The primary factors catalysing the global shrimp feed market growth are changing dietary patterns, rising health awareness among consumers, and increasing shrimp farming in Asian and Latin American countries. Moreover, the commercialisation of vannamei shrimp due to a strong demand from both the developing as well as the developed nations is driving shrimp feed demand.

Figure: Seafood Production (in MT) in Key Countries, 2020

Some of the factors driving the shrimp feed market growth are the increased demand for healthy shrimp and improving shrimp farming practices. Approximately 200 million tonnes of fish and seafood are produced annually worldwide. The demand for seafood, including shrimp, is growing steadily in countries such as Japan, the EU, and the US due to their nutritional profile and extraordinary protein content.Key Trends and Developments

Growing demand for seafood; growing investments in shrimp farming; rising demand for high-quality feed; and innovations in ingredients of shrimp feed are aiding the global shrimp feed market growth.October 2022

Cargill Incorporated and its partner Naturisa S.A. agreed to form a new joint venture with Skyvest EC Holding S.A. to meet Ecuadorian shrimp farmers' increasing demand for high-quality shrimp feed.October 2022

Skretting Aquaculture Innovation (AI) Guayas Research Station was officially opened in Guayaquil, Ecuador, aimed at accelerating more sustainable and innovative feeds in the shrimp farming industry.August 2022

Nutreco N.V.’s aquaculture business line Skretting announced its intent to increase its stake in Eruvaka to 93.7%, from 25.45% in 2018. This acquisition of the majority stake enables Skretting to supply in-house on-farm software and smart equipment to shrimp farmers all over the world, increasing productivity and lowering risk in their operations.Growing demand for seafood

The demand for ready-to-eat and ready-to-cook shrimp recipes raises the demand for processed seafood. The trend of healthy eating is influencing consumers globally as seafood is low-fat and adds minerals and nutrients to consumer’s diets.Surging investments in shrimp farming

Governments in Southeast Asian and Latin American countries are extensively investing to increase shrimp aquaculture and export.Increasing development of innovative shrimp feed ingredients

Market players are developing innovative shrimp feed ingredients that can enhance the functionality, affordability, sustainability, and availability of shrimp feed while promoting the growth and immune health of shrimp.E-commerce channels are influencing shrimp demand

New product launches and availability of such products on e-commerce channels with quick and doorstep delivery expand good quality shrimp demand.Global Shrimp Feed Market Trends

Shrimp feed is crucial for efficient shrimp production and is made up of high-quality essential amino acids, vitamins, and minerals important for optimal shrimp performance and palatability. Owing to the rising need for affordable feed compared to traditional fish meals, farmers have turned towards efficient alternatives such as soybean meals.Furthermore, the growth of the organic shrimp farming market to mitigate the impact of traditional shrimp farming is increasing the application of organic feed produced from natural ingredients and free from chemicals. Since these feeds are free of preservatives, it is anticipated to compel producers to invest in production facilities close to the farms to maintain the feed’s freshness.

Market Segmentation

"Global Shrimp Feed Market Report and Forecast 2025-2034" offers a detailed analysis of the market based on the following segments:Market Breakup by Type

- Grower

- Finisher

- Starter

Market Breakup by Ingredients

- Soybean Meal

- Fish Meal

- Wheat Flour

- Fish Oil

- Others

Market Breakup by Additives

- Vitamins and Proteins

- Fatty Acids

- Antioxidants

- Feed Enzymes

- Antibiotics

- Others

Market Breakup by Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Soybean meal is the most widely utilised form of protein in shrimp diets owing to its high digestibility and amino acid profile. Moreover, it is a prevalent plant-based source of protein for shrimp feed formulations due to its stable price and availability. Soybean meal has the potential to completely replace fish meal sources in shrimp diets.

Fish meal offers high-quality vital amino acids, vitamins, and minerals required for successful shrimp performance. The rapid expansion of the fisheries and aquaculture industry has increased the demand for processed fish meals and their constituting ingredients. The shrimp market is the dominant consumer of fishmeal in the aquaculture sector and the demand continues to be driven by the growing shrimp-farming sector, particularly in the Asia-Pacific and Latin America.

