Strict Regulation Mandating the Use of Insulation Materials for Energy Conservation

Insulation materials provide resistance to heat flow and it also helps in lowering heating and cooling costs. Strict regulations for the mandatory use of insulation materials for energy saving purposes are the major factor contributing to the growth of the industrial insulation market. Energy saving regulations and the need for insulation materials in end-use industries such as oil and gas, chemical and petrochemical, food and beverage are driving the market growth. Additionally, standards established by various associations apply to the design of equipment in the industry, to overhaul and implement to boost the growth of the industrial insulation market across the region.Market Overview

The North America industrial insulation market is segmented into the US, Canada, and Mexico. The market in the region is driven by highly developed industrial and power generation sector. Industrial Insulation plays an important role in nuclear power plants, fossil fuel power plants, hydroelectric power plants, solar power plants, coal-fired power plants and wind power towers. It helps maintain the temperatures of boilers that generate steam. Pipes in these facilities require insulation to maintain temperatures. In recent years, renewable electricity generation from sources other than hydropower has steadily increased in the US due to the increasing to wind and solar generating capacities. According to the US Energy Information Administration, wind energy's share of total utility-scale electricity generating capacity in the US grew from 0.2% in 1990 to about 12% in 2021, and its share of total annual utility-scale electricity generation grew from less than 1% in 1990 to about 9% in 2021. In addition, solar energy's share of total utility-scale electricity generation in the US in 2021 was about 2.8%, up from less than 0.1% in 1990. The increasing electricity generation mainly drives the demand for industrial insulation products in the region. In the chemical & petrochemical industry, many of the products created within the facilities are potentially hazardous at some stage during their manufacture, production, and transportation. The manufacturing process involves high temperatures, high pressure, and chemical reactions. In various chemical plants, different processes contain thermal challenges that the industrial insulation industry addresses by using various insulation materials available in the market. In the US, the chemicals industry is a keystone of the country'ss economy. The US is one of the top chemical producers in the world, accounting for the significant share of the world production. In Canada, the chemical industry has played an important role in the country'ss economy. The industry in the country focuses mainly on crude petroleum and natural gas processing. Hence, the strong presence of the chemical & petrochemical industry in the region propels the demand for industrial insulation products. Further, in the food industry, thermal insulation products are used for pipework, boilers, fryers, storage tanks, and steam distribution systems. Therefore, the increasing use of insulation products in the food & beverage industry bolsters the industrial insulation market growth in North America.North America Industrial Insulation Market Segmentation

The North America industrial insulation market is segmented based on raw material, product, end user, and country.- Based on raw material, the North America industrial insulation market is segmented into wool, foams, fibres, and others. The foams segment held the largest market share in 2022.

- Based on product, the North America industrial insulation market is segmented into pipe, board, blanket, and others. The pipe segment held the largest market share in 2022.

- Based on end user, the North America industrial insulation market is segmented into power generation, chemical and petrochemical, cement, food and beverage, and others. The power generation segment held the largest market share in 2022.

- Based on country, the North America industrial insulation market has been categorized into the US, Canada, and Mexico. Our regional analysis states that the US dominated the market share in 2022.

