Systems

- Computed Tomography Systems

- MRI Systems

- X-ray, C-arm and Radiography Equipment

- Ultrasound Systems

- Mammography Equipment

- Nuclear Medicine Devices

- Others

- Operating Equipment and Surgical Devices

- Anesthesia Machines and Agent Monitors

- Endoscopes and Microscopes

- Vascular Closure Devices

- Electrosurgical Units

- Altherectomy Devices

- Others

- Others

- Patient Monitoring Devices

- Defibrillators

- Coagulation Analyzers

- Neurology Equipment

- Endoscopy Equipment

- Others

Analysis by Application:

- Diagnostic Imaging Systems

- Minimally Invasive Devices

- Biotechnology Instruments

- Others

Analysis by End-User:

- Hospitals and Clinics

- Diagnostic Centres

- Ambulatory Surgical Centres

- Others

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Key Regional Takeaways:

United States Refurbished Medical Equipment Market Analysis

The United States holds 85.80% of the market share in North America. The market is significantly driven by cost containment within healthcare systems. With the increasing financial pressures on hospitals and healthcare providers due to high operational costs and insurance reimbursements, refurbished devices offer a viable solution for maintaining budgets while still delivering quality healthcare. According to the AHA, in 2024 alone, total hospital expenditure grew 5.1% in the United States. Additionally, regulatory compliance is a major factor, as refurbished medical devices must adhere to strict FDA standards, which assure healthcare providers that these devices are safe and effective. Another critical driver is supply chain disruptions, which have been prevalent, making refurbished equipment a necessary alternative when there is a scarcity of new devices. Furthermore, environmental concerns related to e-waste disposal are leading healthcare providers towards more sustainable solutions, and refurbished medical equipment is seen as a way to contribute to sustainability by minimizing waste and promoting the reuse of materials.Europe Refurbished Medical Equipment Market Analysis

In Europe, the growth of the market is largely fueled by several converging trends focused on cost efficiency, sustainability, and healthcare accessibility. Hospitals, private clinics, and diagnostic centers are increasingly constrained by budget limitations and rising healthcare spending, motivating them to explore high-quality refurbished imaging devices, patient monitors, defibrillators, and surgical tools as affordable alternatives to new units. According to reports, in 2022, the average expenditure on healthcare in the European Union was €3,685 per person, marking a 38.6% increase from €2,658 in 2014. Luxembourg exhibited the highest average expenditure, at €6,590 for each resident. Moreover, public procurement policies in numerous EU countries are actively encouraging circular economy principles, prioritizing reuse and refurbishment when feasible. This aligns with sustainable healthcare mandates aimed at reducing waste and carbon footprints. Additionally, digital platforms and specialist refurbishers are streamlining equipment sourcing, certification, maintenance, and parts supply, improving asset lifecycle transparency. Academic institutions, teaching hospitals, and training centers are also relying on refurbished technology for education and simulation, maximizing limited resources.Asia-Pacific Refurbished Medical Equipment Market Analysis

In the Asia-Pacific region, the growing demand for affordable healthcare is a major driver of the refurbished medical equipment market. As healthcare needs continue to rise due to rapidly expanding populations and an increasing burden of chronic diseases, the affordability of new medical equipment remains a significant challenge, especially in developing regions like India, China, and Southeast Asia. According to the Asian Development Bank, in 2024, over 20 nations in the area faced a 20% or greater risk of premature deaths from chronic illnesses. These included India, Indonesia, and the Philippines. Certain Pacific countries had rates that nearly reached or surpassed 40%. Refurbished devices offer an affordable alternative to new equipment, enabling healthcare providers to meet this demand without exceeding budgets. Furthermore, government support in various countries in the region, such as India and Indonesia, is promoting the utilization of refurbished medical devices as part of efforts to improve access to healthcare. Many government agencies in these countries are incentivizing the use of refurbished equipment in public health systems, particularly in rural areas where new equipment may be unaffordable or unavailable.Latin America Refurbished Medical Equipment Market Analysis