Wheat flour is used as a binder by shrimp feed manufacturers to enhance water stability. The utilisation of wheat flour as a carbohydrate in whiteleg shrimp biofloc improves production characteristics such as feed utilisation, survival rates, microbial floc concentration, body composition, and growth performance.

Competitive Landscape

Major players in the shrimp feed market are increasing their collaboration, partnership, and research and development activities to gain a competitive edge.Cargill, Incorporated

Cargill, Incorporated, headquartered in USA and founded in 1865, offers customised feeding programmes to meet individual technical and economic goals. The company provides shrimp feed products under the brands EWOS and Cargill.Charoen Pokphand Foods Public Company Limited

Headquartered in Thailand and founded in 1978, Charoen Pokphand Foods Public Company Limited offers products for white shrimp (Litopenaeus vannamei), and black tiger shrimp, which are available for various age groups from shrimp fry to large-size shrimp.Nutreco N.V.

Headquartered in the Netherlands and founded in 1994, Nutreco N.V. provides products and solutions for different species in aquaculture. The solutions offered for Black Tiger and Whiteleg Shrimp include Xpand, lorica, aquacare mineral balance, aquacare probiotic, optiline, pl and vitalis 2.5.

BioMar Group

Headquartered in Denmark and founded in 1962, BioMar Group offers shrimp feed from hatchery to starters and growers to fulfil the requirement.Global Shrimp Feed Market Analysis by Region

The Asia-Pacific is a prominent region as shrimp is embedded in the culture of many Asian countries such as China and Japan. Governments across the region have set targets to expand shrimp farming aquaculture, which has supported the demand for quality feed. For instance, Pradhan Mantri Matsya Sampada Yojana (PMMSY), aims at enhancing shrimp production in India and achieving a target of producing 1.4 million tonnes by 2024. Indonesia's Ministry of Maritime Affairs and Fisheries set a target to increase its shrimp production by 250% from 800,000 metric tons in 2019 to 2 million metric tons by 2024.In North America, shrimp is the most consumed seafood in the country. Although the USA mostly imports shrimp, there are many farms in Kentucky, Arkansas, Iowa, Nebraska, and Minnesota. Market players are actively working towards building a market for their US-grown, chemical-free, non-GMO shrimp, which is expected to continuously drive the shrimp feed market expansion in the forecast period.

Latin American countries are extensively engaged in shrimp farming, and it is one of the most significant exported products, which plays a crucial role in the economy. Precise feed management techniques to ensure the use of the best nutrient composition and the optimal number of feed occasions are expected to revolutionise shrimp production in Ecuador and across Latin America.

Table of Contents

Companies Mentioned

The key companies featured in this Shrimp Feed market report include:- Cargill, Incorporated

- Charoen Pokphand Foods Public Company Limited

- Nutreco N.V.

- BioMar Group

Table Information

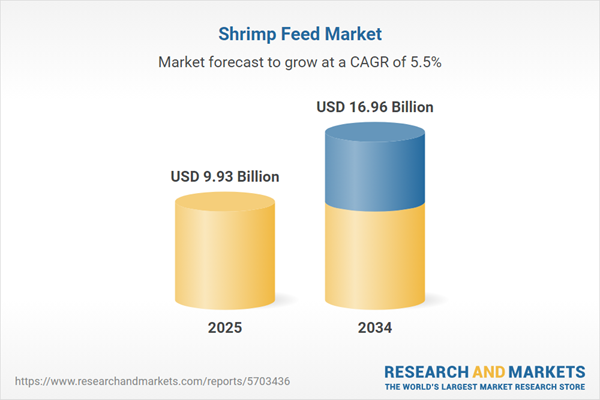

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | August 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 9.93 Billion |

| Forecasted Market Value ( USD | $ 16.96 Billion |

| Compound Annual Growth Rate | 5.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 5 |