List of Tables

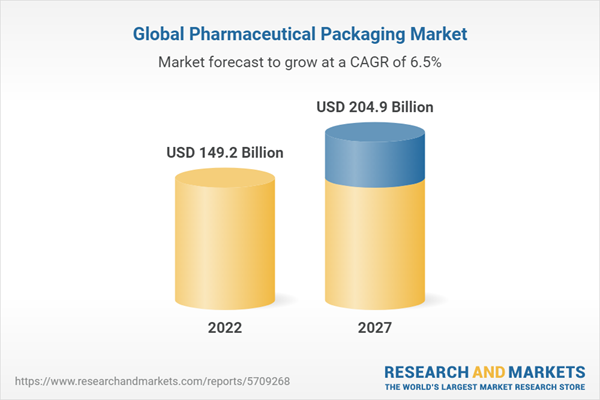

Summary Table: Global Market for Pharmaceutical Packaging, by Region, Through 2027

Table 1: European Pharmaceutical Production Revenue, by Country, 2019

Table 2: Global Market Volume of Pharmaceutical Packaging, by Material, Through 2027

Table 3: Global Market for Pharmaceutical Packaging, by Material, Through 2027

Table 4: Global Market Volume of Plastic and Polymer Pharmaceutical Packaging, by Region, Through 2027

Table 5: Global Market for Plastic and Polymer Pharmaceutical Packaging, by Region, Through 2027

Table 6: Global Market Volume of Paper and Paperboard Pharmaceutical Packaging, by Region, Through 2027

Table 7: Global Market for Paper and Paperboard Pharmaceutical Packaging, by Region, Through 2027

Table 8: Global Market Volume of Glass Pharmaceutical Packaging, by Region, Through 2027

Table 9: Global Market for Glass Pharmaceutical Packaging, by Region, Through 2027

Table 10: Global Market Volume of Metal Pharmaceutical Packaging, by Region, Through 2027

Table 11: Global Market for Metal Pharmaceutical Packaging, by Region, Through 2027

Table 12: Global Market Volume of Other Types of Pharmaceutical Packaging Materials, by Region, Through 2027

Table 13: Global Market for Other Types of Pharmaceutical Packaging Materials, by Region, Through 2027

Table 14: Global Market Volume of Pharmaceutical Packaging, by Packaging Type, Through 2027

Table 15: Global Market for Pharmaceutical Packaging, by Packaging Type, Through 2027

Table 16: Global Market Volume of Primary Pharmaceutical Packaging, by Region, Through 2027

Table 17: Global Market for Primary Pharmaceutical Packaging, by Region, Through 2027

Table 18: Global Market Volume of Secondary Pharmaceutical Packaging, by Region, Through 2027

Table 19: Global Market for Secondary Pharmaceutical Packaging, by Region, Through 2027

Table 20: Global Market Volume of Tertiary Pharmaceutical Packaging, by Region, Through 2027

Table 21: Global Market for Tertiary Pharmaceutical Packaging, by Region, Through 2027

Table 22: Global Market Volume of Pharmaceutical Packaging, by Product, Through 2027

Table 23: Global Market for Pharmaceutical Packaging, by Product, Through 2027

Table 24: Global Market Volume of Pharmaceutical Plastic Bottles, by Region, Through 2027

Table 25: Global Market for Pharmaceutical Plastic Bottles, by Region, Through 2027

Table 26: Global Market Volume of Pharmaceutical Caps and Closures, by Region, Through 2027

Table 27: Global Market for Pharmaceutical Caps and Closures, by Region, Through 2027

Table 28: Global Market Volume of Pharmaceutical Parenteral Containers, by Region, Through 2027

Table 29: Global Market for Pharmaceutical Parenteral Containers, by Region, Through 2027

Table 30: Global Market Volume of Pharmaceutical Blister Packs, by Region, Through 2027

Table 31: Global Market for Pharmaceutical Blister Packs, by Region, Through 2027

Table 32: Global Market Volume of Pharmaceutical Pouches, by Region, Through 2027

Table 33: Global Market for Pharmaceutical Pouches, by Region, Through 2027

Table 34: Global Market Volume of Pharmaceutical Medication Tubes, by Region, Through 2027

Table 35: Global Market for Pharmaceutical Medication Tubes, by Region, Through 2027

Table 36: Global Market Volume of Pharmaceutical Prescription Containers, by Region, Through 2027

Table 37: Global Market for Pharmaceutical Prescription Containers, by Region, Through 2027

Table 38: Global Market Volume of Pharmaceutical Labels and Accessories, by Region, Through 2027

Table 39: Global Market for Pharmaceutical Labels and Accessories, by Region, Through 2027

Table 40: Global Market Volume of Other Pharmaceutical Products, by Region, Through 2027

Table 41: Global Market for Other Pharmaceutical Products, by Region, Through 2027

Table 42: Global Market Volume of Pharmaceutical Packaging, by Application, Through 2027

Table 43: Global Market for Pharmaceutical Packaging, by Application, Through 2027

Table 44: Global Market Volume of Pharmaceutical Packaging for Oral Drugs, by Region Through 2027

Table 45: Global Market for Pharmaceutical Packaging for Oral Drugs, by Region, Through 2027

Table 46: Global Market Volume of Packaging for Pulmonary Drugs, by Region, Through 2027

Table 47: Global Market for Packaging for Pulmonary Drugs, by Region, Through 2027

Table 48: Global Market Volume of Packaging for Transdermal Drugs, by Region, Through 2027

Table 49: Global Market for Packaging for Transdermal Drugs, by Region, Through 2027

