Speak directly to the analyst to clarify any post sales queries you may have.

The paint sprayer is a device that helps in painting a surface evenly with paint or similar liquids. It can be used for painting several surfaces, such as wood, metal, brick, and many more. The demand for paint sprayers is majorly driven by the industries such as automobile, manufacturing, construction, and marine. In addition, the rising trend of DIY (Do it Yourself) projects are anticipated to drive the paint sprayer market. The market is segmented into product, power source, applicator type, and end-user.

“Rising home renovations and DIY activities are expected to surge the demand for paint sprayers globally.”

Key Winning Imperatives in the Global Paint Sprayer Market

- The DIY culture is one of the significant drivers for the paint sprayer market.

- The rising need for reconstruction and renovation has boosted the demand for paint sprayers in recent years, propelling the industry's growth.

- Paint sprayers are efficient tools, and HVLP paint sprayers are a popular choice amongst DIYers and professionals owing to their narrow spraying and highly controllable pressure-entrusting capability.

MARKET TRENDS & OPPORTUNITIES

Efficient & Sustainable Spray Painting

- Protecting the environment is one of the most significant concerns; efficient and sustainable solutions are essential in achieving day-to-day activities. The exceptional growth in the painting industry and consumer demand has placed a significant environmental burden on the planet. Therefore, the paint sprayer market key players focus on integrating sustainability into their offerings.

Home Improvement Projects

- The home renovation industry is growing across the globe, resulting in rising sales of building materials, appliances, and other home improvement elements. In addition, rental housing is witnessing a rising trend, creating opportunities for home remodeling and renovation. This, in turn, is anticipated to boost the demand for paint spray products from the renovation and retrofit industry.

- About 60% of homeowners in the US consider their financial position before investing in renovation activities. Most homeowners in the country focus on renovating their homes at least once a year. Home improvement is initiated to improve the quality of life. In addition, it has been witnessed that millennials and baby boomers have almost the same perspective toward renovating homes in the region. Around 57% of millennials and baby boomers intend to make home improvements once a year. These factors are anticipated to propel the paint sprayer market during the forecast period.

Growth in DIY Activities

- In some developed economies of the US and Europe, most adults indulge in creative and purposeful leisure activities. Some consumers also invest in home improvement and maintenance activities based on their interests. Consumers in countries such as France, Germany, Italy, and the UK consider DIY activities a major hobby. Home remodeling and painting hold a major position within the painting industry. DIY enthusiasts have the skills to paint. Hence, such factors are anticipated to surge the growth of the global paint sprayer market.

INDUSTRY CHALLENGES

Fluctuations In Raw Materials Pricing

- Raw material costs comprise approximately 50% to 60% of the overall cost of production. The prices of major raw materials used to manufacture paint sprayers have been volatile over the last few years. The volatility of raw material prices severely threatens vendor margins in the paint sprayer market. Other operating expenses, such as labor wages, also sharply increase. Chinese manufacturers add more worries to the company’s top line. These factors burden vendors to strive to produce efficient paint sprayers at affordable costs to cope with the competition in the industry.

SEGMENTATION INSIGHTS

INSIGHTS BY PRODUCT

Air paint sprayers are the largest segment and account for 38.74% of the global paint sprayer market share. The air paint sprayers utilize a compressor to atomize the fluid sprayed on the component. Furthermore, these can be further categorized into two types such as HVLP and LVLP. HVLP paint sprayers are most used in the residential sector for DIY activities since they are more lightweight and efficient for users.Segmentation by Product:

- Air

- Airless

- Electrostatic

- Others

INSIGHTS BY POWER SOURCE

The global paint sprayer market is segmented into corded and cordless paint sprayers by the power source. The corded paint sprayers are the largest segment and account for 59.27% of the global share in 2022. A corded paint sprayer can be operated if needed with a continuous runtime. The segment is expected to grow at a CAGR of 4.35%. They can be used on various surfaces, from flat surfaces and brick walls to furniture and wooden fences.Cordless paint sprayers are smaller in size and therefore are easy to transport with this type of sprayer. Cordless paint sprayers are generally light-weighted since they do not have wire. Hence, the user is anticipated to experience less strain while spraying the paint with cordless paint sprayers. The global cordless paint sprayer market is growing at a CAGR of 5.72% during the forecast period.