Table of Contents

1. Introduction1.1 Study Scope

1.2 Research Report Guidance

1.3 Market Segmentation

1.3.1 North America Industrial Insulation Market, by Raw Material

1.3.2 North America Industrial Insulation Market, by Product

1.3.3 North America Industrial Insulation Market, by End User

1.3.4 North America Industrial Insulation Market, by Country

2. Key Takeaways

3. Research Methodology

3.1 Scope of the Study

3.2 Research Methodology

3.2.1 Data Collection:

3.2.2 Primary Interviews:

3.2.3 Hypothesis formulation:

3.2.4 Macro-economic factor analysis:

3.2.5 Developing base number:

3.2.6 Data Triangulation:

3.2.7 Country level data:

4. North America Industrial Insulation Market Landscape

4.1 Market Overview

4.2 North America PEST Analysis

4.3 Expert Opinion

5. North America Industrial Insulation Market - Key Market Dynamics

5.1 Market Drivers

5.1.1 Increasing Demand from Power Generation Sector

5.1.2 Strict Regulation Mandating the Use of Insulation Materials for Energy Conservation

5.2 Market Restraints

5.2.1 High Capital Cost and Lack of Skilled Labor for Installation

5.3 Market Opportunities

5.3.1 Increased Infrastructural Spending in Emerging Economies

5.4 Future Trends

5.4.1 Development of New Products with Latest Technology

5.5 Impact Analysis

6. Industrial Insulation Market - North America Analysis

6.1 North America Industrial Insulation Market Overview

7. North America Industrial Insulation Market Analysis - By Raw Material

7.1 Overview

7.2 North America Industrial Insulation Market, By Raw Material (2021 and 2028)

7.3 Wool

7.3.1 Overview

7.3.2 Wool: Industrial Insulation Market - Revenue and Forecast to 2028 (US$ Million)

7.4 Foams

7.4.1 Overview

7.4.2 Foams: Industrial Insulation Market - Revenue and Forecast to 2028 (US$ Million)

7.5 Fibres and Others

7.5.1 Overview

7.5.2 Fibres and Others: Industrial Insulation Market - Revenue and Forecast to 2028 (US$ Million)

8. North America Industrial Insulation Market Analysis - By Product

8.1 Overview

8.2 North America Industrial Insulation Market, By Product (2021 and 2028)

8.3 Pipe

8.3.1 Overview

8.3.2 Pipe: Industrial Insulation Market - Revenue and Forecast to 2028 (US$ Million)

8.4 Board

8.4.1 Overview

8.4.2 Board: Industrial Insulation Market - Revenue and Forecast to 2028 (US$ Million)

8.5 Blanket

8.5.1 Overview

8.5.2 Blanket: Industrial Insulation Market - Revenue and Forecast to 2028 (US$ Million)

8.6 Others

8.6.1 Overview

8.6.2 Others: Industrial Insulation Market - Revenue and Forecast to 2028 (US$ Million)

9. North America Industrial Insulation Market Analysis - By End User

9.1 Overview

9.2 North America Industrial Insulation Market, By End User (2021 and 2028)

9.3 Power Generation

9.3.1 Overview

9.3.2 Power Generation: Industrial Insulation Market - Revenue and Forecast to 2028 (US$ Million)

9.4 Chemical and Petrochemical

9.4.1 Overview

9.4.2 Chemical and Petrochemical: Industrial Insulation Market - Revenue and Forecast to 2028 (US$ Million)

9.5 Cement

9.5.1 Overview

9.5.2 Cement: Industrial Insulation Market - Revenue and Forecast to 2028 (US$ Million)

9.6 Food and Beverage

9.6.1 Overview

9.6.2 Food and Beverage: Industrial Insulation Market - Revenue and Forecast to 2028 (US$ Million)

9.7 Others

9.7.1 Overview

9.7.2 Others: Industrial Insulation Market - Revenue and Forecast to 2028 (US$ Million)

10. North America Industrial Insulation Market - Country Analysis

10.1 Overview

10.1.1 North America: Industrial Insulations Market, by Key Country

10.1.1.1 US: Industrial Insulations Market -Analysis and Forecast to 2028 (US$ Million)

10.1.1.1.1 US: Industrial Insulations Market, by Raw Material

10.1.1.1.2 US: Industrial Insulations Market, by Product

10.1.1.1.3 US: Industrial Insulations Market, by End User

10.1.1.2 Canada: Industrial Insulations Market -Analysis and Forecast to 2028 (US$ Million)

10.1.1.2.1 Canada: Industrial Insulations Market, by Raw Material