Table 50: Global Market Volume of Packaging for Injectable Drugs, by Region, Through 2027

Table 51: Global Market for Packaging for Injectable Drugs, by Region, Through 2027

Table 52: Global Market Volume of Packaging for Topical Drugs, by Region, Through 2027

Table 53: Global Market for Packaging for Topical Drugs, by Region, Through 2027

Table 54: Global Market Volume of Packaging for Nasal Drugs, by Region, Through 2027

Table 55: Global Market for Packaging for Nasal Drugs, by Region, Through 2027

Table 56: Global Market Volume of Packaging for Ocular/Ophthalmic Drugs, by Region, Through 2027

Table 57: Global Market for Packaging for Ocular/Ophthalmic Drugs, by Region, Through 2027

Table 58: Global Market Volume of Packaging for IV Drugs, by Region, Through 2027

Table 59: Global Market for Packaging for IV Drugs, by Region, Through 2027

Table 60: Global Market Volume of Pharmaceutical Packaging in Other Applications, by Region, Through 2027

Table 61: Global Market for Pharmaceutical Packaging in Other Applications, by Region, Through 2027

Table 62: North American Market Volume of Pharmaceutical Packaging, by Country, Through 2027

Table 63: North American Market for Pharmaceutical Packaging, by Country, Through 2027

Table 64: North American Market Volume of Pharmaceutical Packaging, by Material, Through 2027

Table 65: North American Market for Pharmaceutical Packaging, by Material, Through 2027

Table 66: North American Market Volume of Pharmaceutical Packaging, by Packaging Type, Through 2027

Table 67: North American Market for Pharmaceutical Packaging, by Packaging Type, Through 2027

Table 68: North American Market Volume of Pharmaceutical Packaging, by Product, Through 2027

Table 69: North American Market for Pharmaceutical Packaging, by Product, Through 2027

Table 70: North American Market Volume of Pharmaceutical Packaging, by Application, Through 2027

Table 71: North American Market for Pharmaceutical Packaging, by Application, Through 2027

Table 72: U.S. Market Volume of Pharmaceutical Packaging, by Material, Through 2027

Table 73: U.S. Market for Pharmaceutical Packaging, by Material, Through 2027

Table 74: U.S. Market Volume of Pharmaceutical Packaging, by Packaging Type, Through 2027

Table 75: U.S. Market for Pharmaceutical Packaging, by Packaging Type, Through 2027

Table 76: U.S. Market Volume of Pharmaceutical Packaging, by Product, Through 2027

Table 77: U.S. Market for Pharmaceutical Packaging, by Product, Through 2027

Table 78: U.S. Market Volume of Pharmaceutical Packaging, by Application, Through 2027

Table 79: U.S. Market for Pharmaceutical Packaging, by Application, Through 2027

Table 80: Canadian Market Volume of Pharmaceutical Packaging, by Material, Through 2027

Table 81: Canadian Market for Pharmaceutical Packaging, by Material, Through 2027

Table 82: Canadian Market Volume of Pharmaceutical Packaging, by Packaging Type, Through 2027

Table 83: Canadian Market for Pharmaceutical Packaging, by Packaging Type, Through 2027

Table 84: Canadian Market Volume of Pharmaceutical Packaging, by Product, Through 2027

Table 85: Canadian Market for Pharmaceutical Packaging, by Product, Through 2027

Table 86: Canadian Market Volume of Pharmaceutical Packaging, by Application, Through 2027

Table 87: Canadian Market for Pharmaceutical Packaging, by Application, Through 2027

Table 88: Asia-Pacific Market Volume of Pharmaceutical Packaging, by Country, Through 2027

Table 89: Asia-Pacific Market for Pharmaceutical Packaging, by Country, Through 2027

Table 90: Asia-Pacific Market Volume of Pharmaceutical Packaging, by Material, Through 2027

Table 91: Asia-Pacific Market for Pharmaceutical Packaging, by Material, Through 2027

Table 92: Asia-Pacific Market Volume of Pharmaceutical Packaging, by Packaging Type, Through 2027

Table 93: Asia-Pacific Market for Pharmaceutical Packaging, by Packaging Type, Through 2027

Table 94: Asia-Pacific Market Volume of Pharmaceutical Packaging, by Product, Through 2027

Table 95: Asia-Pacific Market for Pharmaceutical Packaging, by Product, Through 2027

Table 96: Asia-Pacific Market Volume of Pharmaceutical Packaging, by Application, Through 2027

Table 97: Asia-Pacific Market for Pharmaceutical Packaging, by Application, Through 2027

Table 98: Chinese Market Volume of Pharmaceutical Packaging, by Material, Through 2027

Table 99: Chinese Market for Pharmaceutical Packaging, by Material, Through 2027

Table 100: Chinese Market Volume of Pharmaceutical Packaging, by Packaging Type, Through 2027

Table 101: Chinese Market for Pharmaceutical Packaging, by Packaging Type, Through 2027

Table 102: Chinese Market Volume of Pharmaceutical Packaging, by Product, Through 2027

Table 103: Chinese Market for Pharmaceutical Packaging, by Product, Through 2027

Table 104: Chinese Market Volume of Pharmaceutical Packaging, by Application, Through 2027

Table 105: Chinese Market for Pharmaceutical Packaging, by Application, Through 2027

Table 106: Indian Market Volume of Pharmaceutical Packaging, by Material, Through 2027

Table 107: Indian Market for Pharmaceutical Packaging, by Material, Through 2027

Table 108: Indian Market Volume of Pharmaceutical Packaging, by Packaging Type, Through 2027

Table 109: Indian Market for Pharmaceutical Packaging, by Packaging Type, Through 2027