Segmentation by Power Source:

- Corded

- Cordless

INSIGHTS BY APPLICATOR TYPE

The manual applicator type is the largest segment by applicator type and accounts for 65.72% of the global cordless paint sprayer market share. Manual air-assist spray guns apply high-viscosity material under demanding surface quality requirements. The segment is expected to generate additional revenue of USD 262.40 million during the forecast period, growing at a CAGR of 4.52%. Woodcrafters use the manual applicator to finish solid wood furniture with solvent and water-based lacquers.Segmentation by Applicator Type:

- Manual

- Automatic

INSIGHTS BY END-USER

The industrial & commercial end-user segment, consisting of significant contributors such as the automotive and construction industries, generated the maximum revenue in the paint sprayer market in 2022. The scenario is expected to remain consistent throughout the forecast period owing to the rising demand for paint sprayers from industries. However, renovation, retrofit, and DIY activities are expected to drive the market for paint sprayers in the residential and commercial segments. The industrial & commercial end-user segment is expected to grow at a CAGR of 5.25% during the forecast period.The residential segment is expected to witness significant growth in the paint sprayer market owing to the rise in the construction of new homes and buildings. This is because paint sprayers are used in renovation and retrofit activities that can use sprayers such as airless and HVLP paint sprayers. A major trend that has led to the significant demand for paint sprayers is the growth in DIY activities. The global residential paint sprayer market is expected to grow at a CAGR of 4.05% during the forecast period.

Segmentation by End-user

- Industrial & Commercial

- Residential

GEOGRAPHICAL INSIGHTS

APAC is the largest paint sprayer market accounting for approximately 37.87% of the global market. It is expected to be the fastest-growing industry during the forecast period, mainly due to the dominant construction industry. APAC is home to several industries, including manufacturing, services, automobiles, and electrical. This consequently increases the need for paint sprayers in the region. While Japan and South Korea are prominent manufacturers and exporters of electrical appliances and automobiles, Singapore dominates with its excellent construction facilities. Furthermore, the increasing purchasing power of consumers and the rising practice of DIY among young consumers are driving the target market in the region.Segmentation by Geography:

- North America

- US

- Canada

- Europe

- UK

- Italy

- France

- Spain

- Germany

- APAC

- China

- Australia

- Japan

- South Korea

- India

- Latin America

- Brazil

- Mexico

- Middle East & Africa

- South Africa

- GCC

VENDOR LANDSCAPE

The global paint sprayer market is characterized by low market concentration with high competition. The present scenario drives vendors to alter and refine their unique value propositions to achieve a strong market presence. Currently, the paint sprayer market is moderately fragmented and is dominated by vendors such as Graco and Wagner. These significant vendors have a global presence.With the growth in DIY culture and the demand for more user-friendly tools, vendors are customizing their tools for home improvement activities. HVLP paint sprayers are being designed for DIY enthusiasts. They are more compact, lightweight, and affordable and support multiple activities. Hence, vendors can afford more power tools with rechargeable batteries under the DIY product ranges, which are expected to be in the limelight throughout the forecast period.