In Latin America, one of the most significant drivers for the refurbished medical equipment market is economic constraints. With many countries in the region facing economic challenges, healthcare systems are under pressure to provide services with limited budgets. Refurbished medical devices offer a more affordable option for hospitals and clinics to equip themselves with the necessary tools without exceeding their financial capabilities. Additionally, increased healthcare access due to the rise in chronic diseases and the growing elderly population in countries like Brazil and Mexico is catalyzing higher demand for medical equipment. In 2022, over 78,000 women received a cervical cancer diagnosis, and over 40,000 passed away due to the illness in the Americas region. Refurbished devices help fill the gap between the rising healthcare needs and the available budget for equipment. Another important driver is the scarcity of new equipment in certain areas, particularly in rural and remote regions, where new medical devices may not be easily accessible or affordable.Middle East and Africa Refurbished Medical Equipment Market Analysis

In the Middle East and Africa region, the market is significantly influenced by the increasing demand for healthcare services due to population growth and limited access to advanced medical technologies in several countries. Numerous smaller hospitals and clinics across the region are opting for refurbished equipment to expand service offerings without overstretching budgets. The rising number of private healthcare investors and startups is also creating a market for affordable, functional equipment that enables rapid setup of diagnostic centers and specialized facilities. For instance, the Saudi Arabian government intended to boost private sector investments in healthcare from 25% to 35% of total healthcare spending as part of the Vision 2030 initiative, as reported by the Foundation for Research on Equal Opportunity (FREOPP). The growing emphasis on sustainability and reduction of electronic waste (e-waste) is also supporting the use of refurbished machines.Competitive Landscape:

Key players are investing in advanced refurbishment processes that restore used devices to near-original condition, meeting strict performance and safety standards. They are offering certification, warranties, and after-sales support, which builds confidence among hospitals and clinics. Key players also help expand market access by supplying refurbished equipment to underserved and cost-sensitive regions. Their strong distribution networks and partnerships with healthcare providers ensure timely delivery and service. Many large manufacturers include refurbishment divisions, promoting sustainability and extending product life cycles. By providing training, maintenance, and customization services, these companies are adding value to their offerings. Their efforts are not only making medical technology more affordable but also ensuring that quality healthcare reaches a broader population, supporting steady market growth. For instance, in March 2025, Green Pulse revealed plans for an auction of pre-owned medical devices. This auction represented a significant achievement in the company's efforts to promote sustainable practices in healthcare by redistributing medical devices that would otherwise remain unused.The report provides a comprehensive analysis of the competitive landscape in the refurbished medical equipment market with detailed profiles of all major companies, including:

- Philips Electronics Nederland B.V.

- Block Imaging

- EverX Pty Ltd.

- The General Electric Company

- Integrity Medical Systems, Inc.

- Radiology Oncology Systems

- Rad Medical Associates

- Siemens Healthineers AG

- Soma Technology Inc.

Key Questions Answered in This Report

1. How big is the refurbished medical equipment market?2. What is the future outlook of refurbished medical equipment market?