Table 110: Indian Market Volume of Pharmaceutical Packaging, by Product, Through 2027

Table 111: Indian Market for Pharmaceutical Packaging, by Product, Through 2027

Table 112: Indian Market Volume of Pharmaceutical Packaging, by Application, Through 2027

Table 113: Indian Market for Pharmaceutical Packaging, by Application, Through 2027

Table 114: Japanese Market Volume of Pharmaceutical Packaging, by Material, Through 2027

Table 115: Japanese Market for Pharmaceutical Packaging, by Material, Through 2027

Table 116: Japanese Market Volume of Pharmaceutical Packaging, by Packaging Type, Through 2027

Table 117: Japanese Market for Pharmaceutical Packaging, by Packaging Type, Through 2027

Table 118: Japanese Market Volume of Pharmaceutical Packaging, by Product, Through 2027

Table 119: Japanese Market for Pharmaceutical Packaging, by Product, Through 2027

Table 120: Japanese Market Volume of Pharmaceutical Packaging, by Application, Through 2027

Table 121: Japanese Market for Pharmaceutical Packaging, by Application, Through 2027

Table 122: Indonesian Market Volume of Pharmaceutical Packaging, by Material, Through 2027

Table 123: Indonesian Market for Pharmaceutical Packaging, by Material, Through 2027

Table 124: Indonesian Market Volume of Pharmaceutical Packaging, by Packaging Type, Through 2027

Table 125: Indonesian Market for Pharmaceutical Packaging, by Packaging Type, Through 2027

Table 126: Indonesian Market Volume of Pharmaceutical Packaging, by Product, Through 2027

Table 127: Indonesian Market for Pharmaceutical Packaging, by Product, Through 2027

Table 128: Indonesian Market Volume of Pharmaceutical Packaging, by Application, Through 2027

Table 129: Indonesian Market for Pharmaceutical Packaging, by Application, Through 2027

Table 130: Malaysian Market Volume of Pharmaceutical Packaging, by Material, Through 2027

Table 131: Malaysian Market for Pharmaceutical Packaging, by Material, Through 2027

Table 132: Malaysian Market Volume of Pharmaceutical Packaging, by Packaging Type, Through 2027

Table 133: Malaysian Market for Pharmaceutical Packaging, by Packaging Type, Through 2027

Table 134: Malaysian Market Volume of Pharmaceutical Packaging, by Product, Through 2027

Table 135: Malaysian Market for Pharmaceutical Packaging, by Product, Through 2027

Table 136: Malaysian Market Volume of Pharmaceutical Packaging, by Application, Through 2027

Table 137: Malaysian Market for Pharmaceutical Packaging, by Application, Through 2027

Table 138: South Korean Market Volume of Pharmaceutical Packaging, by Material, Through 2027

Table 139: South Korean Market for Pharmaceutical Packaging, by Material, Through 2027

Table 140: South Korean Market Volume of Pharmaceutical Packaging, by Packaging Type, Through 2027

Table 141: South Korean Market for Pharmaceutical Packaging, by Packaging Type, Through 2027

Table 142: South Korean Market Volume of Pharmaceutical Packaging, by Product, Through 2027

Table 143: South Korean Market for Pharmaceutical Packaging, by Product, Through 2027

Table 144: South Korean Market Volume of Pharmaceutical Packaging, by Application, Through 2027

Table 145: South Korean Market for Pharmaceutical Packaging, by Application, Through 2027

Table 146: Rest of Asia-Pacific Market Volume of Pharmaceutical Packaging, by Material, Through 2027

Table 147: Rest of Asia-Pacific Market for Pharmaceutical Packaging, by Material, Through 2027

Table 148: Rest of Asia-Pacific Market Volume of Pharmaceutical Packaging, by Packaging Type, Through 2027

Table 149: Rest of Asia-Pacific Market for Pharmaceutical Packaging, by Packaging Type, Through 2027

Table 150: Rest of Asia-Pacific Market Volume of Pharmaceutical Packaging, by Product, Through 2027

Table 151: Rest of Asia-Pacific Market for Pharmaceutical Packaging, by Product, Through 2027

Table 152: Rest of Asia-Pacific Market Volume of Pharmaceutical Packaging, by Application, Through 2027

Table 153: Rest of Asia-Pacific Market for Pharmaceutical Packaging, by Application, Through 2027

Table 154: European Market Volume of Pharmaceutical Packaging, by Country, Through 2027

Table 155: European Market for Pharmaceutical Packaging, by Country, Through 2027

Table 156: European Market Volume of Pharmaceutical Packaging, by Material, Through 2027

Table 157: European Market for Pharmaceutical Packaging, by Material, Through 2027

Table 158: European Market Volume of Pharmaceutical Packaging, by Packaging Type, Through 2027

Table 159: European Market for Pharmaceutical Packaging, by Packaging Type, Through 2027

Table 160: European Market Volume of Pharmaceutical Packaging, by Product, Through 2027

Table 161: European Market for Pharmaceutical Packaging, by Product, Through 2027

Table 162: European Market Volume of Pharmaceutical Packaging, by Application, Through 2027

Table 163: European Market for Pharmaceutical Packaging, by Application, Through 2027

Table 164: German Market Volume of Pharmaceutical Packaging, by Material, Through 2027

Table 165: German Market for Pharmaceutical Packaging, by Material, Through 2027

Table 166: German Market Volume of Pharmaceutical Packaging, by Packaging Type, Through 2027

Table 167: German Market for Pharmaceutical Packaging, by Packaging Type, Through 2027

Table 168: German Market Volume of Pharmaceutical Packaging, by Product, Through 2027

