Custom software is being used by financial institutions more and more to manage client data securely, expedite key banking activities, and guarantee compliance with laws like PCI-DSS and GDPR. Thus, the BFSI segment recorded 11% revenue share in the market in 2023. The demand for customized solutions that are specifically designed for financial transactions and risk management is being further exacerbated by the proliferation of digital banking, mobile payments, and online insurance services. As the BFSI industry evolves, the demand for robust, secure, and scalable custom software continues to grow.

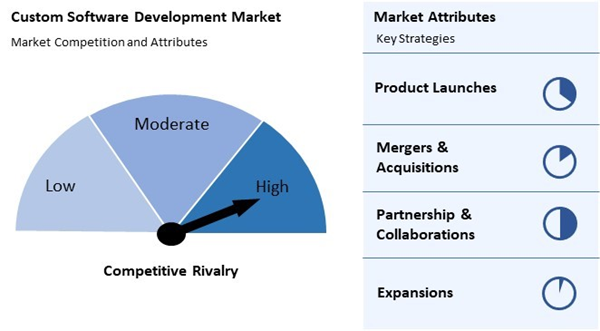

The major strategies followed by the market participants are Partnerships, as the key developmental strategy to keep pace with the changing demands of end users. For instance, In November, 2022, Tata Consultancy Services extended its partnership with Randstad, a world-leading HR services company, to modernize the latter's application estate on the cloud, upgrade its growth and transformation journey, and strengthen its security posture. This partnership would strengthen the TCS capabilities in the security portfolio. TCS would enhance Randstad's security posture with onboarding and rolling out global security services. Additionally, In October, 2022, Capgemini came into collaboration with Panasonic Automotive Systems Company of America, a company that develops, produces, and sells automotive products and technologies. This would also allow the latter company to use Capgemini skills in automotive connectivity and data migration, to complete the project. This collaboration expresses the ability of Capgemini's understand the clients' goals and make them a reality.

Cardinal Matrix - Market Competition Analysis

Based on the Analysis presented in the Cardinal matrix; Microsoft Corporation is the forerunner in the Custom Software Development Market. Companies such as IBM Corporation, Accenture PLC, Tata Consultancy Services Ltd. are some of the key innovators in Custom Software Development Market. In May, 2024, IBM Corporation partnered with Salesforce, a U.S.-based cloud software company, to integrate IBM watsonx AI and Data Platform with the Salesforce Einstein 1 Platform. This partnership aims to enhance AI-driven CRM solutions by enabling bidirectional data integration, flexibility in large language models, and prebuilt AI-powered actions. The partnership seeks to improve customer engagement, data accessibility, and AI-driven automation, helping enterprises streamline workflows and make more data-driven decisions.Market Growth Factors

Digital transformation has become a cornerstone of strategic growth across various industries, driven by the need to stay agile, customer-centric, and competitive in an increasingly connected world. Organizations rapidly adopt custom software solutions to modernize legacy systems, integrate emerging technologies, and meet sector-specific challenges. In conclusion, the demand for custom software solutions surges as industries accelerate their digital transformation journeys.Additionally, one of the main advantages of cloud computing is scalability. Custom software hosted on the cloud can easily adjust to fluctuations in user demand, allowing businesses to scale resources up or down as needed. This elasticity improves performance and ensures cost-efficiency by minimizing idle resource consumption. As a result, cloud adoption is increasingly seen as a strategic move for organizations aiming to modernize operations through customized, high-performance software solutions.

Market Restraining Factors

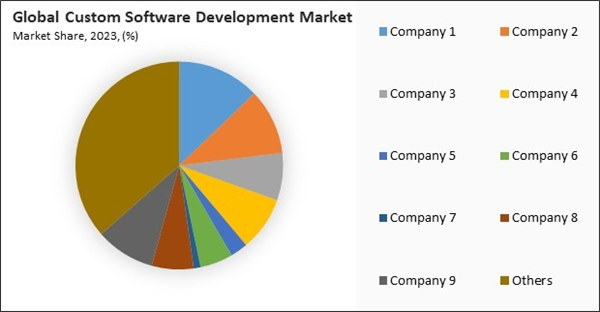

Developing custom software involves a detailed and resource-intensive process - from initial planning and requirement gathering to coding, testing, and deployment. Unlike off-the-shelf software pre-built for general use and mass distribution, custom solutions are tailored to meet specific business needs. This customization demands time, effort, and specialized technical expertise, all contributing to a higher development cost. Consequently, the high development and maintenance costs remain a persistent obstacle, limiting the broader adoption of custom software across industries.The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Partnerships & Collaborations.