3. What are the key factors driving the refurbished medical equipment market?

4. Which region accounts for the largest refurbished medical equipment market share?

5. Which are the leading companies in the global refurbished medical equipment market?

Table of Contents

1 Preface2 Scope and Methodology

2.1 Objectives of the Study

2.2 Stakeholders

2.3 Data Sources

2.3.1 Primary Sources

2.3.2 Secondary Sources

2.4 Market Estimation

2.4.1 Bottom-Up Approach

2.4.2 Top-Down Approach

2.5 Forecasting Methodology

3 Executive Summary

4 Introduction

4.1 Overview

4.2 Key Industry Trends

5 Global Refurbished Medical Equipment Market

5.1 Market Overview

5.2 Market Performance

5.3 Impact of COVID-19

5.4 Market Forecast

6 Market Breakup by Product Type

6.1 Medical Imaging Systems

6.1.1 Market Trends

6.1.2 Market Breakup by Type

6.1.2.1 Computed Tomography Systems

6.1.2.2 MRI Systems

6.1.2.3 X-ray, C-arm & Radiography Equipment

6.1.2.4 Ultrasound Systems

6.1.2.5 Mammography Equipment

6.1.2.6 Nuclear Medicine Devices

6.1.2.7 Others

6.1.3 Market Forecast

6.2 Operating Equipment and Surgical Devices

6.2.1 Market Trends

6.2.2 Major Types

6.2.2.1 Anesthesia Machines and Agent Monitors

6.2.2.2 Endoscopes and Microscopes

6.2.2.3 Vascular Closure Devices

6.2.2.4 Electrosurgical Units

6.2.2.5 Altherectomy Devices

6.2.2.6 Others

6.2.3 Market Forecast

6.3 Others

6.3.1 Market Trends

6.3.2 Major Types

6.3.2.1 Patient Monitoring Devices

6.3.2.2 Defibrillators

6.3.2.3 Coagulation Analyzers

6.3.2.4 Neurology Equipment

6.3.2.5 Endoscopy Equipment

6.3.2.6 Others

6.3.3 Market Forecast

7 Market Breakup by Application

7.1 Diagnostic Imaging Systems

7.1.1 Market Trends

7.1.2 Market Forecast

7.2 Minimally Invasive Devices

7.2.1 Market Trends

7.2.2 Market Forecast

7.3 Biotechnology Instruments

7.3.1 Market Trends

7.3.2 Market Forecast

7.4 Others

7.4.1 Market Trends

7.4.2 Market Forecast

8 Market Breakup by End-User

8.1 Hospitals and Clinics

8.1.1 Market Trends

8.1.2 Market Forecast

8.2 Diagnostic Centres

8.2.1 Market Trends

8.2.2 Market Forecast

8.3 Ambulatory Surgical Centres

8.3.1 Market Trends

8.3.2 Market Forecast

8.4 Others

8.4.1 Market Trends

8.4.2 Market Forecast

9 Market Breakup by Region

9.1 North America

9.1.1 United States

9.1.1.1 Market Trends

9.1.1.2 Market Forecast

9.1.2 Canada

9.1.2.1 Market Trends

9.1.2.2 Market Forecast

9.2 Asia Pacific

9.2.1 China

9.2.1.1 Market Trends

9.2.1.2 Market Forecast

9.2.2 Japan

9.2.2.1 Market Trends

9.2.2.2 Market Forecast

9.2.3 India

9.2.3.1 Market Trends

9.2.3.2 Market Forecast

9.2.4 South Korea

9.2.4.1 Market Trends

9.2.4.2 Market Forecast

9.2.5 Australia

9.2.5.1 Market Trends

9.2.5.2 Market Forecast

9.2.6 Indonesia

9.2.6.1 Market Trends

9.2.6.2 Market Forecast

9.2.7 Others

9.2.7.1 Market Trends

9.2.7.2 Market Forecast

9.3 Europe

9.3.1 Germany

9.3.1.1 Market Trends

9.3.1.2 Market Forecast

9.3.2 France

9.3.2.1 Market Trends

9.3.2.2 Market Forecast

9.3.3 United Kingdom

9.3.3.1 Market Trends

9.3.3.2 Market Forecast

9.3.4 Italy

9.3.4.1 Market Trends

9.3.4.2 Market Forecast

9.3.5 Spain

9.3.5.1 Market Trends

9.3.5.2 Market Forecast

9.3.6 Russia

9.3.6.1 Market Trends

9.3.6.2 Market Forecast

9.3.7 Others

9.3.7.1 Market Trends

9.3.7.2 Market Forecast

9.4 Latin America

9.4.1 Brazil

9.4.1.1 Market Trends

9.4.1.2 Market Forecast

9.4.2 Mexico

9.4.2.1 Market Trends

9.4.2.2 Market Forecast

9.4.3 Others

9.4.3.1 Market Trends

9.4.3.2 Market Forecast

9.5 Middle East and Africa

9.5.1 Market Trends

9.5.2 Market Breakup by Country

9.5.3 Market Forecast

10 SWOT Analysis

10.1 Overview

10.2 Strengths

10.3 Weaknesses

10.4 Opportunities

10.5 Threats

11 Value Chain Analysis

12 Porters Five Forces Analysis

12.1 Overview

12.2 Bargaining Power of Buyers

12.3 Bargaining Power of Suppliers

12.4 Degree of Competition

12.5 Threat of New Entrants