Table 169: German Market for Pharmaceutical Packaging, by Product, Through 2027

Table 170: German Market Volume of Pharmaceutical Packaging, by Application, Through 2027

Table 171: German Market for Pharmaceutical Packaging, by Application, Through 2027

Table 172: U.K. Market Volume of Pharmaceutical Packaging, by Material, Through 2027

Table 173: U.K. Market for Pharmaceutical Packaging, by Material, Through 2027

Table 174: U.K. Market Volume of Pharmaceutical Packaging, by Packaging Type, Through 2027

Table 175: U.K. Market for Pharmaceutical Packaging, by Packaging Type, Through 2027

Table 176: U.K. Market Volume of Pharmaceutical Packaging, by Product, Through 2027

Table 177: U.K. Market for Pharmaceutical Packaging, by Product, Through 2027

Table 178: U.K. Market Volume of Pharmaceutical Packaging, by Application, Through 2027

Table 179: U.K. Market for Pharmaceutical Packaging, by Application, Through 2027

Table 180: French Market Volume of Pharmaceutical Packaging, by Material, Through 2027

Table 181: French Market for Pharmaceutical Packaging, by Material, Through 2027

Table 182: French Market Volume of Pharmaceutical Packaging, by Packaging Type, Through 2027

Table 183: French Market for Pharmaceutical Packaging, by Packaging Type, Through 2027

Table 184: French Market Volume of Pharmaceutical Packaging, by Product, Through 2027

Table 185: French Market for Pharmaceutical Packaging, by Product, Through 2027

Table 186: French Market Volume of Pharmaceutical Packaging, by Application, Through 2027

Table 187: French Market for Pharmaceutical Packaging, by Application, Through 2027

Table 188: Italian Market Volume of Pharmaceutical Packaging, by Material, Through 2027

Table 189: Italian Market for Pharmaceutical Packaging, by Material, Through 2027

Table 190: Italian Market Volume of Pharmaceutical Packaging, by Packaging Type, Through 2027

Table 191: Italian Market for Pharmaceutical Packaging, by Packaging Type, Through 2027

Table 192: Italian Market Volume of Pharmaceutical Packaging, by Product, Through 2027

Table 193: Italian Market for Pharmaceutical Packaging, by Product, Through 2027

Table 194: Italian Market Volume of Pharmaceutical Packaging, by Application, Through 2027

Table 195: Italian Market for Pharmaceutical Packaging, by Application, Through 2027

Table 196: Spanish Market Volume of Pharmaceutical Packaging, by Material, Through 2027

Table 197: Spanish Market for Pharmaceutical Packaging, by Material, Through 2027

Table 198: Spanish Market Volume of Pharmaceutical Packaging, by Packaging Type, Through 2027

Table 199: Spanish Market for Pharmaceutical Packaging, by Packaging Type, Through 2027

Table 200: Spanish Market Volume of Pharmaceutical Packaging, by Product, Through 2027

Table 201: Spanish Market for Pharmaceutical Packaging, by Product, Through 2027

Table 202: Spanish Market Volume of Pharmaceutical Packaging, by Application, Through 2027

Table 203: Spanish Market for Pharmaceutical Packaging, by Application, Through 2027

Table 204: Russian Market Volume of Pharmaceutical Packaging, by Material, Through 2027

Table 205: Russian Market for Pharmaceutical Packaging, by Material, Through 2027

Table 206: Russian Market Volume of Pharmaceutical Packaging, by Packaging Type, Through 2027

Table 207: Russian Market for Pharmaceutical Packaging, by Packaging Type, Through 2027

Table 208: Russian Market Volume of Pharmaceutical Packaging, by Product, Through 2027

Table 209: Russian Market for Pharmaceutical Packaging, by Product, Through 2027

Table 210: Russian Market Volume of Pharmaceutical Packaging, by Application, Through 2027

Table 211: Russian Market for Pharmaceutical Packaging, by Application, Through 2027

Table 212: Rest of European Market Volume of Pharmaceutical Packaging, by Material, Through 2027

Table 213: Rest of European Market for Pharmaceutical Packaging, by Material, Through 2027

Table 214: Rest of European Market Volume of Pharmaceutical Packaging, by Packaging Type, Through 2027

Table 215: Rest of European Market for Pharmaceutical Packaging, by Packaging Type, Through 2027

Table 216: Rest of European Market Volume of Pharmaceutical Packaging, by Product, Through 2027

Table 217: Rest of European Market for Pharmaceutical Packaging, by Product, Through 2027

Table 218: Rest of European Market Volume of Pharmaceutical Packaging, by Application, Through 2027

Table 219: Rest of European Market for Pharmaceutical Packaging, by Application, Through 2027

Table 220: Middle East and African Market Volume of Pharmaceutical Packaging, by Country, Through 2027

Table 221: Middle East and African Market for Pharmaceutical Packaging, by Country, Through 2027

Table 222: Middle East and African Market Volume of Pharmaceutical Packaging, by Material, Through 2027

Table 223: Middle East and African Market for Pharmaceutical Packaging, by Material, Through 2027

Table 224: Middle East and African Market Volume of Pharmaceutical Packaging, by Packaging Type, Through 2027

Table 225: Middle East and African Market for Pharmaceutical Packaging, by Packaging Type, Through 2027

Table 226: Middle East and African Market Volume of Pharmaceutical Packaging, by Product, Through 2027

Table 227: Middle East and African Market for Pharmaceutical Packaging, by Product, Through 2027

Table 228: Middle East and African Market Volume of Pharmaceutical Packaging, by Application, Through 2027

