In the wave of technological developments, industrial sectors such as automotive and healthcare are improving. For instance, in the healthcare industry, penetration of personal and intelligent medical devices will lead to personalized medical technologies and implantable medical devices. Also, adopting robots in the healthcare industry is projected to enable the rollout of state-of-the-art medical solutions such as wearable and implantable technologies. The mentioned development in the healthcare industry is projected to create lucrative growth opportunities for developing components and parts used in implantable medical devices. This opportunity is predicted to fuel the demand for EDM wires. Similarly, the automotive industry is also witnessing a revolution. For producing large auto parts, including dual rigid linear motor axis drives and plastic dashboards, the adoption of EDM wires is rising. Also, with the introduction of electric vehicles, the automotive industry is transforming quickly. The demand for EDM wires in the automotive industry was high from earlier times and has gone up with the introduction of electric vehicles, as EDM wire ensures precise drilling and molding of small and larger parts. As the EDM wire process generates low residual stress on materials, the molds/components/punches become long-lasting and reliable. Similarly, with the introduction of advanced technologies in the aerospace industry, aerospace companies are looking ahead for EDM wires. Landing-gear components, fuel systems, engines, and other high-temperature, high-stress parts are produced using EDM wire as they can withstand the extreme pressure and heat required to make technology work in operation. The mentioned aspects related to changing automotive, aerospace, and healthcare industries due to the dynamic technological environment are projected to generate growth prospects for the SAM EDM wire market.

Market Overview

Brazil, Argentina, and rest of South America are the key contributors to the EDM wire market in the South America. The region has the presence of a limited number of EDM wire manufacturing enterprises. Among all countries in South America, Brazil is estimated to be the most significant contributor to the revenue of the South American EDM wire market during the forecast period, wherein the market growth is largely attributed to the proliferation of the automotive industry in the country. Most of the global automotive companies, including BMW, BYD, Ford, General Motors, Honda, Hyundai, Kia, Land Rover, and Mercedes-Benz, have manufacturing operations in Brazil. The automotive industry accounts for ~15% of Brazil’s industrial GDP. According to Atradius Collections, in the 1st half of 2021, there was a 33% increase in the registration of new passenger cars in Brazil. Colombia has also seen tremendous growth in the automotive industry, which contributed ~US$ 408 million (1.8 trillion Colombian pesos) to the country’s GDP in 2020. Thus, the flourishing automotive industry in several countries is propelling the growth of the EDM wire market in South America.South America EDM Wire Market Segmentation

The South America EDM wire market is segmented into wire type, industry, and country.- Based on wire type, the market is segmented into brass, zinc-coated, and non-coated. The brass segment registered the largest market share in 2022.

- Based on industry, the market is segmented into aerospace, industrial & general mechanics, automotive, healthcare, electronics, and others. The automotive segment held the largest market share in 2022.

- Based on country, the market is segmented into Brazil, Argentina, and rest of SAM. Brazil dominated the market in 2022.

Table of Contents

Companies Mentioned

- Berkenhoff Gmbh.

- Hitachi Metals Ltd.

- Sumitomo Electric Industries.

- Novotech.

- Oki Electric Cable Co., Ltd.

- Yuang Hsian Metal Industrial Corporation.

- Boway Group.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 97 |

| Published | November 2022 |

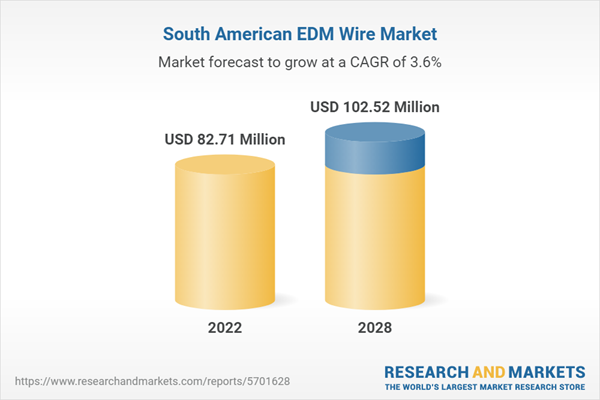

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 82.71 Million |

| Forecasted Market Value ( USD | $ 102.52 Million |

| Compound Annual Growth Rate | 3.6% |

| No. of Companies Mentioned | 7 |