Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

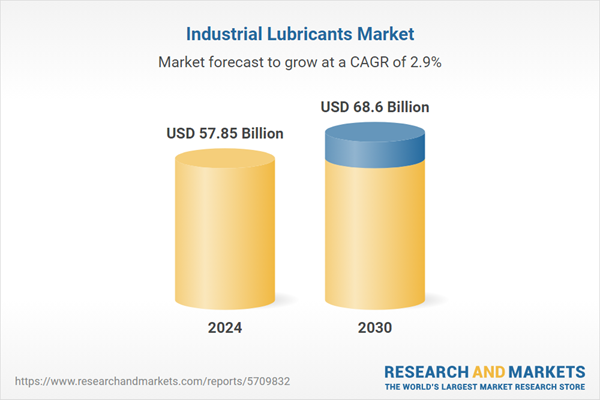

As industrial operations worldwide shift toward higher performance thresholds, stricter environmental compliance, and predictive maintenance frameworks, demand is steadily transitioning from conventional lubricants to formulation-specific, efficiency-optimized solutions. The market is no longer commodity-driven it is increasingly innovation-led. Companies that prioritize technology-enabled lubrication systems, invest in application-specific R&D, and offer end-to-end value-added services are gaining a competitive edge. This transition positions the industrial lubricants sector not just as a supplier of essential materials, but as a strategic enabler of operational excellence and sustainable industrial growth.

Key Market Drivers

Rapid Industrialization and Infrastructure Development

Among the various factors fueling the global industrial lubricants market, rapid industrialization and large-scale infrastructure development stand out as fundamental growth drivers. These two forces create sustained and diversified demand across multiple industrial sectors, making lubricants essential for ensuring operational efficiency, equipment reliability, and long-term asset performance.As countries especially across Asia Pacific, the Middle East, Africa, and Latin America undergo rapid industrialization, there is significant expansion in heavy industries such as Steel and metallurgy, Cement and construction materials, Mining and mineral processing, Petrochemicals and refineries, Power generation and utilities. These industries rely on heavy-duty machinery and continuous operations, where industrial lubricants play a critical role in minimizing wear, reducing friction, preventing corrosion, and supporting uninterrupted production cycles. For example, steel manufacturing plants utilize gear oils, hydraulic fluids, and greases across rolling mills, furnaces, conveyors, and cooling systems making lubricants essential to plant uptime and product quality.

The global infrastructure boom, driven by government spending and public-private partnerships, is boosting the use of large-scale construction equipment and industrial tools. Infrastructure projects such as highways, bridges, ports, airports, rail networks, and smart cities involve extensive use of excavators, bulldozers, cranes, batching plants, and tunneling machines, all of which require regular lubrication. India’s infrastructure landscape has undergone substantial transformation over the past decade, with marked acceleration in transportation network development.

The National Highway (NH) network has expanded 1.6 times, while the length of four-lane and above NH corridors has grown 2.6 times, reflecting a strong emphasis on capacity enhancement. These machines operate under harsh environmental conditions, necessitating high-performance lubricants with excellent thermal stability, water resistance, and anti-wear properties. As infrastructure development intensifies, so does the need for durable and application-specific lubricants that can withstand heavy loads and extreme operating conditions.

Key Market Challenges

Rising Environmental Regulations and Sustainability Pressures

One of the most significant challenges facing the industrial lubricants industry is the growing pressure to comply with environmental regulations, health and safety standards, and sustainability expectations.Regulatory compliance with international frameworks such as REACH (Europe), EPA (United States), and BIS (India) is becoming increasingly stringent. Industries are being pushed to phase out toxic or non-biodegradable lubricants, especially in environmentally sensitive sectors such as marine, hydropower, and agriculture. The transition to Environmentally Acceptable Lubricants (EALs) and bio-based lubricants often involves higher formulation costs, supply chain complexity, and performance trade-offs compared to traditional mineral-based lubricants.

Lubricant manufacturers are under pressure to invest heavily in R&D to develop compliant products, which increases operational costs. In some regions, low-cost conventional lubricants are still preferred due to budget constraints, limiting the market for premium, sustainable alternatives. Non-compliance can lead to legal liabilities, reputational damage, or exclusion from key contracts in sectors with strict ESG standards. Regulatory burdens are reshaping product strategies, increasing operational costs, and slowing adoption of newer formulations especially in cost-sensitive or underdeveloped markets.

Key Market Trends

Integration of Digital Technologies into Lubrication Management

A major shift is underway as industrial lubricant suppliers and end-users increasingly adopt digital solutions to enhance equipment reliability, optimize lubricant usage, and support predictive maintenance strategies.Deployment of Internet of Things (IoT) sensors, cloud-based monitoring platforms, and AI-driven analytics for real-time tracking of lubricant conditions (e.g., viscosity, contamination, temperature, oxidation). Shift from reactive to predictive lubrication management, allowing companies to anticipate wear or failure and intervene before costly downtime occurs. Use of digital twins and asset performance management (APM) tools that integrate lubricant performance into broader operational data.

Lubricants are no longer treated as mere consumables they are becoming integral components of digital maintenance ecosystems. Manufacturers are offering subscription-based lubrication services with diagnostics, performance guarantees, and proactive support. This creates a competitive edge for companies offering smart lubrication solutions while opening new revenue streams from services and data analytics. Digitalization is transforming lubrication from a product-centric to a solution-centric business, enabling higher customer value and operational transparency.

Key Market Players

- Exxon Mobil Corporation

- FUCHS

- Lubrizol Corporation

- Shell Global

- TotalEnergies

- Klüber Lubrication München GmbH & Co. KG

- Valvoline Global Operations

- Chevron Corporation

- Quaker Chemical Corporation

- Castrol Limited

Report Scope:

In this report, the Global Industrial Lubricants Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Industrial Lubricants Market, By Product:

- Process Oils

- General Industrial Oils

- Metalworking Fluids

- Industrial Engine Oils

- Other

Industrial Lubricants Market, By Application:

- Mining

- Power Generation

- Food Processing

- Chemical Manufacturing

- Textile Manufacturing

- Steel & Metals

- Other

Industrial Lubricants Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Industrial Lubricants Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Exxon Mobil Corporation

- FUCHS

- Lubrizol Corporation

- Shell Global

- TotalEnergies

- Klüber Lubrication München GmbH & Co. KG

- Valvoline Global Operations

- Chevron Corporation

- Quaker Chemical Corporation

- Castrol Limited

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | August 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 57.85 Billion |

| Forecasted Market Value ( USD | $ 68.6 Billion |

| Compound Annual Growth Rate | 2.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |