Speak directly to the analyst to clarify any post sales queries you may have.

The author estimates that the prevalence of hepatocellular carcinoma will be high in China, followed by the US and Japan in 2020. The increasing prevalence of HCC is driving the hepatocellular carcinoma treatment market growth. According to estimates, more than 1 million people will be affected with hepatocellular carcinoma annually by 2025.

Hepatocellular Carcinoma Therapeutics: Pipeline Scenario

The global hepatocellular carcinoma treatment market portfolio contains a total of 155+ assets in various development phases. Most industry-sponsored drugs in active clinical development for HCC are in the Phase II stage. Anti-PD-1 and PD-L1 monoclonal antibodies are dominating the Hepatocellular Carcinoma drug pipeline.Hepatocellular Carcinoma Therapeutics: Clinical Trials Scenario

The clinical trial portfolio of the hepatocellular carcinoma treatment market contains 220+ trials in various development phases. Most industry-sponsored drugs in active clinical development for hepatocellular carcinoma are in the Phase II stage. The distribution of clinical trials across Phase I-IV indicates that the vast majority of trials for hepatocellular carcinoma have been in the early and mid-phases of development, with 55-60% of trials in Phase I-II and only 40% in Phase III-IV. The US has a substantial lead in the number of hepatocellular carcinoma clinical trials globally.MARKET TRENDS & DRIVERS

Increasing Adoption for Biological Therapies

- Biological therapies such as immune-targeted therapies (Immunotherapies) are widely used to treat hepatocellular carcinoma. With Nivolumab being the biologic approved for hepatocellular carcinoma in 2017, there is a demand for therapies with novel MOAs. Many new classes of therapies are looking to enter the global hepatocellular carcinoma treatment market over the next few years. The biologics such as programmed cell death 1 (PD-1) and programmed cell death ligand 1 (PD-L1) make inroads into the hepatocellular carcinoma market owing to their better clinical profile.

Anticipated Launch of Emerging Drugs

- A recent wave of biologic products prescribed for treating HCC is likely to create a lucrative opportunity for hepatocellular carcinoma (HCC) treatment market growth. Despite the plethora of therapies currently available to patients with hepatocellular carcinoma (HCC), there is still room for improvement within the treatment space. The author anticipates the launch of five new agents among the 8MM, including three programmed cell death 1 (PD-1) inhibitors (Camrelizumab, Tislelizumab, and Cemiplimab), one programmed cell death ligand 1 (PD-L1) inhibitor (Durvalumab) and one Lymphocyte-activation gene (LAG-3) inhibitor (Relatlimab). Launching these late-stage drugs will create an opportunity for the AD market growth.

Focus on Novel Drugs with Novel Mechanism

- The therapeutic agents targeting PD-1 and PD-L1 have been proven to be very effective in HCC, some are already in the therapeutic armamentarium, and others are in development. Over the next five years, the publisher expects to see a surge of innovation emerging from the research and development pipeline and a range of technology-enabled transformations that will expand the evidence-basis for interventions and bring measurable improvements to outcomes.

INSIGHTS BY DRUG CLASS

Chemotherapeutic drugs are expected to dominate the global HCC therapeutics market among the drug class. However, the targeted therapies are expected to be the fastest-growing segment during the forecast period. Recently approved biologics such as Tecentriq (Atezolizumab) are expected to drive the global hepatocellular carcinoma treatment market from 2022-2027. The HCC industry has historically relied on chemotherapies that have been available for over a decade. But recent developments have led to research on novel mechanisms of action (MOAs) to combat the high numbers of patients experiencing treatment non-response. The hepatocellular carcinoma treatment market will experience significant growth due mainly to the launch of new drugs, most of which are expected to launch between 2023-2026, targeting the moderate-to-severe patient population. The biologics such as anti-PD-1 and PD-L1 inhibitors are making inroads into the HCC market owing to their better clinical profile.Segmentation by Drug Class

- Chemotherapy

- Targeted Therapy

INSIGHTS BY GENDER TYPE

Among the gender type, men were expected to account for a significant share of the global hepatocellular carcinoma treatment market based on gender type. This is because of more likely men predominance over women.Segmentation by Gender Type

- Men

- Women

INSIGHTS BY AGE GROUP

The global hepatocellular carcinoma treatment market based on age group is dominated by the 50 yrs & above age group segment. The disease can occur at any age, but HCC is most often diagnosed in adolescents and adults between 50 and 65.Segmentation by Age Group

