Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

Government Ethanol Blending Mandates

India’s ethanol blending policies - most notably E10, E20, and E85 - are central to the surge in flex engine demand. These mandates, part of the country's broader energy security and import reduction goals, require automakers to produce vehicles compatible with higher ethanol fuel content. Flex engines are well-suited for this transition, as they automatically adapt to varying ethanol blends without compromising performance. The clear regulatory roadmap, combined with increasing ethanol availability and targeted investments in domestic ethanol production, gives manufacturers the confidence to integrate flex-fuel engines into their vehicle portfolios. These government initiatives also promote the development of supporting infrastructure, creating a favorable environment for the growth of flex engine technology in India.Key Market Challenges

Lack of Ethanol Refueling Infrastructure

Despite favorable policies, limited ethanol-blended fuel availability remains a major barrier to flex engine adoption. Most fuel stations across the country are still configured to supply standard petrol or low-blend ethanol fuels, making it difficult for consumers to access E20 or E85 blends needed to fully utilize flex engine capabilities. This infrastructure gap hampers consumer confidence and restricts OEMs from scaling up production of flex-fuel vehicles. Ethanol's corrosive nature and hygroscopic properties also require additional investment in storage and handling systems at retail outlets, further slowing rollout. Until fuel infrastructure development catches up with vehicle production, the full potential of flex engine technology will remain underutilized - especially in non-urban and remote regions.Key Market Trends

OEM Transition to Modular Powertrain Platforms

Automotive manufacturers are increasingly adopting modular powertrain architectures to streamline production and comply with evolving fuel regulations. These platforms are designed to accommodate multiple fuel types - petrol, diesel, and ethanol blends - within a single vehicle framework. For flex engines, this approach reduces engineering time and cost, while offering flexibility in calibration for varying ethanol levels from E10 to E85. As OEMs integrate flex-fuel compatibility into their base designs, flex engines are moving from niche to mainstream product offerings. This trend is also supported by component suppliers developing compatible parts, enabling faster rollout and improved cost-efficiency. Modular designs are positioning flex engines as a future-ready solution aligned with both regulatory and consumer demands.Key Market Players

- Maruti Suzuki India Limited

- Tata Motors Limited

- Mahindra & Mahindra Limited

- Hyundai Motor Company

- Honda Motor Company, Ltd.

- Bajaj Auto Limited

- TVS Motor Company

- Hinduja Group (Ashoke Leyland)

- Toyota Motor Corporation

- Ford Motor Company

Report Scope:

In this report, the India Flex Engine Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:India Flex Engine Market, By Vehicle Type:

- Two-Wheelers

- Passenger Cars

- Commercial Vehicle

India Flex Engine Market, By Blend Type:

- E10 to E25

- E25 to E85

- Above E85

- Others

India Flex Engine Market, By Region:

- North

- South

- East

- West

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the India Flex Engine Market.Available Customizations:

With the given market data, the publisher offers customizations according to the company’s specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Maruti Suzuki India Limited

- Tata Motors Limited

- Mahindra & Mahindra Limited

- Hyundai Motor Company

- Honda Motor Company, Ltd.

- Bajaj Auto Limited

- TVS Motor Company

- Hinduja Group (Ashoke Leyland)

- Toyota Motor Corporation

- Ford Motor Company

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 85 |

| Published | July 2025 |

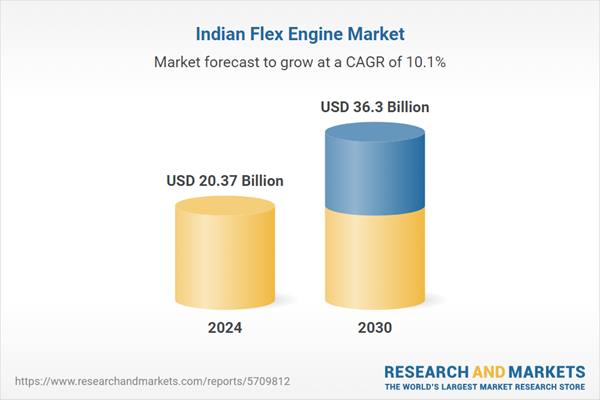

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 20.37 Billion |

| Forecasted Market Value ( USD | $ 36.3 Billion |

| Compound Annual Growth Rate | 10.1% |

| Regions Covered | India |

| No. of Companies Mentioned | 10 |