10.1.1.2.2 Canada: Industrial Insulations Market, by Product

10.1.1.2.3 Canada: Industrial Insulations Market, by End User

10.1.1.3 Mexico: Industrial Insulations Market -Analysis and Forecast to 2028 (US$ Million)

10.1.1.3.1 Mexico: Industrial Insulations Market, by Raw Material

10.1.1.3.2 Mexico: Industrial Insulations Market, by Product

10.1.1.3.3 Mexico: Industrial Insulations Market, by End User

11. Industry Landscape

11.1 Overview

11.2 Strategy and Business Planning

11.3 New Product Development

11.4 Expansion

11.5 Mergers and Acquisitions

12. COMPANY PROFILES

12.1 Saint Gobain S.A.

12.1.1 Key Facts

12.1.2 Business Description

12.1.3 Products and Services

12.1.4 Financial Overview

12.1.5 SWOT Analysis

12.1.6 Key Developments

12.2 Knauf Insulation

12.2.1 Key Facts

12.2.2 Business Description

12.2.3 Products and Services

12.2.4 Financial Overview

12.2.5 SWOT Analysis

12.2.6 Key Developments

12.3 Kingspan Group

12.3.1 Key Facts

12.3.2 Business Description

12.3.3 Products and Services

12.3.4 Financial Overview

12.3.5 SWOT Analysis

12.3.6 Key Developments

12.4 Cabot Corporation

12.4.1 Key Facts

12.4.2 Business Description

12.4.3 Products and Services

12.4.4 Financial Overview

12.4.5 SWOT Analysis

12.4.6 Key Developments

12.5 Johns Manville

12.5.1 Key Facts

12.5.2 Business Description

12.5.3 Products and Services

12.5.4 Financial Overview

12.5.5 SWOT Analysis

12.5.6 Key Developments

12.6 Thomas Group

12.6.1 Key Facts

12.6.2 Business Description

12.6.3 Products and Services

12.6.4 Financial Overview

12.6.5 SWOT Analysis

12.6.6 Key Developments

12.7 Nichias Corporation

12.7.1 Key Facts

12.7.2 Business Description

12.7.3 Products and Services

12.7.4 Financial Overview

12.7.5 SWOT Analysis

12.7.6 Key Developments

12.8 Aspen Aerogels Inc.

12.8.1 Key Facts

12.8.2 Business Description

12.8.3 Products and Services

12.8.4 Financial Overview

12.8.5 SWOT Analysis

12.8.6 Key Developments

12.9 McAllister Mills Inc.

12.9.1 Key Facts

12.9.2 Business Description

12.9.3 Products and Services

12.9.4 Financial Overview

12.9.5 SWOT Analysis

12.9.6 Key Developments

12.10 ROCKWOOL A/S

12.10.1 Key Facts

12.10.2 Business Description

12.10.3 Products and Services

12.10.4 Financial Overview

12.10.5 SWOT Analysis

12.10.6 Key Developments

13. Appendix

13.1 About the Publisher

13.2 Glossary of Terms

List of Tables

Table 1. North America Industrial Insulation Market -Revenue and Forecast to 2028 (US$ Million)

Table 2. US Industrial Insulations Market, by Raw Material - Revenue and Forecast to 2028 (US$ Million)

Table 3. US Industrial Insulations Market, by Product- Revenue and Forecast to 2028 (US$ Million)

Table 4. US Industrial Insulations Market, by End User- Revenue and Forecast to 2028 (US$ Million)

Table 5. Canada Industrial Insulations Market, by Raw Material - Revenue and Forecast to 2028 (US$ Million)

Table 6. Canada Industrial Insulations Market, by Product- Revenue and Forecast to 2028 (US$ Million)

Table 7. Canada Industrial Insulations Market, by End User- Revenue and Forecast to 2028 (US$ Million)

Table 8. Mexico Industrial Insulations Market, by Raw Material - Revenue and Forecast to 2028 (US$ Million)

Table 9. Mexico Industrial Insulations Market, by Product- Revenue and Forecast to 2028 (US$ Million)

Table 10. Mexico Industrial Insulations Market, by End User- Revenue and Forecast to 2028 (US$ Million)

Table 11. Glossary of Terms

List of Figures

Figure 1. North America Industrial Insulation Market Segmentation

Figure 2. North America Industrial Insulation Market Segmentation - By Country

Figure 3. North America Industrial Insulation Market Overview

Figure 4. North America Industrial Insulation Market, By Raw Material

Figure 5. North America Industrial Insulation Market, by Country

Figure 6. North America: PEST Analysis

Figure 7. Expert Opinion

Figure 8. North America Industrial Insulation Market Impact Analysis of Drivers and Restraints