- Below 29 years

- 30-49 years

- 50+ years

GEOGRAPHICAL ANALYSIS

The US dominates the global hepatocellular carcinoma treatment market by geography due to the healthcare affordability in the US, the knowledge and awareness amongst the people, and the technological advancement in this region. However, China is expected to grow faster with a high CAGR in the HCC drug market due to the rise in access and quality of healthcare, increased awareness about disease management, and rising healthcare expenditure in this region. Among 8MM, the US accounts for a significant market share of 48.07%, with a CAGR of 19.33% in the hepatocellular carcinoma treatment market.Segmentation by Geography

- North America

- US

- APAC

- China

- Japan

- Europe

- France

- Germany

- UK

- Italy

- Spain

VENDOR LANDSCAPE

The global hepatocellular carcinoma treatment market is dominated by many companies offering generic drugs and selective pharma/biotech companies offering patented/commercial drugs for treating hepatocellular carcinoma. The U.S. Food and Drug Administration (FDA) approved the Anti PD-1 monoclonal antibody Nivolumab (Opdivo) for treating HCC in 2017. Following this, the FDA approved Keytruda (pembrolizumab) in 2018 and Tecentriq (atezolizumab) in 2020 for treating HCC. Although generic products continue to capture significant hepatocellular carcinoma treatment market share, the arrival of biologics and other targeted therapies indicate a paradigm shift in this therapeutic space through the forecast period.The hepatocellular carcinoma portfolio contains a total of 155+ assets in various development phases. The emerging therapeutics being developed for hepatocellular carcinoma include Camrelizumab, Tislelizumab, Cemiplimab, CS-1003, Relatlimab, and others. Launching these novel emerging drugs will shift the hepatocellular carcinoma treatment paradigm in the near future. With more than 155+ molecules in various stages of development, it is expected that new vendors are likely to enter the market with novel mechanisms of action and better safety and efficacy profiles compared to the existing patented commercial drugs for treating HCC.

The prominent players offering drugs in the global hepatocellular carcinoma treatment market includes Roche, Bayer, Merck & Co., Bristol-Myers Squibb, Exelixis Inc, Eli Lilly and Company, Innovent Biologics, AstraZeneca, BeiGene, Jiangsu HenGrui Medicine, and many others. These players are focused on R&D initiatives for developing technologically advanced and innovative HCC drugs and are also entering into collaborations to maintain their position in the market. These companies have adopted strategies such as collaborations & acquisitions, expansion of geographical footprint, investments in research & development, and manufacture of novel drugs to compete in the global HCC therapeutics market.

Key Vendors

- Merck & Co.

- Bayer

- Roche

- Eli Lilly and Company

- Bristol-Myers Squibb

- Exelixis Inc (Exelixis)

- Innovent Biologics Inc

- Akeso, Inc

- Jiangsu Hengrui Medicine Co Ltd

- AstraZeneca Plc

- BeiGene

- Sanofi SA

Other Prominent Vendors

- Shenzhou Cell

- Yiviva

- Surface Oncology

- Advenchen Laboratories, LLC

- Abbisko Therapeutics

- Shanghai Henlius Biotech

- Novra Technologies Inc

- TaiRx, Inc.

- Zelgen Biopharmaceuticals

- Pfizer

- Virogin Biotech

- Genoscience

Key Milestones In The Hepatocellular Carcinoma Treatment Market :

- In November 2018, Merck & Co., Inc. announced that the Food and Drug Administration granted accelerated approval to pembrolizumab (Keytruda) for patients with hepatocellular carcinoma (HCC) previously treated with sorafenib. The approval was based on KEYNOTE 224 (NCT02702414), a single-arm, multicenter trial enrolling 104 patients with hepatocellular carcinoma.

- In May 2020, Roche announced that the Food and Drug Administration approved atezolizumab in combination with bevacizumab (Tecentriq) for patients with unresectable or metastatic hepatocellular carcinoma who have not received prior systemic therapy. The approval is based on IMbrave150 (NCT03434379), a multicenter, international, open-label, randomized trial in patients with locally advanced unresectable or metastatic hepatocellular carcinoma who had not received prior systemic therapy.

- In May 2019, Eli Lilly and Company announced that the Food and Drug Administration approved ramucirumab (Cyramza) as a single agent for hepatocellular carcinoma (HCC) in patients who have an alpha-fetoprotein (AFP) of ≥ 400 ng/mL and have been previously treated with sorafenib. The approval was based on REACH 2 (NCT02435433), a multinational, randomized, double-blind, placebo-controlled, multicenter study in 292 patients with advanced HCC with AFP ≥ 400 ng/mL who had disease progression on or after sorafenib or who were intolerant.

