Container and Kubernetes security refers to the measures taken to protect containerized applications and the Kubernetes infrastructure that manages them. Containers are isolated environments that package applications and their dependencies, while Kubernetes is an orchestrator that automates container deployment and management. Security in container environments involves securing the container images themselves by ensuring they are free from vulnerabilities and employing best practices for image creation and management.

Kubernetes security focuses on protecting the control plane, securing network communication between cluster components, and implementing authentication and authorization mechanisms. Additionally, securing container and Kubernetes environments requires implementing strong access controls, encrypting sensitive data, monitoring suspicious activities, and employing threat detection and response mechanisms to ensure the integrity and confidentiality of the applications and infrastructure.

The market is primarily driven by the increasing adoption of containerization and container orchestration platforms like Kubernetes. In addition, containers and Kubernetes offer numerous benefits, such as scalability and portability influencing market growth. Moreover, as more businesses move towards cloud-native architectures, the demand for robust security solutions specifically designed for containers and Kubernetes is growing which is augmenting the market growth. Besides this, the growing incidences of high-profile security occurrences and data breaches in recent years are creating awareness about the importance of securing containerized applications and container orchestration systems propelling the market growth.

Also, organizations now recognize the need for comprehensive security measures to safeguard their valuable data and prevent unauthorized access, contributing to market growth. Along with this, the implementation of regulatory requirements and industry standards emphasizing the need for effective security controls in container and Kubernetes environments is creating a positive market outlook.

Container and Kubernetes Security Market Trends/Drivers:

The growing awareness regarding container and Kubernetes security

The rising incidences of security breaches related are augmenting the market growth. In addition, high-profile data breaches and attacks targeting containerized environments are accelerating the market growth. These incidents have led to increased attention from organizations across various industries, resulting in a growing awareness of the need for robust security measures. Besides this, the implementation of comprehensive security solutions specifically designed for containerized environments are propelling the market growth.Organizations are realizing the significance of addressing security concerns related to container image vulnerabilities, misconfigurations, and weaknesses in the orchestration layer. Furthermore, the growing awareness is encouraging organizations to invest in security solutions, implement best practices, conduct security audits, and prioritize security in their technology strategies creating a positive market outlook.

The emerging technological advancements

The development of new technologies to enhance runtime protection for containers and Kubernetes environments utilizing techniques such as behavior monitoring, anomaly detection, and runtime introspection to identify and mitigate threats in real time, ensuring continuous security throughout the container lifecycle is representing another major growth-inducing factor.Besides this, the incorporation of advanced vulnerability management solutions to use automated scanning techniques to identify vulnerabilities in container images, base operating systems, and application dependencies while providing actionable insights and remediation recommendations to help organizations effectively address security risks which is accelerating the market growth. Furthermore, the integration of DevSecOps pipelines enables security scans, vulnerability assessments, and policy enforcement to be integrated directly into the CI/CD process, providing developers with real-time feedback and enabling them to address security issues early in the software development lifecycle which is propelling the market growth.

Favorable government policies

The rising security breaches and concerns led to the implementation of government-favorable policies to enhance security practices in these areas. These government policies aim to promote a secure and resilient ecosystem, foster innovation, and protect critical infrastructure and sensitive data from potential security threats. Besides this, the development of security standards and guidelines specifically customized to their security is accelerating the market growth. These policies provide organizations with recommended security practices, frameworks, and controls to protect containerized workloads and ensure compliance with industry regulations.Along with this, the incorporation of container and Kubernetes security requirements into existing compliance frameworks ensures that organizations operating in regulated industries, such as finance, healthcare, and government sectors, comply with specific security measures to protect sensitive data and systems which is creating a positive market outlook.

Container and Kubernetes Security Industry Segmentation:

The research provides an analysis of the key trends in each segment of the global container and kubernetes security market report, along with forecasts at the global, regional and country levels from 2025-2033. Our report has categorized the market based on component, product, organization size and industry vertical.Breakup by Component:

- Container Security Platform

- Service.

Container security platform dominates the market

The report has provided a detailed breakup and analysis of the market based on the component. This includes container security platform and services. According to the report, the container security platform represented the largest segment.Container security platforms are specifically designed to address the unique security challenges posed by containerized environments. They offer a wide range of features and capabilities, including vulnerability management, runtime protection, access control, image scanning, and compliance monitoring which is influencing the market growth. These platforms enable organizations to identify and mitigate security risks throughout the container lifecycle, from development to deployment and runtime.

The dominance of container security platforms can be attributed to the widespread adoption of containerization and the need for robust security measures in containerized environments. Along with this, organizations recognize the essential importance of securing their containerized applications and infrastructure to protect sensitive data and prevent potential breaches.

Breakup by Product:

- Cloud-based

- On-premise.

On-premises represents the leading segment

The report has provided a detailed breakup and analysis of the market based on the product. This includes cloud-based and on-premises. According to the report, on-premises represented the largest segment.On-premises solutions refer to security products and services that are deployed and managed within an organization's own infrastructure. In addition, many organizations still prefer to have direct control over their security infrastructure and data, especially with sensitive or regulated information which is influencing the market growth. Besides this, certain industries, such as finance, healthcare, and government sectors, often have strict compliance regulations that mandate data to store and secure within their own premises that enable them to meet these regulatory requirements effectively which is accelerating the market growth. Along with this, some organizations may have concerns about data privacy, confidentiality, or latency issues associated with cloud-based security solutions leading to the widespread adoption of on-premises solutions to maintain full visibility and control over their systems.

Breakup by Organization Size:

- Small and Medium-sized Enterprises

- Large Enterprise.

Large Enterprises hold the largest share of the market

A detailed breakup and analysis of the market based on the organization size has also been provided in the report. This includes small and medium-sized enterprises and large enterprises. According to the report, large enterprises accounted for the largest market share.Large enterprises typically have larger and more complex IT infrastructures, with extensive containerized environments and a higher number of Kubernetes clusters. As a result, they require robust security solutions to protect their vast networks, applications, and sensitive data.

Moreover, large enterprises often have more resources and budgets dedicated to cybersecurity compared to smaller organizations. They can invest in advanced container security tools, hire specialized security personnel, and implement comprehensive security strategies to mitigate risks effectively representing another major growth-inducing factor. Besides this, large enterprises are often subject to stricter regulatory compliance requirements, which require a heightened focus on security measures accelerating market growth. Also, compliance with regulations and standards becomes a significant driving force for these organizations to invest in security solutions.

Furthermore, small and medium-sized enterprises (SMEs) are also recognizing the importance of container and Kubernetes security, they may face budget constraints and resource limitations, making it more challenging to implement comprehensive security measures.

Breakup by Industry Vertical:

- BFSI

- Retail and Consumer Goods

- Healthcare and Life Science

- Manufacturing

- IT and Telecommunication

- Government and Public Sector

- Other.

IT and telecommunication represent the largest industry vertical

A detailed breakup and analysis of the market based on the industry vertical has also been provided in the report. This includes BFSI, retail and consumer goods, healthcare and life science, manufacturing, IT and telecommunication, government and public sector, and others. According to the report, IT and telecommunications accounted for the largest market share.The IT industry is one of the primary drivers behind the widespread adoption of containerization and Kubernetes, given the sector's focus on innovation, agility, and scalability. In addition, the increasing demand for security in the information and technology (IT) and telecommunications sector to deploy and manage their applications, resulting in the escalating demand for robust security solutions customized to these platforms is propelling the market growth. Along with this, these industries understand the importance of securing their sensitive data and protecting their infrastructure from potential threats. Consequently, they are investing in container and Kubernetes security solutions, contributing to the dominance of the IT and telecommunications sector in the market.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Afric.

North America exhibits a clear dominance in the market

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America was the largest market for container and Kubernetes security solutions.North America is driven by the significant number of large enterprises, cloud service providers, and technology innovators who have been early adopters of containerization and Kubernetes which is influencing the market growth. These organizations prioritize security and invest in robust security solutions. Additionally, North America has a mature cybersecurity landscape and stringent data protection regulations that drive the demand for container and Kubernetes security solutions. The presence of established vendors and cybersecurity expertise further contributes to market dominance.

