Evolution of Standardized Satellite Platform

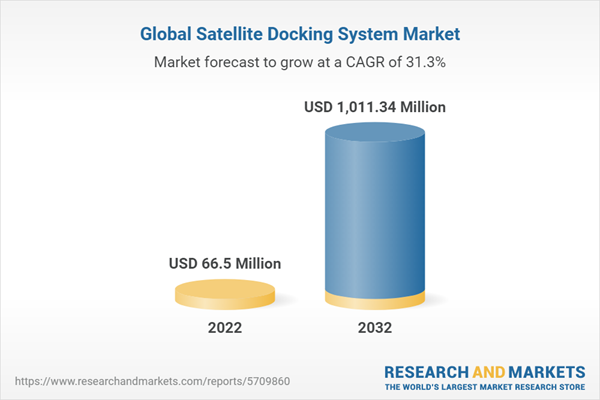

The global satellite docking system market is estimated to reach $1,011.34 million in 2032 from $66.5 million in 2022, at a growth rate of 31.3% during the forecast period 2022-2032. The growth in the global satellite docking system market is expected to be driven by the enforcement of regulations on space sustainability and increase in in-orbit services.

Market Lifecycle Stage

Over the past few years, trends in the number of satellites launched by commercial satellite operators have been increasing drastically. As per the publisher's space database, the global satellite launch forecast estimates 45,131 satellites to be launched within the 2022-2032 timeline. Out of these 45,131 satellites, 95% of satellites are expected to operate in low Earth orbit (LEO). This indicates that over 95% of the satellites are expected to operate in one orbital segment leading to a growing state of congestion, which further adds to the risk perception of collision and space debris concerns.

In addition, commercial satellite operators are opting for the life extension program to keep their existing satellites alive in space for longer periods. This will help them to reduce the satellite operation cost and increase their revenue with the existing satellite. Furthermore, it helps to remove the active space debris to keep the space debris-free and sustainable and reduce the risk of collision. Given the circumstance, the need for a satellite docking system is very high at this point, and the same is expected to persist as well.

Impact

The global satellite docking system market is observing rising investment across all the satellite platforms, which drives the investments across the docking system technology. The major challenge in developing the satellite docking system is there is no standardization in design and mechanism among the satellite docking manufacturers. This leads the developer to integrate their own satellite docking system in their in-orbit service vehicle, which will create incompatibility with the docking system that is integrated with the target satellites. In addition, different small satellite operators are building different types of satellites. Although many satellites use standardized satellite platforms, they are customized products with unique configurations. Therefore, their docking solution requirement will also vary from operator to operator. This will create a need for a variety of satellite docking solutions both for target satellites and service satellites.

Market Segmentation

Segmentation 1: by Service Type

- Refueling

- Inspection, Repair, and Replacement

- De-Orbiting

Based on service type, the satellite docking system market is expected to be dominated by the refueling service satellite during the forecast period.

Segmentation 2: by End User

- Commercial

- Civil Government

- Military

- Deep Space

Based on end user, the global satellite docking system market is expected to be dominated by commercial end users.

Segmentation 3: by Spacecraft Type

- Target Satellites

- Service Satellites

Segmentation 4: by Region

- North America

- Europe

- Rest-of-the-World

North America is expected to account for the highest share of 78% in the satellite docking system market by value in 2021, owing to a significant number of companies based in the region.

Recent Developments in the Global Satellite Docking System Market

- In November 2022, Starfish Space announced that its Otter Pup satellite with high-performance low-thrust electric propulsion, which includes a satellite docking system, is planned to launch in the spring of 2023 to dock with another satellite in the fall of 2023.

- In October 2022, High Earth Orbit (HEO) Robotics collaborated with Satellogic to integrate Satellogic’s growing satellite constellation and high-resolution satellite imagery with HEO’s flyby inspection and computer-vision capabilities.

- In September 2022, Astroscale Holdings, Inc. received funding of $1.79 million from the U.K. Space Agency to develop technologies and capabilities for Cleaning Outer Space Mission through Innovative Capture, which consists of Astroscale's robotic debris capture capabilities and rendezvous and proximity operations to remove space debris and defunct satellites.

- In May 2022, Momentus Inc. signed a partnership with SpaceX for the integration of its Vigoride Orbital Transfer Vehicle and customer payloads on Falcon 9, which would be used for the transporter-5 mission.

- In April 2022, Lockheed Martin Corporation released an open-source Augmentation System Port Interface (ASPIN), a non-proprietary interface standard to support on-orbit servicing and mission augmentation. It uses Mission Augmentation Port (MAP) interface standard online that provides a mechanical interface design for docking spacecraft to one another.

- In March 2022, Rogue Space Systems Corporation announced that Seldor Capital is their first institutional investor, which helps the company to scale up its engineering and operations teams.

- In November 2021, Astroscale Holdings, Inc. launched a universal docking device for spacecraft, ""Docking Plate,"" to capture and de-orbit the defunct satellite.

- In September 2021, Starfish Space secured an investment of about $7 million from NFX and MaC Venture Capital along with PSL Ventures, Boost VC, Liquid2 Ventures, and Hypothesis.

- In September 2021, Orbit Fab, Inc. launched its first propellant tanker to geostationary orbit, which has been designed for refueling the largest space assets and for the harshest orbital regimes.

Demand - Drivers and Limitations

The following are the drivers for the global satellite docking system market:

- Growing Demand for Sustainable Space Operations

- Growing Demand for Optimizing Satellite Operation Cost

The following are the challenges for the global satellite docking system market:

- Lack of Industry Wide Standardization of Docking Solutions

- Reduction in Manufacturing and Launch Costs Impacting the Financial Viability of In-Orbit Services

The following are the opportunities for the global satellite docking system market:

- Opportunity for Software Solution for Rendezvous/Proximity Operations

- Evolution of Standardized Satellite Platform

- Enabling Capabilities for Rendezvous/Proximity Operations

How can this report add value to an organization?

Platform/Innovation Strategy: The product segment helps the reader understand the different types of spacecraft and their related docking components in the industry to conduct safe and secure in-orbit services and life extension missions. Moreover, the study provides the reader with a detailed understanding of the different spacecraft by service satellites and target satellites. In addition, it provides a detailed understanding of the different components used in both the satellites, such as docking plate, refueling port, robotic arm, onboard computer, electromagnet attachment mechanism, rotational alignment guides, sensor unit, and other interfaces.

Growth/Marketing Strategy: The global satellite docking system market has seen major development activities by key players operating in the market, such as business expansion activities, contracts, mergers, partnerships, collaborations, and joint ventures. The favored strategy for the companies has been contracts to strengthen their position in the satellite docking system market. For instance, in September 2022, ClearSpace signed a contract with the U.K. Space Agency of about $2.32 million to perform a feasibility study for a mission to remove derelict objects from low Earth orbit (LEO). Furthermore, in May 2022, Starfish Space collaborated with Benchmark Space Systems to develop advanced precision on-orbit refueling and docking capabilities. To optimize spacecraft control accuracy, Starfish is integrating and testing its CEPHALOPOD RPOD software with Benchmark’s non-toxic hydrogen peroxide-fueled Halcyon thruster for manoeuvres.

Competitive Strategy: Key players in the global satellite docking system market analyzed and profiled in the study involve satellite docking system manufacturers that offer docking systems and enabling capabilities. Moreover, a detailed competitive benchmarking of the players operating in the global satellite docking system market offers various solutions to satellites in space through in-orbit refueling, remove active space debris, inspect, repair, and replace the defect devices. Additionally, comprehensive competitive strategies such as contracts, partnerships, agreements, acquisitions, and collaborations will aid the reader in understanding the untapped revenue pockets in the market.

Key Market Players and Competition Synopsis

The companies that are profiled have been selected based on inputs gathered from primary experts and analysis of the company's coverage, product portfolio, and market penetration.

Some prominent established names in this market are:

Company Type 1: Satellite Docking System Supplier

- Altius Space Machines, Inc.

- Astroscale Holdings, Inc.

- ClearSpace

- Lockheed Martin Corporation

- Northrop Grumman

- Orbit Fab, Inc.

- QinetiQ

- Rogue Space Systems Corporation

- Starfish Space

Company Type 2: Enabling Solution Providers

- D-Orbit SpA

- High Earth Orbit Robotics

- LMO

- Maxar Technologies

- Momentus Inc.

- Obruta Space Solutions Corp.

- Orbit Recycling

- Tethers Unlimited, Inc.

Companies that are not a part of the previously mentioned pool have been well represented across different sections of the report (wherever applicable).

Table of Contents

Companies Mentioned

- Altius Space Machines, Inc.

- Astroscale Holdings, Inc.

- ClearSpace

- Lockheed Martin Corporation

- Northrop Grumman

- Orbit Fab, Inc.

- QinetiQ

- Rogue Space Systems Corporation

- Starfish Space

- D-Orbit SpA

- High Earth Orbit Robotics

- LMO

- Maxar Technologies

- Momentus Inc.

- Obruta Space Solutions Corp.

- Orbit Recycling

- Tethers Unlimited, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 153 |

| Published | December 2022 |

| Forecast Period | 2022 - 2032 |

| Estimated Market Value ( USD | $ 66.5 Million |

| Forecasted Market Value ( USD | $ 1011.34 Million |

| Compound Annual Growth Rate | 31.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 17 |