Driving and Restraining Factors

Drivers

- Digital Transformation Across Industries

- Increasing Adoption of Cloud Computing

- Rapid Advancements in Emerging Technologies

Restraints

- Substantially High Development Costs

- Time-Consuming Development Cycle

Opportunities

- Growing Focus on Data Security and Compliance

- Rising Demand for Personalized Customer Experience

Challenges

- Shortage of Skilled Developers

- Frequent Changes in Client Requirements

Type Outlook

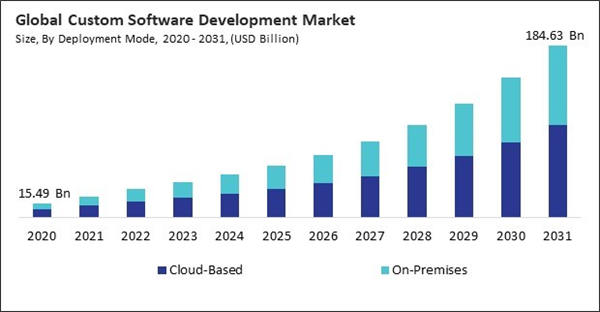

Based on type, the market is classified into web-based solutions, mobile app, and enterprise software. The web-based solutions segment procured 31% revenue share in the market in 2023. As businesses embrace remote work and digital interactions, web-based applications have become essential for ensuring seamless communication, collaboration, and customer engagement. The rise of cloud computing has also made it more feasible for organizations to deploy scalable and easily upgradable web-based software.Deployment Mode Outlook

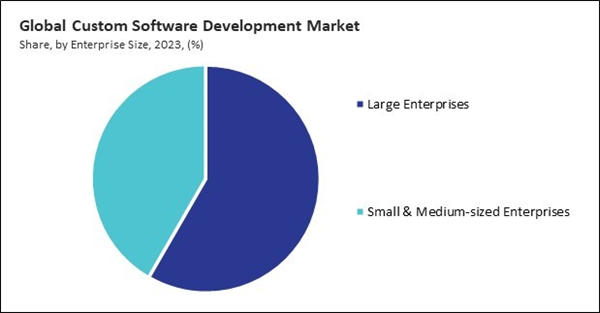

On the basis of deployment mode, the market is bifurcated into cloud-based and on-premises. The on-premises segment recorded 44% revenue share in the market in 2023. Healthcare, finance, and government organizations prefer on-premises custom software to maintain data integrity and comply with stringent regulatory requirements. The appeal of hosting data within the organization's infrastructure and the perceived security advantages make on-premises solutions a preferred choice for businesses with critical data protection needs.Enterprise Size Outlook

By enterprise size, the market is divided into large enterprises and small & medium-sized enterprises. The small & medium-sized enterprises segment garnered 42% revenue share in the market in 2023. Small & medium-sized enterprises (SMEs) often face challenges related to limited resources and budget constraints; hence, they seek cost-effective yet flexible solutions that can be tailored to specific business needs.End User Outlook

Based on end user, the market is segmented into BFSI, government, healthcare, IT & telecom, manufacturing, retail, and others. The IT & telecom segment procured 30% revenue share in the market in 2023. As telecom companies upgrade to 5G and expand network capabilities, they require bespoke software to optimize performance, manage customer data, and enhance service delivery.Market Competition and Attributes

The custom software development market is highly competitive, driven by increasing demand for tailored digital solutions across industries. Competition arises from global IT firms, regional players, and specialized development agencies offering bespoke applications, enterprise solutions, and AI-driven innovations. Market differentiation relies on expertise in emerging technologies, cost-effectiveness, and agile development methodologies. Open-source tools, cloud platforms, and low-code solutions further intensify competition. Customer expectations for rapid deployment, scalability, and security also push companies to innovate and refine their offerings.

