Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Competition in the market is increasingly defined by the ability to balance superior barrier functionality with measurable sustainability gains. Leading producers are channeling R&D into recyclable resin grades, bio-based polymer innovations, and mono-material-compatible barrier technologies that enable simplified recovery without sacrificing performance. This targeted innovation reflects the industry’s shift toward regulatory alignment, brand-driven environmental commitments, and lifecycle efficiency. With end users prioritizing both product protection and compliance with evolving environmental mandates, the global barrier resins market is set to advance as a technically sophisticated and strategically important segment of modern packaging solutions.

Key Market Drivers

Rising Demand for Packaged and Processed Foods

Industry data indicates that nearly 70% of packaged food products in the U.S. market fall into the ultra-processed category, with children deriving over 60% of their daily caloric intake from these products is a key driver propelling the growth of the global barrier resins market, as it directly amplifies the need for high-performance packaging materials capable of preserving product quality and extending shelf life.Currently, urban residents constitute over 50% of the global population, with projections indicating this figure will rise to 68% by 2050, changing dietary habits, and increasing the increasing prevalence of dual-income households, consumers are seeking convenient, ready-to-eat, and long-lasting food options. This shift has led to a surge in consumption of frozen meals, dairy products, snacks, beverages, and other packaged goods. Barrier resins are integral to meeting these needs, as they provide superior protection against oxygen, moisture, UV light, and other external factors that can compromise taste, texture, and nutritional value. Their exceptional sealing capabilities help maintain freshness during transportation, storage, and retail display ensuring that products reach consumers in optimal condition.

The globalization of food trade has heightened the importance of packaging materials that can withstand long supply chains and varying climatic conditions. Barrier resins enable food manufacturers to confidently expand into new markets without compromising product integrity. In parallel, the growing focus on reducing food waste has further cemented their role, as longer shelf life directly correlates with lower spoilage rates. The integration of barrier resins into innovative multilayer and recyclable packaging designs also aligns with consumer and regulatory demands for sustainability, giving food brands a competitive edge. As global consumption of packaged and processed foods continues its upward trajectory, demand for advanced barrier resin solutions is expected to grow at a significant pace, reinforcing their position as a cornerstone of the modern food packaging industry.

Key Market Challenges

High Production Costs

Barrier resins such as EVOH, PVDC, and polyamide involve advanced manufacturing processes, specialized polymerization techniques, and precise quality control to achieve the desired performance characteristics. These processes require significant capital investment, high energy consumption, and skilled technical expertise, all of which contribute to elevated production costs. For price-sensitive markets particularly in developing economies these costs can make high-performance barrier packaging less competitive against lower-cost alternatives, limiting adoption.Key Market Trends

Shift Toward Mono-Material Packaging for Enhanced Recyclability

With global sustainability regulations tightening and consumer awareness of environmental impact rising, brands are moving toward mono-material packaging formats. Unlike traditional multilayer designs that combine different polymers, mono-material structures incorporate a single type of resin often engineered with barrier functionalities to simplify recycling. Advances in resin formulation now allow materials like EVOH or polyethylene blends to deliver high barrier performance while maintaining compatibility with existing recycling streams. This shift is expected to create new opportunities for barrier resin manufacturers that can innovate in performance without sacrificing end-of-life recyclability.Key Market Players

- Evonik Industries AG

- Arkema

- Huntsman International LLC

- BASF SE

- DuPont de Nemours, Inc

- DAIKIN INDUSTRIES, Ltd

- H.B. Fuller Company

- Sika AG

- Mitsubishi Chemical Group Corporation

- The Dow Chemical Company

Report Scope:

In this report, the Global Barrier Resins Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Barrier Resins Market, By Resin Type:

- Polyvinylidiene Chloride (PVDC)

- Ethylene Vinyl Alcohol (EVOH)

- Polyethylene Naphthalate (PEN)

- Polyamide (PA)

- Polyethylene Terephthalate (PET)

- Polyethylene (PE)

- Polypropylene (PP)

- Polyvinyl Alcohol

- Others

Barrier Resins Market, By End Use:

- Food & Beverage

- Pharmaceutical & Medical

- Cosmetics

- Agriculture

- Industrial

- Other

Barrier Resins Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Barrier Resins Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The leading companies profiled in this Barrier Resins market report include:- Evonik Industries AG

- Arkema

- Huntsman International LLC

- BASF SE

- DuPont de Nemours, Inc

- DAIKIN INDUSTRIES, Ltd

- H.B. Fuller Company

- Sika AG

- Mitsubishi Chemical Group Corporation

- The Dow Chemical Company

Table Information

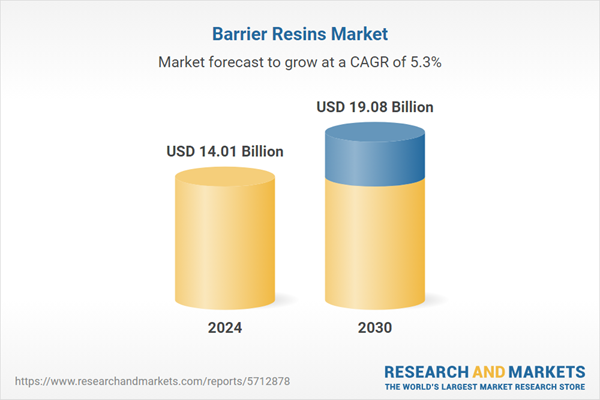

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | September 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 14.01 Billion |

| Forecasted Market Value ( USD | $ 19.08 Billion |

| Compound Annual Growth Rate | 5.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |