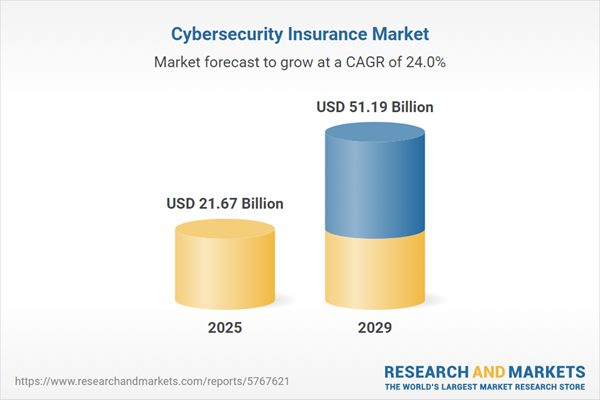

The cybersecurity insurance market size is expected to see exponential growth in the next few years. It will grow to $51.19 billion in 2029 at a compound annual growth rate (CAGR) of 24%. The growth in the forecast period can be attributed to expansion of cybersecurity insurance products, integration of artificial intelligence in risk assessment, growth in remote work and digital transformation, increased adoption by small and medium enterprises (smes), emphasis on incident response and recovery. Major trends in the forecast period include customized cybersecurity insurance policies, collaboration between insurers and cybersecurity firms, focus on employee training and security awareness, cybersecurity risk assessments and audits, dynamic pricing models based on cybersecurity posture.

The increase in data security breaches is a key factor propelling the growth of the cybersecurity insurance market in the coming years. A data breach occurs when information is extracted from a system without the owner's knowledge or consent. Weak and fraudulent identification is one of the most common and easily exploited causes of data breaches. These incidents are becoming more frequent and severe than ever before. As data breaches and other cybercrimes become increasingly common, companies are investing in cyber insurance to mitigate the costs associated with procuring, restoring, and recreating data. For example, in May 2024, the Information Commissioner's Office, a UK-based government agency, reported that over 3,000 cyber breaches were recorded in 2023, with the finance sector representing 22% of the incidents, followed by retail at 18% and education at 11%. Consequently, the rising incidence of data security breaches is driving the demand for growth in the cybersecurity insurance market.

The growing number of Internet of Things (IoT) devices is anticipated to enhance the growth of the cybersecurity insurance market in the future. IoT devices are nonstandard computing devices that can wirelessly connect to a network and provide data. These devices generate significant amounts of data, requiring efficient management. As the IoT ecosystem expands, the related cybersecurity risks and potential financial implications become increasingly evident, encouraging organizations to pursue insurance coverage as a proactive risk management approach. For instance, in September 2024, IOT Analytics, a Germany-based market insights firm, reported that by the end of 2023, there were around 16.6 billion connected IoT devices, marking a 15% increase from 2022. This figure is expected to grow by 13% to reach 18.8 billion by the end of 2024, despite challenges such as cautious enterprise spending, high inflation, and geopolitical tensions. Therefore, the rising number of IoT devices is driving the growth of the cybersecurity insurance market.

Strategic partnerships and collaborations have become a significant trend in the cybersecurity insurance market. Leading companies in the cybersecurity insurance sector are concentrating on forming partnerships to bolster their market position. For example, in July 2024, Resilience, a U.S.-based firm, partnered with Lloyd to broaden its cyber insurance offerings. This collaboration aims to raise the cyber insurance limits for U.S. clients to $20 million, representing a substantial effort to enhance coverage in light of increasing cyber threats. This partnership is a crucial step in addressing the growing complexity and frequency of cyber incidents, offering businesses more robust protection against potential losses.

In September 2024, Commvault, a U.S.-based data management software company, acquired Clumino for $47 million. This acquisition is intended to enhance Commvault's data protection offerings, providing improved security and recovery options for businesses that utilize cloud infrastructure. Clumino is a U.S.-based company that specializes in delivering a software-as-a-service (SaaS) platform centered on enterprise backup solutions.