Key Mergers & Acquisitions In The Hepatocellular Carcinoma Treatment Market:

- In Jun 2018, Blueprint Medicines Corporation and CStone Pharmaceuticals announced an exclusive collaboration and license agreement for the development and commercialization of avapritinib, BLU-554, and BLU-667 in Mainland China, Hong Kong, Macau, and Taiwan, either as monotherapies or combination therapies.

- In Dec 2016, Exelixis Inc. and Ipsen announced an amendment to the exclusive collaboration and licensing agreement for cabozantinib's commercialization and continued development. It is included in the commercialization rights in Canada. Under the terms of the amendment, Exelixis will receive a USD 10 million upfront payment. Exelixis is eligible to receive regulatory milestones for the approvals of cabozantinib in Canada for advanced renal cell carcinoma (RCC) after prior treatment, for first-line RCC, and advanced hepatocellular carcinoma (HCC), as well as additional regulatory milestones for potential further indications.

REPORT COVERS

a) Detailed overview of hepatocellular carcinoma (HCC) treatment market, including disease definition, classification, diagnosis, and treatment patternb) Overview of the global trends of HCC in the eight major markets (8MM)

c) Historical, current, and projected patient pool of HCC in the eight major markets (8MM) for the 2018 - 2027 period

d) Gender type, Disease Type, Age Group, Drug Class, and Geography type segmentations of HCC in the eight major markets (8MM)

e) In-depth analysis of the market segments, which includes products, treatment, and competitor analysis

f) Global hepatocellular carcinoma treatment market share of the industry players, company profiles, product specifications, and competitive landscape

g) Comprehensive data on emerging trends, market drivers, growth opportunities, and restraints

h) Detailed overview of marketed drugs with key coverage of developmental activities, including sponsor name, approved indication, territory, collaborations, licensing, mergers and acquisitions, regulatory designations, and other product-related activities

i) Detailed overview of therapeutic pipeline activity and therapeutic assessment of the products by development stage, product type, route of administration, molecule type, and MOA type for hepatocellular carcinoma across the complete product development cycle, including all clinical and non-clinical stages

j) Detailed overview of clinical trial activity and therapeutic assessment of the products by development stage, product type, route of administration, molecule type, and geography type for hepatocellular carcinoma across all clinical stages

k) Coverage of dormant and discontinued pipeline projects along with the reasons across the hepatocellular carcinoma therapeutics market

l) Coverage of major milestones (product approvals/launches timelines, clinical trial result publications, regulatory designations, licensing & collaborations, research & development progress of pipeline assets) in the HCC space

KEY QUESTIONS ANSWERED

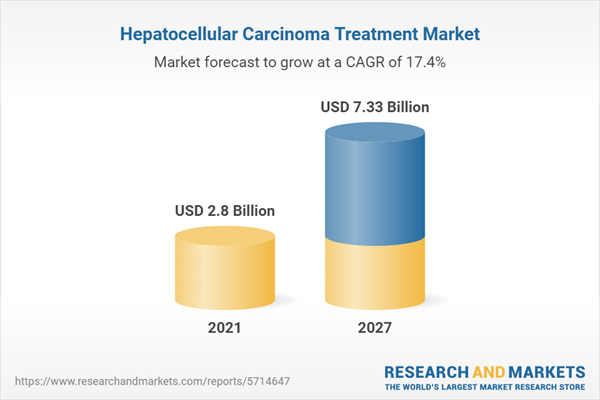

1. How big is the hepatocellular carcinoma treatment market?2. What is the growth rate of the hepatocellular carcinoma treatment market?