Regional Outlook

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The Asia Pacific segment garnered 28% revenue share in the market in 2023. Countries like China, India, and Japan are at the forefront due to their large tech-savvy population and growing number of SMEs. The rising adoption of mobile applications and cloud-based solutions, driven by digital-first business strategies, has significantly increased the demand for custom software.Recent Strategies Deployed in the Market

- May-2024: IBM Corporation partnered with Salesforce, a U.S.-based cloud software company, to integrate IBM watsonx AI and Data Platform with the Salesforce Einstein 1 Platform. This collaboration aims to enhance AI-driven CRM solutions by enabling bidirectional data integration, flexibility in large language models, and prebuilt AI-powered actions. The partnership seeks to improve customer engagement, data accessibility, and AI-driven automation, helping enterprises streamline workflows and make more data-driven decisions.

- Jan-2024: IBM Corporation acquired two integration Platform as a Service (iPaaS) application - StreamSets and webMethods - from Software AG, a Germany-based enterprise software company. This acquisition aims to enhance IBM’s watsonx AI and data platform with advanced data ingestion, integration, and API management tools. By strengthening hybrid cloud and automation capabilities, IBM seeks to accelerate AI-driven digital transformation, offering enterprises more scalable and flexible solutions for managing data and applications across cloud environments.

- Nov-2023: Accenture launched specialized services to help companies customize and manage foundation models, focusing on generative AI. The services include a proprietary AI model "switchboard," model customization techniques, managed services, and training programs. The Hartford, a U.S.-based insurance company, collaborated with Accenture to leverage these AI capabilities for optimizing policy review processes. This initiative aims to accelerate AI adoption, enhance decision-making, and improve efficiency across industries by offering tailored AI solutions.

- Nov-2022: Tata Consultancy Services extended its partnership with Randstad, a world-leading HR services company, to modernize the latter's application estate on the cloud, upgrade its growth and transformation journey, and strengthen its security posture. This partnership would strengthen the TCS capabilities in the security portfolio. TCS would enhance Randstad's security posture with onboarding and rolling out global security services.

- Oct-2022: Capgemini come into collaboration with Panasonic Automotive Systems Company of America, a company that develops, produces, and sells automotive products and technologies. This would also allow the latter company to use Capgemini skills in automotive connectivity and data migration, to complete the project. This collaboration expresses the ability of Capgemini's understand the clients' goals and make them a reality.

- Feb-2022: Tata Consultancy Services (TCS) unveiled Sydney Digital Garage, providing access to the company's global ecosystem of start-ups, academia, and technology providers. The collaboration and innovation center would bring global capabilities to the Australian market, that help customers in New Zealand and Australia to support co-innovation and accelerate digital transformation.

- Jun-2021: Capgemini announced the launch of a new Sustainable IT offering that is built to reduce the IT carbon footprint of the clients. The group helps clients on the sustainability journey with its technical expertise, strong partner ecosystem, and customized approach. Sustainable IT would strengthen Capgemini’s global sustainability offering framework and provides diagnostic and qualitative tools that allow baseline business approaches to sustainable practice.

- May-2021: Brainvire Infotech announced a partnership with Salesforce Inc, an American cloud-based software company, to deliver a market-leading customer experience. Brainvire would expand the digital space team of Salesforce to enlarge its range. This partnership with the world's leading Customer Relationship Management platform would be beneficial for the Brainvire team's skill and accuracy.

List of Key Companies Profiled

- Tata Consultancy Services Ltd.

- Infosys Limited

- Capgemini SE

- Accenture PLC

- Magora Systems

- Microsoft Corporation

- MentorMate, Inc. (Taylor Corporation)

- IBM Corporation

- Cognizant Technology Solutions Corporation

- Brainvire Infotech, Inc.

Market Report Segmentation

By Deployment Mode

- Cloud-Based

- On-Premises

By Enterprise Size

- Large Enterprises

- Small & Medium-sized Enterprises

By Type

- Enterprise Software

- Web-based Solutions

- Mobile App

By End User

- IT & Telecom

- Retail

- BFSI

- Manufacturing

- Healthcare

- Government

- Other End User

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Companies Mentioned

- Tata Consultancy Services Ltd.

- Infosys Limited

- Capgemini SE

- Accenture PLC

- Magora Systems

- Microsoft Corporation

- MentorMate, Inc. (Taylor Corporation)

- IBM Corporation

- Cognizant Technology Solutions Corporation

- Brainvire Infotech, Inc.