Major companies operating in the cybersecurity insurance market include Allianz SE, American International Group Inc., Aon PLC., Arthur J. Gallagher & Co, The Travelers Companies Inc., Axa S. A., AXIS Capital Holdings Ltd., Beazley Group., Chubb Limited., CNA Financial Corporation., Fairfax Financial Holdings Ltd., Liberty Mutual Insurance Group, Lloyd’s of London Ltd., Lockton Companies Inc., Munich Reinsurance Company, Endurance Specialty Holdings Ltd., Zurich Insurance Group Ltd., Tokio Marine Holdings Inc., The Hartford Financial Services Group Inc., Argo Group., Aspen Insurance Holdings Ltd., Berkshire Hathaway Specialty Insurance, United States Fire Insurance, Hiscox Inc., Ironshore Inc., Markel Group Inc., Nationwide Mutual Insurance Company., QBE Insurance Group Limited., Sompo International Holdings Ltd., Starr International Companies Inc., Swiss Reinsurance Company Ltd., CyberPolicy Inc., AmTrust Financial Services Inc.

North America was the largest region in the cybersecurity insurance market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the cybersecurity insurance market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

Cybersecurity insurance is an insurance service that assists in reimbursing the financial losses brought on by cyber events and incidents. Organizations can obtain cybersecurity insurance as a way to help lower the financial risks involved with conducting business online. The insurance contract transfers part of the risk to the insurer in return for a monthly or quarterly payment.

The main types of insurance in cybersecurity insurance are packaged and stand-alone. The packages are used in an insurance policy that protects the policyholder against losses to their own losses. Insurance that offers a number of different coverages in combination usually refers to a policy offering both general liability and property insurance. The different insurance coverages include data breaches and cyber liability, which involve several components such as solutions and services. The different organization sizes include large enterprises and small and medium enterprises (SMEs). The various end users include technology providers and insurance providers.

The cybersecurity insurance market research report is one of a series of new reports that provides cybersecurity insurance market statistics, including cybersecurity insurance industry global market size, regional shares, competitors with a cybersecurity insurance market share, detailed cybersecurity insurance market segments, market trends and opportunities, and any further data you may need to thrive in the cybersecurity insurance industry. This anomaly detection market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenarios of the industry.

The countries covered in the cybersecurity insurance market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Italy, Canada, Spain.

The cybersecurity insurance market includes revenues earned by entities by providing a cybersecurity insurance analytics platform, disaster recovery and business continuity, cybersecurity solutions, cyber risk and vulnerability assessments, cybersecurity resilience, consulting and advisory services, and security awareness training. The market value includes the value of related goods sold by the service provider or included within the service offering. Only goods and services traded between entities or sold to end consumers are included.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Cybersecurity Insurance Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on cybersecurity insurance market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for cybersecurity insurance ? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The cybersecurity insurance market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Insurance Type: Packaged; Stand-Alone2) By Insurance Coverage: Data Breach; Cyber Liability

3) By Component: Solutions; Services

4) By Organization Size: Large Enterprises; Small and Medium Enterprises (SMEs)

5) By End User: Technology Provider; Insurance Provider

Subsegments:

1) By Packaged: Comprehensive Cybersecurity Packages; Industry-Specific Packages2) By Stand-Alone: Cyber Liability Insurance; Data Breach Insurance; Network Security Insurance

Key Companies Mentioned: Allianz SE; American International Group Inc.; Aon PLC.; Arthur J. Gallagher & Co; The Travelers Companies Inc.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

- Allianz SE

- American International Group Inc.

- Aon PLC.

- Arthur J. Gallagher & Co

- The Travelers Companies Inc.

- Axa S. A.

- AXIS Capital Holdings Ltd.

- Beazley Group.

- Chubb Limited.

- CNA Financial Corporation.

- Fairfax Financial Holdings Ltd.

- Liberty Mutual Insurance Group

- Lloyd’s of London Ltd.

- Lockton Companies Inc.

- Munich Reinsurance Company

- Endurance Specialty Holdings Ltd.

- Zurich Insurance Group Ltd.

- Tokio Marine Holdings Inc.

- The Hartford Financial Services Group Inc.

- Argo Group.

- Aspen Insurance Holdings Ltd.

- Berkshire Hathaway Specialty Insurance

- United States Fire Insurance

- Hiscox Inc.

- Ironshore Inc.

- Markel Group Inc.

- Nationwide Mutual Insurance Company.

- QBE Insurance Group Limited.

- Sompo International Holdings Ltd.

- Starr International Companies Inc.

- Swiss Reinsurance Company Ltd.

- CyberPolicy Inc.

- AmTrust Financial Services Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | January 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 21.67 Billion |

| Forecasted Market Value ( USD | $ 51.19 Billion |

| Compound Annual Growth Rate | 24.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 33 |