Table 229: Middle East and African Market for Pharmaceutical Packaging, by Application, Through 2027

Table 230: GCC Countries’ Market Volume of Pharmaceutical Packaging, by Material, Through 2027

Table 231: GCC Countries’ Market for Pharmaceutical Packaging, by Material, Through 2027

Table 232: GCC Countries’ Market Volume of Pharmaceutical Packaging, by Packaging Type, Through 2027

Table 233: GCC Countries’ Market for Pharmaceutical Packaging, by Packaging Type, Through 2027

Table 234: GCC Countries’ Market Volume of Pharmaceutical Packaging, by Product, Through 2027

Table 235: GCC Countries’ Market for Pharmaceutical Packaging, by Product, Through 2027

Table 236: GCC Countries’ Market Volume of Pharmaceutical Packaging, by Application, Through 2027

Table 237: GCC Countries’ Market for Pharmaceutical Packaging, by Application, Through 2027

Table 238: South African Market Volume of Pharmaceutical Packaging, by Material, Through 2027

Table 239: South African Market for Pharmaceutical Packaging, by Material, Through 2027

Table 240: South African Market Volume of Pharmaceutical Packaging, by Packaging Type, Through 2027

Table 241: South African Market for Pharmaceutical Packaging, by Packaging Type, Through 2027

Table 242: South African Market Volume of Pharmaceutical Packaging, by Product, Through 2027

Table 243: South African Market for Pharmaceutical Packaging, by Product, Through 2027

Table 244: South African Market Volume of Pharmaceutical Packaging, by Application, Through 2027

Table 245: South African Market for Pharmaceutical Packaging, by Application, Through 2027

Table 246: Rest of Middle East and African Market Volume of Pharmaceutical Packaging, by Material, Through 2027

Table 247: Rest of Middle East and African Market for Pharmaceutical Packaging, by Material, Through 2027

Table 248: Rest of Middle East and African Market Volume of Pharmaceutical Packaging, by Packaging Type, Through 2027

Table 249: Rest of Middle East and African Market for Pharmaceutical Packaging, by Packaging Type, Through 2027

Table 250: Rest of Middle East and African Market Volume of Pharmaceutical Packaging, by Product, Through 2027

Table 251: Rest of Middle East and African Market for Pharmaceutical Packaging, by Product, Through 2027

Table 252: Rest of Middle East and African Market Volume of Pharmaceutical Packaging, by Application, Through 2027

Table 253: Rest of Middle East and African Market for Pharmaceutical Packaging, by Application, Through 2027

Table 254: Latin American Market Volume of Pharmaceutical Packaging, by Country, Through 2027

Table 255: Latin American Market for Pharmaceutical Packaging, by Country, Through 2027

Table 256: Latin American Market Volume of Pharmaceutical Packaging, by Material, Through 2027

Table 257: Latin American Market for Pharmaceutical Packaging, by Material, Through 2027

Table 258: Latin American Market Volume of Pharmaceutical Packaging, by Packaging Type, Through 2027

Table 259: Latin American Market for Pharmaceutical Packaging, by Packaging Type, Through 2027

Table 260: Latin American Market Volume of Pharmaceutical Packaging, by Product, Through 2027

Table 261: Latin American Market for Pharmaceutical Packaging, by Product, Through 2027

Table 262: Latin American Market Volume of Pharmaceutical Packaging, by Application, Through 2027

Table 263: Latin American Market for Pharmaceutical Packaging, by Application, Through 2027

Table 264: Brazilian Market Volume of Pharmaceutical Packaging, by Material, Through 2027

Table 265: Brazilian Market for Pharmaceutical Packaging, by Material, Through 2027

Table 266: Brazilian Market Volume of Pharmaceutical Packaging, by Packaging Type, Through 2027

Table 267: Brazilian Market for Pharmaceutical Packaging, by Packaging Type, Through 2027

Table 268: Brazilian Market Volume of Pharmaceutical Packaging, by Product, Through 2027

Table 269: Brazilian Market for Pharmaceutical Packaging, by Product, Through 2027

Table 270: Brazilian Market Volume of Pharmaceutical Packaging, by Application, Through 2027

Table 271: Brazilian Market for Pharmaceutical Packaging, by Application, Through 2027

Table 272: Mexican Market Volume of Pharmaceutical Packaging, by Material, Through 2027

Table 273: Mexican Market for Pharmaceutical Packaging, by Material, Through 2027

Table 274: Mexican Market Volume of Pharmaceutical Packaging, by Packaging Type, Through 2027

Table 275: Mexican Market for Pharmaceutical Packaging, by Packaging Type, Through 2027

Table 276: Mexican Market Volume of Pharmaceutical Packaging, by Product, Through 2027

Table 277: Mexican Market for Pharmaceutical Packaging, by Product, Through 2027

Table 278: Mexican Market Volume of Pharmaceutical Packaging, by Application, Through 2027

Table 279: Mexican Market for Pharmaceutical Packaging, by Application, Through 2027

Table 280: Rest of Latin American Market Volume of Pharmaceutical Packaging, by Material, Through 2027

Table 281: Rest of Latin American Market for Pharmaceutical Packaging, by Material, Through 2027

Table 282: Rest of Latin American Market Volume of Pharmaceutical Packaging, by Packaging Type, Through 2027

Table 283: Rest of Latin American Market for Pharmaceutical Packaging, by Packaging Type, Through 2027

Table 284: Rest of Latin American Market Volume of Pharmaceutical Packaging, by Product, Through 2027

Table 285: Rest of Latin American Market for Pharmaceutical Packaging, by Product, Through 2027

