Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Market expansion faces a notable hurdle in the form of raw material price volatility, specifically regarding petrochemical feedstocks, which creates unpredictability in profit margins and production costs. This economic strain is frequently intensified by stringent environmental mandates concerning plastic recyclability. Highlighting the scale of activity required to sustain the global supply chain for downstream applications like specialized film manufacturing, the China Plastics Processing Industry Association reported that the domestic polycarbonate industry reached a cumulative output of roughly 2.53 million tons between January and October 2024.

Market Drivers

The escalating demand for lightweight materials within the automotive sector serves as a major engine for the Global Polycarbonate Films Market. As the industry strategically pivots toward electric vehicles (EVs), manufacturers are increasingly utilizing thermoplastic solutions to counterbalance heavy battery packs and enhance overall energy efficiency. Polycarbonate films play a crucial role in this shift, being widely adopted in interior glazing, sensor housings, and instrument clusters to reduce weight while maintaining optical quality and impact resistance; supporting this trajectory, the International Energy Agency’s 'Global EV Outlook 2024' projected that global electric car sales would hit approximately 17 million units in 2024, opening a significant growth channel for high-performance automotive films.Concurrently, the widespread adoption of flexible display technologies and consumer electronics is fueling sustained market growth. This sector necessitates optical-grade polycarbonate films that offer exceptional dimensional stability and transparency for virtual reality devices, touch screens, and human-machine interface (HMI) panels. To address these specialized requirements, major industry players are upgrading their manufacturing capabilities; for instance, Teijin Limited announced in June 2024 the addition of a new production facility with an annual capacity of 1,350 tons for electronic display components, while Lotte Chemical announced a 2024 investment exceeding 300 billion KRW to construct a new compounding plant with a 500,000-ton capacity to secure the raw material foundation for downstream applications.

Market Challenges

The instability of raw material prices, specifically for petrochemical feedstocks, presents a significant barrier to the growth of the Global Polycarbonate Films Market. Since polycarbonate production is heavily dependent on upstream crude oil derivatives, erratic movements in global energy markets lead to immediate uncertainty regarding resin costs. This financial volatility undermines the ability of film converters to establish stable pricing structures for major clients in the electronics and automotive sectors or to sustain consistent profit margins; consequently, when input costs cannot be accurately predicted, manufacturers are forced to delay investments in new extrusion technologies and restrict inventory levels, thereby stalling overall market progress.The gravity of this operational strain is evident in recent industrial data highlighting the extensive effects of cost uncertainty. For example, the German Chemical Industry Association (VCI) reported that production in the chemical sector declined by 4.2% year-on-year in the fourth quarter of 2024, with capacity utilization dropping to 74.7%. This contraction within the upstream chemical manufacturing foundation emphasizes the challenges producers encounter in preserving optimal output levels amidst fluctuating input costs; for the polycarbonate films industry, such instability restricts the dependable supply of cost-effective raw materials, directly hindering the sector's capacity to scale production in response to growing global demand.

Market Trends

The rise of Chemically Recycled and Bio-Based Polycarbonate Films is fundamentally transforming the market as producers shift from fossil-based feedstocks toward sustainable alternatives to align with circular economy objectives. Differentiating itself from mere lightweighting, this trend focuses on lowering carbon footprints by utilizing renewable raw materials that maintain the physical properties of virgin resins, with industry leaders increasingly applying mass balance methods to create certified environmental grades. In a demonstration of this shift, SABIC revealed in a May 2024 press release regarding NPE2024 that it had developed EV charger housings incorporating up to 50% certified renewable LEXAN polycarbonate resin, effectively promoting the circular bio-economy without sacrificing material durability.In parallel, the incorporation of films into Foldable and Flexible Display Technologies is spurring material innovation, demanding solutions that merge superior structural integrity with extreme thinness. As consumer electronics progress toward ultra-portable formats, polycarbonate films and sheets are being engineered to supplant heavier metal components in display layers and device housings, providing a crucial equilibrium between weight reduction and impact resistance. This technical advancement facilitates the development of more resilient, thinner mobile devices that endure daily use with minimal bulk; as noted in a July 2024 press release by Teijin Limited, the company's specialized polycarbonate sheet technology was instrumental in creating the VAIO Vision+ 14, which features a thickness of only 3.9mm at its thinnest point and weighs approximately 325 grams.

Key Players Profiled in the Polycarbonate Films Market

- SABIC

- Covestro

- Teijin

- Mitsubishi Gas Chemical

- Suzhou OMAY Optical Materials

- Rowland Technologies

- Palram

- 3M

- Idemitsu

- Excelite

Report Scope

In this report, the Global Polycarbonate Films Market has been segmented into the following categories:Polycarbonate Films Market, by Type:

- Clear

- Coloured/Tinted

Polycarbonate Films Market, by Grade:

- Anti-static

- Mirrored

- Abrassion Resistant

- Flame Retardant

- Weatherable

Polycarbonate Films Market, by End-use:

- Automotive

- Building & Construction

- Consumer Products

- Electrical & Electronics

- Medical

- Packaging

Polycarbonate Films Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Polycarbonate Films Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Polycarbonate Films market report include:- SABIC

- Covestro

- Teijin

- Mitsubishi Gas Chemical

- Suzhou OMAY Optical Materials

- Rowland Technologies

- Palram

- 3M

- Idemitsu

- Excelite

Table Information

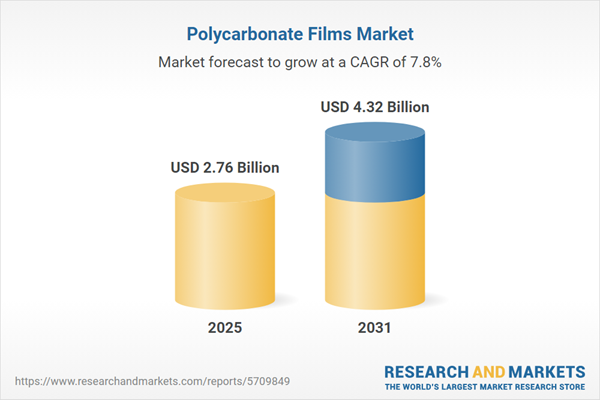

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | January 2026 |

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 2.76 Billion |

| Forecasted Market Value ( USD | $ 4.32 Billion |

| Compound Annual Growth Rate | 7.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |