Rising Adoption of Industry 4.0

The growing adoption of Industry 4.0 in manufacturing, automotive, and construction sectors is expected to boost the demand for seam welding machines. The welding equipment or machines needs to be equipped with high-performance information and communication technology, and customized sensors so that all production-relevant information can be digitized and helps manage the necessary real-time behavior of the system. The industry 4.0 ready seam welding machines consist of several microprocessors connected by bus systems, and they form a network internally. This architecture allows flexible implementation of a variety of system configurations with few different base devices.Industry 4.0 fully automates production processes with minimal to little human intervention. It works on the industrial internet of things (IIoT), cyber-physical systems, cloud computing, cloud robotics, and big data. As a result, welding robot manufacturers are moving to produce networked and intelligent robots compatible with Industry 4.0. Many end-use industries, such as automotive & transportation, metals & machinery, electrical & electronics, and aerospace & defense, have started implementing the industry 4.0 concept in their manufacturing processes to harness the advantages associated with it, including increased productivity, flexibility, and safety; better quality; decreased need for consumables; and reduced production costs.

Another key factor that is boosting the demand for Industry 4.0 in the seam welding machine market is data security. In addition to a high degree of computerization of the individual production facilities, its integration into local networks, open network structures, and globally valid standards for data security, transfer, and interfaces are necessary. Thus, digital security integration in industry 4.0 is expected to boost the growth of the seam welding machine market.

Market Overview

The US, Canada, and Mexico are among the major economies in North America. The presence of many well-established and technologically advanced manufacturing businesses benefits this region's seam welding machine market. With increasing government investments in transportation, building, and infrastructure sectors, the US dominates the market in North America. Seam welding machines are used in the building and construction industries on a large scale; thus, the rising number of residential and commercial building construction projects boosts the market growth across the region. Governments in North American countries are taking initiatives to build the smart industrial sector. For instance, in November 2021, the US Congress passed a US$ 1 trillion infrastructure spending bill; the infrastructure legislation in the country proposes US$ 550 billion in new federal expenditure over the next eight years for upgrading roads, bridges, and highways and modernizing city transit systems and passenger rail networks. Such a rise in spending on infrastructure projects favors the growth of the construction industry, thereby bolstering the demand for seam welding machines.North America is one of the world's largest and wealthiest economies, and construction is the backbone of its economy. The region has witnessed a remarkable rise in infrastructure and construction over the last decade. In Canada, ~50 skyscrapers reached completion in major cities such as Toronto, Vancouver, and Calgary. According to a study by Zillow, a real estate company, the total value of private residential real estate in the US will increase by US$ 6.9 trillion in 2021. Further, the real estate industry had predicted that home prices would rise at a year-on-year rate of 22% in the first half of 2022. Thus, a rise in construction activities in the residential sector is augmenting the need for more welded products, thereby driving the demand for seam welding machines.

North America Seam Welding Machine Market Segmentation

The North America seam welding machine market is segmented into mode, operation, industry, and country. Based on mode, the North America seam welding machine market is segmented into intermittent seam welding and continuous seam welding segment. The continuous seam welding segment accounted for the larger share of the seam welding machine market in 2022.- Based on operation, the North America seam welding machine market is segmented into manual, semi-automatic and automatic segment. The automatic segment accounted for the largest share of the seam welding machine market in 2022.

- Based on industry, the North America seam welding machine market is categorized into construction, automotive, oil and gas, manufacturing, and others. The construction segment accounted for the largest share of the seam welding machine market in 2022.

- Based on country, the market is segmented into the US, Canada, and Mexico. The US dominated the market in 2022.