Table 286: Rest of Latin American Market Volume of Pharmaceutical Packaging, by Application, Through 2027

Table 287: Rest of Latin American Market for Pharmaceutical Packaging, by Application, Through 2027

Table 288: Major Developments in the Global Pharmaceutical Packaging Market, 2021 and 2022

Table 289: Acronyms Used in This Report

List of Figures

Summary Figure: Global Market for Pharmaceutical Packaging, by Region, 2020-2027

Figure 1: Market Dynamics: Drivers and Challenges

Figure 2: Global Pharmaceutical Market, 2001-2021

Figure 3: Global Cancer Incidence, by Select Country, 2020

Figure 4: Medicines in Development, 2021

Figure 5: Global Cancer Incidence, by Region, 2020

Figure 6: Worldwide Number of Cancer Survivors, 2016 and 2040

Figure 7: Supply Chain Analysis of the Pharmaceutical Packaging Market

Figure 8: Porter’s Five Force Analysis: Global Pharmaceutical Packaging Market

Figure 9: Total Number of COVID-19 Vaccine Doses Produced, by Country, March 2021

Figure 10: Global Market Shares of Pharmaceutical Packaging, by Material, 2021

Figure 11: Global Market Shares of Plastic and Polymer Pharmaceutical Packaging, by Region, 2021

Figure 12: Global Market Shares of Paper and Paperboard Pharmaceutical Packaging, by Region, 2021

Figure 13: Global Market Shares of Glass Pharmaceutical Packaging, by Region, 2021

Figure 14: Global Market Shares of Metal Pharmaceutical Packaging, by Region, 2021

Figure 15: Global Market Shares of Other Types of Pharmaceutical Packaging Materials, by Region, 2021

Figure 16: Global Market Shares of Pharmaceutical Packaging, by Packaging Type, 2021

Figure 17: Global Market Shares of Primary Pharmaceutical Packaging, by Region, 2021

Figure 18: Global Market Shares of Secondary Pharmaceutical Packaging, by Region, 2021

Figure 19: Global Market Shares of Tertiary Pharmaceutical Packaging, by Region, 2021

Figure 20: Global Market Shares of Pharmaceutical Packaging, by Product, 2021

Figure 21: Global Market Shares of Pharmaceutical Plastic Bottles, by Region, 2021

Figure 22: Global Market Shares of Pharmaceutical Caps and Closures, by Region, 2021

Figure 23: Global Market Shares of Pharmaceutical Parenteral Containers, by Region, 2021

Figure 24: Global Market Shares of Pharmaceutical Blister Packs, by Region, 2021

Figure 25: Global Market Shares of Pharmaceutical Pouches, by Region, 2021

Figure 26: Global Market Shares of Pharmaceutical Medication Tubes, by Region, 2021

Figure 27: Global Market Shares of Pharmaceutical Prescription Containers, by Region, 2021

Figure 28: Global Market Shares of Pharmaceutical Labels and Accessories, by Region, 2021

Figure 29: Global Market Shares of Other Pharmaceutical Products, by Region, 2021

Figure 30: Global Market Shares of Pharmaceutical Packaging, by Application, 2021

Figure 31: Global Market Shares of Pharmaceutical Packaging for Oral Drugs, by Region, 2021

Figure 32: Global Market Shares of Pharmaceutical Packaging for Oral Drugs, by Region, 2021

Figure 33: Global Market Shares of Packaging for Transdermal Drugs, by Region, 2021

Figure 34: Global Market Shares of Packaging for Injectable Drugs, by Region, 2021

Figure 35: Global Market Shares of Packaging for Topical Drugs, by Region, 2021

Figure 36: Global Market Shares of Packaging for Nasal Drugs, by Region, 2021

Figure 37: Global Market Shares of Packaging for Ocular/Ophthalmic Drugs, by Region, 2021

Figure 38: Global Market Shares of Packaging for IV Drugs, by Region, 2021

Figure 39: Global Market Shares of Pharmaceutical Packaging in Other Applications, by Region, 2021

Figure 40: North American Market Shares of Pharmaceutical Packaging, by Country, 2021

Figure 41: North American Market Shares of Pharmaceutical Packaging, by Material, 2021

Figure 42: North American Market Shares of Pharmaceutical Packaging, by Packaging Type, 2021

Figure 43: North American Market Shares of Pharmaceutical Packaging, by Product, 2021

Figure 44: North American Market Shares of Pharmaceutical Packaging, by Application, 2021

Figure 45: U.S. Market Shares of Pharmaceutical Packaging, by Material, 2021

Figure 46: U.S. Market Shares of Pharmaceutical Packaging, by Packaging Type, 2021

Figure 47: U.S. Market Shares of Pharmaceutical Packaging, by Product, 2021

Figure 48: U.S. Market Shares of Pharmaceutical Packaging, by Application, 2021

Figure 49: Canadian Market Shares of Pharmaceutical Packaging, by Material, 2021

Figure 50: Canadian Market Shares of Pharmaceutical Packaging, by Packaging Type, 2021

Figure 51: Canadian Market Shares of Pharmaceutical Packaging, by Product, 2021

Figure 52: Canadian Market Shares of Pharmaceutical Packaging, by Application, 2021

Figure 53: Asia-Pacific Market Shares of Pharmaceutical Packaging, by Country, 2021

Figure 54: Asia-Pacific Market Shares of Pharmaceutical Packaging, by Material, 2021

Figure 55: Asia-Pacific Market Shares of Pharmaceutical Packaging, by Packaging Type, 2021

Figure 56: Asia-Pacific Market Shares of Pharmaceutical Packaging, by Product, 2021