12.6 Threat of Substitutes

13 Price Analysis

14 Competitive Landscape

14.1 Market Structure

14.2 Key Players

14.3 Profiles of Key Players

14.3.1 Philips Electronics Nederland B.V.

14.3.1.1 Company Overview

14.3.1.2 Product Portfolio

14.3.1.3 Financials

14.3.2 Block Imaging

14.3.2.1 Company Overview

14.3.2.2 Product Portfolio

14.3.3 Everx Pty Ltd.

14.3.3.1 Company Overview

14.3.3.2 Product Portfolio

14.3.4 The General Electric Company

14.3.4.1 Company Overview

14.3.4.2 Product Portfolio

14.3.5 Integrity Medical Systems, Inc.

14.3.5.1 Company Overview

14.3.5.2 Product Portfolio

14.3.6 Radiology Oncology Systems

14.3.6.1 Company Overview

14.3.6.2 Product Portfolio

14.3.7 Rad Medical Associates

14.3.7.1 Company Overview

14.3.7.2 Product Portfolio

14.3.8 Siemens Healthineers AG

14.3.8.1 Company Overview

14.3.8.2 Product Portfolio

14.3.8.3 Financials

14.3.9 Soma Technology Inc.

14.3.9.1 Company Overview

14.3.9.2 Product Portfolio

List of Figures

Figure 1: Global: Refurbished Medical Equipment Market: Major Drivers and Challenges

Figure 2: Global: Refurbished Medical Equipment Market: Sales Value (in Billion USD), 2019-2024

Figure 3: Global: Refurbished Medical Equipment Market: Breakup by Product Type (in %), 2024

Figure 4: Global: Refurbished Medical Equipment Market: Breakup by Application (in %), 2024

Figure 5: Global: Refurbished Medical Equipment Market: Breakup by End-User (in %), 2024

Figure 6: Global: Refurbished Medical Equipment Market: Breakup by Region (in %), 2024

Figure 7: Global: Refurbished Medical Equipment Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 8: Global: Refurbished Medical Equipment (Medical Imaging Systems) Market: Sales Value (in Million USD), 2019 & 2024

Figure 9: Global: Refurbished Medical Equipment (Medical Imaging Systems) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 10: Global: Refurbished Medical Equipment (Computed Tomography Systems) Market: Sales Value (in Million USD), 2019 & 2024

Figure 11: Global: Refurbished Medical Equipment (Computed Tomography Systems) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 12: Global: Refurbished Medical Equipment (MRI Systems) Market: Sales Value (in Million USD), 2019 & 2024

Figure 13: Global: Refurbished Medical Equipment (MRI Systems) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 14: Global: Refurbished Medical Equipment (X-ray, C-arm & Radiography Equipment) Market: Sales Value (in Million USD), 2019 & 2024

Figure 15: Global: Refurbished Medical Equipment (X-ray, C-arm & Radiography Equipment) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 16: Global: Refurbished Medical Equipment (Ultrasound Systems) Market: Sales Value (in Million USD), 2019 & 2024

Figure 17: Global: Refurbished Medical Equipment (Ultrasound Systems) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 18: Global: Refurbished Medical Equipment (Mammography Equipment) Market: Sales Value (in Million USD), 2019 & 2024

Figure 19: Global: Refurbished Medical Equipment (Mammography Equipment) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 20: Global: Refurbished Medical Equipment (Nuclear Medicine Devices) Market: Sales Value (in Million USD), 2019 & 2024

Figure 21: Global: Refurbished Medical Equipment (Nuclear Medicine Devices) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 22: Global: Refurbished Medical Equipment (Others) Market: Sales Value (in Million USD), 2019 & 2024

Figure 23: Global: Refurbished Medical Equipment (Others) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 24: Global: Refurbished Medical Equipment (Operating Equipment and Surgical Devices) Market: Sales Value (in Million USD), 2019 & 2024

Figure 25: Global: Refurbished Medical Equipment (Operating Equipment and Surgical Devices) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 26: Global: Refurbished Medical Equipment (Others) Market: Sales Value (in Million USD), 2019 & 2024