Table of Contents

1. Introduction1.1 Study Scope

1.2 Research Report Guidance

1.3 Market Segmentation

1.3.1 North America Seam Welding Machine Market - By Mode

1.3.2 North America Seam Welding Machine Market - By Operation

1.3.3 North America Seam Welding Machine Market - By Industry

1.3.4 North America Seam Welding Machine Market - By Country

2. Key Takeaways

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

4. North America Seam Welding Machine Market Landscape

4.1 Market Overview

4.2 North America PEST Analysis

4.3 Ecosystem Analysis

4.4 Expert Opinion

5. North America Seam Welding Machine Market - Key Market Dynamics

5.1 Market Drivers

5.1.1 Increasing Adoption in Energy, Shipbuilding, and Construction Industries Worldwide

5.1.2 Rising Adoption of Industry 4.0

5.2 MARKET RESTRAINTS

5.2.1 High Maintenance and Operating Costs

5.3 MARKET OPPORTUNITIES

5.3.1 Increase in Demand for Laser-Based Beam Welding

5.4 FUTURE TRENDS

5.4.1 Advancements in Automated Seam Welding Technology

5.5 Impact Analysis of Drivers and Restraints

6. Seam Welding Machine Market - North America Market Analysis

6.1 North America Seam Welding Machine Market Overview

6.2 North America Seam Welding Machine Market Forecast and Analysis

7. North America Seam Welding Machine Market Revenue and Forecast to 2028 - Mode

7.1 Overview

7.2 North America Seam Welding Machine Market, by Mode (2021 and 2028)

7.3 Intermittent Seam Welding

7.3.1 Overview

7.3.2 Intermittent Seam Welding: Seam Welding Machine Market Revenue and Forecast to 2028 (US$ Million)

7.4 Continuous Seam Welding

7.4.1 Overview

7.4.2 Continuous Seam Welding: Seam Welding Machine Market- Revenue and Forecast to 2028 (US$ Million)

8. North America Seam Welding Machine Market Analysis - By Operation

8.1 Overview

8.2 North America Seam Welding Machine Market, by Operation (2021 and 2028)

8.3 Manual

8.3.1 Overview

8.3.2 Manual: Seam Welding Machine Market- Revenue and Forecast to 2028 (US$ Million)

8.4 Semi-Automatic

8.4.1 Overview

8.4.2 Semi-Automatic: Seam Welding Machine Market- Revenue and Forecast to 2028 (US$ Million)

8.5 Automatic

8.5.1 Overview

8.5.2 Automatic: Seam Welding Machine Market- Revenue and Forecast to 2028 (US$ Million)

9. North America Seam Welding Machine Market - By Industry

9.1 Overview

9.2 North America Seam Welding Machine Market by Industry (2021 and 2028)

9.3 Construction

9.3.1 Overview

9.3.2 Construction: Seam Welding Machine Market - Revenue and Forecast to 2028 (US$ Million)

9.4 Automotive

9.4.1 Overview

9.4.2 Automotive: Seam Welding Machine Market - Revenue and Forecast to 2028 (US$ Million)

9.5 Oil and Gas

9.5.1 Overview

9.5.2 Oil and Gas: Seam Welding Machine Market - Revenue and Forecast to 2028 (US$ Million)

9.6 Manufacturing

9.6.1 Overview

9.6.2 Manufacturing: Seam Welding Machine Market - Revenue and Forecast to 2028 (US$ Million)

9.7 Others

9.7.1 Overview

9.7.2 Others: Seam Welding Machine Market - Revenue and Forecast to 2028 (US$ Million)

10. North America Seam Welding Machine Market - Country Analysis

10.1 Overview

10.1.1 North America: Seam Welding Machine, by Key Country

10.1.1.1 US: Seam Welding Machine Market - Revenue and Forecast to 2028 (US$ Million)

10.1.1.1.1 US: Seam Welding Machine Market, By Mode

10.1.1.1.2 US: Seam Welding Machine Market, By Operation

10.1.1.1.3 US: Seam Welding Machine Market, By Industry

10.1.1.2 Canada: Seam Welding Machine Market - Revenue and Forecast to 2028 (US$ Million)

10.1.1.2.1 Canada: Seam Welding Machine Market, By Mode

10.1.1.2.2 Canada: Seam Welding Machine Market, By Operation

10.1.1.2.3 Canada: Seam Welding Machine Market, By Industry

10.1.1.3 Mexico: Seam Welding Machine Market - Revenue and Forecast to 2028 (US$ Million)

10.1.1.3.1 Mexico: Seam Welding Machine Market, By Mode

10.1.1.3.2 Mexico: Seam Welding Machine Market, By Operation

10.1.1.3.3 Mexico: Seam Welding Machine Market, By Industry

11. Industry Landscape

11.1 Overview

11.2 Market Initiative

11.3 New Product Development

12. Company Profiles

12.1 A.C.T Otomotiv Müh. Dan. San. Tic. Ltd. ?ti.

12.1.1 Key Facts

12.1.2 Business Description

12.1.3 Products and Services

12.1.4 Financial Overview

12.1.5 SWOT Analysis

12.1.6 Key Developments

12.2 Emerson Electric Co.

12.2.1 Key Facts

12.2.2 Business Description

12.2.3 Products and Services

12.2.4 Financial Overview

12.2.5 SWOT Analysis

12.2.6 Key Developments

12.3 MITUSA Inc.

12.3.1 Key Facts

12.3.2 Business Description

12.3.3 Products and Services

12.3.4 Financial Overview

12.3.5 SWOT Analysis

12.3.6 Key Developments

12.4 Miller Electric Manufacturing Co.

12.4.1 Key Facts

12.4.2 Business Description

12.4.3 Products and Services

12.4.4 Financial Overview

12.4.5 SWOT Analysis

12.4.6 Key Developments

12.5 KOIKE ARONSON, INC.

12.5.1 Key Facts

12.5.2 Business Description

12.5.3 Products and Services

12.5.4 Financial Overview

12.5.5 SWOT Analysis

12.5.6 Key Developments

13. Appendix

13.1 About the Publisher

13.2 Word Index

List of Tables

Table 1. North America Seam Welding Machine Market, Revenue and Forecast, 2019-2028 (US$ Million)

Table 2. US: Seam Welding Machine Market, By Mode - Revenue and Forecast to 2028 (US$ Million)

Table 3. US: Seam Welding Machine Market, By Operation - Revenue and Forecast to 2028 (US$ Million)

