Inherently Conductive Polymer is the fastest growing segment, Asia-Pacific is the largest regional market

Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

Electroactive Polymers (EAPs) are experiencing rising adoption in flexible electronics, where their lightweight and adaptable properties enable innovations such as flexible displays, wearable sensors, and smart textiles requiring mechanical flexibility without compromising electrical performance. This demand aligns with strong industry momentum; according to the Organic and Printed Electronics Association’s March 2024 Business Climate Survey presented at LOPEC 2024, the flexible and printed electronics industry anticipated 13% revenue growth for 2024.Additionally, expanding applications in medical and biomedical technologies significantly propel the market, as EAPs support advancements in smart prosthetics, biocompatible implants, and diagnostic tools due to their responsive and tissue-mimicking characteristics. The medtech industry reflects robust investment activity, with J.P. Morgan’s 2024 Medtech Industry Insights reporting venture funding of USD 19.1 billion across 691 rounds in 2024 year-to-date, a 12% increase from 2023. Robotics, another key EAP end-use sector, also shows strong financial backing; according to The Robot Report in September 2024, robotics investments totaled USD 9.7 billion in the first seven months of 2024 compared to USD 8 billion during the same period in 2023, demonstrating sustained confidence in technologies incorporating EAP-based actuators and sensors.

Key Market Challenges

The elevated production costs associated with specialized processing techniques pose a significant barrier to the growth of the Global Electroactive Polymers Market. These production requirements demand substantial investment in advanced equipment and skilled labor, creating a higher cost structure compared with traditional materials and limiting competitiveness in cost-sensitive applications.This challenge is compounded by broader industry cost pressures. According to IPC’s February 2024 Sentiment of the Global Electronics Manufacturing Supply Chain Report, 66% of electronics manufacturers reported rising labor costs and over 44% cited increasing material expenses, making it more difficult for advanced materials such as EAPs to achieve widespread commercialization. These constraints hinder market penetration and slow the adoption of EAP-based solutions across various industrial segments.

Key Market Trends

The development of biodegradable electroactive polymers is a notable trend, reflecting the broader shift toward sustainable materials. These eco-friendly EAPs support circular economy initiatives by decomposing safely at end-of-life. The European Bioplastics Association reported in 2023 that bio-based polyethylene represented over 25% of global bio-based polymer production, demonstrating growing market preference for sustainable alternatives. Reinforcing this trend, researchers at the Massachusetts Institute of Technology developed a biodegradable poly(beta-amino ester) in December 2024, capable of replacing microplastics in various applications, highlighting the potential for environmentally responsible EAP materials.Another emerging trend is the increasing use of EAPs in energy harvesting and storage technologies, capitalizing on their ability to convert mechanical or thermal energy into electricity for powering self-sustaining devices and advanced capacitors. According to Invest India (June 2023), global electronics production - an important sector for EAP utilization - is projected to grow from USD 87 billion in 2022 to USD 300 billion by 2026. Reflecting investment in EAP-compatible technologies, e-peas secured USD 17.5 million in December 2024 to expand its energy harvesting integrated circuit portfolio, underscoring the growing importance of EAPs in next-generation energy solutions.

Key Market Players Profiled:

- Parker-Hannifin Corp

- Avient Corporation

- 3M Co.

- Kenner Material and System Co. Ltd.

- Solvay SA

- The Lubrizol Corporation

- Premix Oy

- Merck & Co., Inc.

- NOVASENTIS, INC.

- Wacker Chemie AG

Report Scope:

In this report, the Global Electroactive Polymers Market has been segmented into the following categories:By Type:

- Conductive Plastic

- Inherently Conductive Polymer

- Inherently Dissipative Polymer

- Others

By Application:

- ESD Protection

- EMI Shielding

- Actuators

- Others

By Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Electroactive Polymers Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The companies profiled in this Electroactive Polymers market report include:- Parker-Hannifin Corp

- Avient Corporation

- 3M Co.

- Kenner Material and System Co. Ltd.

- Solvay SA

- The Lubrizol Corporation

- Premix Oy

- Merck & Co., Inc.

- NOVASENTIS, INC.

- Wacker Chemie AG

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | November 2025 |

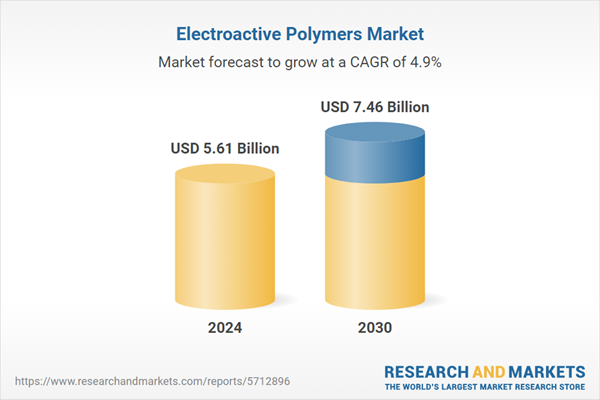

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 5.61 Billion |

| Forecasted Market Value ( USD | $ 7.46 Billion |

| Compound Annual Growth Rate | 4.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |