The global bioprocess validation market demand is experiencing significant growth, primarily driven by the increasing production of biopharmaceuticals. In 2023, the European Medicines Agency (EMA) approved 77 medicines for human use, with 39 containing a novel active substance, reflecting a strong biopharmaceutical development pipeline. This upward trend is expected to continue into 2024 and 2025, with numerous biologics and biosimilars anticipated to receive approval.

The expansion of biopharmaceutical production further amplifies the demand for rigorous bioprocess validation, which ensures the quality, safety, and efficacy of these therapeutics. Process validation, analytical method validation, and cleaning validation are becoming essential components of compliance frameworks, particularly as manufacturing processes grow more sophisticated with the adoption of continuous bioprocessing, single-use technologies, and automation.

The bioprocess validation market share in the United States is recording clear growth from various aspects, holding 88.90% market share. In particular, the US FDA has issued stringent regulations for any manufacture of biopharmaceuticals, which demand for extensive validation to ascertain product safety, efficacy, and approval in the market. Later on, in January 2025, an updated guidance by the FDA was released, in which bioanalytical method validation for biomarkers has been recognized as a stringent need with established protocols during troubleshooting and development of drugs.

Also, yet the FDA's Office of Biostatistics plays to the great role of developing an analysis to consider the safety and efficacy of any medications in biopharmaceutical pre-market reviews, ever the whole of verifying sound evidence of the validations undertaken extensively is encouraged. Such regulatory strides, combined with the growing complexity of the biopharmaceutical products, will increase the demand for advanced bioprocess validation services in the United States.

Bioprocess Validation Market Trends:

Stringent Regulatory Requirements

In recent years, regulatory agencies have intensified their focus on process validation to ensure the safety and efficacy of biopharmaceuticals. In January 2025, the U.S. Food and Drug Administration (FDA) released the "Bioanalytical Method Validation for Biomarkers" guidance, providing detailed recommendations for validating bioanalytical methods used in drug development.Similarly, the European Medicines Agency (EMA) has emphasized process validation in its guidelines, underscoring the necessity for comprehensive validation data in regulatory submissions. These stringent regulatory requirements compel biopharmaceutical companies to invest significantly in validation processes, thereby driving the global bioprocess validation market growth.

Technological Advancements

In 2024 and 2025, technological advancements have significantly bolstered the global bioprocess validation market. Governments worldwide have released several guidelines, which underscores the need for advanced validation techniques in bioprocessing. Additionally, the International Council for Harmonisation (ICH) introduced the M10 guideline on bioanalytical method validation, which has been adopted by regulatory bodies like the European Medicines Agency (EMA). This guideline provides a framework for validating bioanalytical assays, promoting the adoption of innovative technologies in bioprocess validation.Additionally, the FDA's adoption of the first edition of ISO 17665 in March 2024, which establishes guidelines for developing, validating, and controlling medical device sterilization processes, underscores its dedication to enhancing sterilization validation techniques in bioprocessing. These regulatory developments highlight the increasing reliance on cutting-edge technologies to ensure the efficacy and safety of biopharmaceutical products.

Growth in Contract Manufacturing Organizations (CMOs)

The expansion of Contract Development and Manufacturing Organizations (CDMOs) significantly influences the global bioprocess validation market. Over the past decade, CDMOs have been pivotal in the biopharmaceutical sector, contributing to the development of over 80% of New Molecular Entities (NMEs) approved by the FDA and EMA. Since 2017, they have produced more than 55% of NMEs, including critical vaccines and treatments.

Currently, CDMOs manufacture approximately 40% of all drug doses, vaccines, and over-the-counter products distributed in Western markets. This substantial involvement underscores the growing reliance on CDMOs for efficient and compliant bioprocesses, thereby driving the demand for comprehensive validation services to ensure product quality and regulatory adherence.

Bioprocess Validation Industry Segmentation:

The research provides an analysis of the key trends in each segment of the global bioprocess validation market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on test type, process component, and end user.Analysis by Test Type:

- Extractables Testing Services

- Microbiological Testing Services

- Physiochemical Testing Services

- Integrity Testing Services

- Compatibility Testing Services

- Others

These intricate procedures ensure compliance with GMPs and lower the risk of possible side effects for patients. Thanks to the ever-complicated nature of biopharmaceuticals and the burgeoning popularity of single-use systems in manufacturing, demand for extractables testing services is on the rise, and this has consequently solidified their position at the forefront of the market.

Analysis by Process Component:

- Filter Elements

- Media Containers and Bags

- Freezing And Thawing Process Bags

- Mixing Systems

- Bioreactors

- Transfer Systems

- Others

Membrane filters, depth filters, and sterile filters are among the most commonly used filter elements in bioprocessing. Any removed contending into cell culture media, buffer, or a final drug product can guarantee its integrity. The emergence of single-use filtration systems is also in demand owing to their economy on the material used, reduced risk of cross-contamination, and convenience of use under GMP conditions.