Figure 27: Global: Refurbished Medical Equipment (Others) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 28: Global: Refurbished Medical Equipment (Diagnostic Imaging Systems) Market: Sales Value (in Million USD), 2019 & 2024

Figure 29: Global: Refurbished Medical Equipment (Diagnostic Imaging Systems) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 30: Global: Refurbished Medical Equipment (Minimally Invasive Devices) Market: Sales Value (in Million USD), 2019 & 2024

Figure 31: Global: Refurbished Medical Equipment (Minimally Invasive Devices) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 32: Global: Refurbished Medical Equipment (Biotechnology Instruments) Market: Sales Value (in Million USD), 2019 & 2024

Figure 33: Global: Refurbished Medical Equipment (Biotechnology Instruments) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 34: Global: Refurbished Medical Equipment (Others) Market: Sales Value (in Million USD), 2019 & 2024

Figure 35: Global: Refurbished Medical Equipment (Others) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 36: Global: Refurbished Medical Equipment (Hospitals and Clinics) Market: Sales Value (in Million USD), 2019 & 2024

Figure 37: Global: Refurbished Medical Equipment (Hospitals and Clinics) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 38: Global: Refurbished Medical Equipment (Diagnostic Centres) Market: Sales Value (in Million USD), 2019 & 2024

Figure 39: Global: Refurbished Medical Equipment (Diagnostic Centres) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 40: Global: Refurbished Medical Equipment (Ambulatory Surgical Centres) Market: Sales Value (in Million USD), 2019 & 2024

Figure 41: Global: Refurbished Medical Equipment (Ambulatory Surgical Centres) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 42: Global: Refurbished Medical Equipment (Others) Market: Sales Value (in Million USD), 2019 & 2024

Figure 43: Global: Refurbished Medical Equipment (Others) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 44: North America: Refurbished Medical Equipment Market: Sales Value (in Million USD), 2019 & 2024

Figure 45: North America: Refurbished Medical Equipment Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 46: United States: Refurbished Medical Equipment Market: Sales Value (in Million USD), 2019 & 2024

Figure 47: United States: Refurbished Medical Equipment Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 48: Canada: Refurbished Medical Equipment Market: Sales Value (in Million USD), 2019 & 2024

Figure 49: Canada: Refurbished Medical Equipment Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 50: Asia Pacific: Refurbished Medical Equipment Market: Sales Value (in Million USD), 2019 & 2024

Figure 51: Asia Pacific: Refurbished Medical Equipment Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 52: China: Refurbished Medical Equipment Market: Sales Value (in Million USD), 2019 & 2024

Figure 53: China: Refurbished Medical Equipment Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 54: Japan: Refurbished Medical Equipment Market: Sales Value (in Million USD), 2019 & 2024

Figure 55: Japan: Refurbished Medical Equipment Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 56: India: Refurbished Medical Equipment Market: Sales Value (in Million USD), 2019 & 2024

Figure 57: India: Refurbished Medical Equipment Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 58: South Korea: Refurbished Medical Equipment Market: Sales Value (in Million USD), 2019 & 2024

Figure 59: South Korea: Refurbished Medical Equipment Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 60: Australia: Refurbished Medical Equipment Market: Sales Value (in Million USD), 2019 & 2024

Figure 61: Australia: Refurbished Medical Equipment Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 62: Indonesia: Refurbished Medical Equipment Market: Sales Value (in Million USD), 2019 & 2024

Figure 63: Indonesia: Refurbished Medical Equipment Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 64: Others: Refurbished Medical Equipment Market: Sales Value (in Million USD), 2019 & 2024

Figure 65: Others: Refurbished Medical Equipment Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 66: Europe: Refurbished Medical Equipment Market: Sales Value (in Million USD), 2019 & 2024

Figure 67: Europe: Refurbished Medical Equipment Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 68: Germany: Refurbished Medical Equipment Market: Sales Value (in Million USD), 2019 & 2024

Figure 69: Germany: Refurbished Medical Equipment Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 70: France: Refurbished Medical Equipment Market: Sales Value (in Million USD), 2019 & 2024