3. Who are the key players in the global hepatocellular carcinoma treatment market

4. Which region holds the largest global hepatocellular carcinoma treatment market share?

5. What are the latest trends in the hepatocellular carcinoma treatment market?

Table of Contents

1. Hepatocellular Carcinoma Overview1.1. Hepatocellular Carcinoma (Hcc) - An Overview

2. Hepatocellular Carcinoma Epidemiology & Overview

2.1. 8Mm: Historic & Projected Volume of Incidence & Prevalence of Hcc

2.2. 8Mm: Comparative Analysis of Incidence & Prevalence of Hcc

2.3. 8Mm: Historic & Projected Volume of Incidence of Hcc Cases by Age Group

2.4. 8Mm: Comparative Analysis of Incidence of Hcc Cases by Age Group

2.5. Us: Historic & Projected Volume of Incidence & Prevalence of Hcc

2.6. Us: Comparative Analysis of Incidence & Prevalence of Hcc

2.7. Us: Historic & Projected Volume of Incidence of Hcc Cases by Age Group

2.8. Us: Comparative Analysis of Incidence of Hcc Cases by Age Group

2.9. China: Historic & Projected Volume of Incidence & Prevalence of Hcc

2.10. China: Comparative Analysis of Incidence & Prevalence of Hcc

2.11. China: Historic & Projected Volume of Incidence of Hcc Cases by Age Group

2.12. China: Comparative Analysis of Incidence of Hcc Cases by Age Group

2.13. Japan: Historic & Projected Volume of Incidence & Prevalence of Hcc

2.14. Japan: Comparative Analysis of Incidence & Prevalence of Hcc

2.15. Japan: Historic & Projected Volume of Incidence of Hcc Cases by Age Group

2.16. Japan: Comparative Analysis of Incidence of Hcc Cases by Age Group

2.17. Germany: Historic & Projected Volume of Incidence & Prevalence of Hcc

2.18. Germany: Comparative Analysis of Incidence & Prevalence of Hcc

2.19. Germany: Historic & Projected Volume of Incidence of Hcc Cases by Age Group

2.20. Germany: Comparative Analysis of Incidence of Hcc Cases by Age Group

2.21. Uk: Historic & Projected Volume of Incidence & Prevalence of Hcc

2.22. Uk: Comparative Analysis of Incidence & Prevalence of Hcc

2.23. Uk: Historic & Projected Volume of Incidence of Hcc Cases by Age Group

2.24. Uk: Comparative Analysis of Incidence of Hcc Cases by Age Group

2.25. France: Historic & Projected Volume of Incidence & Prevalence of Hcc

2.26. France: Comparative Analysis of Incidence & Prevalence of Hcc

2.27. France: Historic & Projected Volume of Incidence of Hcc Cases by Age Group

2.28. France: Comparative Analysis of Incidence of Hcc Cases by Age Group

2.29. Italy: Historic & Projected Volume of Incidence & Prevalence of Hcc

2.30. Italy: Comparative Analysis of Incidence & Prevalence of Hcc

2.31. Italy: Historic & Projected Volume of Incidence of Hcc Cases by Age Group

2.32. Italy: Comparative Analysis of Incidence of Hcc Cases by Age Group

2.33. Spain: Historic & Projected Volume of Incidence & Prevalence of Hcc

2.34. Spain: Comparative Analysis of Incidence & Prevalence of Hcc

2.35. Spain: Historic & Projected Volume of Incidence of Hcc Cases by Age Group

2.36. Spain: Comparative Analysis of Incidence of Hcc Cases by Age Group

3. Hepatocellular Carcinoma Market Size & Overview

3.1. 8Mm: Historic & Projected Revenue of Hcc

3.2. 8Mm: Historic & Projected Revenue of Hcc Snapshot

3.3. 8Mm: Historic & Projected Revenue Segmentation by Gender Type, Age Group & Drug Class