Europe is driven by the widespread adoption of containerization and Kubernetes in industries such as finance, healthcare, and manufacturing. In addition, stricter data privacy regulations such as the General Data Protection Regulation (GDPR) have pushed organizations to prioritize container security to comply with stringent data protection requirements propelling the market growth.

The Asia Pacific region is driven by rapid digital transformation, expanding cloud infrastructure, and increasing adoption of containerization technologies by enterprises in countries such as China, India, and Japan contributing to the market growth in this region. Also, the emergence of local players and government initiatives to enhance cybersecurity further fuel the market expansion in the Asia Pacific region.

Competitive Landscape:

Key players in the market are taking various measures to strengthen their position and stay competitive. They are investing in research and development (R&D) to enhance their security offerings. They focus on developing advanced solutions that address emerging threats and vulnerabilities specific to container and Kubernetes environments which include features such as runtime protection, vulnerability scanning, and container image security, propelling the market growth. Moreover, companies are actively targeting new customer segments and expanding their customer base across industries and geographical regions.They are engaging in marketing and sales initiatives to create awareness about the importance of security and the benefits of their solutions. Furthermore, leading market players are forming strategic partnerships with other technology providers, security vendors, or cloud service providers to expand their market reach and offer integrated solutions. They also acquire smaller companies with specialized security expertise to enhance their product portfolio.

The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Alert Logic Inc. (HelpSystems LLC)

- Anchore inc

- Aqua Security Software Ltd.

- Fidelis Cybersecurity

- NeuVector Inc. (SUSE)

- Palo Alto Networks Inc.

- Qualys Inc.

- Red Hat Inc. (International Business Machines Corporation)

- Sysdig Inc.

- Trend Micro Incorporated.

Key Questions Answered in This Report

- How big is the global container and kubernetes security market?

- What is the expected growth rate of the global container and kubernetes security market during 2025-2033?

- What are the key factors driving the global container and kubernetes security market?

- What has been the impact of COVID-19 on the global container and kubernetes security market?

- What is the breakup of the global container and kubernetes security market based on the component?

- What is the breakup of the global container and kubernetes security market based on the product?

- What is the breakup of the global container and kubernetes security market based on the organization size?

- What is the breakup of the global container and kubernetes security market based on the industry vertical?

- What are the key regions in the global container and kubernetes security market?

- Who are the key players/companies in the global container and kubernetes security market?

Table of Contents

Companies Mentioned

- Alert Logic Inc. (HelpSystems LLC)

- Anchore inc

- Aqua Security Software Ltd.

- Fidelis Cybersecurity

- NeuVector Inc. (SUSE)

- Palo Alto Networks Inc.

- Qualys Inc.

- Red Hat Inc. (International Business Machines Corporation)

- Sysdig Inc. Trend Micro Incorporated

Table Information

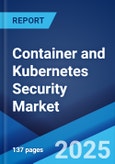

| Report Attribute | Details |

|---|---|

| No. of Pages | 137 |

| Published | June 2025 |

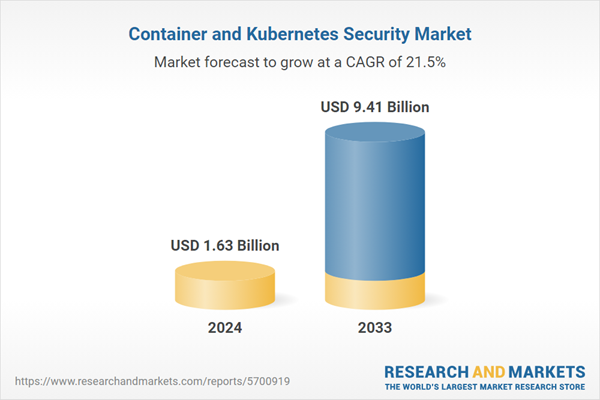

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 1.63 Billion |

| Forecasted Market Value ( USD | $ 9.41 Billion |

| Compound Annual Growth Rate | 21.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 9 |