The COVID-19 outbreak accelerated the shift from office environments to remote work scenarios (work from home), emphasizing data-centric security more. In 2020, organizations had to navigate a wave of IT architectural change and move to a remote work environment. The employee's sudden and unexpected move to home offices has accelerated enterprises' need to move to the cloud to keep their business running. Integrating meeting solutions, cloud servers, and security quickly became commonplace.

- Based on the survey conducted by Barracuda, 53% of respondents said the COVID-19 crisis prompted them to accelerate their plans to move all their data to a 100% cloud-based model. Hence, the plan to move all data to a 100% cloud-based model increased the emphasis on data-centric security in the cloud, as companies are highly concerned about sharing crucial data with unauthorized internal users.

Market Overview

The North American data-centric security market is spread across the US, Canada, and Mexico. The region invests heavily in data security solutions to prevent intellectual property theft and compromise systems that monitor and control the country's defense systems and capabilities. To keep pace with modern defense advancements, countries like the United States have developed new technologies, such as unmanned vehicles, hypersonic weapons, etc. These advancements rely heavily on data and connectivity, making them vulnerable to breaches and attacks. The adoption of data-centric security solutions is likely to grow with the increasing internet penetration in the region. In addition, expanding wireless networks for mobile devices has increased data vulnerability, making data security an essential and integral part of every regional organization. As a result, there is a growing necessity for the region to focus on developing countermeasures to protect critical information. The US federal government is in a unified effort to launch one of the largest federal change initiatives, accelerating the adoption of data-centric securities that help drive market growth.North America Data-Centric Security Market Segmentation

The North America data-centric security market is segmented into component, deployment mode, organization size, verticals, and country.- Based on component, the market is bifurcated into solution and service. The service segment is expected to register the larger market share in 2022.

- Based on deployment mode, the North America data-centric-security market is segmented into cloud-based and on-premises. The cloud-based segment is projected to hold a larger market share in 2022. On the basis of organization size, the data-centric security market is segmented into small and medium enterprises and large enterprises. In 2022, the large enterprises is expected to hold the largest market share.

- Based on country, the market is segmented into the US, Canada, and Mexico. The US dominated the market share in 2022. Broadcom Corporation, Forcepoint, IBM Corporation, Imperva, Informatica Corporation, Micro Focus, NetApp, Talend, and Varonis are the leading companies operating in the data-centric security market in the region.

Table of Contents

Companies Mentioned

- Broadcom Corporation

- Forcepoint

- Ibm Corporation

- Imperva

- Informatica Corporation

- Micro Focus

- Netapp

- Talend

- Varonis

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 130 |

| Published | November 2022 |

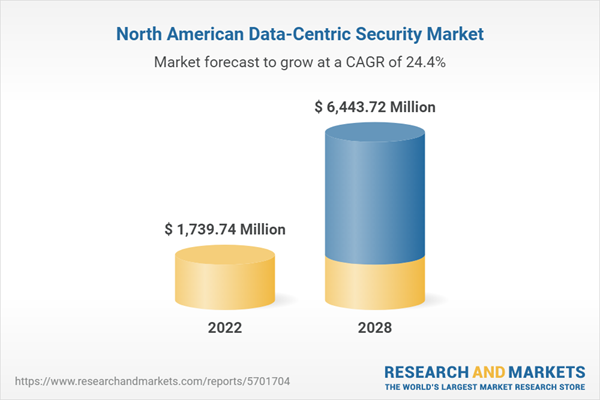

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( $ | $ 1739.74 Million |

| Forecasted Market Value ( $ | $ 6443.72 Million |

| Compound Annual Growth Rate | 24.4% |

| Regions Covered | North America |

| No. of Companies Mentioned | 9 |