3.4. Us: Historic & Projected Revenue of Hcc

3.5. Us: Historic & Projected Revenue of Hcc Snapshot

3.6. Us: Historic & Projected Revenue Segmentation by Gender Type, Age Group & Drug Class

3.7. China: Historic & Projected Revenue of Hcc

3.8. China: Historic & Projected Revenue of Hcc Snapshot

3.9. China: Historic & Projected Revenue Segmentation by Gender Type, Age Group & Drug Class

3.10. Japan: Historic & Projected Revenue of Hcc

3.11. Japan: Historic & Projected Revenue of Hcc Snapshot

3.12. Japan: Historic & Projected Revenue Segmentation by Gender Type, Age Group & Drug Class

3.13. Germany: Historic & Projected Revenue of Hcc

3.14. Germany: Historic & Projected Revenue of Hcc Snapshot

3.15. Germany: Historic & Projected Revenue Segmentation by Gender Type, Age Group & Drug Class

3.16. Uk: Historic & Projected Revenue of Hcc

3.17. Uk: Historic & Projected Revenue of Hcc Snapshot

3.18. Uk: Historic & Projected Revenue Segmentation by Gender Type, Age Group & Drug Class

3.19. France: Historic & Projected Revenue of Hcc

3.20. France: Historic & Projected Revenue of Hcc Snapshot

3.21. France: Historic & Projected Revenue Segmentation by Gender Type, Age Group & Drug Class

3.22. Italy: Historic & Projected Revenue of Hcc

3.23. Italy: Historic & Projected Revenue of Hcc Snapshot

3.24. Italy: Historic & Projected Revenue Segmentation by Gender Type, Age Group & Drug Class

3.25. Spain: Historic & Projected Revenue of Hcc

3.26. Spain: Historic & Projected Revenue of Hcc Snapshot

3.27. Spain: Historic & Projected Revenue Segmentation by Gender Type, Age Group & Drug Class

4. Hepatocellular Carcinoma Marketed Drugs Overview

4.1. Hepatocellular Carcinoma Marketed Drugs - An Overview

4.2. Hepatocellular Carcinoma Marketed Drugs - Summary

5. Hepatocellular Carcinoma Pipeline Drugs Overview

5.1. Hcc Pipeline Drugs - An Overview

5.2. Hcc Pipeline Drugs - Snapshot

5.3. Pipeline Drugs Overview & Snapshot - by Disease Type

5.4. Hcc Pipeline Drugs Overview & Snapshot - by Development Phase

5.5. Hcc Pipeline Drugs Overview & Snapshot - by Route of Administration

5.6. Hcc Pipeline Drugs Overview & Snapshot - by Mechanism of Action

5.7. Hcc Pipeline Drugs Overview & Snapshot - by Molecule Type

5.8. Hcc Pipeline Drugs Overview & Snapshot - by Geography Type

6. Hepatocellular Carcinoma Clinical Trials Overview

6.1. Hcc Clinical Trials Overview Snapshot

6.2. Hcc Clinical Trials Overview - by Recruitment Status

6.3. Hcc Clinical Trials Overview - by Product Type

6.4. Hcc Clinical Trials Overview - by Route of Administration

6.5. Hcc Clinical Trials Overview - by Molecule Type

6.6. Hcc Clinical Trials Overview - by Geography Type

7. Hepatocellular Carcinoma Market Dynamics

7.1. Hcc Therapeutics Market Drivers

7.2. Hcc Therapeutics Market Constraints

7.3. Hcc Therapeutics Market Trends

8. Hepatocellular Carcinoma Competitive Landscape

8.1. Hcc Competitive Landscape - Marketed Drugs

8.2. Key Company Profiles

8.3. Other Key Company Profiles

8.4. Competitive Scenario of Hcc Therapeutics Market

8.5. Key Company Overviews

8.6. Hepatocellular Carcinoma Competitive Landscape - Pipeline Drugs

8.7. Key Emerging Company Profiles

8.8. Other Key Emerging Company Profiles

8.9. Key Company Overviews

9. Hepatocellular Carcinoma Miscellaneous

9.1. Key Tentative Drug Approvals Timeline

9.2. Key Regulatory Designations

9.3. Key Milestones

9.4. Deals & Collaborations

9.5. Inactive/Discontinued/Dormant Products

9.6. Unmet Needs/Strategic Recommendations

10. Appendix

10.1. About Arizton

10.2. Research Methodology

10.3. List of Abbreviations

Companies Mentioned

- Merck & Co.

- Bayer

- Roche

- Eli Lilly and Company

- Bristol-Myers Squibb

- Exelixis Inc (Exelixis)

- Innovent Biologics Inc

- Akeso, Inc

- Jiangsu Hengrui Medicine Co Ltd

- AstraZeneca Plc

- BeiGene

- Sanofi SA

- Shenzhou Cell

- Yiviva

- Surface Oncology

- Advenchen Laboratories, LLC

- Abbisko Therapeutics

- Shanghai Henlius Biotech

- Novra Technologies Inc

- TaiRx, Inc.

- Zelgen Biopharmaceuticals

- Pfizer

- Virogin Biotech

- Genoscience

Methodology

Our research comprises a mix of primary and secondary research. The secondary research sources that are typically referred to include, but are not limited to, company websites, annual reports, financial reports, company pipeline charts, broker reports, investor presentations and SEC filings, journals and conferences, internal proprietary databases, news articles, press releases, and webcasts specific to the companies operating in any given market.

Primary research involves email interactions with the industry participants across major geographies. The participants who typically take part in such a process include, but are not limited to, CEOs, VPs, business development managers, market intelligence managers, and national sales managers. We primarily rely on internal research work and internal databases that we have populated over the years. We cross-verify our secondary research findings with the primary respondents participating in the study.

LOADING...

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 189 |

| Published | January 2023 |

| Forecast Period | 2021 - 2027 |

| Estimated Market Value ( USD | $ 2.8 Billion |

| Forecasted Market Value ( USD | $ 7.33 Billion |

| Compound Annual Growth Rate | 17.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 24 |