Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

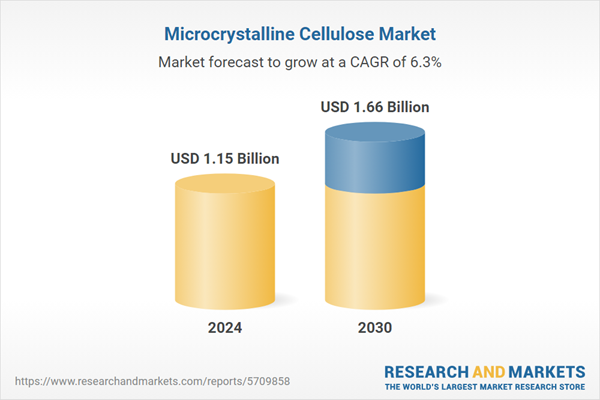

The market’s expansion is anchored by robust demand from the pharmaceutical industry, particularly for oral solid dosage forms, while adoption in nutraceuticals, functional foods, and personal care products continues to rise. Strategic factors such as sustainability initiatives, innovations in production technologies, and accelerating demand across emerging Asia-Pacific markets are shaping long-term growth trajectories. Consequently, MCC is increasingly recognized not only as a foundational excipient but also as a versatile material poised to meet evolving industrial and consumer requirements.

Key Market Drivers

Rising Demand for Nutraceuticals and Dietary Supplements

The increasing global demand for nutraceuticals and dietary supplements has become one of the most significant growth drivers of the microcrystalline cellulose (MCC) market. A significant portion of the global population regularly consumes dietary supplements, with many perceiving natural products as inherently safe. However, prior studies indicate that nearly 20% of consumers report using dietary supplements alongside prescription or over-the-counter medications, highlighting potential considerations for safety, interactions, and informed usage. Consumers worldwide are becoming more health-conscious, with greater emphasis on preventive healthcare and wellness-oriented lifestyles.This shift is strongly influenced by rising incidences of lifestyle-related diseases such as obesity, diabetes, and cardiovascular disorders, coupled with aging populations that require long-term nutritional support. Non-communicable diseases (NCDs) are responsible for approximately 74% of global deaths each year, claiming around 41 million lives. Projections indicate this figure could rise to 52 million by 2030. Nonetheless, most of these deaths are linked to five modifiable risk factors unhealthy diets, tobacco use, physical inactivity, air pollution, and alcohol consumption underscoring significant opportunities for preventive health interventions. As a result, nutraceuticals and dietary supplements have gained rapid acceptance, and MCC plays a critical role in their production.

MCC is extensively used as a binder, filler, and disintegrant in tablets and capsules the most common dosage forms of dietary supplements. Its superior compressibility ensures strong yet easily disintegrating tablets, improving both manufacturing efficiency and consumer experience. In addition, MCC enhances the stability of active ingredients, prolongs shelf life, and maintains uniform dosage distribution, which are vital in nutraceutical production where product consistency and reliability are essential. Consumers of nutraceuticals often demand clean-label, plant-derived, and non-synthetic ingredients.

As MCC is obtained from natural cellulose sources such as wood pulp and cotton linters, it aligns seamlessly with these consumer expectations. This “natural” positioning enhances its adoption, especially among brands marketing supplements as organic, sustainable, and eco-friendly. The nutraceutical industry is expanding rapidly in both developed and emerging markets. In North America and Europe, rising health awareness and premium wellness trends have led to high per capita supplement consumption. Meanwhile, Asia-Pacific especially China and India is witnessing strong growth driven by a rising middle class, urbanization, and growing acceptance of Western dietary habits. This expansion significantly boosts MCC demand, as manufacturers require high-quality excipients to meet growing supplement production volumes.

Key Market Challenges

High Production Costs and Raw Material Dependence

The production of MCC involves specialized chemical processing of cellulose derived primarily from wood pulp or cotton linters. This process requires significant capital investment, sophisticated technology, and stringent quality control to ensure pharmaceutical and food-grade compliance. Additionally, fluctuations in the availability and pricing of raw materials especially wood pulp directly affect production costs. Manufacturers in regions with limited access to high-quality cellulose face higher operational expenses, reducing profit margins. These elevated costs can act as a barrier to entry for new players and limit market expansion, particularly in price-sensitive emerging economies.Key Market Trends

Expansion of MCC Applications Beyond Traditional Industries

While pharmaceuticals and food remain core markets, the future will see broader adoption of MCC in emerging applications such as bioplastics, 3D printing materials, and biomedical engineering. For example, MCC’s renewable and biodegradable nature makes it a potential ingredient in sustainable packaging solutions, addressing the growing demand for alternatives to single-use plastics. In biomedical fields, MCC is being studied for wound dressings, drug delivery systems, and tissue scaffolding due to its biocompatibility and functional versatility. This trend toward diversification of applications is expected to unlock new revenue streams and reduce dependence on traditional end-use sectors.Key Market Players

- Roquette Frères.

- JRS PHARMA GmbH & Co. KG

- Asahi Kasei Corporation

- Apollo Scientific Ltd

- SEPPIC

- Ankit Pulps and Boards Pvt Ltd

- GODAVARI BIOREFINERIES LTD

- International Flavors & Fragrances Inc

- DFE Pharma

- Fengchen Group Co., Ltd

Report Scope:

In this report, the Global Microcrystalline Cellulose Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Microcrystalline Cellulose Market, By Source:

- Wood-based

- Non-wood-based

Microcrystalline Cellulose Market, By Form:

- Powder

- Liquid

Microcrystalline Cellulose Market, By Application:

- Pharmaceutical

- Personal Care & Cosmetics

- Food & Beverages

- Paints & Coatings

- Other

Microcrystalline Cellulose Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Microcrystalline Cellulose Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Roquette Frères.

- JRS PHARMA GmbH & Co. KG

- Asahi Kasei Corporation

- Apollo Scientific Ltd

- SEPPIC

- Ankit Pulps and Boards Pvt Ltd

- GODAVARI BIOREFINERIES LTD

- International Flavors & Fragrances Inc

- DFE Pharma

- Fengchen Group Co., Ltd

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | August 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 1.15 Billion |

| Forecasted Market Value ( USD | $ 1.66 Billion |

| Compound Annual Growth Rate | 6.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |