Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

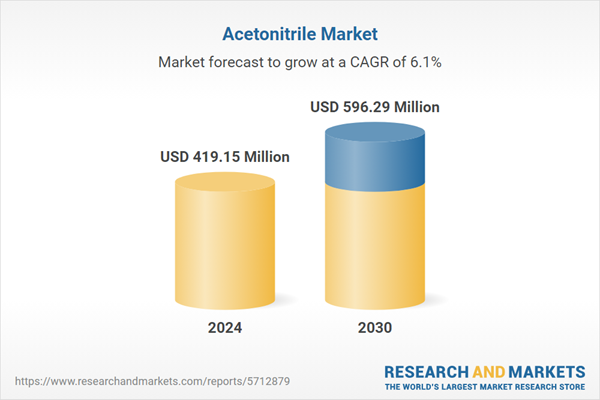

The market's growth trajectory remains robust, underpinned by advancements in diagnostic technologies, heightened consumer health consciousness, and a shift toward more affordable, accessible, and personalized health solutions. As these Acetonitrile products become increasingly central to health management strategies, the market is expected to continue expanding. Regulatory support and ongoing innovations in diagnostics further enhance the market's potential, positioning the Acetonitrile segment as a lucrative opportunity for stakeholders in the healthcare and diagnostics industries.

Key Market Drivers

Rising Demand from the Agrochemical Sector

Rising demand from the agrochemical sector is a significant growth driver for the global acetonitrile market, fueled by the need to enhance agricultural productivity and address global food security challenges. The UN’s Hunger Hotspots report, published in November 2024, identifies Haiti, Mali, South Sudan, Sudan, and the Occupied Palestinian Territories as facing the most severe hunger alerts.Between March and June 2025, projections indicate that nearly two million people across these regions will experience emergency-level food insecurity, reflecting an acute escalation in humanitarian needs. Acetonitrile serves as a vital solvent and reaction medium in the synthesis of a wide range of agrochemicals, including pesticides, herbicides, and insecticides. Its excellent solvency properties, low viscosity, and ability to dissolve a broad spectrum of organic compounds make it ideal for producing high-purity, high-performance formulations.

The growth in agrochemical consumption is being driven by multiple macroeconomic and environmental factors. Rapid population growth, urbanization, and shrinking arable land are pressuring farmers to increase crop yields per hectare. Climate change is further intensifying pest infestations, weed proliferation, and plant diseases, creating a stronger need for advanced crop protection solutions. These market conditions are directly boosting demand for acetonitrile in agrochemical manufacturing, as it plays a critical role in the production of active ingredients that are both effective and compliant with evolving regulatory standards.

Emerging economies in Asia-Pacific, Latin America, and parts of Africa are experiencing accelerated agricultural modernization. By 2025, China is expected to make significant strides in modernizing its agriculture and rural regions, achieving a stronger and more resilient agricultural base, reducing the income disparity between rural and urban populations, and advancing agricultural modernization in areas where conditions are conducive. Governments and private sector players are investing in advanced agrochemical formulations to improve crop resilience and productivity.

This trend has expanded the market for high-quality solvents like acetonitrile, particularly in regions transitioning from traditional farming to commercial-scale agriculture. The agrochemical sector’s shift toward more targeted, environmentally friendly, and high-efficiency formulations has increased the importance of high-purity acetonitrile in synthesis and analytical testing. The compound’s compatibility with precision formulation processes ensures consistent product quality, making it an indispensable input for agrochemical manufacturers.

Key Market Challenges

Supply-Demand Imbalance and Production Dependency

Acetonitrile is primarily produced as a byproduct during the manufacture of acrylonitrile, which is used in plastics, fibers, and synthetic rubber. This byproduct-dependent supply chain makes acetonitrile production highly vulnerable to fluctuations in acrylonitrile output. Any slowdown in acrylonitrile demand due to market downturns or plant shutdowns can create significant supply shortages, leading to price volatility and unreliable availability. This structural limitation often hinders the ability of manufacturers to meet growing demand, especially during periods of rapid expansion in the pharmaceutical or chemical industries.Key Market Trends

Transition Toward Bio-Based and Sustainable Acetonitrile Production

The push for greener chemistry is leading to a notable shift toward bio-based and low-carbon acetonitrile production methods. Innovations in catalytic processes, renewable feedstocks, and energy-efficient manufacturing are reducing dependency on fossil-based acrylonitrile byproducts. This transition not only aligns with global sustainability targets but also offers a more stable and independent supply pathway, mitigating risks from petrochemical market fluctuations. Companies investing early in bio-based acetonitrile are positioning themselves as preferred suppliers to environmentally conscious pharmaceutical, agrochemical, and analytical industries.Key Market Players

- INEOS

- Honeywell International Inc

- MOEVE, S.A.

- Alkyl Amines Chemicals Limited

- Henan GP Chemicals Co.,Ltd

- Shandong Xinhua Pharma

- Zhengzhou Meiya Chemical Products Co.,Ltd

- Jindal Speciality Chemicals Pvt. Ltd

Report Scope:

In this report, the Global Acetonitrile Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Acetonitrile Market, By Product:

- Derivative

- Solvent

Acetonitrile Market, By End Use:

- Pharmaceutical

- Analytical

- Agrochemicals

- Electronics

- Chemical

- Other

Acetonitrile Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Acetonitrile Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The leading companies profiled in this Acetonitrile market report include:- INEOS

- Honeywell International Inc

- MOEVE, S.A.

- Alkyl Amines Chemicals Limited

- Henan GP Chemicals Co.,Ltd

- Shandong Xinhua Pharma

- Zhengzhou Meiya Chemical Products Co.,Ltd

- Jindal Speciality Chemicals Pvt. Ltd

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | September 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 419.15 Million |

| Forecasted Market Value ( USD | $ 596.29 Million |

| Compound Annual Growth Rate | 6.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 9 |