Figure 57: Asia-Pacific Market Shares of Pharmaceutical Packaging, by Application, 2021

Figure 58: Chinese Market Shares of Pharmaceutical Packaging, by Material, 2021

Figure 59: Chinese Market Shares of Pharmaceutical Packaging, by Packaging Type, 2021

Figure 60: Chinese Market Shares of Pharmaceutical Packaging, by Product, 2021

Figure 61: Chinese Market Shares of Pharmaceutical Packaging, by Application, 2021

Figure 62: Indian Market Shares of Pharmaceutical Packaging, by Material, 2021

Figure 63: Indian Market Shares of Pharmaceutical Packaging, by Packaging Type, 2021

Figure 64: Indian Market Shares of Pharmaceutical Packaging, by Product, 2021

Figure 65: Indian Market Shares of Pharmaceutical Packaging, by Application, 2021

Figure 66: Japanese Market Shares of Pharmaceutical Packaging, by Material, 2021

Figure 67: Japanese Market Shares of Pharmaceutical Packaging, by Packaging Type, 2021

Figure 68: Japanese Market Shares of Pharmaceutical Packaging, by Product, 2021

Figure 69: Japanese Market Shares of Pharmaceutical Packaging, by Application, 2021

Figure 70: Indonesian Market Shares of Pharmaceutical Packaging, by Material, 2021

Figure 71: Indonesian Market Shares of Pharmaceutical Packaging, by Packaging Type, 2021

Figure 72: Indonesian Market Shares of Pharmaceutical Packaging, by Product, 2021

Figure 73: Indonesian Market Shares of Pharmaceutical Packaging, by Application, 2021

Figure 74: Malaysian Market Shares of Pharmaceutical Packaging, by Material, 2021

Figure 75: Malaysian Market Shares of Pharmaceutical Packaging, by Packaging Type, 2021

Figure 76: Malaysian Market Shares of Pharmaceutical Packaging, by Product, 2021

Figure 77: Malaysian Market Shares of Pharmaceutical Packaging, by Application, 2021

Figure 78: South Korean Market Shares of Pharmaceutical Packaging, by Material, 2021

Figure 79: South Korean Market Shares of Pharmaceutical Packaging, by Packaging Type, 2021

Figure 80: South Korean Market Shares of Pharmaceutical Packaging, by Product, 2021

Figure 81: South Korean Market Shares of Pharmaceutical Packaging, by Application, 2021

Figure 82: Rest of Asia-Pacific Market Shares of Pharmaceutical Packaging, by Material, 2021

Figure 83: Rest of Asia-Pacific Market Shares of Pharmaceutical Packaging, by Packaging Type, 2021

Figure 84: Rest of Asia-Pacific Market Shares of Pharmaceutical Packaging, by Product, 2021

Figure 85: Rest of Asia-Pacific Market Shares of Pharmaceutical Packaging, by Application, 2021

Figure 86: European Market Shares of Pharmaceutical Packaging, by Country, 2021

Figure 87: European Market Shares of Pharmaceutical Packaging, by Material, 2021

Figure 88: European Market Shares of Pharmaceutical Packaging, by Packaging Type, 2021

Figure 89: European Market Shares of Pharmaceutical Packaging, by Product, 2021

Figure 90: European Market Shares of Pharmaceutical Packaging, by Application, 2021

Figure 91: German Market Shares of Pharmaceutical Packaging, by Material, 2021

Figure 92: German Market Shares of Pharmaceutical Packaging, by Packaging Type, 2021

Figure 93: German Market Shares of Pharmaceutical Packaging, by Product, 2021

Figure 94: German Market Shares of Pharmaceutical Packaging, by Application, 2021

Figure 95: U.K. Market Shares of Pharmaceutical Packaging, by Material, 2021

Figure 96: U.K. Market Shares of Pharmaceutical Packaging, by Packaging Type, 2021

Figure 97: U.K. Market Shares of Pharmaceutical Packaging, by Product, 2021

Figure 98: U.K. Market Shares of Pharmaceutical Packaging, by Application, 2021

Figure 99: French Market Shares of Pharmaceutical Packaging, by Material, 2021

Figure 100: French Market Shares of Pharmaceutical Packaging, by Packaging Type, 2021

Figure 101: French Market Shares of Pharmaceutical Packaging, by Product, 2021

Figure 102: French Market Shares of Pharmaceutical Packaging, by Application, 2021

Figure 103: Italian Market Shares of Pharmaceutical Packaging, by Material, 2021

Figure 104: Italian Market Shares of Pharmaceutical Packaging, by Packaging Type, 2021

Figure 105: Italian Market Shares of Pharmaceutical Packaging, by Product, 2021

Figure 106: Italian Market Shares of Pharmaceutical Packaging, by Application, 2021

Figure 107: Spanish Market Shares of Pharmaceutical Packaging, by Material, 2021

Figure 108: Spanish Market Shares of Pharmaceutical Packaging, by Packaging Type, 2021

Figure 109: Spanish Market Shares of Pharmaceutical Packaging, by Product, 2021

Figure 110: Spanish Market Shares of Pharmaceutical Packaging, by Application, 2021

Figure 111: Russian Market Shares of Pharmaceutical Packaging, by Material, 2021

Figure 112: Russian Market Shares of Pharmaceutical Packaging, by Packaging Type, 2021

Figure 113: Russian Market Shares of Pharmaceutical Packaging, by Product, 2021

Figure 114: Russian Market Shares of Pharmaceutical Packaging, by Application, 2021

Figure 115: Rest of European Market Shares of Pharmaceutical Packaging, by Material, 2021