Analysis by End User:

- Pharmaceutical and Biotechnology Companies

- Contract Development and Manufacturing Organizations

- Others

FDA, EMA, and ICH operate under very stringent regulations, requiring biopharmaceutical companies to validate processes-protocols-from upstream fermentation processes to downstream purification-in order to produce reliable products. Any change in the affiliated process parameters will affect the product's consistency, which in turn increases emphasis on validation during drug manufacturing. Advances in single-use bioprocessing systems, automation, and digital biomanufacturing are giving rise to the use of new analytical tools that enable process validation through real-time monitoring.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Other factors benefiting North America include an established biopharmaceutical industry, where several big players are investing in new biologics, biosimilars, and gene therapies. The rising adoption of advanced bioprocessing technologies-such as single-use systems, automation, and AI-driven analytics-is giving the necessary boost to this market. Growth of CDMOs in North America has also led to a demand for third-party validation services in compliance with regulatory standards for services confirming operational excellence.

Key Regional Takeaways:

United States Bioprocess Validation Market Analysis

The U.S. bioprocess validation market is expanding due to the strict regulatory requirements by the U.S. Food and Drug Administration (FDA) for biopharmaceutical production. The comprehensive validation studies required in the Biologics License Application (BLA) process have propelled the demand for validation services. The existing robust biopharmaceutical industry, where a large portion of the companies are heavily investing in optimizing their production processes, is driving adoption. The biopharmaceutical industry in the U.S. is a major contributor to the economy, accounting for around 1.6% of the nation's GDP, as per reports.Furthermore, scaling up production around monoclonal antibodies (mAb) and cell and gene therapies will call for the implementation of advanced methodologies for bioprocess validation to guarantee product quality and efficacy. Besides that, investments in research and development (R&D), the provision of government funds, and public-private partnerships bolster innovations in bioprocess validation technologies. Furthermore, the trend towards single-use bioprocessing will offer any rigorous validation required to overcome these sources of contamination and ensure reproducibility an encouraging outlook.

Moreover, as biomanufacturing becomes more complex, furthered by the introduction of continuous processes and increased automation, a larger obligation arises for extensive validation protocols. In addition, the validation has to cover all aspects from sourcing raw materials to licensing/batch release of the finished product for automated systems and continuous processes to work reliably. Key players in the country are striving to extend their service offerings to cater to the rising demand from the industry, thereby augmenting market growth.

Europe Bioprocess Validation Market Analysis

A very strong regulatory environment led by the European Medicines Agency (EMA) and the European Directorate for the Quality of Medicines & HealthCare (EDQM) creates a highly developed continuum of validation requirements for biologics and biosimilars. The long-established biopharmaceutical sector in the region, especially Germany, the UK, and France, fuels demand for process validation solutions. The growing demand for personalized medicine, cell and gene therapies, and next-generation biologics is leading to the establishment of stringent validation strategies for compliance. The gene therapy market in Europe is projected to grow at 12.8% CAGR during the forecast period of 2024-2032, according to The research.Emerging investments and developments in biomanufacturing are pushing the expansion of the validation market. Quality-by-design (QbD) principles and real-time process monitoring initiatives in the European Union further drive trust in robust validation tools. Besides this, with the rising sustainability concerns globally, new validation innovations are founded on minimizing environmental impact, specifically in single-use technologies.

Besides this, a supportive network of CDMOs and biopharma clusters in the region complements the validation market. CDMO is a third-party firm that offers specialized services in biomanufacturing like process development, scale-up, and production. As these organizations turn to advanced technologies, they seek to ensure consistency and quality in their processes by implementing robust validation protocols.

Asia Pacific Bioprocess Validation Market Analysis

The Asia Pacific bioprocess validation market is witnessing strong growth on account of the rapid expansion of biopharmaceutical manufacturing in countries like China, India, South Korea, and Japan. In addition, governing agencies in the region are promoting domestic biologics production through financial incentives and favorable regulations, increasing demand for validation services.Besides this, rising healthcare expenditure and a growing patient base drive the need for cost-effective biosimilars, leading manufacturers to focus on robust validation processes to meet international regulatory standards. As per the India Brand Equity Foundation (IBEF), India’s public healthcare expenditure reached 1.9% of GDP in the financial year 2024.

Moreover, the region's lower operational costs attract global biopharma companies, creating a surge in contract development and manufacturing organization (CDMO) activities, which require stringent process validation. Apart from this, the increasing adoption of single-use bioprocessing systems necessitates validation studies to ensure process reliability. Expansion of research institutes and academic collaborations with industry players further strengthens the market.