Figure 9. North America Industrial Insulation Market - Revenue and Forecast to 2028 (US$ Million)

Figure 10. North America Industrial Insulation Market Revenue Share, By Raw Material (2021 and 2028)

Figure 11. North America Wool: Industrial Insulation Market - Revenue and Forecast To 2028 (US$ Million)

Figure 12. North America Foams: Industrial Insulation Market - Revenue and Forecast To 2028 (US$ Million)

Figure 13. North America Fibers and Others: Industrial Insulation Market - Revenue and Forecast To 2028 (US$ Million)

Figure 14. North America Industrial Insulation Market Revenue Share, By Product (2021 and 2028)

Figure 15. North America Pipe: Industrial Insulation Market - Revenue and Forecast To 2028 (US$ Million)

Figure 16. North America Board: Industrial Insulation Market - Revenue and Forecast To 2028 (US$ Million)

Figure 17. North America Blanket: Industrial Insulation Market - Revenue and Forecast To 2028 (US$ Million)

Figure 18. North America Others: Industrial Insulation Market - Revenue and Forecast To 2028 (US$ Million)

Figure 19. North America Industrial Insulation Market Revenue Share, By End User (2021 and 2028)

Figure 20. North America Power Generation: Industrial Insulation Market - Revenue and Forecast To 2028 (US$ Million)

Figure 21. North America Chemical and Petrochemical: Industrial Insulation Market - Revenue and Forecast To 2028 (US$ Million)

Figure 22. North America Cement: Industrial Insulation Market - Revenue and Forecast To 2028 (US$ Million)

Figure 23. North America Food and Beverage: Industrial Insulation Market - Revenue and Forecast To 2028 (US$ Million)

Figure 24. North America Others: Industrial Insulation Market - Revenue and Forecast To 2028 (US$ Million)

Figure 25. North America: Industrial Insulations Market, by Key Country - Revenue (2021) (US$ ‘Million)

Figure 26. North America: Industrial Insulations Market Revenue Share, by Key Country (2020 and 2028)

Figure 27. US: Industrial Insulations Market -Revenue and Forecast to 2028 (US$ Million)

Figure 28. Canada: Industrial Insulations Market -Revenue and Forecast to 2028 (US$ Million)

Figure 29. Mexico: Industrial Insulations Market -Revenue and Forecast to 2028 (US$ Million)

Companies Mentioned

- Aspen Aerogels Inc.

- Cabot Corporation

- Johns Manville

- Kingspan Group

- Knauf Insulation

- McAllister Mills Inc.

- Nichias Corporation

- ROCKWOOL A/S

- Saint Gobain S.A.

- Thomas Group

Table Information

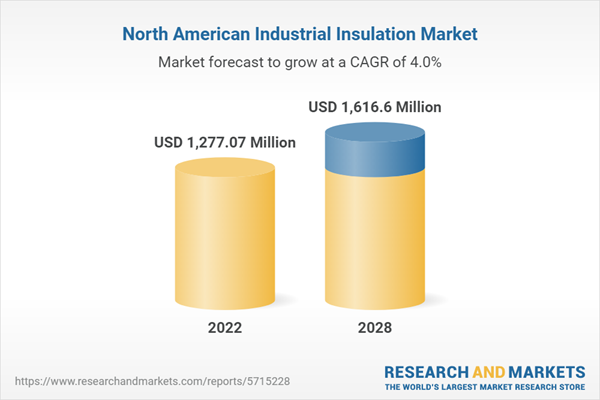

| Report Attribute | Details |

|---|---|

| No. of Pages | 115 |

| Published | December 2022 |

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 1277.07 Million |

| Forecasted Market Value ( USD | $ 1616.6 Million |

| Compound Annual Growth Rate | 4.0% |

| Regions Covered | North America |

| No. of Companies Mentioned | 10 |