Figure 71: France: Refurbished Medical Equipment Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 72: United Kingdom: Refurbished Medical Equipment Market: Sales Value (in Million USD), 2019 & 2024

Figure 73: United Kingdom: Refurbished Medical Equipment Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 74: Italy: Refurbished Medical Equipment Market: Sales Value (in Million USD), 2019 & 2024

Figure 75: Italy: Refurbished Medical Equipment Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 76: Spain: Refurbished Medical Equipment Market: Sales Value (in Million USD), 2019 & 2024

Figure 77: Spain: Refurbished Medical Equipment Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 78: Russia: Refurbished Medical Equipment Market: Sales Value (in Million USD), 2019 & 2024

Figure 79: Russia: Refurbished Medical Equipment Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 80: Others: Refurbished Medical Equipment Market: Sales Value (in Million USD), 2019 & 2024

Figure 81: Others: Refurbished Medical Equipment Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 82: Latin America: Refurbished Medical Equipment Market: Sales Value (in Million USD), 2019 & 2024

Figure 83: Latin America: Refurbished Medical Equipment Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 84: Brazil: Refurbished Medical Equipment Market: Sales Value (in Million USD), 2019 & 2024

Figure 85: Brazil: Refurbished Medical Equipment Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 86: Mexico: Refurbished Medical Equipment Market: Sales Value (in Million USD), 2019 & 2024

Figure 87: Mexico: Refurbished Medical Equipment Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 88: Others: Refurbished Medical Equipment Market: Sales Value (in Million USD), 2019 & 2024

Figure 89: Others: Refurbished Medical Equipment Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 90: Middle East and Africa: Refurbished Medical Equipment Market: Sales Value (in Million USD), 2019 & 2024

Figure 91: Middle East and Africa: Refurbished Medical Equipment Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 92: Global: Refurbished Medical Equipment Industry: SWOT Analysis

Figure 93: Global: Refurbished Medical Equipment Industry: Value Chain Analysis

Figure 94: Global: Refurbished Medical Equipment Industry: Porter’s Five Forces Analysis

List of Tables

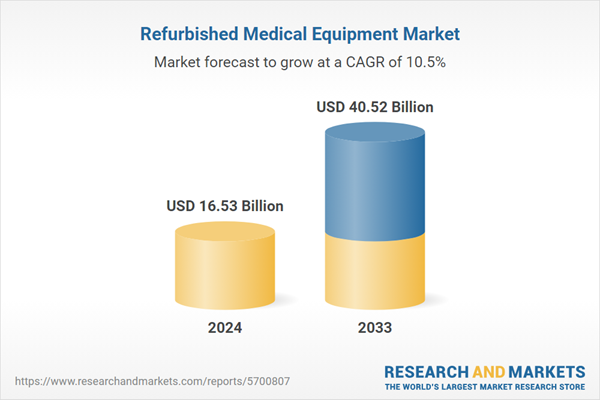

Table 1: Global: Refurbished Medical Equipment Market: Key Industry Highlights, 2024 and 2033

Table 2: Global: Refurbished Medical Equipment Market Forecast: Breakup by Product Type (in Million USD), 2025-2033

Table 3: Global: Refurbished Medical Equipment Market Forecast: Breakup by Application (in Million USD), 2025-2033

Table 4: Global: Refurbished Medical Equipment Market Forecast: Breakup by End-User (in Million USD), 2025-2033

Table 5: Global: Refurbished Medical Equipment Market Forecast: Breakup by Region (in Million USD), 2025-2033

Table 6: Global: Refurbished Medical Equipment Market: Competitive Structure

Table 7: Global: Refurbished Medical Equipment Market: Key Players

Companies Mentioned

- Philips Electronics Nederland B.V.

- Block Imaging

- EverX Pty Ltd

- The General Electric Company

- Integrity Medical Systems Inc.

- Radiology Oncology Systems Inc.

- Rad Medical Associates

- Siemens Healthineers AG

- Soma Technology Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 144 |

| Published | August 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 16.53 Billion |

| Forecasted Market Value ( USD | $ 40.52 Billion |

| Compound Annual Growth Rate | 10.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 9 |