These partnerships facilitate the exchange of knowledge, bringing cutting-edge scientific discoveries and technological innovations into the biomanufacturing sector. By combining academic expertise with industry experience, these collaborations help develop more efficient, reliable, and cost-effective validation methods. Furthermore, evolving regulatory frameworks, particularly in China and India, are aligning with global standards, reinforcing the necessity of extensive bioprocess validation protocols.

Latin America Bioprocess Validation Market Analysis

The Latin American bioprocess validation market is growing due to increasing biopharmaceutical production in countries like Brazil, Mexico, and Argentina. Government initiatives supporting local biologics manufacturing and biosimilar development drive validation requirements. In line with this, rising investments in biotech startups and CDMOs is contributing to the market expansion. Reports indicate a substantial rise in venture capital investments in biotech across Brazil and Latin America, with Brazil accounting for over 60% of the region's share in 2023.Furthermore, the region is aligning its regulatory frameworks with international standards, prompting manufacturers to enhance validation procedures. Growing demand for vaccines and monoclonal antibodies is boosting process validation needs. Additionally, the rising adoption of single-use bioprocessing systems is increasing the need for validation services to ensure sterility and efficiency.

Middle East and Africa Bioprocess Validation Market Analysis

The growing pharmaceutical and biopharmaceutical manufacturing sectors in the UAE, Saudi Arabia, and South Africa are driving market expansion. In the Middle East and Africa's pharmaceutical industry, 16 M&A deals were announced in Q3 2024, totaling USD 1.8 billion, according to reports. In addition, government initiatives promoting local vaccine and biosimilar production are increasing validation requirements.The region’s improving regulatory landscape, with agencies striving to meet global quality standards, is encouraging rigorous validation processes. Furthermore, growing investments in biotechnology research and partnerships with global biopharma companies further support the market growth. Apart from this, the rise in chronic diseases and demand for biologics is pushing manufacturers to adopt validated bioprocessing solutions for quality assurance.

Competitive Landscape:

Key players in the bioprocess validation market are adopting strategic initiatives to reinforce their market presence and address the evolving needs of the biopharmaceutical sector. They are investing in advanced technologies to optimize validation processes while maintaining compliance with strict regulatory requirements. Collaborations and partnerships are being formed to expand service offerings and global reach. Additionally, companies are focusing on integrating digital solutions and automation to improve efficiency and data accuracy in validation procedures. These initiatives indicate a commitment to innovation, quality assurance, and the expansion of capabilities to support the growing complexity of biopharmaceutical products.The report provides a comprehensive analysis of the competitive landscape in the bioprocess validation market with detailed profiles of all major companies, including:

- Almac Group, Biozeen

- Doc S.R.L.

- Eurofins Scientific

- Hangzhou Anow Microfiltration Co. Ltd.

- Hangzhou Cobetter Filtration Equipment Co. Ltd.

- Hangzhou Tianshan Precision Filter Material Co. Ltd.

- Meissner Filtration Products, Inc.

- Merck KGaA

- Sartorius AG

- SGS SA

- Thermo Fisher Scientific Inc.

Key Questions Answered in This Report

- How big is the bioprocess validation market?

- What is the future outlook of bioprocess validation market?

- What are the key factors driving the bioprocess validation market?

- Which region accounts for the largest bioprocess validation market share?

- Which are the leading companies in the global bioprocess validation market?

Table of Contents

Companies Mentioned

- Almac Group

- Biozeen

- Doc S.R.L.

- Eurofins Scientific

- Hangzhou Anow Microfiltration Co. Ltd.

- Hangzhou Cobetter Filtration Equipment Co. Ltd.

- Hangzhou Tianshan Precision Filter Material Co. Ltd.

- Meissner Filtration Products Inc.

- Merck KGaA

- Sartorius AG

- SGS SA

- Thermo Fisher Scientific Inc

Table Information

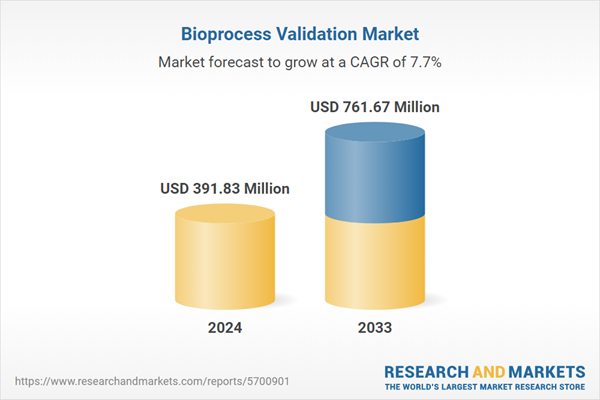

| Report Attribute | Details |

|---|---|

| No. of Pages | 141 |

| Published | June 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 391.83 Million |

| Forecasted Market Value ( USD | $ 761.67 Million |

| Compound Annual Growth Rate | 7.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 12 |