Company Profiles

- Wagner

- Wagner SprayTech

- HomeRight

- Titan Tool

- Earlex

- Graco

- Lemmer Spray Systems

- Sames

- Rongpeng Air Tools

- Blastech

- Buvico Spraying Equipments

- Vands Engineering Solution

- MOD Engineering

- TECCPO

- Batavia

- NEU MASTER

- Robert Bosch

- EXEL Industries

- Litheli

- YATTICH

- Worksite

- HYCHIKA

- NoCry

- Fuji Industrial Spray Equipment

KEY QUESTIONS ANSWERED

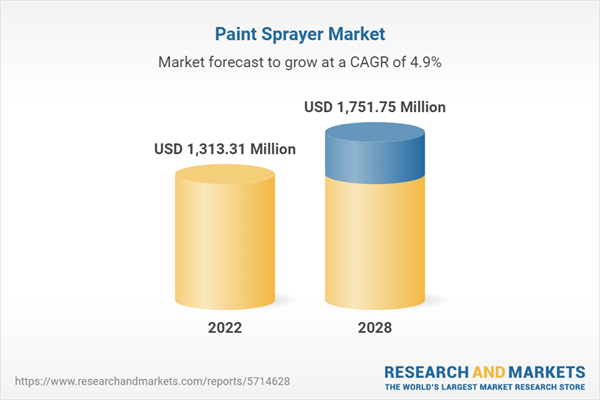

1. How big is the paint sprayer market?2. What is the growth rate of the global paint sprayer market?

3. What are the primary trends in the paint sprayer market?

4. Who are the key players in the global paint sprayer market?

5. Which region holds the highest paint sprayer market share?

Table of Contents

1 Research Methodology2 Research Objectives

3 Research Process

4 Scope & Coverage

4.1 Market Definition

4.1.1 Inclusions

4.1.2 Exclusions

4.1.3 Market Estimation Caveats

4.2 Base Year

4.3 Scope of the Study

4.4 Market Segmentation

4.4.1 Market by Product

4.4.2 Market by Power Source

4.4.3 Market by Applicator Type

4.4.4 Market by End-User

4.4.5 Market Segmentation by Geography

5 Report Assumptions & Caveats

5.1 Key Caveats

5.2 Currency Conversion

5.3 Market Derivation

6 Market at a Glance

7 Premium Insights

7.1.1 Market Overview

7.1.2 Market Trends

7.1.3 Market Opportunities

7.1.4 Market Drivers

7.1.5 Market Challenges

7.1.6 Segment Review

7.1.7 Company & Strategies

7.1.8 Company Profiles

8 Introduction

8.1 Overview

8.2 Paint Recycling

8.3 Value Chain

8.3.1 Material Suppliers

8.3.2 Manufacturers

8.3.3 Distributors

8.3.4 Application

8.4 Frequently Asked Question (Faq)

8.4.1 Can Flammable or Combustible Materials Be Used With Paint Sprayers?

8.4.2 is Operating a Paint Sprayer Easy?

8.4.3 What Kind of Paints Can Be Used in Paint Sprayers?

8.4.4 What is the Suitable Type of Paint Sprayer for Residential Use?

8.4.5 is It Worth Getting a Paint Sprayer?