Figure 116: Rest of European Market Shares of Pharmaceutical Packaging, by Packaging Type, 2021

Figure 117: Rest of European Market Shares of Pharmaceutical Packaging, by Product, 2021

Figure 118: Rest of European Market Shares of Pharmaceutical Packaging, by Application, 2021

Figure 119: Middle East and African Market Shares of Pharmaceutical Packaging, by Country, 2021

Figure 120: Middle East and African Market Shares of Pharmaceutical Packaging, by Material, 2021

Figure 121: Middle East and African Market Shares of Pharmaceutical Packaging, by Packaging Type, 2021

Figure 122: Middle East and African Market Shares of Pharmaceutical Packaging, by Product, 2021

Figure 123: Middle East and African Market Shares of Pharmaceutical Packaging, by Application, 2021

Figure 124: GCC Countries’ Market Shares of Pharmaceutical Packaging, by Material, 2021

Figure 125: GCC Countries’ Market Shares of Pharmaceutical Packaging, by Packaging Type, 2021

Figure 126: GCC Countries’ Market Shares of Pharmaceutical Packaging, by Product, 2021

Figure 127: GCC Countries’ Market Shares of Pharmaceutical Packaging, by Application, 2021

Figure 128: South African Market Shares of Pharmaceutical Packaging, by Material, 2021

Figure 129: South African Market Shares of Pharmaceutical Packaging, by Packaging Type, 2021

Figure 130: South African Market Shares of Pharmaceutical Packaging, by Product, 2021

Figure 131: South African Market Shares of Pharmaceutical Packaging, by Application, 2021

Figure 132: Rest of Middle East and African Market Shares of Pharmaceutical Packaging, by Material, 2021

Figure 133: Rest of Middle East and African Market Shares of Pharmaceutical Packaging, by Packaging Type, 2021

Figure 134: Rest of Middle East and African Market Shares of Pharmaceutical Packaging, by Product, 2021

Figure 135: Rest of Middle East and African Market Shares of Pharmaceutical Packaging, by Application, 2021

Figure 136: Latin American Market Shares of Pharmaceutical Packaging, by Country, 2021

Figure 137: Latin American Market Shares of Pharmaceutical Packaging, by Material, 2021

Figure 138: Latin American Market Shares of Pharmaceutical Packaging, by Packaging Type, 2021

Figure 139: Latin American Market Shares of Pharmaceutical Packaging, by Product, 2021

Figure 140: Latin American Market Shares of Pharmaceutical Packaging, by Application, 2021

Figure 141: Brazilian Market Shares of Pharmaceutical Packaging, by Material, 2021

Figure 142: Brazilian Market Shares of Pharmaceutical Packaging, by Packaging Type, 2021

Figure 143: Brazilian Market Shares of Pharmaceutical Packaging, by Product, 2021

Figure 144: Brazilian Market Shares of Pharmaceutical Packaging, by Application, 2021

Figure 145: Mexican Market Shares of Pharmaceutical Packaging, by Material, 2021

Figure 146: Mexican Market Shares of Pharmaceutical Packaging, by Packaging Type, 2021

Figure 147: Mexican Market Shares of Pharmaceutical Packaging, by Product, 2021

Figure 148: Mexican Market Shares of Pharmaceutical Packaging, by Application, 2021

Figure 149: Rest of Latin American Market Shares of Pharmaceutical Packaging, by Material, 2021

Figure 150: Rest of Latin American Market Shares of Pharmaceutical Packaging, by Packaging Type, 2021

Figure 151: Rest of Latin American Market Shares of Pharmaceutical Packaging, by Product, 2021

Figure 152: Rest of Latin American Market Shares of Pharmaceutical Packaging, by Application, 2021

Figure 153: Market Entry Strategies: Suggestions for Small and Medium-sized Players

Figure 154: Market Player Positioning, by Key Companies

Figure 155: Amcor PLC: Annual Sales, 2020-2022

Figure 156: Amcor PLC: Sales Share, by Business Segment, 2022

Figure 157: Amcor PLC: Sales Share, by Region, 2022

Figure 158: AptarGroup Inc.: Annual Revenue, 2019-2021

Figure 159: AptarGroup Inc.: Revenue Share, by Region, 2021

Figure 160: AptarGroup Inc.: Revenue Share, by Segment, 2021

Figure 161: Becton, Dickinson and Co.: Revenue Share, by Business Segment, 2021

Figure 162: Becton, Dickinson and Co.: Revenue Share, by Region, 2021

Figure 163: Becton, Dickinson and Co.: Annual Sales, 2019-2021

Figure 164: Berry Global Inc.: Revenue Share, by Business Segment, 2021

Figure 165: Berry Global Inc.: Annual Sales, 2019-2021

Figure 166: Bilcare Ltd.: Annual Revenue, 2019-2021

Figure 167: Constantia Flexibles: Revenue Share, by Division, 2021

Figure 168: Constantia Flexibles: Revenue Share, by Region, 2021

Figure 169: Gerresheimer AG: Revenue Share, by Business Segment, 2021

Figure 170: Gerresheimer AG: Revenue Share, by Region, 2021

Figure 171: Gerresheimer AG: Annual Revenue, 2019-2021

Figure 172: Mondi Group: Annual Sales, 2019-2021

Figure 173: Schott: Net Sales, 2020 and 2021

Figure 174: Schott: Revenue Share, by Region, 2021

Figure 175: West Pharmaceutical Services Inc.: Annual Revenue, 2019-2021

Figure 176: West Pharmaceutical Services Inc.: Revenue Share, by Product Category, 2021

Figure 177: West Pharmaceutical Services Inc.: Revenue Share, by Region, 2021