Table 4. US: Seam Welding Machine Market, By Industry- Revenue and Forecast to 2028 (US$ Million)

Table 5. Canada: Seam Welding Machine Market, By Mode - Revenue and Forecast to 2028 (US$ Million)

Table 6. Canada: Seam Welding Machine Market, By Operation - Revenue and Forecast to 2028 (US$ Million)

Table 7. Canada: Seam Welding Machine Market, By Industry- Revenue and Forecast to 2028 (US$ Million)

Table 8. Mexico: Seam Welding Machine Market, By Mode - Revenue and Forecast to 2028 (US$ Million)

Table 9. Mexico: Seam Welding Machine Market, By Operation - Revenue and Forecast to 2028 (US$ Million)

Table 10. Mexico: Seam Welding Machine Market, By Industry- Revenue and Forecast to 2028 (US$ Million)

Table 11. List of Abbreviation

List of Figures

Figure 1. North America Seam Welding Machine Market Segmentation

Figure 2. North America Seam Welding Machine Market Segmentation - Country

Figure 3. North America Seam Welding Machine Market Overview

Figure 4. North America Seam Welding Machine Market, By Mode

Figure 5. North America Seam Welding Machine Market, By Country

Figure 6. North America: PEST Analysis

Figure 7. North America Seam Welding Machine Market Ecosystem Analysis

Figure 8. Expert Opinion

Figure 9. North America Seam Welding Machine Market: Impact Analysis of Drivers and Restraints

Figure 10. North America Seam Welding Machine Market, Forecast and Analysis (US$ Million)

Figure 11. North America Seam Welding Machine Market Revenue Share, by Mode (2021 and 2028)

Figure 12. North America Intermittent Seam Welding: Seam Welding Machine Market- Revenue and Forecast to 2028 (US$ Million)

Figure 13. North America Continuous Seam Welding: Seam Welding Machine Market- Revenue and Forecast to 2028 (US$ Million)

Figure 14. North America Seam Welding Machine Market Revenue Share, by Operation (2021 and 2028)

Figure 15. North America Manual: Seam Welding Machine Market- Revenue and Forecast to 2028 (US$ Million)

Figure 16. North America Semi-Automatic: Seam Welding Machine Market- Revenue and Forecast to 2028 (US$ Million)

Figure 17. North America Automatic Seam Welding Machine: Seam Welding Machine Market- Revenue and Forecast to 2028 (US$ Million)

Figure 18. North America Seam Welding Machine Market Revenue Share by Industry (2021 and 2028)

Figure 19. North America Construction: Seam Welding Machine Market - Revenue and Forecast to 2028 (US$ Million)

Figure 20. North America Automotive: Seam Welding Machine Market - Revenue and Forecast to 2028 (US$ Million)

Figure 21. North America Oil and Gas: Seam Welding Machine Market - Revenue and Forecast to 2028 (US$ Million)

Figure 22. North America Manufacturing: Seam Welding Machine Market - Revenue and Forecast to 2028 (US$ Million)

Figure 23. North America Others: Seam Welding Machine Market - Revenue and Forecast to 2028 (US$ Million)

Figure 24. North America: Seam Welding Machine- Revenue and Forecast to 2028 (US$ Million)

Figure 25. North America: Seam Welding Machine Revenue Share, by Key Country (2021 and 2028)

Figure 26. US: Seam Welding Machine Market - Revenue and Forecast to 2028 (US$ Million)

Figure 27. Canada: Seam Welding Machine Market - Revenue and Forecast to 2028 (US$ Million)

Figure 28. Mexico: Seam Welding Machine Market - Revenue and Forecast to 2028 (US$ Million)

Companies Mentioned

- A.C.T Otomotiv Müh. Dan. San. Tic. Ltd. Şti.

- KOIKE ARONSON, INC.

- Miller Electric Manufacturing Co.

- MITUSA Inc

Table Information

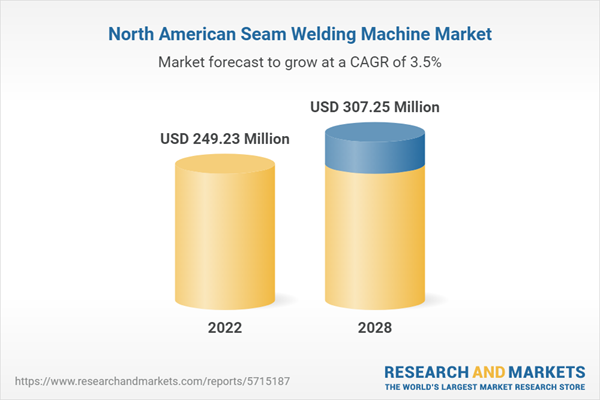

| Report Attribute | Details |

|---|---|

| No. of Pages | 90 |

| Published | December 2022 |

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 249.23 Million |

| Forecasted Market Value ( USD | $ 307.25 Million |

| Compound Annual Growth Rate | 3.5% |

| Regions Covered | North America |