8.4.6 What is the Best Pressure for Spray Painting?

8.4.7 How Runny Should the Paint Be for a Spray Gun?

8.4.8 Does Spraying Paint Requires Two Coats?

8.5 Automotive Industry

8.6 Construction Insights

8.6.1 Residential Construction

8.6.2 Commercial Construction

8.6.3 Public Infrastructural Construction

9 Market Opportunities & Trends

9.1 Efficient & Sustainable Spray Painting

9.2 Technological Advances

9.3 Home Improvement Projects

10 Market Growth Enablers

10.1 Growth of Automotive Industry

10.2 Growth in Diy Activities

10.3 Advances in Li-Ion Batteries

10.4 Growing Construction Industry

11 Market Restraints

11.1 Fluctuations in Raw Material Prices

11.2 Cost & Maintenance of Paint Sprayers

11.3 Low-Cost Labor in Developing Economies

12 Market Landscape

12.1 Market Overview

12.2 Market Size & Forecast

12.3 Five Forces Analysis

12.3.1 Threat of New Entrants

12.3.2 Bargaining Power of Suppliers

12.3.3 Bargaining Power of Buyers

12.3.4 Threat of Substitutes

12.3.5 Competitive Rivalry

13 Product

13.1 Market Snapshot & Growth Engine

13.2 Market Overview

13.3 Air

13.3.1 Market Overview

13.3.2 Market Size & Forecast

13.3.3 Market by Geography

13.4 Airless

13.4.1 Market Overview

13.4.2 Market Size & Forecast

13.4.3 Market by Geography

13.5 Electrostatic

13.5.1 Market Overview

13.5.2 Market Size & Forecast

13.5.3 Market by Geography

13.6 Others

13.6.1 Market Overview

13.6.2 Market Size & Forecast

13.6.3 Market by Geography

14 Power Source

14.1 Market Snapshot & Growth Engine

14.2 Market Overview

14.3 Corded

14.3.1 Market Overview

14.3.2 Market Size & Forecast

14.3.3 Market by Geography

14.4 Cordless

14.4.1 Market Overview

14.4.2 Market Size & Forecast

14.4.3 Market by Geography

15 Applicator Type

15.1 Market Snapshot & Growth Engine

15.2 Market Overview

15.3 Manual

15.3.1 Market Overview

15.3.2 Market Size & Forecast

15.3.3 Market by Geography

15.4 Automatic

15.4.1 Market Overview

15.4.2 Market Size & Forecast

15.4.3 Market by Geography

16 End-User

16.1 Market Snapshot & Growth Engine

16.2 Market Overview

16.3 Industrial & Commercial

16.3.1 Market Overview

16.3.2 Market Size & Forecast

16.3.3 Market by Geography

16.4 Residential

16.4.1 Market Overview

16.4.2 Market Size & Forecast

16.4.3 Market by Geography

17 Geography

17.1 Market Snapshot & Growth Engine

17.2 Geographic Overview

18 Apac

18.1 Market Overview

18.2 Market Size & Forecast

18.3 Product

18.3.1 Market Size & Forecast

18.4 Power Source

18.4.1 Market Size & Forecast

18.5 Applicator Type

18.5.1 Market Size & Forecast

18.6 End-User

18.6.1 Market Size & Forecast

18.7 Key Countries

18.7.1 China: Market Size & Forecast

18.7.2 Japan: Market Size & Forecast

18.7.3 South Korea: Market Size & Forecast

18.7.4 India: Market Size & Forecast

18.7.5 Australia: Market Size & Forecast

19 Europe

19.1 Market Overview

19.2 Market Size & Forecast

19.3 Product

19.3.1 Market Size & Forecast

19.4 Power Source

19.4.1 Market Size & Forecast

19.5 Applicator Type

19.5.1 Market Size & Forecast

19.6 End-User

19.6.1 Market Size & Forecast

19.7 Key Countries

19.7.1 Germany: Market Size & Forecast

19.7.2 Italy: Market Size & Forecast

19.7.3 Uk: Market Size & Forecast

19.7.4 Spain: Market Size & Forecast

19.7.5 France: Market Size & Forecast

20 North America

20.1 Market Overview

20.2 Market Size & Forecast

20.3 Product

20.3.1 Market Size & Forecast

20.4 Power Source

20.4.1 Market Size & Forecast

20.5 Applicator Type

20.5.1 Market Size & Forecast

20.6 End-User

20.6.1 Market Size & Forecast

20.7 Key Countries

20.7.1 Us: Market Size & Forecast

20.7.2 Canada: Market Size & Forecast

21 Latin America

21.1 Market Overview

21.2 Market Size & Forecast

21.3 Product

21.3.1 Market Size & Forecast

21.4 Power Source

21.4.1 Market Size & Forecast

21.5 Applicator Type

21.5.1 Market Size & Forecast

21.6 End-User

21.6.1 Market Size & Forecast

21.7 Key Countries

21.7.1 Mexico: Market Size & Forecast

21.7.2 Brazil: Market Size & Forecast

22 Middle East & Africa

22.1 Market Overview

22.2 Market Size & Forecast

22.3 Product

22.3.1 Market Size & Forecast

22.4 Power Source

22.4.1 Market Size & Forecast

22.5 Applicator Type

22.5.1 Market Size & Forecast

22.6 End-User

22.6.1 Market Size & Forecast

22.7 Key Countries

22.7.1 South Africa: Market Size & Forecast

22.7.2 Gcc: Market Size & Forecast

23 Competitive Landscape

23.1 Competition Overview

24 Company Profiles

24.1 Wagner

24.1.1 Business Overview

24.1.2 Wagner Spraytech

24.1.3 Product Offerings

24.2 Homeright In

24.2.1 Product Offerings

24.2.2 Titan Tool

24.2.3 Product Offerings

24.2.4 Earlex

24.2.5 Product Offerings

24.3 Graco

24.3.1 Business Overview

24.3.2 Product Offerings

24.4 Lemmer Spray Systems

24.4.1 Business Overview

24.4.2 Product Offerings

24.5 Sames

24.5.1 Business Overview

24.5.2 Product Offerings

24.6 Rongpeng Air Tools

24.6.1 Business Overview

24.6.2 Product Offerings

24.7 Blastech

24.7.1 Business Overview

24.7.2 Product Offerings

24.8 Buvico Spraying Equipments

24.8.1 Business Overview

24.8.2 Product Offerings

24.9 Vands Engineering Solution

24.9.1 Business Overview

24.9.2 Product Offerings

24.10 Mod Engineering

24.10.1 Business Overview

24.10.2 Product Offerings

24.11 Teccpo

24.11.1 Business Overview

24.11.2 Product Offerings

24.12 Batavia

24.12.1 Business Overview

24.12.2 Product Offerings

24.13 Neu Master

24.13.1 Business Overview

24.13.2 Product Offerings

24.14 Robert Bosch

24.14.1 Business Overview

24.14.2 Product Offerings

24.15 Exel Industries

24.15.1 Business Overview

24.15.2 Product Offerings

24.16 Litheli

24.16.1 Business Overview

24.16.2 Product Offerings

24.17 Yattich

24.17.1 Business Overview

24.17.2 Product Offerings

24.18 Worksite

24.18.1 Business Overview

24.18.2 Product Offerings

24.19 Hychika

24.19.1 Business Overview

24.19.2 Product Offerings

24.20 Nocry

24.20.1 Business Overview

24.20.2 Product Offerings

24.21 Fuji Industrial Spray Equipment

24.21.1 Business Overview

24.21.2 Product Offerings

25 Report Summary

25.1 Key Takeaways

25.2 Strategic Recommendations

26 Quantitative Summary

26.1 Product

26.2 Power Source

26.3 Applicator Type

26.4 End-User

26.5 Geography

26.6 Apac

26.6.1 Product

26.6.2 Power Source

26.6.3 Applicator Type

26.6.4 End-User

26.7 Europe

26.7.1 Product

26.7.2 Power Source

26.7.3 Applicator Type

26.7.4 End-User

26.8 North America

26.8.1 Product

26.8.2 Power Source

26.8.3 Applicator Type

26.9 End-User

26.9.1 End-User

26.10 Latin America

26.10.1 Product

26.10.2 Power Source

26.10.3 Applicator Type

26.10.4 End-User

26.11 Middle East & Africa

26.11.1 Product

26.11.2 Power Source

26.11.3 Applicator Type

26.11.4 End-User

27 Appendix

27.1 Abbreviations

Companies Mentioned

- Wagner

- Graco

- Lemmer Spray Systems

- Sames

- Rongpeng Air Tools

- Blastech

- Buvico Spraying Equipments

- Vands Engineering Solution

- MOD Engineering

- TECCPO

- Batavia

- NEU MASTER

- Robert Bosch

- EXEL Industries

- Litheli

- YATTICH

- Worksite

- HYCHIKA

- NoCry

- Fuji Industrial Spray Equipment

Methodology

Our research comprises a mix of primary and secondary research. The secondary research sources that are typically referred to include, but are not limited to, company websites, annual reports, financial reports, company pipeline charts, broker reports, investor presentations and SEC filings, journals and conferences, internal proprietary databases, news articles, press releases, and webcasts specific to the companies operating in any given market.

Primary research involves email interactions with the industry participants across major geographies. The participants who typically take part in such a process include, but are not limited to, CEOs, VPs, business development managers, market intelligence managers, and national sales managers. We primarily rely on internal research work and internal databases that we have populated over the years. We cross-verify our secondary research findings with the primary respondents participating in the study.

LOADING...

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 241 |

| Published | January 2023 |

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 1313.31 Million |

| Forecasted Market Value ( USD | $ 1751.75 Million |

| Compound Annual Growth Rate | 4.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 20 |